How uncertainty kills commerce

- Transfer

The author of the article discusses which factor is more important for creating trustworthy commercial relations between suppliers and consumers of services — a reduction in waiting time or certainty in obtaining a result.

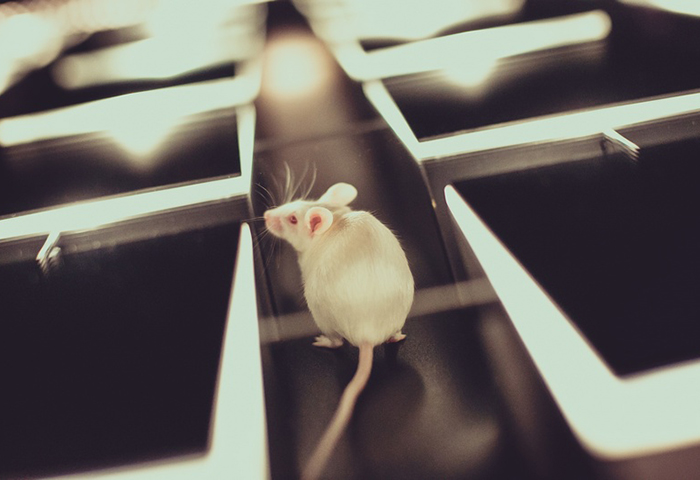

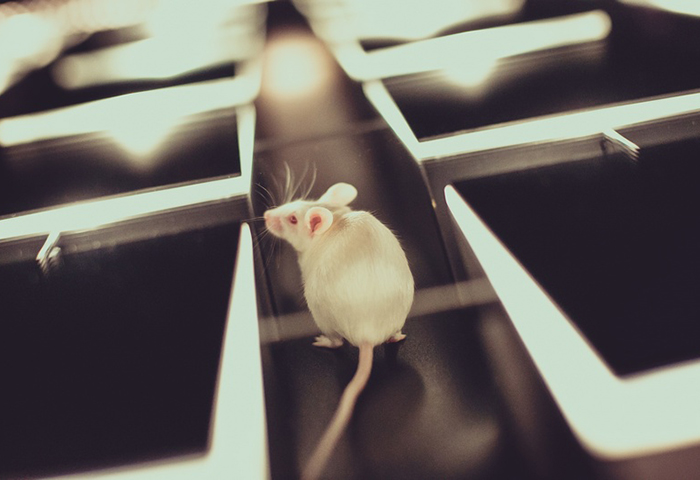

Scientists have found that humans and mice have a lot in common.

As a new study from the University of Minnesota Medical School shows , both of them are very worried about the time spent waiting for any events.

During the study, both categories of subjects were asked to wait and receive an award (food for mice, videos for people). Then, already during the wait, a similar offer was received several times.

In both situations, the researchers found that mice and people waited steadily even when this process began to inconvenience them. In economic language, the concept that scientists have studied is called “irreversible costs.”

Irreversible costs are the reluctance to consider other options, including the refusal to change current activities and further losses after the decision was made.

Economists have long considered this idea a delusion. They suggest not focusing on costs as soon as they occur, and focusing on future costs and profits.

The idea of irreversible losses confuses not only people (and, as we now know, mice), but also businesses.

Companies that invest time, money and corporate reputation into something can ultimately become so involved in it that they will continue to hope for better results even in the light of obstacles and information about the unattainability of expected indicators.

Top managers explain this policy by the fact that large monetary and temporary investments have already been made, so the company may well not to leave the chosen course, because further waiting will not entail serious new costs. And maybe one day the market will turn in their direction, and the expectations will be justified.

But the modern business world exists in a constantly changing environment in which time is one of the most valuable currencies. From this point of view, the misconceptions associated with the concept of irreversible costs may lead companies into one of three pitfalls.

If you think in more practical categories, this research and the concept of irreversible costs are directly related to the biggest obstacle that consumers and businesses face in a commercial environment.

This is uncertainty.

Let's face it: irreversible costs would not seem so irreversible if the result of their investment was known in advance. In this case, even waiting would be perceived more calmly.

If someone has invested resources in anything, then he believes that the longer he waits, the more likely the reward is close. However, the uncertainty of the result, combined with not knowing the time to achieve it, can lead to the fact that waiting will bring the business to collapse.

