Other column: on budget smartphones and local brands

My friends of old age often call me (young people usually know what they want) and ask me to advise their cell phone. Like, I’m standing in a store, is there such and such a thing on sale, what to choose? So a couple of years ago they used to say something like this: there is a good Nokia and there is a good Samsung, tell me what to prefer. In 2013, the situation changed radically. They called several times and asked for help in choosing between devices of local Russian brands. At the same time, the models of manufacturers of the "first tier" were not considered in principle. Just in case, I asked my comrades - what about Samsung, but what about Sony? They answered something like this: “And we have a budget of 200 bucks. A hand doesn’t rise to pay for a $ 200 Sony when there is a brand X model nearby, and it has a screen one and a half times larger.

Indeed, I do not recall adequate options from A-brands with a value of 6-7-8 thousand rubles. World-class companies focus on more expensive models - and put their whole soul into them, as they say. Naturally, some with enviable persistence plan to climb into the “initial” segment, but these attempts cannot be called any success. For example, just yesterday I was dealing with the LG Optimus L5 II Dual model for 7 thousand rubles. (A little later I will write a review, you just need to beg it to use for at least a week.) The device itself is not bad - though until you remember that analogues from B-brands cost almost half the price. And in terms of iron, they also win: for example, in this very L5 II Dual there is a rather old “stone” MediaTek MT6575, and in some Highscreen Spark for 3,500 (also “dual-SIM”,

LG Optimus L5 II Dual

Actually, the fact that LG SUDDENLY used the budget platform MediaTek in its low-cost model (it’s 20 percent cheaper in purchasing analogues from Qualcomm), says the following: the Korean company tried to cheapen its product to compete with small brands in markets like the Russian one. The attempt, however, was not counted: the price still turned out to be too high. (Although lower than the Optimus L5 Dual at one time - in the middle of the life cycle it cost about 8.5 thousand.)

According to some reports, a few more first-tier manufacturers will soon try to follow a similar path. For example, if you believe the rumors, Sony intends to give the development of low-cost models to the side (however, there is nothing new here - this was still practiced in Sony Ericsson). In the meantime, the Japanese vendor is selling the Xperia C smartphone with two SIM cards and the MediaTek MT6589 chipset in China. There is no other way: in China, the situation with local brands is even “worse” than in Russia. Do not make an inexpensive product even cheaper - they will trample.

Sony Xperia C

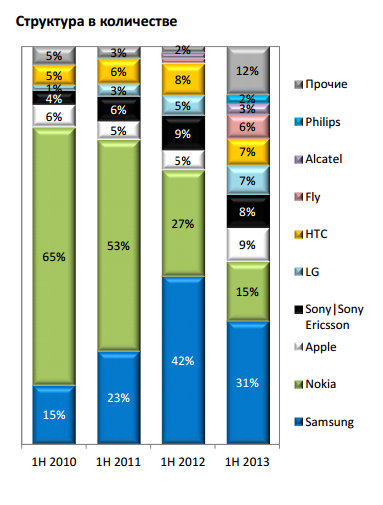

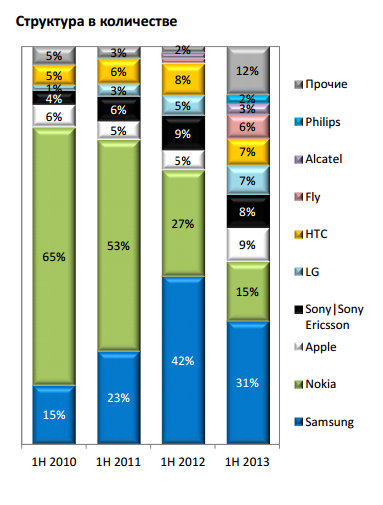

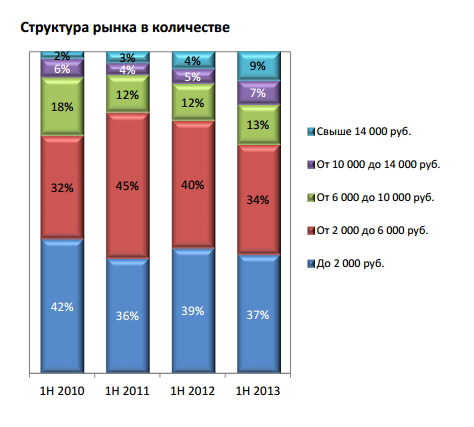

In Russia, the process of “trampling” the market with domestic brands has also started. Just look at this chart published by the Euroset analytical department:

