Rome Club Report 2018, Chapter 3.12: “Reforms of the Economic System”

- Transfer

I propose to deal with the report of the “world government” myself, and at the same time help you translate the original source.

Financial sector reforms require urgent discussion, and they, in fact, are on the agenda both within states and internationally. But in a sense, reform is just the first step. For effective and long-term changes for the better, it is necessary to deepen and look at the economic and political systems that have shaped the current state of the financial sector.

One of the clearest examples that is being considered at the moment is the EU. The European Economic Community has emerged as a common market consisting of six countries that have previously fought each other for more than a thousand years. Economic integration united the six peacefully and caused the inexpediency of internecine wars. Starting its development from coal and steel, and soon adding agriculture and, ultimately, covering all sectors of the economy, attracting more countries and creating common infrastructures, the EU has become one of the greatest successful examples in history since World War II. The EU also represents a balance between local, provincial and national governance processes, on the one hand, and European processes, on the other, that work best,

The environmental crisis, which was discussed mainly in chapter 1, will force us to redefine economic structures much more deeply. We need new thoughts to solve the problems of the 21st century. In addition, other issues, such as the elimination of a large number of jobs, the demographic transition, and terrorism, require new thinking. This chapter presents only a few examples that give only partial answers.

Oxford economist Kate Roworth, a member of the Club of Rome, wrote a book called Donut Economics [Donut Economics], in which she argues that today's ideas about economics are outdated. Current students are the future politicians of the 2050s, who learn from the textbooks of the 1950s, based on the theories of the 1850s, and perhaps even earlier. Rowort argues that, given the challenges of the twenty-first century, starting with climate change, inequality and pumping recurring financial crises, such an ancient approach is a disaster. Rowort looks at the tasks from a different angle. The goal of humanity in this century is to meet the needs of all economic systems and living beings at the expense of the planet’s capabilities; we can present it in the form of a donut (with a hole in the middle) with external and internal borders. Planetary boundaries, according to Rockstrom (see section 1.3) are external, i.e. some limiting ring; and the set of social problems, largely on a number of SDG objectives (see Section 1.10), are an inner ring.

We need to contextualize our economic thinking, says Rowort and pays attention to the fact that everything needs to be considered in context. The economy is not like a machine that works in the world, but is something built into it, more of a passer-by of the heart and its circulatory system. In this sense, Rowort uses the ideas of systemology.

Her book outlines the seven principles of guidance for economists to develop institutions and policies necessary to bring humanity into a safe and equitable “donut” space between social and planetary boundaries. Thus, the economy becomes a tool that helps create both equality and stability. This is more or less the opposite of the rules on which our economic systems are based today, where maximum economic growth is the main and constant goal, while social and environmental ones are considered as secondary.

Most of the described principles of Rowworth are already part of discussions about stability. They may seem altruistic, and it can be argued that individuals or groups of people will primarily think about their own advantage. Nevertheless, the author argues that with proper public control (the highest) benefits can and should become a higher priority for society:

In his book “Finding Prosperity” [Reinventing Prosperity - English], Maxton and Randers emphasize that all the main problems facing human well-being today, such as increasing income inequality, continuing global poverty and environmental degradation, are theoretically easy to solve. In practice, however, they are much more complicated, since most generally accepted “solutions” are simply unacceptable for people and governments and pay attention only to short-term perspectives. In an interview, Randers says that the process of solving such problems in a democracy is very difficult, if not impossible. On the contrary, he sees China as an example of a nation that is able to solve long-term problems and that implements effective policies, affecting poverty reduction,

The authors continue to make serious attempts to describe political measures and solutions that will help solve the main problems facing humanity, solutions that could be implemented throughout the world. The book discusses 40-year-old discussions about economic growth and recession, explaining how unemployment, poverty and inequality can be reduced, as well as effectively addressing climate change and ecosystem deterioration and, if desired, still have economic growth. Maxton and Randers define 13 assumptions that relate to these systemic problems of unemployment, inequality and climate change.

Reducing unemployment can, at least mathematically, be achieved by reducing the average working year. This means reallocating work hours for more people who are willing to work. Busy people will have more time that they can devote to their family, to rest, to acquire new knowledge and skills to expand their horizons. At the same time, the average labor productivity should not change.

Acting workers and their employers may not like this idea, but they are forced to come to terms with it, especially in countries with high unemployment. Projects can be introduced gradually, allowing people to learn and adapt.

On the other hand, it would be possible to raise the retirement age and allow older people to work as long as employers and consumers are satisfied with the result of their work. If a longer period of work becomes habitual, then new jobs can be expected, which is especially suitable for people with more experience in managing, coordinating and resolving conflict situations, but workers may suffer from ordinary physical problems at their age. Also, posts that require certain qualifications in using tools or products of the past (for example, for repair and maintenance of something) may be claimed by older people or freelancers. As working older people reduce the cost of general well-being,

The third idea in this context is to pay for helping older people in their homes. Riana Eisler calls for a “caring revolution,” consisting of a significant renewal, financially and in terms of prestige, of caring for people in old age. In order to make such work more in demand, it may be necessary to create a department that will perform the function of monitoring acceptable wage and labor conditions. Salary must first come from state budgets to the total amount of expenses covered by taxpayers. Public acceptance will grow, as people will view this idea as an adequate solution to problems with the elderly population.

