How to file a tax return for 2013 electronically in a few days (RF)

This post will be devoted to how easy, simple and fast (having lost a maximum of thirty minutes in the tax) to fill out and send the tax return for 2013 (that is, the one that must be sent before April 30, 2014) . Along the way, access to the personal account of the taxpayer will be sorted out and what opportunities this gives. In fact, this is a step-by-step instruction on how to do all this in a couple of days.

All of the above applies to the Tax Service of the Russian Federation.

The year 2014 has come , the year of universalelectrification and industrialization - the year in which you can conduct all your communication with the tax inspectorate of the Russian Federation completely through the Internet:

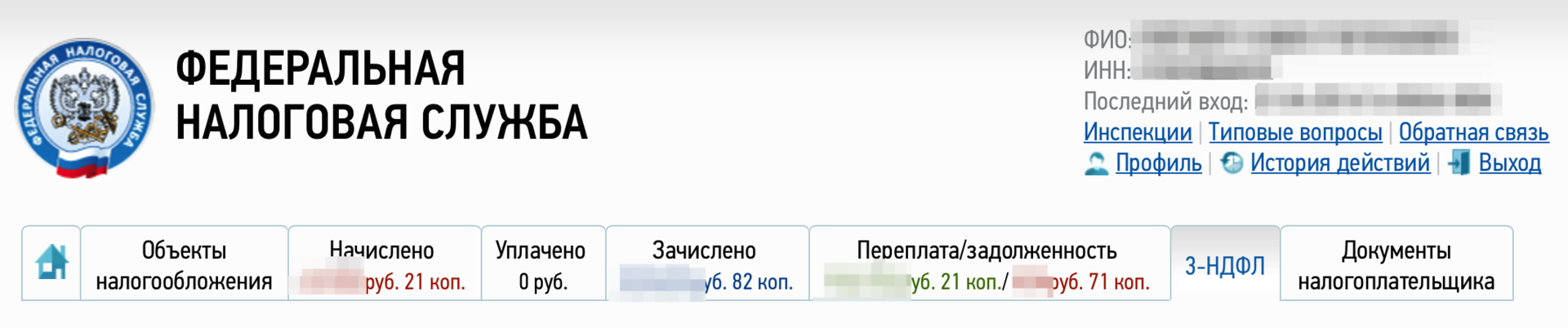

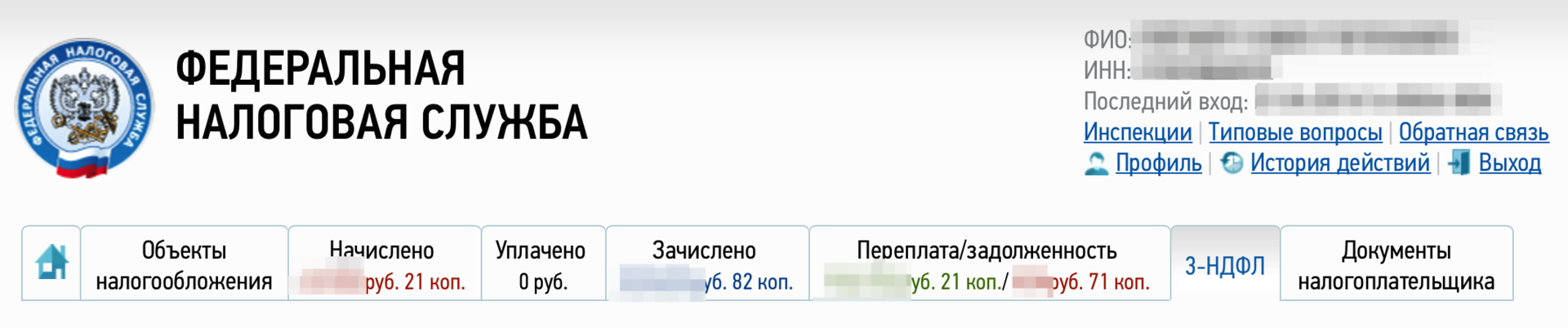

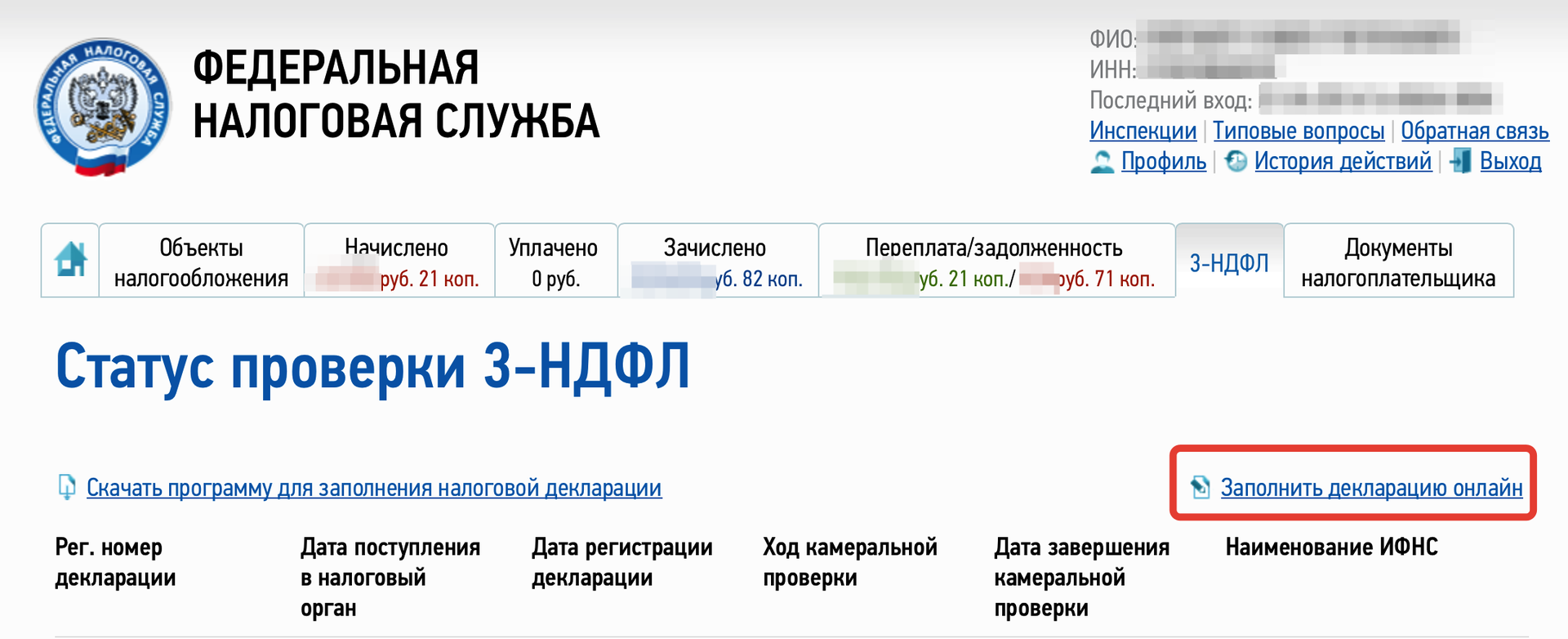

But most importantly, you can file an electronic declaration online! Below, for example, is a screenshot of the taxpayer’s personal account.

So: today began April 28th. If you have not filed a 2013 declaration yet, but you need to do this, then you have very little time left (until April 30). And in my opinion, now in the tax there are a lot of the same “ last minute ”. Let's take a look at what it takes to turn from a “last minute ” into a trendy internet geek.

I’ll clarify in advance that I live in Moscow. Therefore, if you are from another city, make corrections for the wind .

Get / find your Taxpayer Identification Number aka TIN.

If you already know your inn, then just make a copy of the certificate of receipt. If not, then you need to proceed to the service "Find out your TIN" . And find out the TIN there. The page with the TIN is best printed in duplicate. - why see later.

You have two options for gaining access to the taxpayer’s personal account - either obtaining an access password (in my opinion, it will not hurt in any case), or using a qualified electronic signature (CECP) (I can’t get a universal electronic card as quickly and easily as I understood).

Theoretically, you should have enough CEC for all your needs, but after that abnormal amount of sex that I had to do with cryptography - in my opinion regular access will also be very useful. If you want to go in a very short way - to point 3.

