How much opium is for the people? How does FOREX work and is it needed? (Part II)

A month ago my article appeared on Habré . Surprisingly, it caused a rather large stream of comments, which for the most part approved the author’s thoughts, but also a flurry of negative and overly emotional assessments by representatives of Forex cuisines.

In addition, a number of provocative questions were asked that can conditionally be reduced to a variation of one of two:

- What are the criteria for a “kitchen"? (variations: is this broker (name) kitchen or not? etc.)

- What are the differences between ITinvest services and services of kitchens criticized by you?

Not wanting to engage in controversy and a dispute with representatives of the forex community (after all, the article was not written for them), I nevertheless felt obligated to continue explaining what the “correct” forex is, and also:

- why and on what terms we offer it,

- how it is regulated and how it should be regulated,

- why all forex kitchens are currently engaged in illegal business activities.

Along the way, the reader will receive an answer to the provocative questions formulated above. To whom the text will seem boring - please read only the headings.

How was it before and how is the exchange better than the interbank?

In 1994 and 1995, I worked on a currency bank and vigorously tapped the keys of the Reuters Dealing trading system. They worked mainly on the MM market (Money Market), on taiga bonds and, naturally, on currencies. Traded the dollar against the German mark, pound, yen, Swiss and French francs, and, of course, the ruble-dollar. The work went to its own position, but client orders nevertheless served as the basis for the functioning of the desk. So we worked to ensure export-import operations of a large clientele of the bank. The minimum lot is 1 million dollars (pounds, DM, ...) and 1 billion rubles in transactions with the ruble. The euro was not yet in circulation, and the ruble was not yet fully denominated.

Why am I telling you all this? Besides, I know firsthand how this market is structured, who its real participants are and why these participants need a foreign exchange market. Only from the inside you can understand how the delivery and settlements of currencies bought and sold actually occur. Of course, the market has changed since then. But not too dramatically. Banks - the main players in this market have not stopped trading in the interbank market. Deutsche Bank (which, according to some estimates, holds about 40% of this market), as well as other global players: UBS, Citi, Morgan Stanley, Goldman Sachs and JPMorgan, still do the weather on this market and participate in trading almost all the sites where currencies are traded. If you find in this row the name of your company that provides access services to the global global FOREX market (or the mythical liquidity aggregator,

However, in addition to the interbank market, other liquidity pools have developed over the past few years. Here we should mention first of all the Moscow Exchange currency market, which has existed since 1992. Recall that the exchange was formed primarily as a currency platform: MICEX - Moscow Interbank Currency Exchange. Have you read the name carefully? If not, read it again.

So, why do we need an exchange if there is an over-the-counter market? Just to

- A) ensure the reliability of settlements (the exchange removes the risk of non-delivery by the counterparty),

- B) ensure market liquidity (the exchange collects all bidders in one place at one time),

- C) to ensure fairness and transparency of the price of the goods being traded - the price is determined as a result of an “auction” that is continuously carried out in the “exchange glass” during trading.

You can get acquainted with the structure of exchanges in more detail by disassembling the website of the Moscow Exchange group of companies , or "bird's-eye view" according to one of our previous publications .

Electronic trading platforms - an alternative to exchanges

In the west, instead of currency exchanges, other liquidity pools developed, the so-called ECN (Electronic Communication Network) and MTF (Multilateral Trading Facility). What is their difference from exchanges, we will not analyze now, leaving this for later. I can only say that all of them, as well as exchanges, operate within the framework of American or European legislation and are subject to the SEC or MiFID directives. On these ECNs there are exchange glasses and other exchange delights that allow them to provide the same advantages that the exchange provides, namely, liquidity and fairness of the price at any given time.

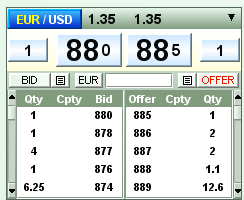

Here, for example, the figure shows the ECN Currenex stock market, access to which are available to large customers of our company:

The standard lot is 1 million, but it is clear that some participants put 100 thousand (0.1) and even 50 thousand (0.05). In addition, it can be seen that the spread for 1 million euros is only 0.5 pips, and for 12 million - already 1.5 pips.