Another step is, as already mentioned, the idea of unconditional income for all, that is, income that is not due to a particular job. This issue is currently being discussed in many countries, not least of all in Silicon Valley, in companies that realize that their huge profits are the result of the destruction of millions of jobs. It is worthwhile to initiate a broad discussion of this issue, both at the national and international level.

A related idea is to increase and guarantee higher unemployment benefits. Other measures to reduce unemployment and, consequently, inequalities may fall into the category of public stimulus packages. These may include physical infrastructure, lifelong education and environmental restoration.

The Carbon Pricing Leadership Coalition (CPLC), initiated by World Bank President Jim Yoon Kim, was formed during the Climate Conference (COP21) in Paris (see sections 1.5 and 3.7). The idea - not a new one, of course - is supported by Makston and Randers and is aimed at taxing all types of fossil fuels. The novelty is that the profit will be distributed equally among all citizens. This will benefit the majority of the population: the poor and those who consume less electricity. At the same time, such an idea encourages the transition to clean electricity.

The same idea can be taken to replace the taxation of human labor on the use of the physical resources of the planet. It would also shift commercial interest from productivity to resource efficiency (see also section 3.9).

In democratic countries, it may become natural to raise inheritance taxes. Again, this will require international unanimity. The state can allocate funds for agreed social priorities, but it can also leave many options for older people.

Another international task is the reform of WTO rules that allow countries to introduce tariffs on products and services that are clearly detrimental to the environment. As stated in paragraph 1.9, WTO rules still have a strong anti-environmental impact. These last two points relate to the broader problem of global governance, which we consider in section 3.16.

Some of the interesting initiatives outlined in Chapter 3 show that a lot can be done even in modern conditions, but successful implementation is an exception to the rule. The main course of economic development in all countries is still traditional, often destructive to the environment, often beneficial to the rich, but not the poor. If the transition to a stable world society ever becomes a basic concept, political measures are needed to make stable enterprises more profitable than unstable.

Traditional environmental and social policy measures have been taken to manage and control the environment and taxation in order to ensure social justice. By and large, these measures improved the situation in terms of polluted air, water and social justice, but they could not correct the unstable trends described in Chapter 1 of this paper.

The most effective method of transition to a stable society is to change the financial system for business. Of course, mandatory standards and prohibitions must act as in the case of pollutants and hazardous chemicals, especially in agriculture. However, standards will only slightly reduce electricity consumption and greenhouse gas emissions. In order to make significant progress in this regard, economic instruments are needed, here the price of GHG emissions, electricity, water, basic natural resources and for soil degradation should be set. The easiest way to do this is to enter a tax. It will rise if global prices fall, but it can also be reduced if market prices rise. The advantage of this measure is high predictability.

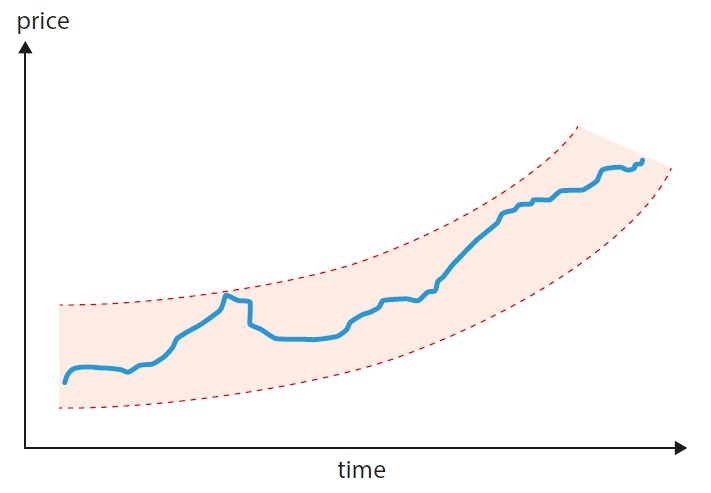

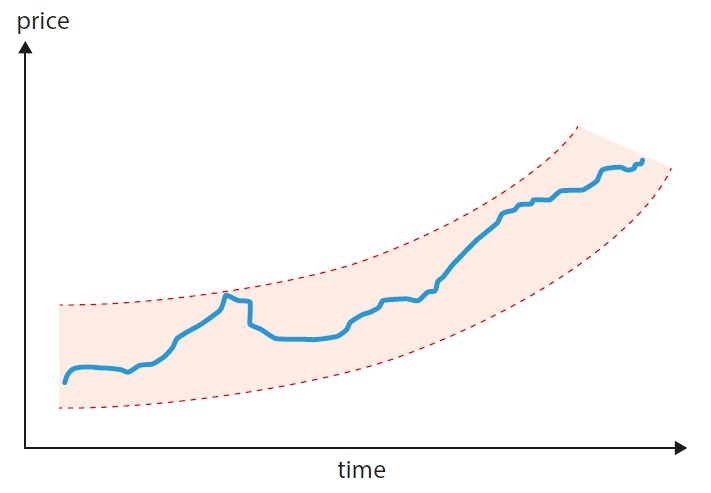

Fig.3.12. To minimize state intervention, the corridor can be politically aligned (dotted lines). If market prices (blue line) fall into the upper or lower boundaries of the corridor, the state will intervene to return it to the corridor.