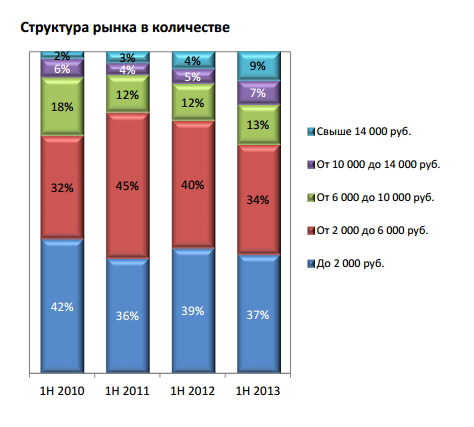

Who grew up in the first half of 2013 compared to the first half of 2012? First of all, the “Other” item is striking: these are the very local brands that increase supplies, lower prices and thereby reduce the share of first-tier brands. In particular, the shares of Samsung and Nokia noticeably “lost weight”. Meanwhile, Fly, Alcatel and Philips - by the technical level of products and the approach to pricing, they practically do not differ from all the same local B-brands - have grown significantly. Moreover, it is due to budgetary decisions worth up to 10 thousand rubles, as evidenced by the following Euroset schedule and data on sales of phones and smartphones in the first half of 2013. During this period, about 17.3 million mobile devices were sold in Russia, which is 7% less than in the first half of 2012.

Pay attention to the segments "from 2 to 6 thousand" and "from 6 to 10 thousand." The sales volumes in them did not change too seriously (a drop from 40% to 34% in the area of “from 2 to 6 thousand” is explained primarily by the extinction as a class of touch phones - NOT smartphones). And if earlier only A-brands ruled the ball there, now they are being replaced by second-tier brands (12% versus 2% - see the first chart). The “first tier” remains to be saved in the segments “from 10 to 14” and “from 14 and above”, investing in advertising and marketing of the corresponding models. Actually, large manufacturers are busy with just this, due to which growth was demonstrated in the two indicated segments in the first half of 2013.

However, I allow myself to assume that in some first half of 2014 the share of the total share of “Other” or “Other” will grow again, and this will also be due to the “from 10 to 14 thousand” segment. Because B-brands today, having taken serious positions in lower segments, are aimed precisely at it. Naturally, here they will have much more difficult: a smartphone buyer for 12-14 thousand is much more demanding than a smartphone buyer for 7 thousand. The first would like to see a fresh version of Android with mandatory updates, a really high-quality camera, some kind of software chips, and so on, and the second is ready to put up with some technical backwardness of the device due to its low price.

However, the trouble began: today B-brands offer such chips in the “from 10 to 14 thousand” segment that manufacturers of the first echelon are simply not able to provide for comparable money. So, in Highscreen Alpha R for 13 thousand installed a screen with a resolution of 1920 x 1080 pixels, that is, Full HD. And at the end of August in Russia will appear Alcatel One Touch Idol X (and again a model from the B-brand) for 14 thousand. According to Alik’s characteristics, it’s slightly weaker than Alpha (there is no memory card slot, one battery for 2,000 mAh versus two for 2,000 and 4,000 and so on), and nevertheless, A-brands are powerless against such options. Yes, there is a very niche 5.5-inch “shovel” Lenovo IdeaPhone K900 with Intel Atom for 17 thousand (which, however, is already much more expensive), and prices for other devices with Full HD-displays start at 18-19 thousand .