Currenex is the largest electronic site in North America owned by StateStreet Corp. It trades almost all currencies against each other. However, delivery and settlement of completed transactions are outside the scope of this ECN.

In Europe, one of the most famous currency exchanges is EBS , owned by the voice broker ICap. In addition to these two liquidity aggregators, there are several smaller sites and, finally, there is simply an interbank market where Deutsche Bank is still the main player (at least in Europe).

What are the criteria for a “kitchen"?

Now, armed with this knowledge, we will try to answer the question posed. To do this, we will need to study the agency (regulations, contract, user agreement or any other document that describes the essence of the relationship between the client and the alleged "kitchen"). So far, we are interested in two things in agriment: how the supply of currency is arranged and how settlements are made according to it (we, after all, are going to buy currency on the world market, and not play thimbles). We know that the supply of euros, for example, should go to a bank account opened in the currency of euros, and the supply of dollars to a dollar account. Both accounts must be opened with a reputable commercial bank that is known to operate in the global FOREX market. Settlements for completed transactions should default to spot, i.e. on the third trading day, starting from today (unless, of course, other conditions are agreed upon upon the transaction, which also happens, but is still an exception). Those. if you make a transaction BUY 1 EUR / USD @ 1.3588, this means that $ 3558,800 should leave your dollar account the day after tomorrow, and 1 mio EUR should come to your euro account with a value date the day after tomorrow.

When you buy one currency against another currency (which is sold in this case), you will have a long position in the first and a short position in the second, unless of course you had a second currency in sufficient quantity. After the delivery and settlements take place, for the presence of a long position you will be “dripped” with interest, as to the current account at the rate accepted for this currency. For the presence of a short bank, the interest will be debited from you as for a loan or for overdraft on the account at the rates accepted for this currency. These rates for different currencies and for different directions of the position naturally differ. Check if all these conditions are stipulated in the kitchen.

The transaction processing cost does not depend on its volume. Accordingly, transactions with a volume of 10k have a unit cost of 100 times greater than transactions of 1 mio

This is in the interbank market. Why do interbank settlements take place on the third business day? Because there is no centralized clearing. The day after the transaction, bank back offices for tickets received from the desk draw up documents for all transactions completed, contact the counterparties, receive confirmation from them, if necessary, draw up contracts and summarize the trading results in a single payment register, which is transferred to the settlement department on the third day and correspondent relations. This is a big job that requires a lot of people, a developed correspondent network. Only large banks can afford the pleasure of actively trading in the international currency market.

Not only this, it is necessary that other participants also open limits on the bank. Are you sure that serious players have opened limits in your “kitchen”? Take an interest in these players. A list of them is given above. That is why the minimum lot on the interbank market is equal to one million dollars or pounds or euros (it does not matter). The cost of the transaction makes small transactions in the interbank market unprofitable. The whole bullshit with respect to the developed developed system for routing and processing applications for different dealing desks and liquidity aggregators, depending on the volume, as well as the supposedly developed technologies of the "modern forex industry" remains bullshit, cheating and hide the banal rule: a typical forex broker has nowhere to go in fact, does not withdraw its customers. Well, of course, with the exception of hedging the balance of an open currency position.

On the stock market, the rules are the same, but due to standardization and the cheaper mechanism for concluding and confirming transactions, it is possible to reduce the size of the traded lot from 1 million to 100k. It is theoretically possible to lower it to 10k (as we saw in the picture above), but placing orders below 100k in the ECN trading system is considered bad form, and serious players avoid placing such small orders in a glass. In addition, since the processing cost of an executed order does not depend on its volume, 10k transactions have a unit cost 100 times higher than 1 mio transactions.

The standardization of transactions and settlements on them not only reduces the cost of transactions, but also makes it possible to reduce the settlement time for completed transactions. So on the currency market of the Moscow Exchange, the main currency market operates in T + 1 mode. The same rule applies to Currenex.

Kitchen, who is your broker, where is your clearing, show your settlement bank?