to your personal taxpayer account (the TIN is the login). If you have not yet received access, then a little lower I will step by step and with pictures will tell you how to do it.

In principle, the details of what access options are described in the corresponding section on the website of the Federal Tax Service of the Russian Federation, but we are interested in a simple way.

Personally, I went without recording.

I have the whole procedure, along with clarifications on where to stand, etc. - it took 26 minutes from the moment of entering the building to leaving it.

In "any" Federal Tax Service, you officially theoretically require a certificate of TIN issuance. In practice, when submitting an application in an online form, they either do not ask him at all, or they are satisfied with the listing from the site made in step 1.

Unfortunately, your key to GosUslug is not suitable. According to accreditation information , here is a list of accredited organizations . Through intense telephone torture, I found one with which I thought I could work. (No, we are not affiliated).

So, to get the digital signature you have three options:

I chose the third one (although in retrospect the toad had long convinced me of the usefulness of the second one), as a result, during the day they contacted me and asked to print and sign documents for the arrival of a specialist. The next day, a young man arrived at dinner, who brought some of the documents, as well as the seal of the organization. We all signed and said goodbye in ~ 15-25 minutes.

At the exit, I had a lot of documents and RuToken S 64k .

Next you will need ... Windows and Internet Explorer. No, it doesn’t work on the Mac / Linux at all, in my opinion, due to the incompatibility of crypto standards. Guest certificates are not even imported into keychain mac os. If you are interested in my trial and error for mac os - welcome to comment. But I started a virtual machine under parallels and did everything through it. It is necessary to clearly realize that even under a virtual machine this works very medium in stability. (for my taste).

Best of all is the last 7. Since the 8th, the crypto provider (and we will need it) judging by the forum , crypto-pro has a lot of problems.

Just in case, in order not to spend half a day later on floating glitches that no one will help you solve.

Everything is very simple - they don’t even give a trialka without registration .

Download the trial on CryptoPro CSP 3.6 on cryptopro.ru.