Imposing a tax on electricity, water, etc. is easier said than done, since it will not be in demand. Thus, the main task is to find a pricing policy with which the political majority will agree.

One of the methods was described in the UNEP report in section 2. It involves an increase in the prices of electricity and other resources in parallel with real achievements in resource efficiency. If the average use of electricity, for example, in private homes, will increase by 1% over 1 year, then prices for electricity in homes will increase by 1% next year, plus inflation. Similarly for transport, industry and services. If everyone knows that prices will rise, then we can expect self-increasing dynamics, because from year to year it becomes more and more profitable to invest in additional energy efficiency.

To avoid too many interventions, the corridor can be politically aligned (dotted lines in Figure 3.12). Market prices may fluctuate (blue line). But if market prices fall into the corridor line, corrective intervention returns it to the corridor, thereby preventing speculation. Consumers, manufacturers, traders, engineers and investors will pay increasing attention to resource efficiency. If it is five times, and in some cases 20 times, energy efficiency is technically achievable (see section 3.9), it can be expected that the result will become more and more impressive.

There are a number of problems that need to be solved:

Existing industry processes such as smelting aluminum from bauxite or electrolysis, in any case, have almost exhausted their potential for energy efficiency. But in many cases, replacing methods or materials can still work efficiently in the form of jumps.

Fig. 3.13 Economic indicators do not always deteriorate from high electricity prices (Source: von Weizsacker and Jesinghaus [German, approx. Ln.] (1992). Database: OECD, 1991)

Technological progress reaches poor families much later secured. If rich people become more efficient and, consequently, raise prices in accordance with the proposed policy, then it will never reach the poor. To solve this problem, it is necessary to realize the idea of a low level of “tariff lines of life”, which is not affected by the stated policy.

Some industries simply cannot compete internationally if their domestic electricity prices rise higher than abroad. Here the answer is twofold: try to harmonize policy at the international level; and as long as it does not work properly, the income from the tax on electricity collected in such industries can be returned to the industry as value added or as a certain number of jobs. Relevant industrial sectors will not lose money, but inside the sectors there will be a powerful incentive to improve energy efficiency. Sweden in 1992 had such a “income-neutral” scheme when introducing an expensive charge of nitric oxide (NOx) applicable to stationary combustion plants, the chemical industry, waste incineration, metal production, pulp and paper, food and woodworking industries. Production was quite such a decision, because the relevant industries did not lose profits. In the end, they even became more competitive.

The fear of losing competitiveness should not be exaggerated. During the “energy crisis” of the 1970s and 1980s, four different economic regions supported different strategies regarding electricity prices. In the Soviet Union, prices were and remained low, despite the high prices for export sales of oil (OPEC). In the United States, the government feared that the “American way of life” would worsen greatly if gas prices were high, so essentially no fuel taxes existed, and there was still a lot of domestic oil in the country. In Western Europe, gas taxes remained high, and electricity was expensive. Japan, finally, not having its own fuel, about which it was possible to speak, with a terrible environment due to air pollution, had very high taxes on gasoline, and electricity was very expensive, partly because of pollution control measures, and also because of the financing and development of nuclear power. What happened to the economic performance of these four regions? Figure 3.13 presents a terrific answer: the higher the price of electricity, the more successful the country was at that time!

Well, the reason may be different. But in Japan, historically, an economic miracle happened after electricity prices soared. It is clear that there are hundreds of other measures that can help make the transition to a sustainable economic development more profitable, but in the absence of a pricing regime they will include a megabureaucracy and are unlikely to change the overall picture.

A more subtle view of the future, characterized by the concept of a regenerative economy, is an excellent vision and should be part of any progressive political program. This can be confirmed by already existing practical innovations. One concept of a young Austrian holistic thinker and author, Christian Felber, is called “Economy for the Common Good” (EOO). He believes that there must be ways and means to avoid the “tragedy of the communities” by reviewing the commercial goals of private companies. Preserving the common good can be a new ethical driver for enterprises that have joined its EOO concept. Reflecting on the reasons for the countless collateral losses of the current economic system, Felber and his friends, mainly businessmen and business consultants, associated with the Attac movement, formulated the concept of EOO within two years. It includes the “overall good balance sheet”, which was presented at a public meeting in Vienna in October 2010. During the meeting, 25 companies volunteered to introduce this innovative concept in the next fiscal year, and the conference participants decided to initiate a movement to introduce EEO. EOO is designed to encourage and allow enterprises to transform the traditional principle of maximizing profits for the common good, as well as to transform the principle of competition into the principle of cooperation. This program included the ideas of Alfie Cohn, Joachim Bauer, Gerald Huter and Martin Nowak and others. One philosophical branch of EOO goes back to Aristotle's Nicomachean ethics, which states that when we seek happiness, we do it for our own sake, and not because that happiness helps us to realize some other (including financial) result. Based on the goal of changing the overall incentive structure underlying the neoliberal economic thinking, the founders of the EEO focused on identifying the values that should become known in the future, respectively, the common good should be achieved. These values were chosen from a set that underlies almost all democratic constitutions throughout the world, namely:

Felber argues that if we all allow interpersonal and environmental relationships to succeed and develop, society will open up a new understanding of productivity and economic success. A new economy of connectivity has emerged, which could be an alternative to the current economy of rivalry and separation.

