Easy money is over: the main trends of the ICO 2018 market

Image: Unsplash

Despite a more than 50% decrease in cryptocurrency capitalization since the beginning of 2018, investments in ICO continue to increase. At the same time, the market cannot be called stable: the specifics of investments change from quarter to quarter and acquire new features. We studied the analytical reports of ICOrating and Bloomchain , specializing in the study of cryptocurrency projects, and identified 3 main trends that have become entrenched in the ICO market today.

Tokensale become larger

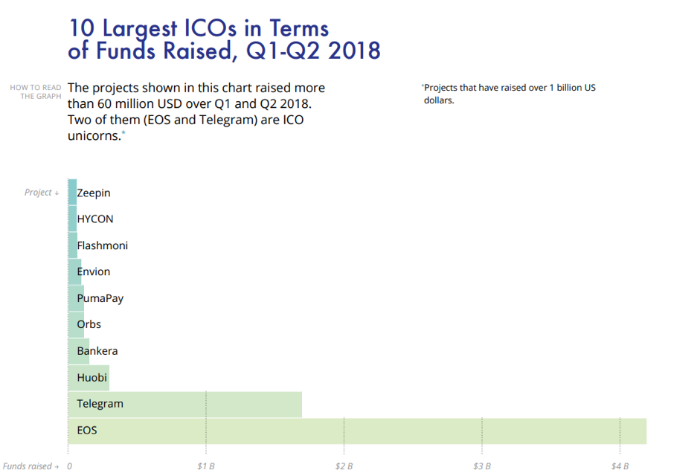

The amount of capital invested in ICO in the first half of 2018 is more than $ 11.6 billion, which is 110.2% more than in the previous period. At the same time, the number of ICOs conducted increased only by 30.2%. The key reason was the presence in the market of such promising projects as EOS and Telegram. They were the first companies whose ICO brought in more than $ 1 billion.

Chances of successful investment attraction have decreased

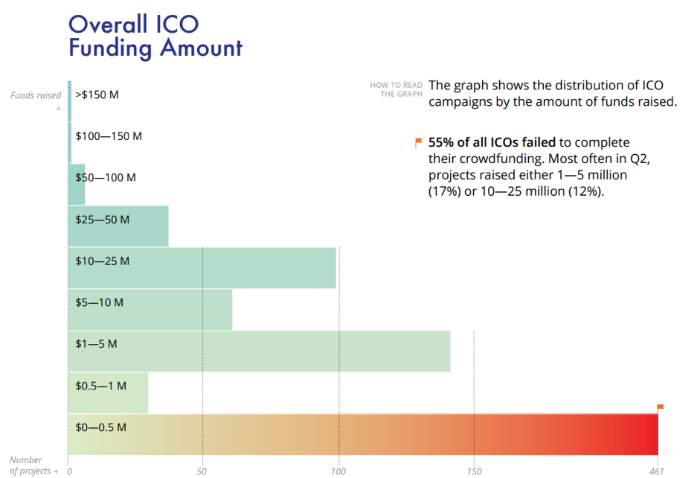

According to the results of the first half of 2018, more than half of the projects that entered the ICO for this period could not attract more than $ 100,000. For comparison, in the same period in 2017, only 13% faced such problems. On the one hand, this indicates a decline in the quality of projects seeking funding, on the other - an increase in the demands of investors.

Due to the large amount of scum identified by recent studies, market participants have become more cautious: as a result, 55% of the projects launched in the last quarter failed without collecting the required amount. Not only did the likelihood of failure increase, but also the duration of successful campaigns.

Tokens are increasingly buying investment funds

In their study, ICOrating noticed a sharp increase in the share of institutional capital and a decrease in the number and value of tokens acquired by private individuals. For a successful ICO, projects are increasingly worth focusing on the requirements of investment funds - the share of funds in most ICOs is 60-80%. For companies that have completed crowdfunding, in turn, cooperation with cryptocurrency exchanges becomes important.

Access to the private market is also restricted at the legislative level. For example, in Russia, if the laws “On digital financial assets”, “On attracting investments using investment platforms” and “On digital rights” are adopted , individuals without a qualified investor status will not be able to buy tokens of more than 50 thousand rubles.

Other materials on finance and stock market from ITI Capital :

- Analytics and market reviews

- Purchase of shares of American companies from Russia

- Huawei overtook Apple in terms of sales. The capitalization of the American company still reached $ 1 trillion

- Analysts: Microsoft's capitalization could reach $ 1 trillion

- Mass media: large-scale cyber attacks accelerated the growth of capitalization of companies in the information security industry

- Bloomberg: Hedge Funds Recognize Brexit Results Before Others And Earn Billions