How to convince your site visitors to buy a product using competitors? Part 1

This time we want to share the first part of Tommy Walker's material on how to deal with the prejudices of potential customers and persuade doubting visitors to your site to buy using information about competitors.

I often hear around the saying about different brands:

- I use Tide powder! I washed them for the last 10 years. I will only wash the tide until death!

- Oh, God, do what you want, but in clothes from Gap I will be a real laughing stock!

All these people have an already established idea of the brand, which cannot be changed through advertising, friends' advice, marketing. Or is it still possible?

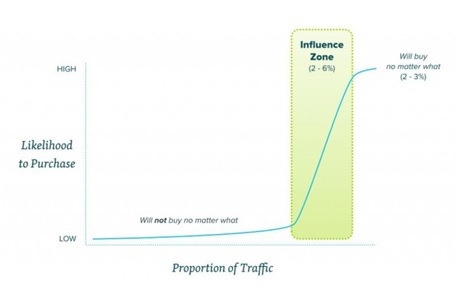

According to the customer distribution schedule, there are:

- a large layer of people who will not buy from you for anything,

- those who will always buy everything from you (2-3% of traffic),

- layer of people who are at the stage of choice (influence zone, 2-6% of traffic).

Each of us has visitors who will never, for no reason, under any circumstances buy (competitors, onlookers looking in store windows, people conducting research, etc.).

Of course, you should try to minimize the number of inactive clients who visit the site, working with traffic, choosing the right channels and using more advanced settings for advertising campaigns, such as negative keywords and geo-targeting. You can also stop spending money and make efforts to attract non-convertible traffic ... but this also will not solve the problem.

Why users do not buy: the psychological side of the issue

Comparing the above chart with the opinions I heard, I came to the conclusion that it is not pricing or design that affects the user's desire to purchase the product.

Of course, it’s easy to say that it’s enough to tweak the schedule a little, tell an interesting story, improve the call to action or a micro copy, and this will improve the profit from your site.

It may, of course, improve, but this will happen only in the upper curve within the influence zone.

But what about the bottom of the curve? This will be more difficult.

There are users who roam different sites, doing so-called “comparisons”, trying to find offers that are convenient for you and not very profitable for you, such as a flexible return policy, customer reviews and free shipping. For example, 61% of shoppers are willing to drop a basket if they are not offered free shipping.

Let's try to work with the bottom of the curve.

We analyze the prejudices of the customers of your competitors

In order to persuade potential customers from the bottom of the curve, you need to study the market and competitors. This knowledge is very important, because often your clients and clients of competitors believe that you miss some important function or key advantage, while you have all this.

For example, I had a client who sold software for a law firm. Having analyzed analog solutions and substitute solutions, I found that he had only 3-4 direct competitors and a small group of competitors on the periphery who used similar solutions (such as calendars and management contacts), but they did not directly engage in legal practice.

During a study of competitors, their clients and the market as a whole, I came to the conclusion that most law firms do not even consider the option of buying software if it does not meet the following characteristics:

1. Lawyers have already used it.

2. The software company had experience working with real lawyers who can vouch for it if necessary.

At a deeper level, this is due to the fact that they hardly got rid of their tendency to maintain the status quo, when they felt comfortable only if everything remained as it is.

I also learned that those who chose the solution of competitors did not believe that my client meets all their requirements, which means that he could not overcome the main prejudice that stops users at the time of making a purchase decision.

They did not know that my client had a much wider user base than its competitors (more than 250,000 users), and that his experience was over 30 years.

As a result, they decided not to focus on the number of 250,000 customers and use photos of fake users to “impress”. In the end, the information about their client base and work experience looked something like this:

However, it seems that one of their main competitors conducted similar studies around the same time, because in the end they changed the design of the site, which began to look like this :

As some studies show , when information is displayed on the landing page or in the headline, it seems to users that it is more important. That is, if you say that the product saves 8 hours of time, then this is more important than its design or price.

There is also the effect of the crowd, which we spoke about earlier, when people prefer to surround themselves with personalities who look, think and act just like them. At the same time, they are usually wary of people from another circle.

Therefore, fake photos from stocks will not cause the crowd effect that the company needs so much to make a potential customer real.

Analysis of your competitors

Despite the fact that you do not have access to the database of competitors 'clients, there are several methods that you can use to find out what your competitors' clients are thinking about.