A practical guide on the “Common Good Economy” allows companies and external appraisers to get more or less consensual results in their operations and valuations. Currently in Germany, Spain and Austria there are about 400 companies that have been evaluated and tested voluntarily, reaching between 200 and 800 points of the “common good”.

The next step may be that governments must comply with high tariffs, providing tax breaks, favorable credit terms or purchasing preferences for government procurement. This is the political goal of the international movement EOO, which currently has more than 3,000 volunteers in 150 local offices. The first municipalities and regional parliaments have already announced that they will provide companies with good balance sheet results on a priority basis in terms of public procurement. Even when these legal incentives begin to take effect and provide economic benefits for ethical business strategies, young companies already report additional benefits that include improved customer relationships, staff loyalty and reputational benefits.

Of the more than one hundred companies that join EOO, only one will be represented here, and this is perhaps the most unlikely sector of our economy, that is, the banking sector. This case study is the savings bank Dornbirn, Dornbirner Sparkasse, Vorarlberg, Austria. It belongs to the Austrian savings bank system, founded in 1819 by the father Johann Baptist Weber. Its original purpose was to make banking accessible to a wider population base. Weber, in contrast to Muhammad Yunus of Bangladesh, believed that if there could be savings banks aiming at ordinary and rather poor people as their clients, all of this would be beneficial. Dombriner Sparkess [Dornbirner Sparkasse AG - German, approx. per. ] was founded in 1867 as a community bank in Dornbirn (approximately 50,000 inhabitants) and was transformed into a limited liability company in 2002. The shares are now owned by the bank responsible for managing the shares and the city of Dornbirn. The bank has 14 branches in the small province of Vorarlberg. It has approximately 350 employees and a balance of 2.3 billion Euros (2015). At 18.3% (2015), the equity ratio was significantly higher than that of many large banks for business.

Dombriner Sparkessa has adapted his predictable strategy for 2020 with the active participation of employees, focused on the values of thinking and on the interests of clients, as a means of getting closer to his clients. These values include the use of banking services as a means of practice and expanding analysis, openness, trust, determination, courage and stability. In the process of planning a strategy and in the context of an “overall good balance sheet”, these values were deepened, and the bank developed even stricter obligations for them. The management also decided to conduct verification and certification from outside. During the audit in 2016, the core group confirmed that internal discussions during the audit led to great results. The bank is proud to be

Other activities related to obtaining high scores from EOO that are interested in Dombriner Sparkessa and its employees are ethical financial management. Assets with poor ethical ratings were phased out of the bank’s portfolios and replaced with “good overall”. This process has sharpened participants' views on ethical investment and its connection to the daily operations of the bank. Perhaps the most important thing is that their bottom line has not suffered at all from the new orientation. On the contrary, they were able to attract several business clients for precisely this reason, including a cooperative with almost 5,000 members, who opened his business account with Dombriner Sparkessa and also placed part of his capital there.

To be continued...

For the translation, thanks to Dmitry Zavadskiy and Butolina Ksenya. If you are interested, I invite you to join the "flashmob" to translate a 220-page report. Write in a personal or email magisterludi2016@yandex.ru

Preface

Chapter 1.1.1 “Various types of crises and feelings of helplessness”

Chapter 1.1.2: “Financing”

Chapter 1.1.3: “An Empty World Against Full Peace”

Chapter 3.1: “Regenerative Economy”

Chapter 3.3: “Blue Economy”

Chapter 3.10: “ Tax on bits ”

Chapter 3.11:“ Financial Sector Reforms ”

Chapter 3.12:“ Economic System Reforms ”

Chapter 3.13:“ Philanthropy, Investment, Crowdsourse and Blockchain ”

Chapter 3.14:“ Not a Single GDP ... ”

Chapter 3.15:“ Collective Leadership ”

Chapter 3.16: “Global Government”

Chapter 3.17: “Actions at the National Level: China and Bhutan”

Chapter 3.18: “Gra motivation for the future "

3.12 Reforms of the economic system

Financial sector reforms require urgent discussion, and they, in fact, are on the agenda both within states and internationally. But in a sense, reform is just the first step. For effective and long-term changes for the better, it is necessary to deepen and look at the economic and political systems that have shaped the current state of the financial sector.

One of the clearest examples that is being considered at the moment is the EU. The European Economic Community has emerged as a common market consisting of six countries that have previously fought each other for more than a thousand years. Economic integration united the six peacefully and caused the inexpediency of internecine wars. Starting its development from coal and steel, and soon adding agriculture and, ultimately, covering all sectors of the economy, attracting more countries and creating common infrastructures, the EU has become one of the greatest successful examples in history since World War II. The EU also represents a balance between local, provincial and national governance processes, on the one hand, and European processes, on the other, that work best,

The environmental crisis, which was discussed mainly in chapter 1, will force us to redefine economic structures much more deeply. We need new thoughts to solve the problems of the 21st century. In addition, other issues, such as the elimination of a large number of jobs, the demographic transition, and terrorism, require new thinking. This chapter presents only a few examples that give only partial answers.