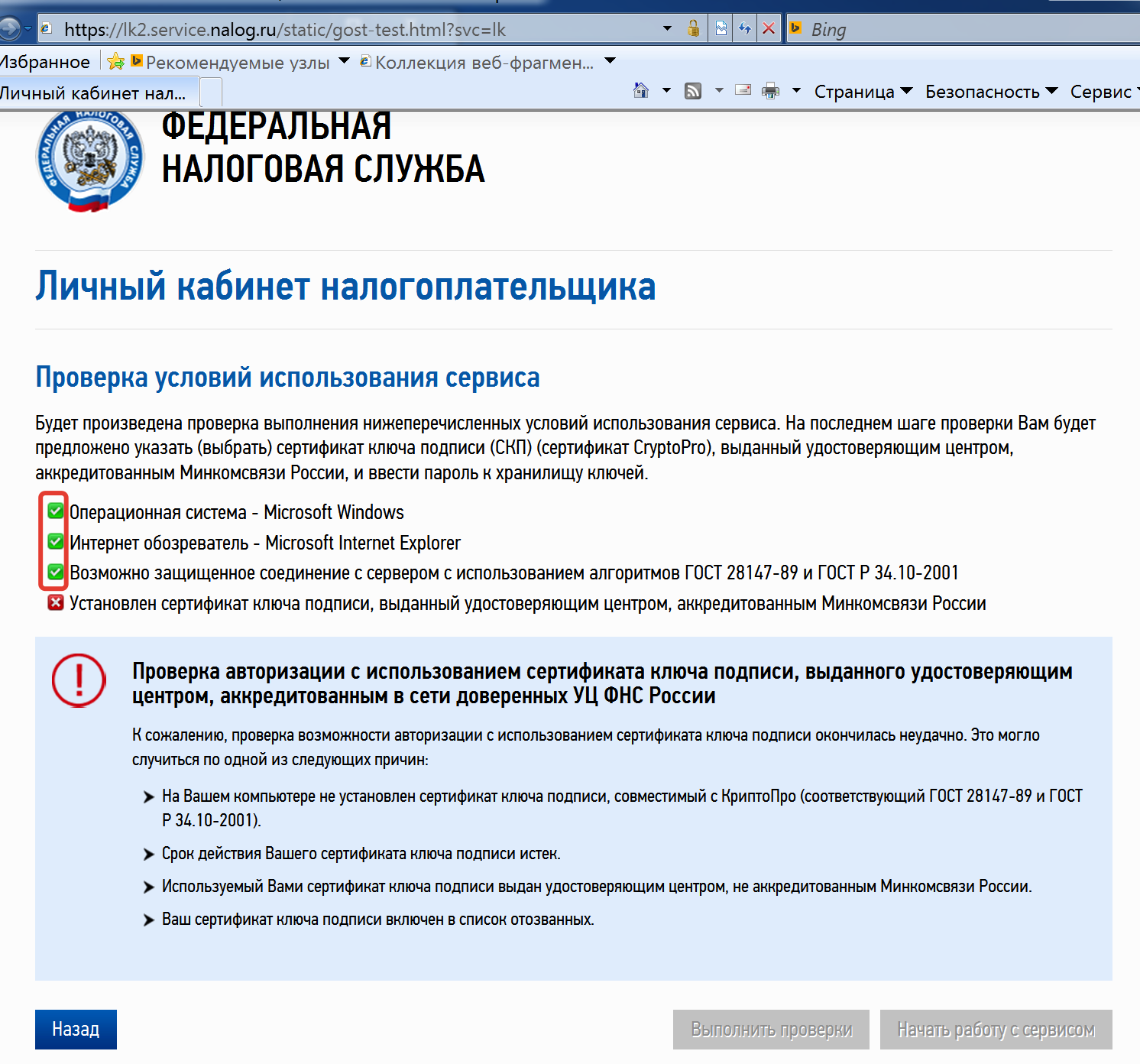

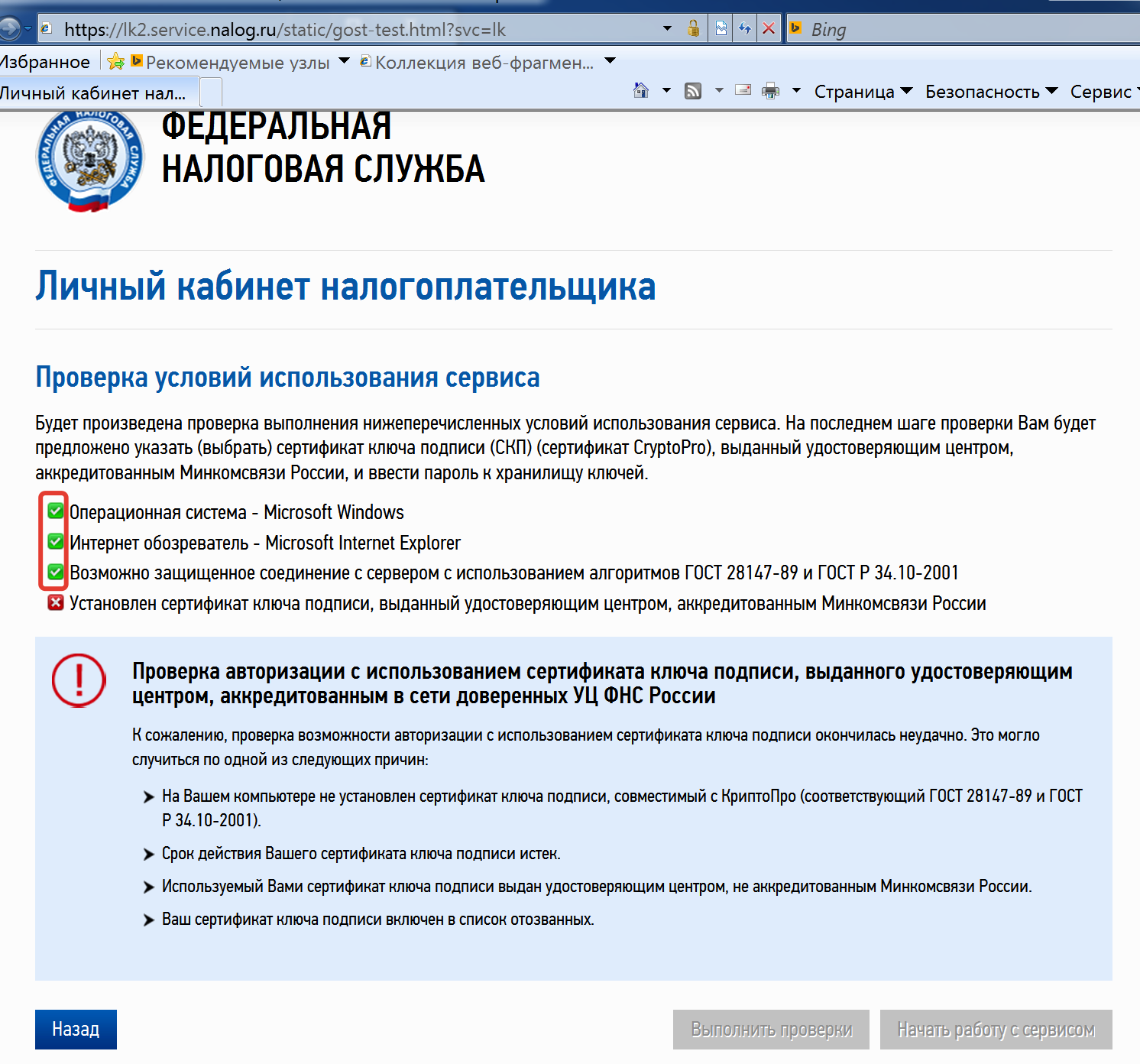

We go to the special link for testing https://lk2.service.nalog.ru/static/gost-test.html?svc=lk and make sure that everything except the key works.

Download and install drivers for RuToken Windows.

Configuring certificates consists of three items (all three judging by experience must be completed).

