Business planning. Article 2. A business plan is an attempt to convince yourself that you should not start this business

So, dear readers, given the success of the previous article on business planning, I think it should be continued. Last time we focused on the introductory topic of business planning, where we discussed the features of ideas, how they arise and how much they cost. I also suggested that you ask questions (if you are just planning to start your own business), and think about it.

I want to highlight the following important points regarding the business plan as a whole:

• A business plan is not only an attempt to analyze your business and its chances, but also your guide to action in the near future after starting a business.

• The best way to write a business plan, especially in the initial stages - with a piece of paper and a pencil. And away from irritants. And only then organizing and transferring to a computer.

Today we will continue to examine the business planning process more precisely, but before that I would like to acquaint you with a list of topics that are usually included in a business plan, and I plan to devote one article to each topic. A rather ambitious task, since usually a business plan includes about 15-20 sections, and each is important in its own way. That is, ideally, you and I should get about 20 articles.

So the list:

1. Description of the business

2. Description of the product (product / service)

3. Market analysis

4. Location of the business

5. Competitive environment (within the framework of the article it is planned to consider the five Porter forces as an additional option)

6. Risks and opportunities (plans include SWOT here -analysis if it will not be too commonplace)

7. Business management in general and operational management

8. Human resources policy

9. Results

Note: in this section I take for granted that you have at least general knowledge of finance and financial reporting, especially topics of the value of money, taking into account time, basic principles of accounting and business valuation methods)

10. Possible third-party sources of financing

11. List of capital investments

12. Balance sheet

13. Break-even point calculation

14. Forecasted income statement

15. Forecasted cash flow report

16. Deviation analysis

17. Summary

Also, a couple of articles are planned somewhere between the main articles special topics, for example, on the role of the team in business, features of obtaining financing, etc.

Before starting the discussion, there are a couple of requests to my esteemed audience:

• I intentionally try not to use modern pop neologisms, translating material into Russian, so inaccuracies can sometimes occur, since I study all the material in English. For example, I try to write “cash flows” instead of “cash flow”. But sometimes I can inaccurately translate and use "financial flows", for example. In this case, I ask you not to rush into criticism, but simply to indicate an inaccuracy that will be corrected.

• Your comments and suggestions are very important to me, since the purpose of my articles is a mutual service. I give you interesting information, you give me an incentive for a more in-depth study of business topics, as well as your experience and knowledge. Therefore, if we are all interested, I will consider that I have achieved the goal.

• Each constructive comment will be taken into account, for example, the Besu user prompted to write about the role of like-minded people, and the OneTwo user generally threw a new topic for the article, which will be soon.

• Criticism. I love constructive criticism. She makes you think. Unconstructive criticism causes only a defensive reaction, no more. In this case, ignore. In life - not always.

So, we tightened something. We move on. Today we are talking about business in general.

Do you know what the most important decision you have to make without even starting to write a business plan? Answer: what is your business and what will it be like in five years.

If you make a mistake at this stage, the chances of success are significantly reduced. Because the whole planning process will be based on your vision of the business, current vision and future. Let's start with questions (I would advise you to ask yourself more questions in general, they stimulate thinking and action):

• What kind of business is this? Production, service, trade? What kind of product? Who are the buyers? What is the stage of your business industry (does your strategy depend on this)? Is this a startup? Expanding your current business? Merger?

• Type of organization? Partnership, SP? AO?

• Why will your business grow?

• HOW will it grow?

• When will it open?

• How much time can you devote to him?

• Is your business subject to seasonal influences ?

These are very difficult questions, and if general answers come to a head, after writing a business plan, you should know the exact answer to each of them.

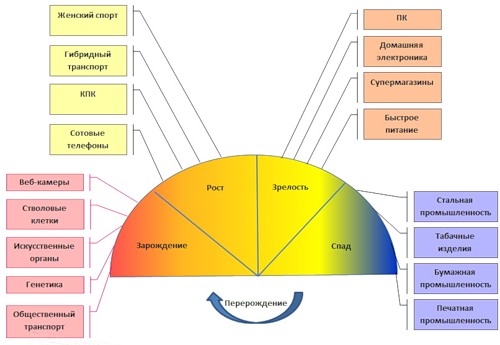

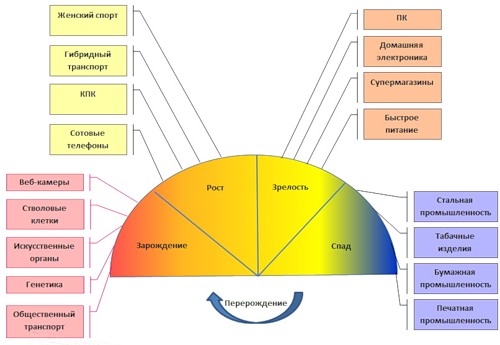

For example, is it important to understand what your business industry looks like? A look at this diagram (I drew it myself, so please forgive minor flaws):

This understanding will help you determine your goals. The more specific the goal, the less time and money you will waste. This is really important - no further than today I had a presentation of the draft business plan (I and the team as speakers), and so, the first question of potential investors was “what is your goal, guys? You have a ten word limit . ”

A few additional questions for startups:

• Why do you think you will be successful?