During the study, people and mice knew that they would receive an award. This knowledge allowed them to weigh the pros and cons, and they waited patiently further. They were also given signals on how much more time would pass to the desired result.

The knowledge that the time spent was guaranteed to pay off, could affect the fact that the subjects continued to wait. They accepted the wait as a condition of a deal. The definiteness of the result was sufficient reason to suffer.

However, certainty and the ability to guarantee it are not considered to be important conditions for innovation in a modern commercial ecosystem.

And perhaps the time has come when this situation should be changed.

We live in a world where many services are available on demand. And for such a world there is nothing worse than waiting.

Modern consumers and businesses spend a lot of time hoping for a particular outcome.

Waiting creates a fertile ground for uncertainty.

Consumers are waiting for the right bus or train to arrive, languishing in traffic jams. They spend time waiting for a support staff member to answer their questions, until doctors take them in or when airport checks end. Consumers queue up in supermarkets or on website downloads.

The company Timex conducted a study in which it measured how much time Americans spend on waiting.

It turned out that a lot of time is wasting. The consumer spends the full six months of life in anticipation of certain events. In general, Americans lose a little more than 37 billion hours a year.

Businesses are also often idle. They are waiting for the funds from the buyers to come in, not knowing whether the funds will really come in, whether everything is in order with them, and sometimes in what amount they will come. Buyers spend time deciding when to pay for the services of these businesses, based on how much time they have to wait for payment from their customers.

This situation is especially relevant when partners are located in different countries. They spend time finding out where in the literal sense their money is located.

Such uncertainty while waiting can be costly for businesses.

Managing and forecasting cash becomes impossible. Often companies are forced to look for other sources of working capital to fill in the gaps, which is worth the extra effort.

The game with the element of waiting only adds fuel to the fire of the world of services on demand.

Retailers and commercial players know that consumers tend to make purchases in places where the desired product becomes available to them immediately, and that they are loyal to any seller who can offer an acceptable combination of convenience and speed of delivery.

Our own research into the behavior of thousands of consumers during shopping and online shopping also shows that in many cases people value convenience morethan the price. It is not surprising that retailers invest in improving the speed and comfort of service, considering this to be the main elements of a first-class service.

If we talk about the commercial side of payments, innovators have been puzzled for over a decade by the obsession to implement the concept of payment for services in real time. Today, there are more than three dozen different fast payment schemes in the United States that are at a particular stage of development and are aimed at accelerating transactions between banks and corporate clients.

Serious talk about the acceleration of payments began since in 2015 the US Federal Reserve gathered a working group to study this subject. The initiative’s goal is to create a real-time payment and settlement standard across the entire United States banking system. In 2017, the working group published its recommendations. In the same year, the National Association of Clearing Organizations submitted a project to accelerate the time for conducting transactions in the ACH system to one day across all banks in the country.

But why stop for a period of one day? After all, you can wait for the next acceleration for quite some time. And ultimately, speed is the most important thing, isn't it?

I recently held a discussion on the global state of B2B payments at a single industry conference. During the discussion, an electronic survey of corporate bankers and representatives of the Fintech industry was held in the audience.

When a question was asked about the most important characteristic of a modern B2B payment system, the audience chose between five answers:

- the cost of payments;

- payment security;

- the speed of payments and closing of the transaction;

- data transmitted along with payments;

- transparency of the payment process.

The undisputed leader was the transparency of the process. In this case, the term meant certainty about where the funds are located during their movement between banks across state borders.

It turns out that while consumers want billions to be invested by banks in redistributing the existing payment system and speeding up, banks themselves put at the center of certainty about when the funds sent will arrive at their destination.

The same can be said about their corporate clients, for whom it is important to know exactly about the availability of available funds and the time when the funds can be used.

And this is a very reasonable approach, because without the possibility of taking into account these two factors, banks and “corpses” cannot plan, optimize and manage cash operations.

Payment speed does not provide any special advantages, provided that the systems of most corporate clients do not support real-time settlements. What they can do is work with real-time information.

The most important attribute of a modern international payment system is not the ability to conduct quick transactions, but it is precisely the certainty.

This does not mean at all that there are no cases of their own for payments on demand, and that in the future, expedited transactions will not be one of the available options.