The exchange or ECN gives only a deal, but not settlements on it. For completeness, we lack clearing and settlement. Clearing and settlement of exchange transactions is done by independent organizations. Clearing is a procedure for reconciling mutual obligations of participants based on the results of exchange trading. Activities, by the way, are licensed in all countries. Well, settlements based on clearing results are carried out by special banking organizations - clearing houses of exchanges. Activities are also licensed.

For example, in the group of companies of the Moscow Exchange, clearing is carried out by CJSC JSCB National Clearing Center (NCC), and settlements are carried out by NPO National Settlement Depository (CJSC NSD). It is there that the funds of our customers trading on the Moscow Exchange are stored.

And for our clients trading currencies with Currenex, the state’s largest and oldest European clearing house ABN AMRO Clearing is cleared and settled on transactions by the state.

Therefore, if the Forex-kitchen declares that the transactions are executed not on the OTC market, but on the exchange itself, then the following should be indicated in the case with the client:

- A) the exchange (or other platform) on which transactions are made (the place of transactions),

- B) a settlement organization that performs settlements on all transactions completed (the place where the funds of bidders are stored).

- C) a clearing organization that reconciles mutual debt between participants in exchange trading, if the trading platform allows clearing through several clearing houses.

The last two functions can be combined in one legal entity, but cannot be combined with the exchange. If your broker in the trading agency has provided and indicated all these points, then perhaps he is not a kitchen. However, most cuisines do not disclose any items on their sites. If you are very meticulous, they will let you see them in the office. If you go there and persevere. After you sign it.

However, even when some Forex kitchen says that it gives the exchange market or ECN (even the same Currenex), this does not necessarily mean that it really brings its customers there. This may mean that she, as I noted above, only hedges her own risks on this site. Check is easy. Ask who clears - go to the clearing site, look at its licenses, call and make sure that among the clients of this clearing is your esteemed Forex cuisine. This is if the kitchen is not a bidder. She can act on a sub-brokerage scheme, right? The same goes for the calculations. Therefore, it is worth asking a completely inextricable question: cuisine, who is your broker, where is your clearing, where is your settlement bank?

And silence in response ...

If anyone finds inthe list of bidders for the Moscow Exchange at least one forex broker, let him immediately share this discovery.

What is the commission, Creator?

Another interesting question. The fact is that transactions cost money. Any transaction has its own cost, with the exception of a fictitious transaction concluded inside the kitchen, which is not sent anywhere. Let's look at the commissions in the agency. Is there a commission or not? Are they higher or lower? A normal broker works for a commission. Kitchen - works without commission. Why take a commission in the kitchen if the client loses everything to her anyway?

Another criterion of "kitchen" is the shoulder. Here, for example, is what we can read on the website of one kitchen:

To start trading on a live account, you will not need a lot of money. In ****** there are accounts without a minimum deposit, which means that you can become a trader with almost any amount. At the same time, thanks to the capabilities of margin trading, you can make large transactions: a leverage of 1: 1000 will allow you to operate on the Forex market with an amount that is 1,000 times the balance of your account.

This is a sign of the kitchen. Not a single real player and no real financial intermediary will take the risk of providing not only 1000, but even 100 leverage.

I didn’t mention a single name in the previous or in this article, so there is no need to accuse me of black PR or desecration of any particular company. However, there is Google who knows everything. And all the names are known to him. And all jurisdictions. And for some reason all kitchens suddenly turn out to be registered in some Grenadines, Caymans, BVI and it is still not clear where. Where are Russian forex brokers? They are not with the exception of licensed brokerage companies and banks. But it’s not about them.

We ask ourselves a question. And why, in fact, do they prefer offshore jurisdictions? The answer here is: so that the deceived customers go to sue them on .... In short, where they are only registered, but where there is no office, no money, no staff, or the international FOREX market itself. Such a wonderful world financial center in the Grenadines is being built!

Ignorance of the laws does not exempt

However, there is another answer to the question: why are there no Forex kitchens in Russian jurisdictions? Everything is simple. Exactly because their activity here is illegal. Therefore, they are present here in the form of unlicensed intermediaries and consultants who are not responsible for anything. What laws violate the Forex kitchens registered in offshore companies, as well as their intermediaries and numerous consultants living here unclear at whose expense?

