Buffett's testament or what financial consultants are silent

W. Buffett bequeathed to his wife after his death to invest all funds in the ETF exchange fund on the S & P 500 (VOO) and live in his pleasure. However, books, the Internet and financial consultants urge us to make diversified portfolios with the obligatory inclusion of bonds in them. By the way, Buffett’s diversification is also not flattering, and calls for all eggs to be kept in one basket, just to look after it carefully.

In this article we will try to figure out whether to believe the oracle from Omaha or to listen to financial advisers. And help us in this Python and Quantopian.

The most common recommendation is to determine the share of bonds in the portfolio, taking into account the age of the investor. So, if you are 50 years old, then at least half the value of your portfolio should fall on bonds. In connection with this distribution, we will consider the following portfolio models:

But is it possible to earn something with such portfolios? And will not it be painfully painful for us to spend aimlessly years waiting for a miracle from such diversification?

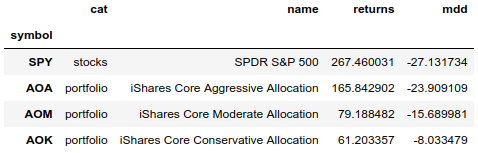

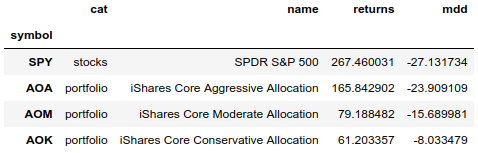

Below is a table with ETF funds representing ready-made portfolios. In them, assets are already distributed in accordance with standard portfolio models. Such a fund can be bought and forgotten and not rebalanced. Management companies will do everything for us. These funds appeared in 2009 and in the table you can compare the yield and drawdown with the S & P 500 (in this case we will use SPY, since VOO appeared later, in 2010) for an identical period.

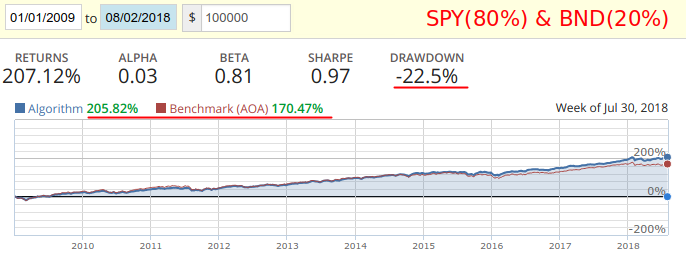

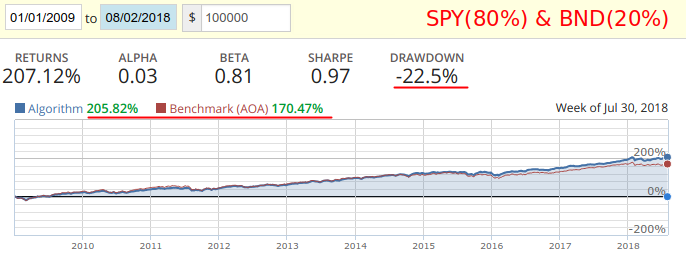

AOA's aggressive portfolio contains 20% of bonds and loses SPY 100% yield. Below is a test of the monthly rebalancing of SPY (80%) and the BND bond fund (20%) against AOA:

As can be seen from the test, independently rebalancing a portfolio of two assets 1 time per month, we would get more profitability and less drawdown. But still would have lost SPY for 9 years. As well as profitability and drawdown next to the reference AOA, we will use this pair to compare the results for a longer period.