But the very understanding of speed requires a clear definition and is highly dependent on the context.

Major market players, along with innovators, are already working to accelerate transactions in the context of those cases where it is in demand and does not entail a thorough rework of their infrastructure from banks or corporations.

If we consider payments from the point of view of retail, then here the choice of the consumer increasingly depends on certainty.

Skipping the queue stage by making a reservation is quick and convenient, provided that such an opportunity is advertised and corresponds to the description. Just like in Starbucks. The promise of speed and convenience makes sense only if the ability to receive the order and the exact time it is received are guaranteed.

Buying from an Instagram feed is a great way to find cool new things, considering, of course, that the ordering process will also be quick and without unnecessary obstacles.

If, when you click on the “Buy” button, a consumer is required to fill in many fields for delivery and payment, or are asked to receive a promotional code with a 10% discount sent to email, then in the mind of the buyer uncertainty and prejudice will arise in relation to any similar ads. Profit from such contextual purchases will be high only if they work easily, safely and steadily anywhere on the platform.

Consumers choose Walmart, because they know that visiting this store will save time and money. Therefore, Walmart continues to seriously invest in the elements of service, allowing consumers to save. Confidence in daily low prices every week brings to the chain stores 100 million Americans and 270 million people worldwide.

Delivery guarantee is probably the main reason Amazon won almost half of all US e-commerce sales last year. Informing about the services that Prime members receive can help keep consumers in the club, the cost of participation in which has risen to $ 119 a year.

American consumers often start and end their search for products on Amazon, and there’s a reason. They are confident that Amazon offers them the widest range available on the first click. Purchased goods can be delivered within one to two days or even two hours, and the process of ordering and service are at the same stable level for all merchants of the site.

This sense of certainty is the reason why American consumers are starting to use Alexa more often as their virtual assistant. The service, in turn, helps Amazon expand into new segments - groceries, clothing, health care, household services and inventory, fast food restaurants, prescription drugs and medicines, as well as many others.

And consumers everywhere support this growth, because they are confident that Amazon will necessarily provide the stated service. And confidence creates trust.

MIT famous mathematician and professor Claude Shannon once said that information removes uncertainty. Despite the fact that his name may be unknown in wide circles, his contribution to the development of cryptography, artificial intelligence and information technology speaks for itself.

Shannon is considered the “father of the information age”. He is credited with creating the first device capable of learning with the help of artificial intelligence, a magnetic mouse trained to navigate the labyrinth created by Shannon and becoming smarter with each attempt to go through it.

Consumers and businesses each day decide whether to wait. They make choices based on the options available and the context in which the decision is made.

Information provides this context.

However, it is precisely certainty that is the foundation for creating trusting commercial relationships.

Information - accurate, relevant, giving the basis for action, provided to consumers and businesses at the time of decision making - this is what creates trust. This information helps to determine whether waiting is acceptable, and if so, whether it is not delayed and whether it is time to move on to considering other options, discarding thoughts of irreversible costs.

Innovators offering information solutions and creating context and certainty will earn the trust of businesses, consumers, and many other participants in the commercial ecosystem.

Scientists have found that humans and mice have a lot in common.

As a new study from the University of Minnesota Medical School shows , both of them are very worried about the time spent waiting for any events.

During the study, both categories of subjects were asked to wait and receive an award (food for mice, videos for people). Then, already during the wait, a similar offer was received several times.

In both situations, the researchers found that mice and people waited steadily even when this process began to inconvenience them. In economic language, the concept that scientists have studied is called “irreversible costs.”

Irreversible costs are the reluctance to consider other options, including the refusal to change current activities and further losses after the decision was made.

Economists have long considered this idea a delusion. They suggest not focusing on costs as soon as they occur, and focusing on future costs and profits.

Sinking ship irreversible costs

The idea of irreversible losses confuses not only people (and, as we now know, mice), but also businesses.

Companies that invest time, money and corporate reputation into something can ultimately become so involved in it that they will continue to hope for better results even in the light of obstacles and information about the unattainability of expected indicators.

Top managers explain this policy by the fact that large monetary and temporary investments have already been made, so the company may well not to leave the chosen course, because further waiting will not entail serious new costs. And maybe one day the market will turn in their direction, and the expectations will be justified.