3.12.1 “The economy of donut”

Oxford economist Kate Roworth, a member of the Club of Rome, wrote a book called Donut Economics [Donut Economics], in which she argues that today's ideas about economics are outdated. Current students are the future politicians of the 2050s, who learn from the textbooks of the 1950s, based on the theories of the 1850s, and perhaps even earlier. Rowort argues that, given the challenges of the twenty-first century, starting with climate change, inequality and pumping recurring financial crises, such an ancient approach is a disaster. Rowort looks at the tasks from a different angle. The goal of humanity in this century is to meet the needs of all economic systems and living beings at the expense of the planet’s capabilities; we can present it in the form of a donut (with a hole in the middle) with external and internal borders. Planetary boundaries, according to Rockstrom (see section 1.3) are external, i.e. some limiting ring; and the set of social problems, largely on a number of SDG objectives (see Section 1.10), are an inner ring.

We need to contextualize our economic thinking, says Rowort and pays attention to the fact that everything needs to be considered in context. The economy is not like a machine that works in the world, but is something built into it, more of a passer-by of the heart and its circulatory system. In this sense, Rowort uses the ideas of systemology.

Her book outlines the seven principles of guidance for economists to develop institutions and policies necessary to bring humanity into a safe and equitable “donut” space between social and planetary boundaries. Thus, the economy becomes a tool that helps create both equality and stability. This is more or less the opposite of the rules on which our economic systems are based today, where maximum economic growth is the main and constant goal, while social and environmental ones are considered as secondary.

Most of the described principles of Rowworth are already part of discussions about stability. They may seem altruistic, and it can be argued that individuals or groups of people will primarily think about their own advantage. Nevertheless, the author argues that with proper public control (the highest) benefits can and should become a higher priority for society:

- From GDP growth to donut: the goal of the economy is much wider than just GDP growth; it must meet the needs of all within the resources of the plans. This single step completely changes the whole idea and form of economic progress - from endless growth to the prosperity of a balance of structures.

- From an autonomous market to an integrated economy: this item points to the obvious phenomenon that the economy is embedded in society and in the living world, respectively, serves for their development and cannot develop independently.

- From rational economically advantageous human behavior to socially adapted people: human nature is much richer than the individualistic egoism of modern economic theory suggests. We are complementary, interdependent, seeking to be closer, adaptable, social beings embedded in the web of life.

- From mechanical equilibrium to dynamic complexity: Newtonian physics is not the right tool for economic analysis; it is much more effective to cover a multitude of components and the evolutionary thinking of systemology.

- From “economic growth will adjust everything again” to a deliberate distribution: the economic theory of “seepage from the top down” does not work. It is time to create an economy in which the generated benefit is distributed much more equitably among those who helped create it.

- From “economic growth will nullify all problems” to the realization of the ability to regenerate: it is a myth when they say that economic growth will behave like a well-trained child who cleans up toys behind him. Realization of the ability to regenerate in a circular structure is much better than the degrading tendency of the modern economy with attempts to restore a living world.

- From growth to steady growth: today's economies should grow, regardless of whether they are benefiting or not. The economies of tomorrow — they must make us thrive, whether they grow or not.

3.12.2 Reforms that may find support for most

In his book “Finding Prosperity” [Reinventing Prosperity - English], Maxton and Randers emphasize that all the main problems facing human well-being today, such as increasing income inequality, continuing global poverty and environmental degradation, are theoretically easy to solve. In practice, however, they are much more complicated, since most generally accepted “solutions” are simply unacceptable for people and governments and pay attention only to short-term perspectives. In an interview, Randers says that the process of solving such problems in a democracy is very difficult, if not impossible. On the contrary, he sees China as an example of a nation that is able to solve long-term problems and that implements effective policies, affecting poverty reduction,

The authors continue to make serious attempts to describe political measures and solutions that will help solve the main problems facing humanity, solutions that could be implemented throughout the world. The book discusses 40-year-old discussions about economic growth and recession, explaining how unemployment, poverty and inequality can be reduced, as well as effectively addressing climate change and ecosystem deterioration and, if desired, still have economic growth. Maxton and Randers define 13 assumptions that relate to these systemic problems of unemployment, inequality and climate change.

Reducing unemployment can, at least mathematically, be achieved by reducing the average working year. This means reallocating work hours for more people who are willing to work. Busy people will have more time that they can devote to their family, to rest, to acquire new knowledge and skills to expand their horizons. At the same time, the average labor productivity should not change.

Acting workers and their employers may not like this idea, but they are forced to come to terms with it, especially in countries with high unemployment. Projects can be introduced gradually, allowing people to learn and adapt.