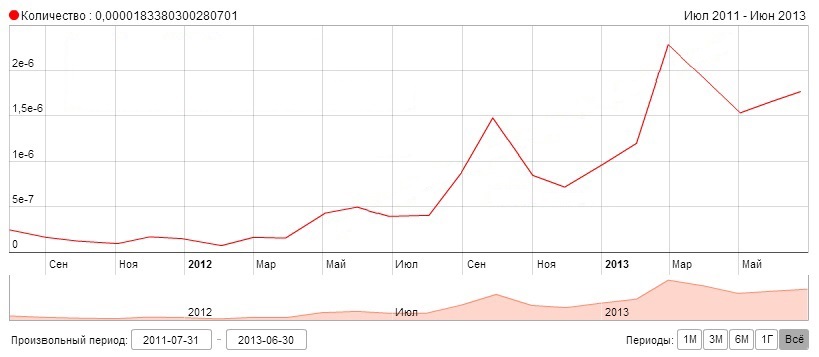

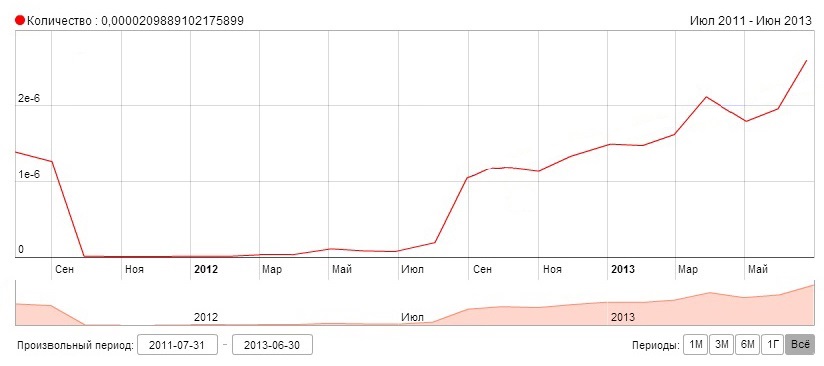

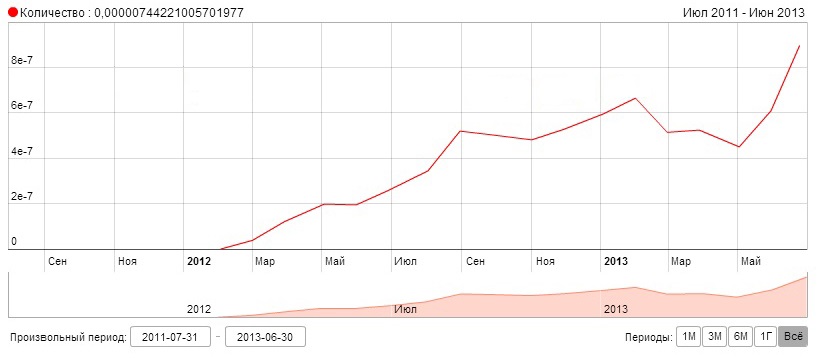

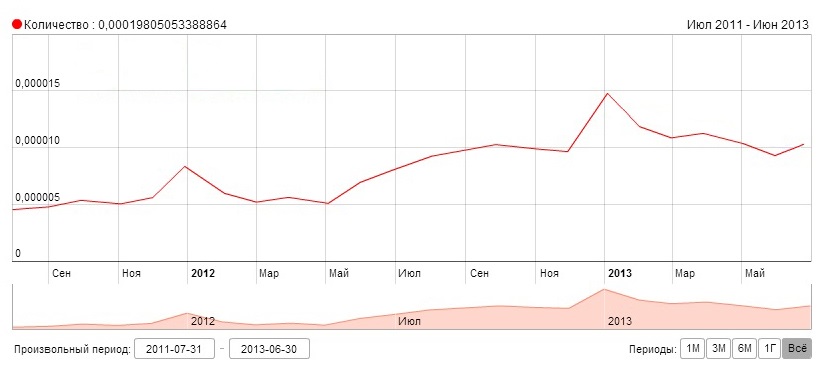

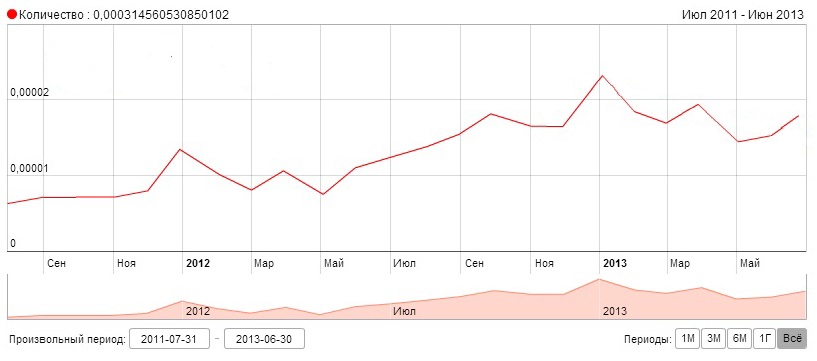

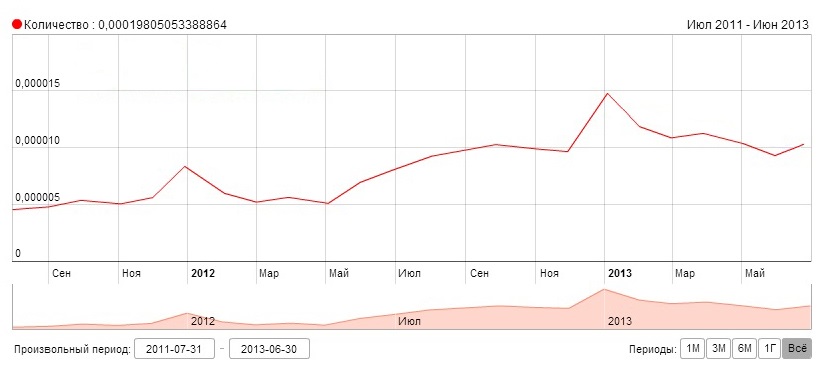

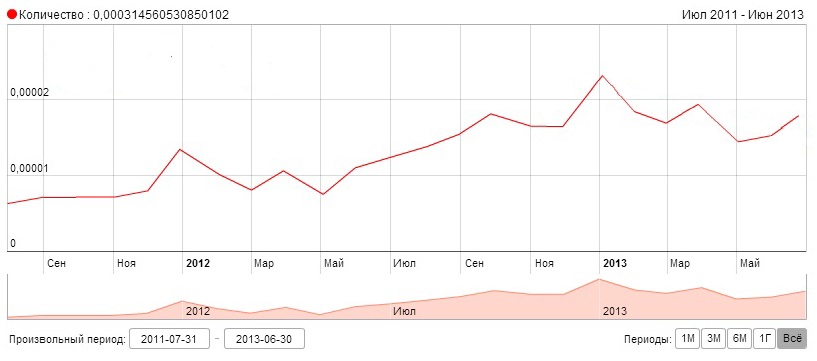

It fits perfectly into such a picture and this is a small study conducted with the help of Yandex. It estimates the growth in the number of queries for the phrase “smartphones [substitute brand]”.