But the modern business world exists in a constantly changing environment in which time is one of the most valuable currencies. From this point of view, the misconceptions associated with the concept of irreversible costs may lead companies into one of three pitfalls.

- If a business does not want to deviate from the “all or nothing” strategy and does not have time to “live” until the moment when such an approach yields, then it can completely sink the company.

- The company will be deprived of new opportunities in the future, as the expectation of a “coming major breakthrough” is a serious distraction that selects resources that could be used to explore other options.

- Or the decision to leave the current rate is made too late, not allowing to benefit from the needs of the market.

If you think in more practical categories, this research and the concept of irreversible costs are directly related to the biggest obstacle that consumers and businesses face in a commercial environment.

This is uncertainty.

Let's face it: irreversible costs would not seem so irreversible if the result of their investment was known in advance. In this case, even waiting would be perceived more calmly.

If someone has invested resources in anything, then he believes that the longer he waits, the more likely the reward is close. However, the uncertainty of the result, combined with not knowing the time to achieve it, can lead to the fact that waiting will bring the business to collapse.

During the study, people and mice knew that they would receive an award. This knowledge allowed them to weigh the pros and cons, and they waited patiently further. They were also given signals on how much more time would pass to the desired result.

The knowledge that the time spent was guaranteed to pay off, could affect the fact that the subjects continued to wait. They accepted the wait as a condition of a deal. The definiteness of the result was sufficient reason to suffer.

However, certainty and the ability to guarantee it are not considered to be important conditions for innovation in a modern commercial ecosystem.

And perhaps the time has come when this situation should be changed.

Demands of the economy on demand

We live in a world where many services are available on demand. And for such a world there is nothing worse than waiting.

Modern consumers and businesses spend a lot of time hoping for a particular outcome.

Waiting creates a fertile ground for uncertainty.

Consumers are waiting for the right bus or train to arrive, languishing in traffic jams. They spend time waiting for a support staff member to answer their questions, until doctors take them in or when airport checks end. Consumers queue up in supermarkets or on website downloads.

The company Timex conducted a study in which it measured how much time Americans spend on waiting.

It turned out that a lot of time is wasting. The consumer spends the full six months of life in anticipation of certain events. In general, Americans lose a little more than 37 billion hours a year.

Businesses are also often idle. They are waiting for the funds from the buyers to come in, not knowing whether the funds will really come in, whether everything is in order with them, and sometimes in what amount they will come. Buyers spend time deciding when to pay for the services of these businesses, based on how much time they have to wait for payment from their customers.

This situation is especially relevant when partners are located in different countries. They spend time finding out where in the literal sense their money is located.

Such uncertainty while waiting can be costly for businesses.

Managing and forecasting cash becomes impossible. Often companies are forced to look for other sources of working capital to fill in the gaps, which is worth the extra effort.

The game with the element of waiting only adds fuel to the fire of the world of services on demand.

Retailers and commercial players know that consumers tend to make purchases in places where the desired product becomes available to them immediately, and that they are loyal to any seller who can offer an acceptable combination of convenience and speed of delivery.

Our own research into the behavior of thousands of consumers during shopping and online shopping also shows that in many cases people value convenience morethan the price. It is not surprising that retailers invest in improving the speed and comfort of service, considering this to be the main elements of a first-class service.

If we talk about the commercial side of payments, innovators have been puzzled for over a decade by the obsession to implement the concept of payment for services in real time. Today, there are more than three dozen different fast payment schemes in the United States that are at a particular stage of development and are aimed at accelerating transactions between banks and corporate clients.

Serious talk about the acceleration of payments began since in 2015 the US Federal Reserve gathered a working group to study this subject. The initiative’s goal is to create a real-time payment and settlement standard across the entire United States banking system. In 2017, the working group published its recommendations. In the same year, the National Association of Clearing Organizations submitted a project to accelerate the time for conducting transactions in the ACH system to one day across all banks in the country.

But why stop for a period of one day? After all, you can wait for the next acceleration for quite some time. And ultimately, speed is the most important thing, isn't it?

Certainty and its crucial

I recently held a discussion on the global state of B2B payments at a single industry conference. During the discussion, an electronic survey of corporate bankers and representatives of the Fintech industry was held in the audience.