On the other hand, it would be possible to raise the retirement age and allow older people to work as long as employers and consumers are satisfied with the result of their work. If a longer period of work becomes habitual, then new jobs can be expected, which is especially suitable for people with more experience in managing, coordinating and resolving conflict situations, but workers may suffer from ordinary physical problems at their age. Also, posts that require certain qualifications in using tools or products of the past (for example, for repair and maintenance of something) may be claimed by older people or freelancers. As working older people reduce the cost of general well-being,

The third idea in this context is to pay for helping older people in their homes. Riana Eisler calls for a “caring revolution,” consisting of a significant renewal, financially and in terms of prestige, of caring for people in old age. In order to make such work more in demand, it may be necessary to create a department that will perform the function of monitoring acceptable wage and labor conditions. Salary must first come from state budgets to the total amount of expenses covered by taxpayers. Public acceptance will grow, as people will view this idea as an adequate solution to problems with the elderly population.

Another step is, as already mentioned, the idea of unconditional income for all, that is, income that is not due to a particular job. This issue is currently being discussed in many countries, not least of all in Silicon Valley, in companies that realize that their huge profits are the result of the destruction of millions of jobs. It is worthwhile to initiate a broad discussion of this issue, both at the national and international level.

A related idea is to increase and guarantee higher unemployment benefits. Other measures to reduce unemployment and, consequently, inequalities may fall into the category of public stimulus packages. These may include physical infrastructure, lifelong education and environmental restoration.

The Carbon Pricing Leadership Coalition (CPLC), initiated by World Bank President Jim Yoon Kim, was formed during the Climate Conference (COP21) in Paris (see sections 1.5 and 3.7). The idea - not a new one, of course - is supported by Makston and Randers and is aimed at taxing all types of fossil fuels. The novelty is that the profit will be distributed equally among all citizens. This will benefit the majority of the population: the poor and those who consume less electricity. At the same time, such an idea encourages the transition to clean electricity.

The same idea can be taken to replace the taxation of human labor on the use of the physical resources of the planet. It would also shift commercial interest from productivity to resource efficiency (see also section 3.9).

In democratic countries, it may become natural to raise inheritance taxes. Again, this will require international unanimity. The state can allocate funds for agreed social priorities, but it can also leave many options for older people.

Another international task is the reform of WTO rules that allow countries to introduce tariffs on products and services that are clearly detrimental to the environment. As stated in paragraph 1.9, WTO rules still have a strong anti-environmental impact. These last two points relate to the broader problem of global governance, which we consider in section 3.16.

3.12.3 Green Economy Increasingly Profitable

Some of the interesting initiatives outlined in Chapter 3 show that a lot can be done even in modern conditions, but successful implementation is an exception to the rule. The main course of economic development in all countries is still traditional, often destructive to the environment, often beneficial to the rich, but not the poor. If the transition to a stable world society ever becomes a basic concept, political measures are needed to make stable enterprises more profitable than unstable.

Traditional environmental and social policy measures have been taken to manage and control the environment and taxation in order to ensure social justice. By and large, these measures improved the situation in terms of polluted air, water and social justice, but they could not correct the unstable trends described in Chapter 1 of this paper.

The most effective method of transition to a stable society is to change the financial system for business. Of course, mandatory standards and prohibitions must act as in the case of pollutants and hazardous chemicals, especially in agriculture. However, standards will only slightly reduce electricity consumption and greenhouse gas emissions. In order to make significant progress in this regard, economic instruments are needed, here the price of GHG emissions, electricity, water, basic natural resources and for soil degradation should be set. The easiest way to do this is to enter a tax. It will rise if global prices fall, but it can also be reduced if market prices rise. The advantage of this measure is high predictability.

Fig.3.12. To minimize state intervention, the corridor can be politically aligned (dotted lines). If market prices (blue line) fall into the upper or lower boundaries of the corridor, the state will intervene to return it to the corridor.

Imposing a tax on electricity, water, etc. is easier said than done, since it will not be in demand. Thus, the main task is to find a pricing policy with which the political majority will agree.

One of the methods was described in the UNEP report in section 2. It involves an increase in the prices of electricity and other resources in parallel with real achievements in resource efficiency. If the average use of electricity, for example, in private homes, will increase by 1% over 1 year, then prices for electricity in homes will increase by 1% next year, plus inflation. Similarly for transport, industry and services. If everyone knows that prices will rise, then we can expect self-increasing dynamics, because from year to year it becomes more and more profitable to invest in additional energy efficiency.

To avoid too many interventions, the corridor can be politically aligned (dotted lines in Figure 3.12). Market prices may fluctuate (blue line). But if market prices fall into the corridor line, corrective intervention returns it to the corridor, thereby preventing speculation. Consumers, manufacturers, traders, engineers and investors will pay increasing attention to resource efficiency. If it is five times, and in some cases 20 times, energy efficiency is technically achievable (see section 3.9), it can be expected that the result will become more and more impressive.

There are a number of problems that need to be solved:

Existing industry processes such as smelting aluminum from bauxite or electrolysis, in any case, have almost exhausted their potential for energy efficiency. But in many cases, replacing methods or materials can still work efficiently in the form of jumps.

Fig. 3.13 Economic indicators do not always deteriorate from high electricity prices (Source: von Weizsacker and Jesinghaus [German, approx. Ln.] (1992). Database: OECD, 1991)

Technological progress reaches poor families much later secured. If rich people become more efficient and, consequently, raise prices in accordance with the proposed policy, then it will never reach the poor. To solve this problem, it is necessary to realize the idea of a low level of “tariff lines of life”, which is not affected by the stated policy.

