What trends should be taken into account by users and providers of mobile banking

- Transfer

It has been ten years since Apple launched the App Store. For businesses, he opened a completely new channel of interaction and changed many consumer behaviors.

During this time, we have witnessed several cycles of explosive fragmentation in the market of mobile wallets and subsequent consolidation . For each probable task, separate applications were created, which a year later they lost their relevance against the background of analogues offering more ample opportunities (example: Facebook and many similar highly specialized applications).

The avalanche mix of reducing the cost of maintaining information systems and changing consumer preferences put banks in such a position that, continuing the analogy, they are now in the place of Facebook. Providers of banking services, when choosing the right strategy, have a chance to snatch mobile users from the clutches of non-banking financial applications, expand their customer base and get more profit in the process.

Consumer confidence trends

When, in 2014, the FIS international financial solutions provider began its PACE survey of customer preferences trends and the ability of banking service providers to respond promptly and adequately to their change, American consumers were deeply concerned about security issues and were generally suspicious of their banking providers.

Just four years later, in 2018, the results of the study showed that consumers were almost completely satisfied with the measures taken by banks to enhance security and privacy. The majority of respondents (94%) reported that their banks "ensure the security and integrity of transactions" and "protect personal information from unauthorized access." And why don't the banks take care of this, given the recent scandals about data leakage in popular applications like Uber and Facebook?

When asked who consumers trust more - their banks or technology companies - 48% of respondents chose the first and only 3% have more confidence in the second. Twenty-five percent of respondents trust both parties equally, and another 24% could not give a clear answer.

The tipping point for mobile banking

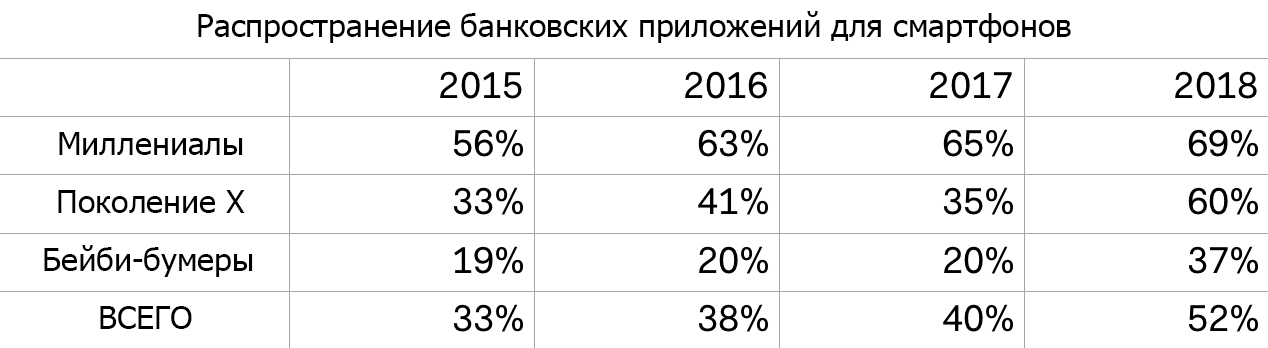

Until 2018, the most active users of mobile banking and financial applications were the millennials. However, according to the annual analysis of data from the FIS report, a turning point may come in 2018: the rate of distribution of banking applications for smartphones by 2018 has risen to 52% mainly due to representatives of generation X and baby boomers.

The overall utilization rates are also growing rapidly: the average number of monthly banking operations performed with smartphones increased by more than 2 times in all age groups - from 2.3 last year to 5 this year. Again, the main driving force behind this trend was the representatives of generation X and baby boomers.

Why it happens? We believe that the solution is simpler than it seems: the most tangible leaps in the distribution of applications are associated with clients of local banks and credit cooperatives. Small institutions finally began to launch and promote their own mobile applications.

The study revealed the need for certain strategic changes in the mindset of banking service providers, especially small ones. The “face” of the bank today is a mobile interface, not a physical department or employees.

This trend is even more noticeable amid growing consumer preferences to work through self-service systems and to get a greater degree of control over their bank accounts. If in the past years it was not so significant for the respondents of the PACE study, then in 2018 the increase in control turned out to be in 3rd place, not much lagging behind the issue of trust in the bank.

Give it to them and they will like it.

However, it is not enough just to launch and promote a mobile application. Of course, it is nice to check balance with a smartphone, transfer funds between accounts and find the nearest ATMs on the card. But consumers want to perform other, more complex operations, such as collecting checks or sending money to a friend.

The lack of such functionality in a single solution led to the current market fragmentation, and this forces consumers to use a whole hodgepodge of different applications. According to PACE, 57% of consumers regularly look for alternative financial services beyond the offerings of their banks. Most of all they are interested in alternative options for direct transfer of funds to other customers (46%), international transfers and cashing checks. All these functions could be implemented in the application of a banking service provider. With a well-thought-out monetary fund management policy, banks will be able to offer customers even more convenient transfer terms.

For example, take P2P payments. You've probably heard about Zelle- direct transfer network for bank account holders. The application quickly gained popularity, reaching a total volume of payments of $ 25 billion and 85 million transactions in the first quarter of 2018. Zelle left behind Venmo ($ 12 billion), which was very popular among millenials, and almost reached PayPal ($ 30 billion with transactions at POS terminals). This allows us to conclude that banks managed to reclaim 85 million interactions, within each of which users opened a banking application, saw its logo and received a positive impression from the service. And this is very important.

Parity functionality

Mobile wallet, P2P payments, check collection, card management and even investing - all these elements can be easily and quickly added to banking mobile applications. Moreover, it is an opportunity for banking service providers to attract the attention of customers and build good, long-lasting relationships with them.

Previously, this idea was skeptical, believing that support for such functionality is available only to large banks with their huge budgets and development teams. However, most applications of local banks and credit unions are products of vendors or are written in close cooperation with technology companies. The development of such solutions to order from a third-party company has become the norm due to the ongoing reduction of costs and requirements for the implementation of such projects.

Small banking providers are now more than ever to offer digital opportunities previously only available to large banks. If we take into account the demand for mobile applications and integrated financial services from reliable suppliers, then banking organizations have an excellent opportunity to capture the palm in the mobile banking segment among the most diverse categories of customers, both young and older.