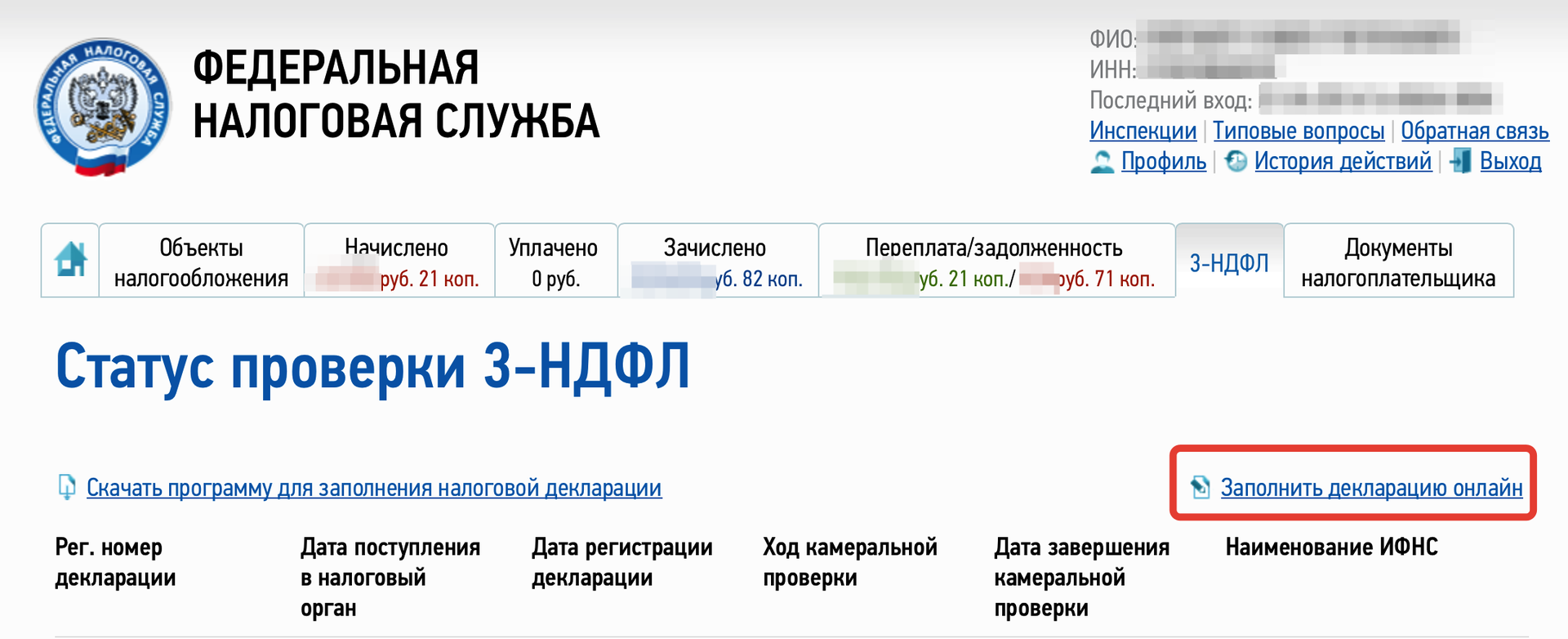

Go to the 3-NDFL section of your personal account, click on the " fill out online declaration " button .

I will not detail the filling out of the declaration - this is beyond the scope of the current article, and the Internet is full of manuals on this topic, but in a nutshell:

Attention ! When sending 3-personal income tax - attach scans of necessary documents to it!