Some industries simply cannot compete internationally if their domestic electricity prices rise higher than abroad. Here the answer is twofold: try to harmonize policy at the international level; and as long as it does not work properly, the income from the tax on electricity collected in such industries can be returned to the industry as value added or as a certain number of jobs. Relevant industrial sectors will not lose money, but inside the sectors there will be a powerful incentive to improve energy efficiency. Sweden in 1992 had such a “income-neutral” scheme when introducing an expensive charge of nitric oxide (NOx) applicable to stationary combustion plants, the chemical industry, waste incineration, metal production, pulp and paper, food and woodworking industries. Production was quite such a decision, because the relevant industries did not lose profits. In the end, they even became more competitive.

The fear of losing competitiveness should not be exaggerated. During the “energy crisis” of the 1970s and 1980s, four different economic regions supported different strategies regarding electricity prices. In the Soviet Union, prices were and remained low, despite the high prices for export sales of oil (OPEC). In the United States, the government feared that the “American way of life” would worsen greatly if gas prices were high, so essentially no fuel taxes existed, and there was still a lot of domestic oil in the country. In Western Europe, gas taxes remained high, and electricity was expensive. Japan, finally, not having its own fuel, about which it was possible to speak, with a terrible environment due to air pollution, had very high taxes on gasoline, and electricity was very expensive, partly because of pollution control measures, and also because of the financing and development of nuclear power. What happened to the economic performance of these four regions? Figure 3.13 presents a terrific answer: the higher the price of electricity, the more successful the country was at that time!

Well, the reason may be different. But in Japan, historically, an economic miracle happened after electricity prices soared. It is clear that there are hundreds of other measures that can help make the transition to a sustainable economic development more profitable, but in the absence of a pricing regime they will include a megabureaucracy and are unlikely to change the overall picture.

3.14.4 The economy of the common good

A more subtle view of the future, characterized by the concept of a regenerative economy, is an excellent vision and should be part of any progressive political program. This can be confirmed by already existing practical innovations. One concept of a young Austrian holistic thinker and author, Christian Felber, is called “Economy for the Common Good” (EOO). He believes that there must be ways and means to avoid the “tragedy of the communities” by reviewing the commercial goals of private companies. Preserving the common good can be a new ethical driver for enterprises that have joined its EOO concept. Reflecting on the reasons for the countless collateral losses of the current economic system, Felber and his friends, mainly businessmen and business consultants, associated with the Attac movement, formulated the concept of EOO within two years. It includes the “overall good balance sheet”, which was presented at a public meeting in Vienna in October 2010. During the meeting, 25 companies volunteered to introduce this innovative concept in the next fiscal year, and the conference participants decided to initiate a movement to introduce EEO. EOO is designed to encourage and allow enterprises to transform the traditional principle of maximizing profits for the common good, as well as to transform the principle of competition into the principle of cooperation. This program included the ideas of Alfie Cohn, Joachim Bauer, Gerald Huter and Martin Nowak and others. One philosophical branch of EOO goes back to Aristotle's Nicomachean ethics, which states that when we seek happiness, we do it for our own sake, and not because that happiness helps us to realize some other (including financial) result. Based on the goal of changing the overall incentive structure underlying the neoliberal economic thinking, the founders of the EEO focused on identifying the values that should become known in the future, respectively, the common good should be achieved. These values were chosen from a set that underlies almost all democratic constitutions throughout the world, namely:

- Human dignity

- Solidarity

- Environmental sustainability

- Justice

- Democracy (transparency and participation)

Felber argues that if we all allow interpersonal and environmental relationships to succeed and develop, society will open up a new understanding of productivity and economic success. A new economy of connectivity has emerged, which could be an alternative to the current economy of rivalry and separation.

A practical guide on the “Common Good Economy” allows companies and external appraisers to get more or less consensual results in their operations and valuations. Currently in Germany, Spain and Austria there are about 400 companies that have been evaluated and tested voluntarily, reaching between 200 and 800 points of the “common good”.

The next step may be that governments must comply with high tariffs, providing tax breaks, favorable credit terms or purchasing preferences for government procurement. This is the political goal of the international movement EOO, which currently has more than 3,000 volunteers in 150 local offices. The first municipalities and regional parliaments have already announced that they will provide companies with good balance sheet results on a priority basis in terms of public procurement. Even when these legal incentives begin to take effect and provide economic benefits for ethical business strategies, young companies already report additional benefits that include improved customer relationships, staff loyalty and reputational benefits.

Of the more than one hundred companies that join EOO, only one will be represented here, and this is perhaps the most unlikely sector of our economy, that is, the banking sector. This case study is the savings bank Dornbirn, Dornbirner Sparkasse, Vorarlberg, Austria. It belongs to the Austrian savings bank system, founded in 1819 by the father Johann Baptist Weber. Its original purpose was to make banking accessible to a wider population base. Weber, in contrast to Muhammad Yunus of Bangladesh, believed that if there could be savings banks aiming at ordinary and rather poor people as their clients, all of this would be beneficial. Dombriner Sparkess [Dornbirner Sparkasse AG - German, approx. per. ] was founded in 1867 as a community bank in Dornbirn (approximately 50,000 inhabitants) and was transformed into a limited liability company in 2002. The shares are now owned by the bank responsible for managing the shares and the city of Dornbirn. The bank has 14 branches in the small province of Vorarlberg. It has approximately 350 employees and a balance of 2.3 billion Euros (2015). At 18.3% (2015), the equity ratio was significantly higher than that of many large banks for business.

