LSI and Avago - the imperceptible merger of giants

In the world of IT and high technology, multi-billion dollar transactions in which companies change owners are absolutely not uncommon. Some of them attracted close attention of the public (banal examples - Instagram, Oculus Rift and Beats), while others, despite the considerable sums, remain almost unnoticed by almost anyone except specialists in the industry. The same thing happened with LSI, which Avago Technologies acquired for an impressive $ 6.6 billion. What kind of company is this, Avago Technologies, and why did they pay $ 11.15 apiece for LSI shares?

To understand what this merger brings, it is necessary to delve into the history of both companies.

Avago Technologies is a Singapore-based company headquartered in Singapore and San Jose in California. Its history began in 1961, when a department was established in Hewlett-Packard, engaged in research work in a number of hi-tech industries. In 1999, Agilent Technologies was founded on the basis of this department, to which all HP businesses were transferred that were not directly related to computers, information storage and image processing. Agilent's IPO has become one of the most significant in Silicon Valley history. Agilent did a lot, so it was decided to concentrate the company's efforts and sell part of the business.

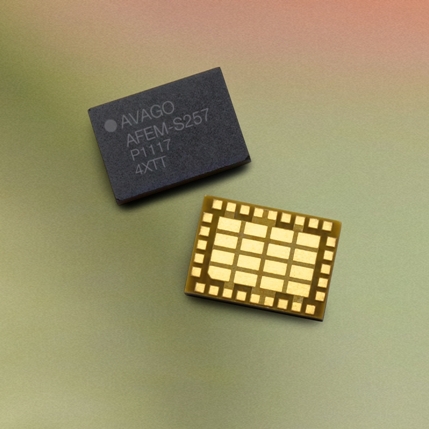

In 2001, the medical division (one of the first in HP) was sold to Philips, and in 2005, the Semiconductor Products Group (semiconductor product group) was sold to Kohlberg Kravis Roberts and Silver Lake Partners. It was this division that later became Avago Technologies. The range of Avago products is incredibly wide, starting with LEDs and ending with microwave circuits. The company sells its products to more than 7,000 customers around the world. Many of the company's customers work in the military-industrial complex and the aerospace industry. They produce components of homing systems, jet engine control systems, navigation systems, components of radar devices and secure communications.

The company's developments in such areas as mobile communications, fiber-optic communication lines, and radio equipment are also being used.

Now a little about LSI.

It was founded in 1981 in California under the name LSI Logic. Initial funding was received from venture investors (including Sequoia Capital), and in May 1983 the company entered an IPO. In the 90s ... SoC, SAS, RAID and everything else, primarily related to storage systems, became the company's main focus. The company was strengthened by a number of very smart purchases: Mint Technology, Symbios Logic, Seeq, IntraServer, Syntax Systems and many others. One of the most significant purchases was the acquisition of the American Megatrends RAID controller division in 2001 and the purchase of the SandForce flash controller manufacturer in 2012.

Thus, at the moment, LSI has accumulated a huge pool of patents and developments in the field of corporate data storage systems and mega-data centers. Avago, on the other hand, has technologies for fiber optic data transmission. The new alliance is able to give a significant impetus to the market, because now often it is data lines that become the bottleneck in huge data centers.

Another unexpected news came recently, on May 29, 2014. Seagate Technology acquired Avago's LSI acceleration and flash component division, LSI's Accelerated Solutions Division (“ASD”) and Flash Components Division (“FCD”), from Avago. The transaction amount is $ 450 million in cash. This is a useful acquisition for Seagate, which will enable the corporation to offer a more complete package of data storage solutions. Avago, in turn, made it clear that their interest is precisely developments in the field of SAS and corporate storage systems.

I, in turn, will continue to acquaint you with the new products that LSI (now LSI an Avago Technologies Company) will introduce, and not to forget about interesting excursions into the history of computer technology and data storage.