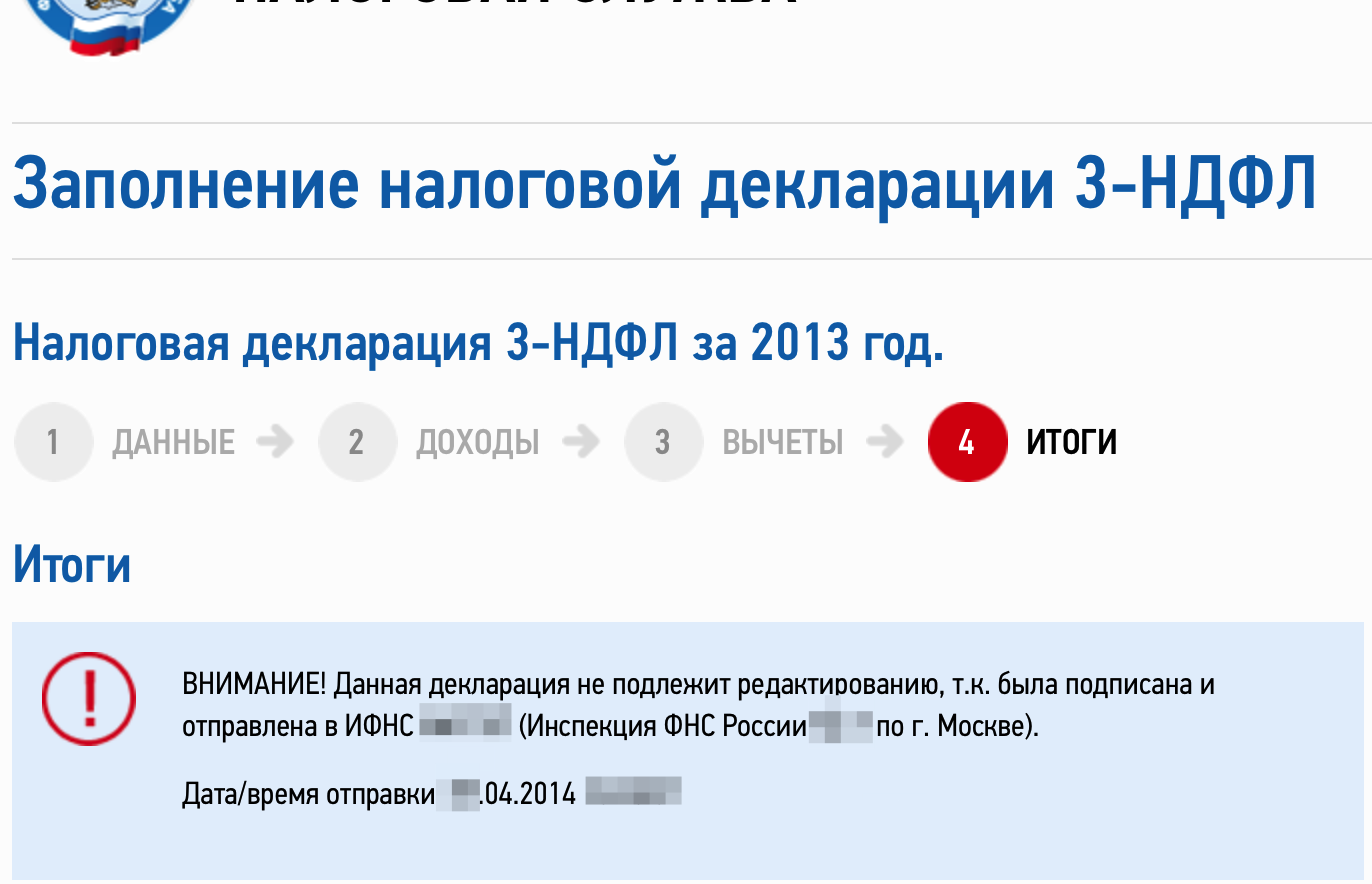

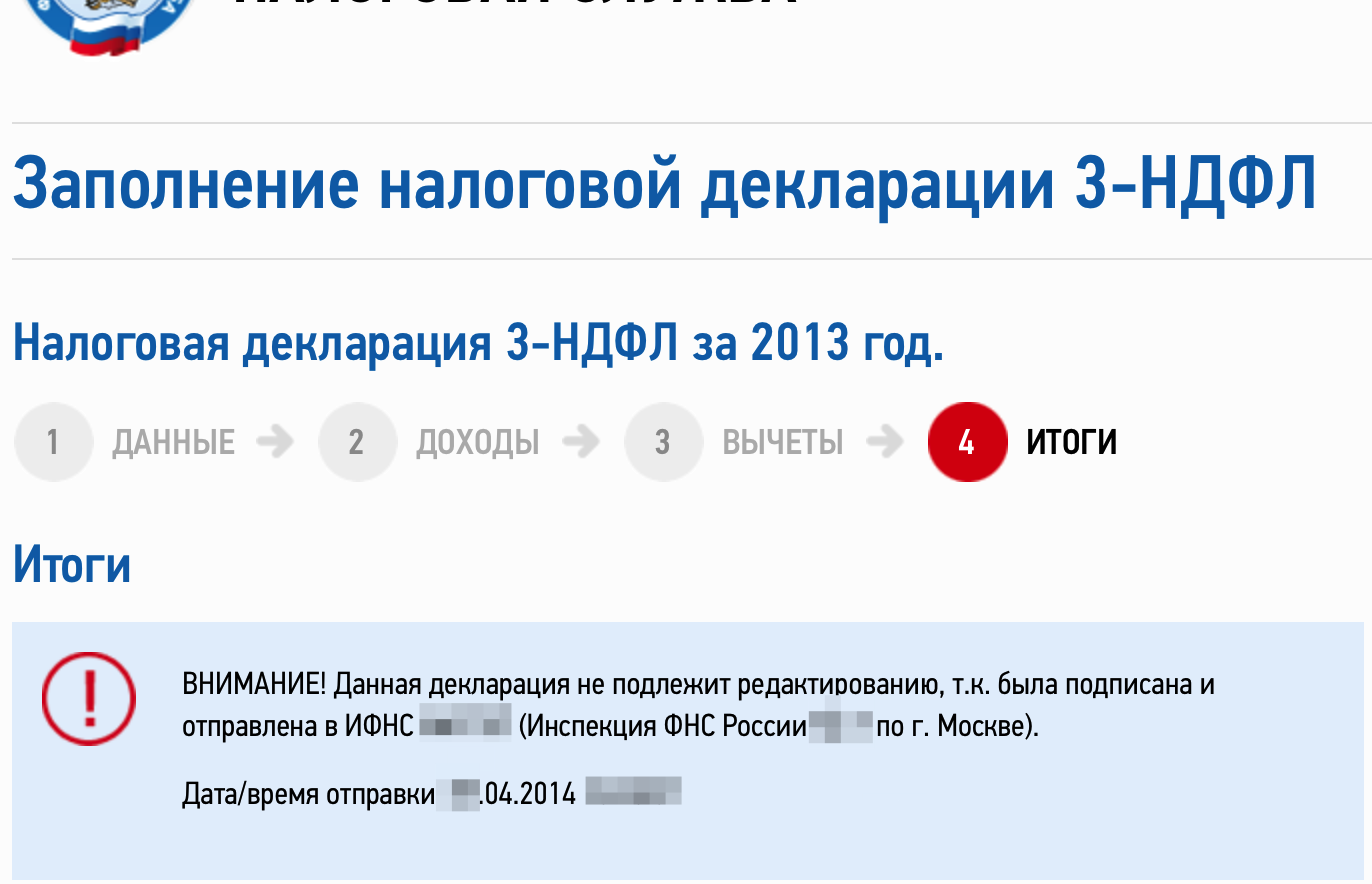

And after sending, when you go to section 3-personal income tax - you should see something similar to the following picture.

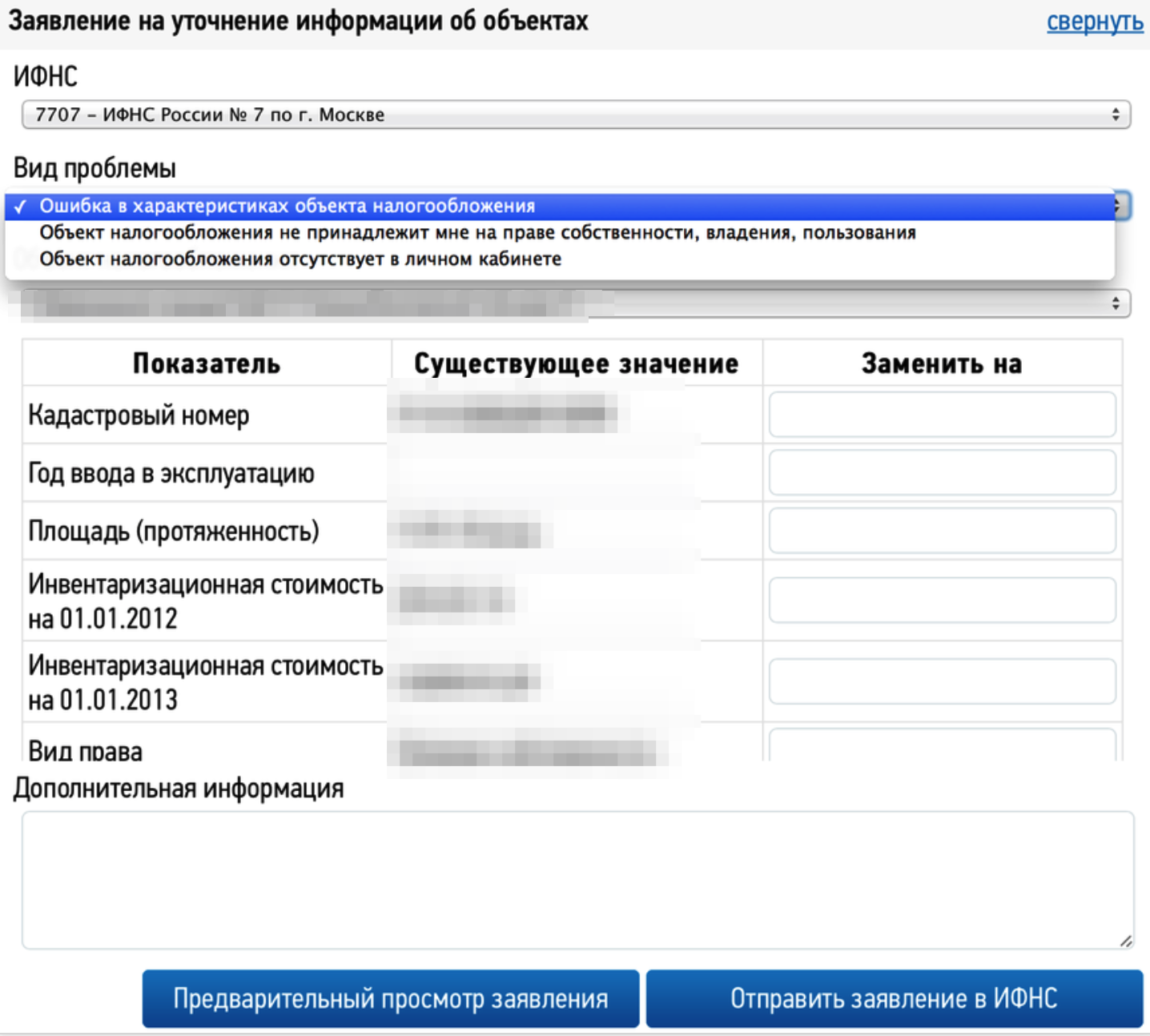

PS In addition to personal income tax and personal income tax return, you must pay taxes on real estate and transport. I highly recommend checking the list of taxable items that, in the opinion of the tax authority, apply to you. The fact is that in 2014 the tax database seems to have gone astray (the roofing felts were gone, the roofing felts are the base, the roofing felts the inventory is a dark story) - and many of them did not record their real estate. Before payment, check if the tax is calculated correctly! If it’s wrong, feel free to submit an application !

For example, I was recorded on a whole apartment building, a multi-access building located nearby. But after filing the " Application for clarification of information about objects " - removed.

UPDATE: Added e-government to the hub .