Dombriner Sparkessa has adapted his predictable strategy for 2020 with the active participation of employees, focused on the values of thinking and on the interests of clients, as a means of getting closer to his clients. These values include the use of banking services as a means of practice and expanding analysis, openness, trust, determination, courage and stability. In the process of planning a strategy and in the context of an “overall good balance sheet”, these values were deepened, and the bank developed even stricter obligations for them. The management also decided to conduct verification and certification from outside. During the audit in 2016, the core group confirmed that internal discussions during the audit led to great results. The bank is proud to be

Other activities related to obtaining high scores from EOO that are interested in Dombriner Sparkessa and its employees are ethical financial management. Assets with poor ethical ratings were phased out of the bank’s portfolios and replaced with “good overall”. This process has sharpened participants' views on ethical investment and its connection to the daily operations of the bank. Perhaps the most important thing is that their bottom line has not suffered at all from the new orientation. On the contrary, they were able to attract several business clients for precisely this reason, including a cooperative with almost 5,000 members, who opened his business account with Dombriner Sparkessa and also placed part of his capital there.

To be continued...

For the translation, thanks to Dmitry Zavadskiy and Butolina Ksenya. If you are interested, I invite you to join the "flashmob" to translate a 220-page report. Write in a personal or email magisterludi2016@yandex.ru

More translations of the report of the Club of Rome 2018

Preface

Chapter 1.1.1 “Various types of crises and feelings of helplessness”

Chapter 1.1.2: “Financing”

Chapter 1.1.3: “An Empty World Against Full Peace”

Chapter 3.1: “Regenerative Economy”

Chapter 3.3: “Blue Economy”

Chapter 3.10: “ Tax on bits ”

Chapter 3.11:“ Financial Sector Reforms ”

Chapter 3.12:“ Economic System Reforms ”

Chapter 3.13:“ Philanthropy, Investment, Crowdsourse and Blockchain ”

Chapter 3.14:“ Not a Single GDP ... ”

Chapter 3.15:“ Collective Leadership ”

Chapter 3.16: “Global Government”

Chapter 3.17: “Actions at the National Level: China and Bhutan”

Chapter 3.18: “Gra motivation for the future "

"Analytics"

- "Come on!" - the anniversary report of the Club of Rome

- The anniversary report of the Club of Rome - embalming capitalism

- Club of Rome, jubilee report. Verdict: “The Old World is doomed. New World is inevitable! ”

About #philtech

#philtech (технологии + филантропия) — это открытые публично описанные технологии, выравнивающие уровень жизни максимально возможного количества людей за счёт создания прозрачных платформ для взаимодействия и доступа к данным и знаниям. И удовлетворяющие принципам филтеха:

1. Открытые и копируемые, а не конкурентно-проприетарные.

2. Построенные на принципах самоорганизации и горизонтального взаимодействия.

3. Устойчивые и перспективо-ориентированные, а не преследующие локальную выгоду.

4. Построенные на [открытых] данных, а не традициях и убеждениях

5. Ненасильственные и неманипуляционные.

6. Инклюзивные, и не работающие на одну группу людей за счёт других.

Акселератор социальных технологических стартапов PhilTech — программа интенсивного развития проектов ранних стадий, направленных на выравнивание доступа к информации, ресурсам и возможностям. Второй поток: март–июнь 2018.

Чат в Telegram

Сообщество людей, развивающих филтех-проекты или просто заинтересованных в теме технологий для социального сектора.

#philtech news

Телеграм-канал с новостями о проектах в идеологии #philtech и ссылками на полезные материалы.

Подписаться на еженедельную рассылку

#philtech (технологии + филантропия) — это открытые публично описанные технологии, выравнивающие уровень жизни максимально возможного количества людей за счёт создания прозрачных платформ для взаимодействия и доступа к данным и знаниям. И удовлетворяющие принципам филтеха:

1. Открытые и копируемые, а не конкурентно-проприетарные.

2. Построенные на принципах самоорганизации и горизонтального взаимодействия.

3. Устойчивые и перспективо-ориентированные, а не преследующие локальную выгоду.

4. Построенные на [открытых] данных, а не традициях и убеждениях

5. Ненасильственные и неманипуляционные.

6. Инклюзивные, и не работающие на одну группу людей за счёт других.

Акселератор социальных технологических стартапов PhilTech — программа интенсивного развития проектов ранних стадий, направленных на выравнивание доступа к информации, ресурсам и возможностям. Второй поток: март–июнь 2018.

Чат в Telegram

Сообщество людей, развивающих филтех-проекты или просто заинтересованных в теме технологий для социального сектора.

#philtech news

Телеграм-канал с новостями о проектах в идеологии #philtech и ссылками на полезные материалы.

Подписаться на еженедельную рассылку