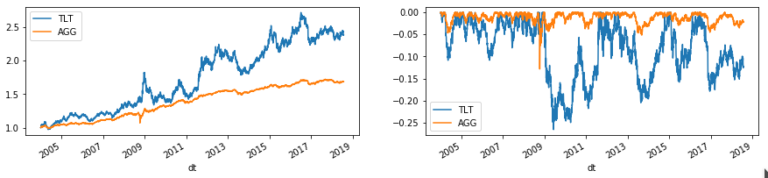

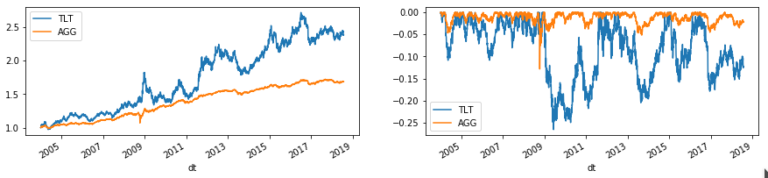

For beginning investors, bonds represent the reliability of investments, but in reality this is not the case. Corporate and, especially, high-yield bonds (as well as bonds of developing countries) are more at risk than treasuries. Lower yields and drawdowns of several ETF funds on bonds:

Observation. TLT behaved curiously in 2008, the price of which rose sharply at the beginning of the crisis and also fell sharply at the end.

Given this behavior, the use of TLT in backtests leads to a positive impact on the portfolio, which can be misleading to potential investors. AGG Foundation behaves more stable.

In the tests, we take the strategy where we will keep SPY while SMA (50) over SMA (200). In the case of a bearish intersection, all capital will be transferred to AGG.

Against this strategy, we will put sets similar to standard portfolios, and we will rebalance them monthly and annually. Results for the period from 2004 to 2018:

The results show that SPY is good in itself, and if you add a simple intersection of SMA (50) and SMA (200) with shifting into bonds, the gain is obvious. But if you reduce the number of rebalancing to monthly (or even annual), you can get a leading yield and reduce the drawdown.

Buffett is right. But the primitive strategy (SPY + AGG), based on the signals of the crossing of the averages, has been ahead of model portfolios (AOA, AOM, AOK) since 2004. Even if rebalanced once a year, just looking at the position of the medium. During several rebalancing, it is enough to look at the schedule and forget until next year. For this task, you can make a telegram-bot.

Obviously, complex portfolios from consultants can be easily replaced with ready-made ETF funds AOA, AOM and AOK (or analogues of other managers), depending on the required risk. This is in case you still need a portfolio.

Confused by the lack of diversification in emerging markets? SPY includes the world's largest multinational companies. Their products and services surround us every day. Are developing country companies growing faster? The duration of their growth is shorter, and the fall is more painful.

In this article we will try to figure out whether to believe the oracle from Omaha or to listen to financial advisers. And help us in this Python and Quantopian.

Standard Briefcases

The most common recommendation is to determine the share of bonds in the portfolio, taking into account the age of the investor. So, if you are 50 years old, then at least half the value of your portfolio should fall on bonds. In connection with this distribution, we will consider the following portfolio models:

- 80% of stocks, 20% of bonds - an aggressive portfolio;

- 40% of stocks, 60% of bonds - moderate portfolio;

- 20% of stocks, 80% of bonds - a conservative portfolio.

But is it possible to earn something with such portfolios? And will not it be painfully painful for us to spend aimlessly years waiting for a miracle from such diversification?

Are the prices for portfolio services justified today? Maybe enough consultation?

Below is a table with ETF funds representing ready-made portfolios. In them, assets are already distributed in accordance with standard portfolio models. Such a fund can be bought and forgotten and not rebalanced. Management companies will do everything for us. These funds appeared in 2009 and in the table you can compare the yield and drawdown with the S & P 500 (in this case we will use SPY, since VOO appeared later, in 2010) for an identical period.

AOA's aggressive portfolio contains 20% of bonds and loses SPY 100% yield. Below is a test of the monthly rebalancing of SPY (80%) and the BND bond fund (20%) against AOA:

As can be seen from the test, independently rebalancing a portfolio of two assets 1 time per month, we would get more profitability and less drawdown. But still would have lost SPY for 9 years. As well as profitability and drawdown next to the reference AOA, we will use this pair to compare the results for a longer period.