PPPS Please note that this is my first post on the Habr.

All of the above applies to the Tax Service of the Russian Federation.

Introduction

The year 2014 has come , the year of universal

- receive up-to-date information on property and vehicles, on the amounts of accrued and paid tax payments, on the existence of overpayments, on tax arrears to the budget;

- View all tax notifications that have been issued to you (it seems that only from the moment you open access to the taxpayer’s office);

- View your payments received by the tax authorities;

- apply to the tax authorities without a personal visit to the tax office;

- View the history of your correspondence with the tax inspectorates of the Russian Federation over the past three years

- Disagree with accrued taxes, object to real estate / transport objects that you do not own (more / already / in general?)

- Receive and print tax notices and receipts for tax payments;

- receive up-to-date information on property and vehicles, on the amount of accrued and paid tax payments, on the presence of overpayments, on tax arrears to the budget

- monitor the status of desk audit of tax returns in the form of No. 3-NDFL;

But most importantly, you can file an electronic declaration online! Below, for example, is a screenshot of the taxpayer’s personal account.

So: today began April 28th. If you have not filed a 2013 declaration yet, but you need to do this, then you have very little time left (until April 30). And in my opinion, now in the tax there are a lot of the same “ last minute ”. Let's take a look at what it takes to turn from a “last minute ” into a trendy internet geek.

I’ll clarify in advance that I live in Moscow. Therefore, if you are from another city, make corrections for the wind .

What needs to be done, in stages

1. Obtaining TIN

Get / find your Taxpayer Identification Number aka TIN.

If you already know your inn, then just make a copy of the certificate of receipt. If not, then you need to proceed to the service "Find out your TIN" . And find out the TIN there. The page with the TIN is best printed in duplicate. - why see later.

2. Obtaining access to the personal account of the taxpayer through a password

You have two options for gaining access to the taxpayer’s personal account - either obtaining an access password (in my opinion, it will not hurt in any case), or using a qualified electronic signature (CECP) (I can’t get a universal electronic card as quickly and easily as I understood).

Theoretically, you should have enough CEC for all your needs, but after that abnormal amount of sex that I had to do with cryptography - in my opinion regular access will also be very useful. If you want to go in a very short way - to point 3.

to your personal taxpayer account (the TIN is the login). If you have not yet received access, then a little lower I will step by step and with pictures will tell you how to do it.

In principle, the details of what access options are described in the corresponding section on the website of the Federal Tax Service of the Russian Federation, but we are interested in a simple way.

2.1. Submission of online application

2.2. Optionally, an appointment with the tax office

Personally, I went without recording.

2.3. Visiting your territorial FTS or any FTS

I have the whole procedure, along with clarifications on where to stand, etc. - it took 26 minutes from the moment of entering the building to leaving it.

In "any" Federal Tax Service, you officially theoretically require a certificate of TIN issuance. In practice, when submitting an application in an online form, they either do not ask him at all, or they are satisfied with the listing from the site made in step 1.

3. Obtaining access to the personal account of the taxpayer through a qualified electronic digital signature (CECP)

Access to the service “Personal account of a taxpayer for individuals” is possible with the help of EP / UEC without visiting the inspection.

A taxpayer can obtain a qualified certificate of an electronic verification key from a Certification Authority accredited by the Ministry of Communications of Russia. For correct authorization in the service, it is recommended to use a qualified certificate of an electronic verification key that meets the requirements of Order No. MMV-7-4 / 142 of the Federal Tax Service of Russia of 08.04.2013.

Unfortunately, your key to GosUslug is not suitable. According to accreditation information , here is a list of accredited organizations . Through intense telephone torture, I found one with which I thought I could work. (No, we are not affiliated).

So, to get the digital signature you have three options:

- “Fill out the questionnaire, wait a few days, pay by bank transfer, wait for arrival to the account, then they will call” (c) most organizations from the list;

- To come with documents and a plastic card, pay on the spot, receive an electronic digital signature within an hour.

The easiest way to call and go with a passport, SNILS and plastic. Theoretically, an hour (expect half a day with the road) can get the key. The nucrf release service costs 1,200 rubles and another 850 rubles for rutoken s 64k.

This is an option that I should choose, but in connection with the park at work, I chose the third;

- Fill out documents, pay via the Internet, send a payment. + Payment for urgency. Did it all in the afternoon. This option costs 5000r (for the specialist’s departure) + 2300r (for urgency) more than the second.

I chose the third one (although in retrospect the toad had long convinced me of the usefulness of the second one), as a result, during the day they contacted me and asked to print and sign documents for the arrival of a specialist. The next day, a young man arrived at dinner, who brought some of the documents, as well as the seal of the organization. We all signed and said goodbye in ~ 15-25 minutes.

At the exit, I had a lot of documents and RuToken S 64k .

4. Install and configure software

Next you will need ... Windows and Internet Explorer. No, it doesn’t work on the Mac / Linux at all, in my opinion, due to the incompatibility of crypto standards. Guest certificates are not even imported into keychain mac os. If you are interested in my trial and error for mac os - welcome to comment. But I started a virtual machine under parallels and did everything through it. It is necessary to clearly realize that even under a virtual machine this works very medium in stability. (for my taste).

4.1. We put windows 7

Best of all is the last 7. Since the 8th, the crypto provider (and we will need it) judging by the forum , crypto-pro has a lot of problems.

4.2. We put all updates for 7-ki and IE

Just in case, in order not to spend half a day later on floating glitches that no one will help you solve.

4.3. Register on cryptopro.ru

Everything is very simple - they don’t even give a trialka without registration .

4.4. Download and install the crypto provider

Download the trial on CryptoPro CSP 3.6 on cryptopro.ru.