When a question was asked about the most important characteristic of a modern B2B payment system, the audience chose between five answers:

- the cost of payments;

- payment security;

- the speed of payments and closing of the transaction;

- data transmitted along with payments;

- transparency of the payment process.

The undisputed leader was the transparency of the process. In this case, the term meant certainty about where the funds are located during their movement between banks across state borders.

It turns out that while consumers want billions to be invested by banks in redistributing the existing payment system and speeding up, banks themselves put at the center of certainty about when the funds sent will arrive at their destination.

The same can be said about their corporate clients, for whom it is important to know exactly about the availability of available funds and the time when the funds can be used.

And this is a very reasonable approach, because without the possibility of taking into account these two factors, banks and “corpses” cannot plan, optimize and manage cash operations.

Payment speed does not provide any special advantages, provided that the systems of most corporate clients do not support real-time settlements. What they can do is work with real-time information.

The most important attribute of a modern international payment system is not the ability to conduct quick transactions, but it is precisely the certainty.

This does not mean at all that there are no cases of their own for payments on demand, and that in the future, expedited transactions will not be one of the available options.

But the very understanding of speed requires a clear definition and is highly dependent on the context.

Major market players, along with innovators, are already working to accelerate transactions in the context of those cases where it is in demand and does not entail a thorough rework of their infrastructure from banks or corporations.

Waiting price

If we consider payments from the point of view of retail, then here the choice of the consumer increasingly depends on certainty.

Skipping the queue stage by making a reservation is quick and convenient, provided that such an opportunity is advertised and corresponds to the description. Just like in Starbucks. The promise of speed and convenience makes sense only if the ability to receive the order and the exact time it is received are guaranteed.

Buying from an Instagram feed is a great way to find cool new things, considering, of course, that the ordering process will also be quick and without unnecessary obstacles.

If, when you click on the “Buy” button, a consumer is required to fill in many fields for delivery and payment, or are asked to receive a promotional code with a 10% discount sent to email, then in the mind of the buyer uncertainty and prejudice will arise in relation to any similar ads. Profit from such contextual purchases will be high only if they work easily, safely and steadily anywhere on the platform.

Consumers choose Walmart, because they know that visiting this store will save time and money. Therefore, Walmart continues to seriously invest in the elements of service, allowing consumers to save. Confidence in daily low prices every week brings to the chain stores 100 million Americans and 270 million people worldwide.

Delivery guarantee is probably the main reason Amazon won almost half of all US e-commerce sales last year. Informing about the services that Prime members receive can help keep consumers in the club, the cost of participation in which has risen to $ 119 a year.

American consumers often start and end their search for products on Amazon, and there’s a reason. They are confident that Amazon offers them the widest range available on the first click. Purchased goods can be delivered within one to two days or even two hours, and the process of ordering and service are at the same stable level for all merchants of the site.

This sense of certainty is the reason why American consumers are starting to use Alexa more often as their virtual assistant. The service, in turn, helps Amazon expand into new segments - groceries, clothing, health care, household services and inventory, fast food restaurants, prescription drugs and medicines, as well as many others.

And consumers everywhere support this growth, because they are confident that Amazon will necessarily provide the stated service. And confidence creates trust.

Certainty certainty

MIT famous mathematician and professor Claude Shannon once said that information removes uncertainty. Despite the fact that his name may be unknown in wide circles, his contribution to the development of cryptography, artificial intelligence and information technology speaks for itself.

Shannon is considered the “father of the information age”. He is credited with creating the first device capable of learning with the help of artificial intelligence, a magnetic mouse trained to navigate the labyrinth created by Shannon and becoming smarter with each attempt to go through it.

Consumers and businesses each day decide whether to wait. They make choices based on the options available and the context in which the decision is made.

Information provides this context.

However, it is precisely certainty that is the foundation for creating trusting commercial relationships.

Information - accurate, relevant, giving the basis for action, provided to consumers and businesses at the time of decision making - this is what creates trust. This information helps to determine whether waiting is acceptable, and if so, whether it is not delayed and whether it is time to move on to considering other options, discarding thoughts of irreversible costs.

Innovators offering information solutions and creating context and certainty will earn the trust of businesses, consumers, and many other participants in the commercial ecosystem.