Quantopian Code

import pandas as pd

import numpy as np

assets = [

{'symbol': symbol('SPY'), 'weight': 0.80},

{'symbol': symbol('BND'), 'weight': 0.20},

]

definitialize(context):

set_benchmark(symbol('AOA'))

schedule_function(rebalance, date_rules.month_start(), time_rules.market_open())

defrebalance(context, data):

today = get_datetime()

df = pd.DataFrame(assets).set_index('symbol')

df['can_trade'] = data.can_trade(df.index)

df.loc[df['can_trade'] == False, 'weight'] = 0

df['weight'] = df['weight'] / df['weight'].sum()

for asset in df.index:

if df.loc[asset, 'can_trade']:

order_target_percent(asset, df.loc[asset, 'weight'])Not all bonds are equally useful.

For beginning investors, bonds represent the reliability of investments, but in reality this is not the case. Corporate and, especially, high-yield bonds (as well as bonds of developing countries) are more at risk than treasuries. Lower yields and drawdowns of several ETF funds on bonds:

Observation. TLT behaved curiously in 2008, the price of which rose sharply at the beginning of the crisis and also fell sharply at the end.

Given this behavior, the use of TLT in backtests leads to a positive impact on the portfolio, which can be misleading to potential investors. AGG Foundation behaves more stable.

Let's try to beat SPY + AGG with portfolios

In the tests, we take the strategy where we will keep SPY while SMA (50) over SMA (200). In the case of a bearish intersection, all capital will be transferred to AGG.

Against this strategy, we will put sets similar to standard portfolios, and we will rebalance them monthly and annually. Results for the period from 2004 to 2018:

- Return - total income for the period, including dividends.

- Max drawdown - the maximum drawdown for the period.

- Exposure - position holding time.

- Transactions - the total number of transactions in the full cycle, opening and closing.

- VT - Vanguard Total World Stock Index fund, which provides coverage for the global stock market (includes the whole world).

- The EEM is the iShares MSCI Emerging Index Fund, which provides coverage for emerging market shares.

The results show that SPY is good in itself, and if you add a simple intersection of SMA (50) and SMA (200) with shifting into bonds, the gain is obvious. But if you reduce the number of rebalancing to monthly (or even annual), you can get a leading yield and reduce the drawdown.

Quantopian code

import talib # библиотека для технического анализаimport numpy as np

# функция, выполняемая перед началом тестированияdefinitialize(context):

context.asset = symbol('SPY')

context.bond = symbol('AGG') # облигации# ребалансировка на открытии рынка при пересечении

schedule_function(simple, date_rules.every_day(), time_rules.market_open())

defsimple(context, data):

price_hist = data.history(context.asset, 'price', 210, '1d')

sma50 = talib.SMA(price_hist, timeperiod=50)

sma200 = talib.SMA(price_hist, timeperiod=200)

allow = sma50[-1] >= sma200[-1]

# проводим сделкиif data.can_trade(context.asset):

if allow:

# покупаем актив на 100% портфеля

order_target_percent(context.bond, 0.)

order_target_percent(context.asset, 1.)

else:

# покупаем обонды на 100% портфеля

order_target_percent(context.asset, 0.)

order_target_percent(context.bond, 1.)Conclusion

Buffett is right. But the primitive strategy (SPY + AGG), based on the signals of the crossing of the averages, has been ahead of model portfolios (AOA, AOM, AOK) since 2004. Even if rebalanced once a year, just looking at the position of the medium. During several rebalancing, it is enough to look at the schedule and forget until next year. For this task, you can make a telegram-bot.

Obviously, complex portfolios from consultants can be easily replaced with ready-made ETF funds AOA, AOM and AOK (or analogues of other managers), depending on the required risk. This is in case you still need a portfolio.

Confused by the lack of diversification in emerging markets? SPY includes the world's largest multinational companies. Their products and services surround us every day. Are developing country companies growing faster? The duration of their growth is shorter, and the fall is more painful.