Firstly, Federal Law No. 325 “On Organized Tenders”, which regulates the activities of exchanges. The fact is that by organizing such a fictitious trade and calling it exchange trading (possibly for solidity and imparting a touch of legality), the “kitchen” is subject to this law, since it actually carries out trade organization activities without a stock exchange license. This is illegal entrepreneurial activity in the territory of the Russian Federation, which can be stopped at any time.

Secondly, Federal Law No. 7 “On Clearing and Clearing Activities”, which regulates clearing activities. Many forex kitchen employees, after you squeeze them, say that they clear clients' transactions within themselves, and some write it on websites. Say, one client bought, another client sold, why bring their deals to the market? It is clear that this has nothing to do with real clearing. Just misuse of a term that deliberately misleads a potential customer. In any case, such activity, if conducted, constitutes a violation of federal law No. 7. Clearing activity is possible only on the basis of a license of a clearing organization issued in the manner prescribed by law. This activity is not combined with either exchange or brokerage licenses.

Thirdly, when clients interact with financial intermediaries: banks and professional participants in the securities market, their interests are protected by Federal Law No. 46-ФЗ “On the Protection of the Rights and Legal Interests of Investors in the Securities Market”, because the objectives of this law are to ensure state and public protection of the rights and legitimate interests of investors, as well as to determine the procedure for paying compensation and providing other forms of compensation for damage to investors caused by illegal actions of issuers and other participants in the securities market. When trading with forex-kitchen, customers lose such protection. It is clear that forex-kitchen does not conclude any contracts for each transaction with its clients. There is no contract for a deal - there is no subject for protection. And those contracts that are offered, on the contrary, they deduce the interaction between the client and Forex cuisine from the Russian legislative field. If we try to formalize everything in the form of a contract of commission (commission), or an agency contract provided for by the Civil Code of Russia, then we will come to a professional licensed activity. We look at Federal Law No. 39 “On the Securities Market”, which regulates the activities of professional participants: brokers, dealers, depositories, etc. The activities of a broker or dealer without an appropriate license are illegal business activities in the Russian Federation.

Fourth, according to Art. 4 FZ No. 46 (Restrictions on the securities market in order to protect the rights and legitimate interests of investors), the terms of contracts concluded with investors that restrict the rights of investors compared to the rights provided for by the legislation of the Russian Federation on the protection of the rights and legitimate interests of investors in the securities market are void. As mentioned above, Forex-kitchen does not conclude any contracts for each transaction with its clients.

Fifthly, Federal Law No. 38 “On Advertising” has been violated with respect to the publication of unfair and unreliable advertising and the promise of easy earnings, which really aren’t, the use of terms that mislead the client, such as investments, exchange trading, currency trading, clearing, dealing etc.

To financial intermediaries, by the way, Federal Law No. 38 prohibits promising or guaranteeing income, to keep silent about other conditions for the provision of relevant services that affect the amount of income that people who use the services will receive, or the amount of expenses that people who use the services incur, if the advertisement says at least one of these conditions.

And this list can go on and on ...

When I see an advertisement in the metro where a certain company invites me to take part in currency wars - as a professional, I know that this is not a figure of speech, namely, unfair advertising and deceit of workers.

The only economic sense of the kitchen forex is the selection of "extra" money ...

The trouble is that all forex experts understand perfectly the illegitimacy and deficiency of their existence here in Russia and really want to legalize their activities. I have talked with many of their representatives in recent years. And in private conversations they all acknowledge that what they provide is a game. Betting game. Spread betting. In Russian, this is the adoption of rates on the exchange rate. The sole purpose of this game is to satisfy the excitement and craving for risk. No more. There is no investment, there is no currency trading. There is a sweepstakes and bookmaker, clothed in the form of filing a trade order in a particular currency.

Then the question arises: why not get a bookmaker’s license and calmly continue to honestly provide services, the economic meaning of which, if any, is to select “extra” money from those entities that really have extra money?