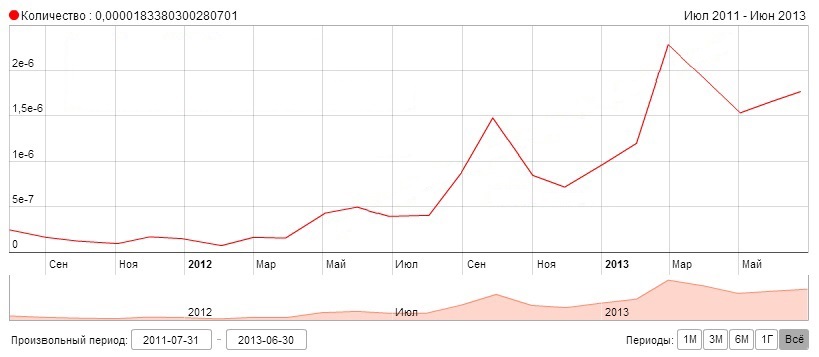

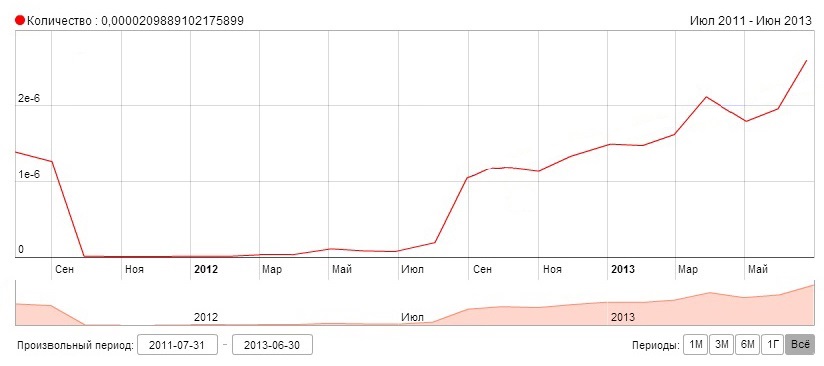

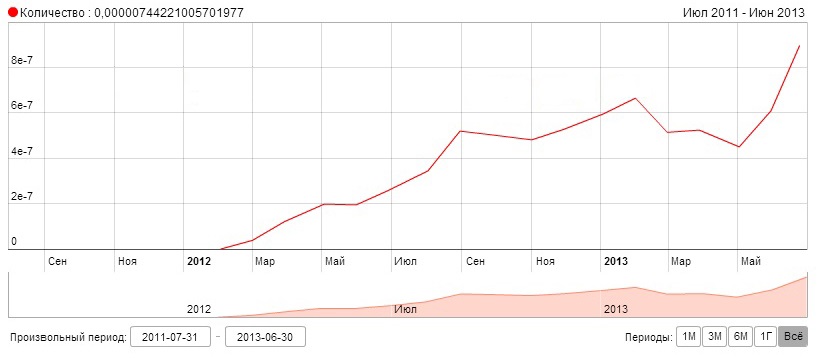

To get started, we’ll give charts for several brands of the “second tier”.

Highscreen:

Explay:

teXet:

And now - for a couple of brands of the first.

HTC:

Samsung:

Sony:

I don’t mean at all that users do not show any interest in HTC, Samsung or Sony smartphones. Manifest. I just want to note that this very interest is very calm - there is no explosive growth in the number of requests, on the contrary, in the case of HTC and Samsung, the graph does go down at all. Meanwhile, the growing interest in B-brand smartphones has been replaced with the naked eye.

It is clear that the “first echelon” will not give up so easily. It will be interesting to see what respected grandees will take in the struggle for non-operator markets. That is, for those countries where they successfully trade smartphones under their own brand, roughly speaking, anyone can - with some experience, connections in Asia and start-up capital. There are enough such comrades in Russia. Back in 2011, local smartphone brands could be counted on the fingers of one hand. Today there are a couple of dozen. And these very dozens with pleasure "bite" the Big Serious Manufacturers with a World Name.

Indeed, I do not recall adequate options from A-brands with a value of 6-7-8 thousand rubles. World-class companies focus on more expensive models - and put their whole soul into them, as they say. Naturally, some with enviable persistence plan to climb into the “initial” segment, but these attempts cannot be called any success. For example, just yesterday I was dealing with the LG Optimus L5 II Dual model for 7 thousand rubles. (A little later I will write a review, you just need to beg it to use for at least a week.) The device itself is not bad - though until you remember that analogues from B-brands cost almost half the price. And in terms of iron, they also win: for example, in this very L5 II Dual there is a rather old “stone” MediaTek MT6575, and in some Highscreen Spark for 3,500 (also “dual-SIM”,

LG Optimus L5 II Dual

Actually, the fact that LG SUDDENLY used the budget platform MediaTek in its low-cost model (it’s 20 percent cheaper in purchasing analogues from Qualcomm), says the following: the Korean company tried to cheapen its product to compete with small brands in markets like the Russian one. The attempt, however, was not counted: the price still turned out to be too high. (Although lower than the Optimus L5 Dual at one time - in the middle of the life cycle it cost about 8.5 thousand.)

According to some reports, a few more first-tier manufacturers will soon try to follow a similar path. For example, if you believe the rumors, Sony intends to give the development of low-cost models to the side (however, there is nothing new here - this was still practiced in Sony Ericsson). In the meantime, the Japanese vendor is selling the Xperia C smartphone with two SIM cards and the MediaTek MT6589 chipset in China. There is no other way: in China, the situation with local brands is even “worse” than in Russia. Do not make an inexpensive product even cheaper - they will trample.