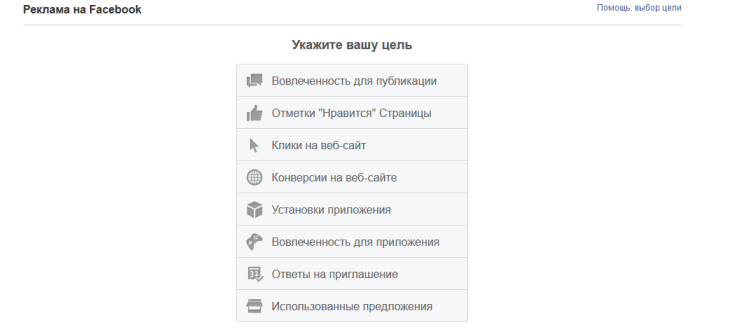

Method number 1. Conduct a direct survey using Facebook Ads

The main advantage of the social network Facebook, which has more than 1.2 billion registered users, is the fact that many people create separate pages specifically to like the companies with which they collaborate. This is necessary to create closer ties with partners.

Luckily for you, likes do create these links as one of the targets for Facebook Ad.

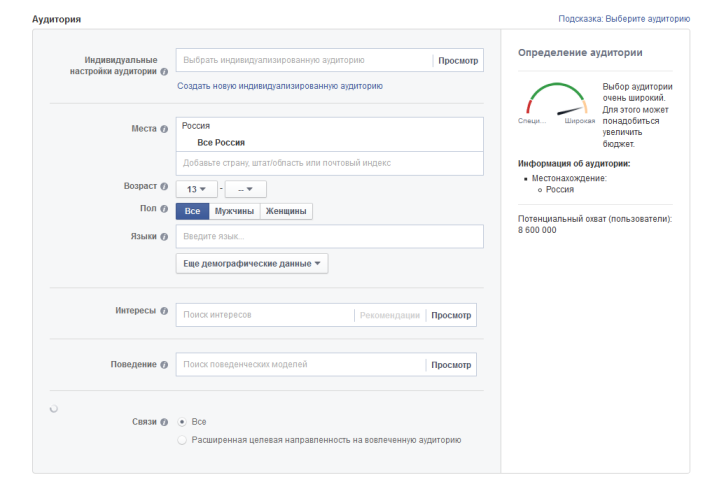

By clicking on the “audience” button on your Facebook page , you can get a little more information.

Now, depending on the characteristics of your competitor, and how secretive the client will be, you can improve partnerships with third parties to use the results.

For example, if MailChimpI would like to interview AWeber customers, they would most likely get a better response with a partner like eMail Institute than if they acted alone.

Creating a Survey for the Clients of Your Competitors

During the development of a survey, you need to overcome your own illusory superiority - the belief that you are much better than your competitors. Then you can easily understand why users prefer a competitor rather than you.

Ask questions like:

1. What attracts you to [competitor’s name]?

2. What is their [product / service] useful to you?

3. How would you rate their service?

4. How fast do they respond to requests?

5. How do you feel about [your company name]?

6. What should we do so that you choose us?

... along with other descriptions of consumer requirements, you will be able to determine for yourself the optimal types of questions that will help understand the needs of customers, divide users into several groups and understand how a competitor's client perceives his activities.

This document, published on MIT , teaches you how to use existing methods to create an effective survey of customer requirements in order to learn more about how to increase the number of your customers. It is very important to properly structure the survey results.

For example, based on a survey of cinema visitors, seventeen “tactical” needs were identified (cleanliness in the cinema hall, comfortable seats, high-quality sound and good visibility, a wide selection of films, etc.). In turn, these needs were divided into six "strategic" categories - a wealth of choice, impressions of watching a movie, building a cinema, food and drink, a cinema hall, and a cinema location.

From the point of view of competition, your goals should be not only an understanding of the weaknesses of competitors, but also what role you play for their customers.

In some cases, they simply do not suspect your existence, in others their opinion about you is erroneous, or they are simply not familiar enough with your brand.

A source:http://conversionxl.com/customers-will-never-buy/?hvid=4L08rO

Only registered users can participate in the survey. Please come in.

Have you ever thought that it would be nice to conduct Customer Development with competitor customers?

- 14.7% Yes, I even tried to communicate with competitors' clients 15

- 34.3% Yes, I thought, but did not 35

- 38.2% No, I didn’t think about it 39

- 12.7% I will never do this 13