4.5. Check the intermediate result

We go to the special link for testing https://lk2.service.nalog.ru/static/gost-test.html?svc=lk and make sure that everything except the key works.

4.6. Configure the token

Download and install drivers for RuToken Windows.

4.7. We configure certificates according to the instructions

Configuring certificates consists of three items (all three judging by experience must be completed).

- Installation of root certificates of the National Certification Authority;

- Setting the certificate revocation list (CRL);

- Installation of personal certificates;

5. Now you need to fill out a declaration - it's the same form 3-NDFL

Go to the 3-NDFL section of your personal account, click on the " fill out online declaration " button .

I will not detail the filling out of the declaration - this is beyond the scope of the current article, and the Internet is full of manuals on this topic, but in a nutshell:

- You will need to ask for 2-NDFL certificates from your place of work (if any), and transfer the data to the online form;

- Fill in all income;

- It is advisable (for you) to indicate all tax deductions;

- To pay taxes;

- If necessary, include in the declaration the date of payment of taxes;

- Send a tax return - this is the point for which we received a signature;

Attention ! When sending 3-personal income tax - attach scans of necessary documents to it!

And after sending, when you go to section 3-personal income tax - you should see something similar to the following picture.

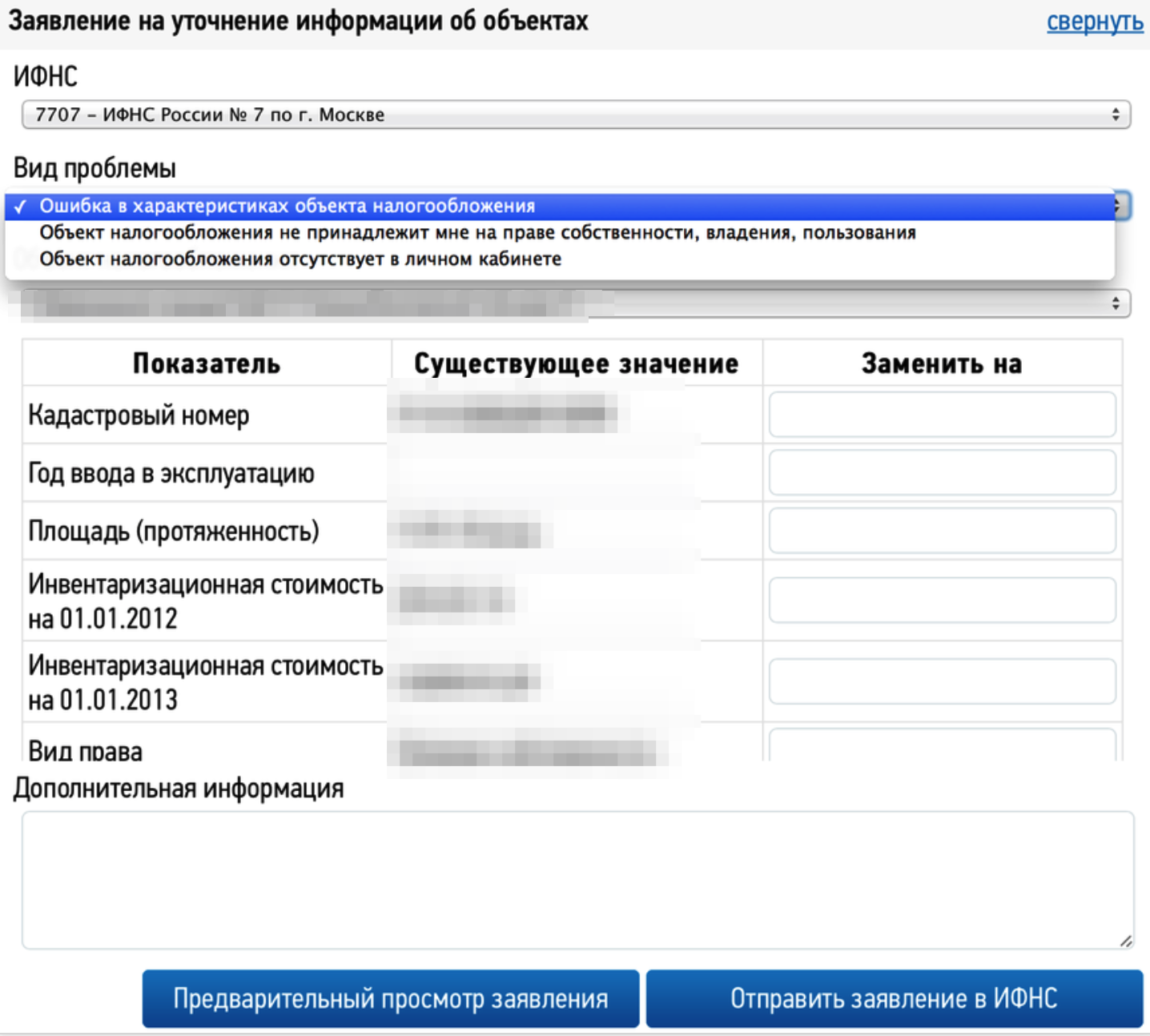

PS In addition to personal income tax and personal income tax return, you must pay taxes on real estate and transport. I highly recommend checking the list of taxable items that, in the opinion of the tax authority, apply to you. The fact is that in 2014 the tax database seems to have gone astray (the roofing felts were gone, the roofing felts are the base, the roofing felts the inventory is a dark story) - and many of them did not record their real estate. Before payment, check if the tax is calculated correctly! If it’s wrong, feel free to submit an application !

For example, I was recorded on a whole apartment building, a multi-access building located nearby. But after filing the " Application for clarification of information about objects " - removed.

UPDATE: Added e-government to the hub .

PPPS Please note that this is my first post on the Habr.