But no Forex kitchen wants to be an honest bookmaker. They want to be the

If we are talking about creating special regulation for Forex offices, then it should be based on the following simple and understandable principles:

- Limiting the risk of customers by limiting the available leverage depending on the volatility and liquidity of the traded instrument. Now this is not. Who is against?

- Customer segregation by acceptable risk, depending on experience and trading capital. Now this is not.

- Elimination of an existing conflict of interest between the client and the intermediary. Either an intermediary is an intermediary who works for a commission (broker), or he honestly takes the risk and does not take commissions (dealer), but at the same time he cannot store and dispose of clients' funds. Now this is not so.

- Introduction and control of risk standards for one client and for all clients integrally. Now this is not.

- Introduction and control of the limit of open foreign exchange position on the company. Now this is not.

- Reasonable capital adequacy requirements of such companies.

- Transparency of pricing and execution of transactions.

Regulation in any case should not contradict neither the current regulation in the financial sector, nor the Civil Code.

Finally, I want to tell those representatives of the near-market industry who, over the years of their work, have not learned to see the difference between Forex cuisines and normal brokers. It is approximately the same as between the "hotel for an hour" and a normal hotel of 3 or 4 or even 5 stars. The first serves the satisfaction of possibly natural, but base needs, and the latter participate in economic life: they provide temporary shelter to people who are here on business or on vacation.

Why do we need stock markets? To stimulate investment in the business by providing investors with guarantees that they can always sell their shares at prevailing prices - this ensures the liquidity of their investments. The forex market, as understood by the representatives of forex cuisines, does not solve a single economic problem and the economy is not needed in its pure form.

Post scriptum

I reread the text just written and found that the topic is “ what are we better? "Not disclosed.

Attention! There is continuous advertising.

So, we provide an honest foreign exchange market where there are real transactions. Where settlements are made for each transaction: delivery against payment on the Western market (on the Currenex site ) and on the currency and precious metals market of the Moscow Exchange. Arbitration is possible on these two sites. In addition, arbitration is possible between currencies and currency futures traded on the derivatives market.

Clearing transactions conducted on Currenex is conducted for us by ABN Amro Clearing, which also maintains our settlement and trading accounts as a Russian licensed broker, introducing its customers to the market.

The Currenex access limit is $ 20k (agree that a person who has $ 20k in his pocket will be more careful in controlling his risks than a person who has only $ 100).

A leverage equal to 20 is quite adequate to the volatility of exchange rates and corresponds to the leverage that is available to our clients on the Moscow Exchange currency market .

The Moscow Exchange market is included by us in the Unified Monetary Position with other markets. The Currenex market will be added to the EDP later. So far, the cost of exchange fees on both platforms is the same: $ 15 for a deal of $ 1 million.

Connection: terminals SmartX TM(Moscow Exchange's foreign exchange market), direct access to both markets through certified FIX gateways, and an additional direct access terminal to the Currenex site. Norolling pins MT4, 5 and other kitchen appliances.

Full transparency + legal protection allows both us and the customers who, for whatever reason, have chosen these markets, to feel comfortable and protected.

If you have questions, please contact the sales department 8-495-933-32-32

Clearing transactions conducted on Currenex is conducted for us by ABN Amro Clearing, which also maintains our settlement and trading accounts as a Russian licensed broker, introducing its customers to the market.

The Currenex access limit is $ 20k (agree that a person who has $ 20k in his pocket will be more careful in controlling his risks than a person who has only $ 100).

A leverage equal to 20 is quite adequate to the volatility of exchange rates and corresponds to the leverage that is available to our clients on the Moscow Exchange currency market .

The Moscow Exchange market is included by us in the Unified Monetary Position with other markets. The Currenex market will be added to the EDP later. So far, the cost of exchange fees on both platforms is the same: $ 15 for a deal of $ 1 million.

Connection: terminals SmartX TM(Moscow Exchange's foreign exchange market), direct access to both markets through certified FIX gateways, and an additional direct access terminal to the Currenex site. No

Full transparency + legal protection allows both us and the customers who, for whatever reason, have chosen these markets, to feel comfortable and protected.

If you have questions, please contact the sales department 8-495-933-32-32

Posted by Vladimir Tvardovsky, Chairman of the Board, ITinvest.