Sony Xperia C

In Russia, the process of “trampling” the market with domestic brands has also started. Just look at this chart published by the Euroset analytical department:

Who grew up in the first half of 2013 compared to the first half of 2012? First of all, the “Other” item is striking: these are the very local brands that increase supplies, lower prices and thereby reduce the share of first-tier brands. In particular, the shares of Samsung and Nokia noticeably “lost weight”. Meanwhile, Fly, Alcatel and Philips - by the technical level of products and the approach to pricing, they practically do not differ from all the same local B-brands - have grown significantly. Moreover, it is due to budgetary decisions worth up to 10 thousand rubles, as evidenced by the following Euroset schedule and data on sales of phones and smartphones in the first half of 2013. During this period, about 17.3 million mobile devices were sold in Russia, which is 7% less than in the first half of 2012.

Pay attention to the segments "from 2 to 6 thousand" and "from 6 to 10 thousand." The sales volumes in them did not change too seriously (a drop from 40% to 34% in the area of “from 2 to 6 thousand” is explained primarily by the extinction as a class of touch phones - NOT smartphones). And if earlier only A-brands ruled the ball there, now they are being replaced by second-tier brands (12% versus 2% - see the first chart). The “first tier” remains to be saved in the segments “from 10 to 14” and “from 14 and above”, investing in advertising and marketing of the corresponding models. Actually, large manufacturers are busy with just this, due to which growth was demonstrated in the two indicated segments in the first half of 2013.

However, I allow myself to assume that in some first half of 2014 the share of the total share of “Other” or “Other” will grow again, and this will also be due to the “from 10 to 14 thousand” segment. Because B-brands today, having taken serious positions in lower segments, are aimed precisely at it. Naturally, here they will have much more difficult: a smartphone buyer for 12-14 thousand is much more demanding than a smartphone buyer for 7 thousand. The first would like to see a fresh version of Android with mandatory updates, a really high-quality camera, some kind of software chips, and so on, and the second is ready to put up with some technical backwardness of the device due to its low price.

However, the trouble began: today B-brands offer such chips in the “from 10 to 14 thousand” segment that manufacturers of the first echelon are simply not able to provide for comparable money. So, in Highscreen Alpha R for 13 thousand installed a screen with a resolution of 1920 x 1080 pixels, that is, Full HD. And at the end of August in Russia will appear Alcatel One Touch Idol X (and again a model from the B-brand) for 14 thousand. According to Alik’s characteristics, it’s slightly weaker than Alpha (there is no memory card slot, one battery for 2,000 mAh versus two for 2,000 and 4,000 and so on), and nevertheless, A-brands are powerless against such options. Yes, there is a very niche 5.5-inch “shovel” Lenovo IdeaPhone K900 with Intel Atom for 17 thousand (which, however, is already much more expensive), and prices for other devices with Full HD-displays start at 18-19 thousand .

It fits perfectly into such a picture and this is a small study conducted with the help of Yandex. It estimates the growth in the number of queries for the phrase “smartphones [substitute brand]”.

To get started, we’ll give charts for several brands of the “second tier”.

Highscreen:

Explay:

teXet:

And now - for a couple of brands of the first.

HTC:

Samsung:

Sony:

I don’t mean at all that users do not show any interest in HTC, Samsung or Sony smartphones. Manifest. I just want to note that this very interest is very calm - there is no explosive growth in the number of requests, on the contrary, in the case of HTC and Samsung, the graph does go down at all. Meanwhile, the growing interest in B-brand smartphones has been replaced with the naked eye.

It is clear that the “first echelon” will not give up so easily. It will be interesting to see what respected grandees will take in the struggle for non-operator markets. That is, for those countries where they successfully trade smartphones under their own brand, roughly speaking, anyone can - with some experience, connections in Asia and start-up capital. There are enough such comrades in Russia. Back in 2011, local smartphone brands could be counted on the fingers of one hand. Today there are a couple of dozen. And these very dozens with pleasure "bite" the Big Serious Manufacturers with a World Name.