• What is your experience in this area? (one of the main factors of failure is precisely the lack of experience in this area)

• Have you talked to people who are already in this business?

• Have you spoken to potential customers? By suppliers?

All these questions will help you write a short but understandable description of the business.

Let's look at an example of such a description (in a compressed version), which we will then analyze in detail:

“Company X specializes in the sale of extra-fresh (no more than one day from the moment of receipt from fishermen) seafood to wholesale and retail customers. Currently, 60% of sales are in retail. The company plans to focus more on wholesale trade, because, despite the low margin, labor costs are lower, turnover is higher. Retail demand is seasonal and fluctuates depending on the weather. Wholesale demand is stable and growing (there are offers from new customers). "The owner of the business is a former fisherman with connections among the rest of the fishermen, which gives confidence in a stable supply."

So, such a paragraph is often enough to make the first conclusions to an outside observer. For example, from the first sentence (the most important, the so-called elevator pitch ,The phrase you are catching attention to is clear of three important things - that they are engaged in seafood, that the products are distinguished by the freshness of an extra class, and that their market is wide. From the following proposals, the strategy becomes clear - wholesale. It becomes clear what is the key to potential success - a stable base of suppliers, and signed contracts from buyers.

That is, on the basis of these facts, it becomes clear that the business is stable and has growth potential. Of course, this is not enough to solve. But this is enough to attract attention.

So, today we have examined the most important questions, for the answer to which you will have to study, think and state a lot. To get the same elevator pitch (I can’t pick up the exact translation, but the point is that you should be able to tell the potential investor about the business while you are traveling with him in the elevator. Usually it is no more than 20-30 seconds. This phrase came from the scheme 30 seconds-30 minutes -3 hours, if you are interested in the investor during the trip in the elevator, he will invite you to the office, where you will have 30 minutes for a more detailed presentation of the business. If the investor remains interested afterwards, he will invite you later to the presentation, where he will gather his people who are interested in your area. This is a three hour meeting ).

I would like to complete the article as follows. A couple of days ago I witnessed a brilliant description of a businessand elevator pitch. No comment (for reasons of confidentiality, I have painted the essence of the business, but the essence of the reception should be clear to you):

I want to highlight the following important points regarding the business plan as a whole:

• A business plan is not only an attempt to analyze your business and its chances, but also your guide to action in the near future after starting a business.

• The best way to write a business plan, especially in the initial stages - with a piece of paper and a pencil. And away from irritants. And only then organizing and transferring to a computer.

Top view

Today we will continue to examine the business planning process more precisely, but before that I would like to acquaint you with a list of topics that are usually included in a business plan, and I plan to devote one article to each topic. A rather ambitious task, since usually a business plan includes about 15-20 sections, and each is important in its own way. That is, ideally, you and I should get about 20 articles.

So the list:

Section One. Business

1. Description of the business

2. Description of the product (product / service)

3. Market analysis

4. Location of the business

5. Competitive environment (within the framework of the article it is planned to consider the five Porter forces as an additional option)

6. Risks and opportunities (plans include SWOT here -analysis if it will not be too commonplace)

7. Business management in general and operational management

8. Human resources policy

9. Results

Section Two. Actual and Predicted Financial Information

Note: in this section I take for granted that you have at least general knowledge of finance and financial reporting, especially topics of the value of money, taking into account time, basic principles of accounting and business valuation methods)

10. Possible third-party sources of financing

11. List of capital investments

12. Balance sheet

13. Break-even point calculation

14. Forecasted income statement

15. Forecasted cash flow report

16. Deviation analysis

17. Summary

Also, a couple of articles are planned somewhere between the main articles special topics, for example, on the role of the team in business, features of obtaining financing, etc.

Small digression

Before starting the discussion, there are a couple of requests to my esteemed audience:

• I intentionally try not to use modern pop neologisms, translating material into Russian, so inaccuracies can sometimes occur, since I study all the material in English. For example, I try to write “cash flows” instead of “cash flow”. But sometimes I can inaccurately translate and use "financial flows", for example. In this case, I ask you not to rush into criticism, but simply to indicate an inaccuracy that will be corrected.

• Your comments and suggestions are very important to me, since the purpose of my articles is a mutual service. I give you interesting information, you give me an incentive for a more in-depth study of business topics, as well as your experience and knowledge. Therefore, if we are all interested, I will consider that I have achieved the goal.

• Each constructive comment will be taken into account, for example, the Besu user prompted to write about the role of like-minded people, and the OneTwo user generally threw a new topic for the article, which will be soon.

• Criticism. I love constructive criticism. She makes you think. Unconstructive criticism causes only a defensive reaction, no more. In this case, ignore. In life - not always.

So, we tightened something. We move on. Today we are talking about business in general.

Do you know what the most important decision you have to make without even starting to write a business plan? Answer: what is your business and what will it be like in five years.

If you make a mistake at this stage, the chances of success are significantly reduced. Because the whole planning process will be based on your vision of the business, current vision and future. Let's start with questions (I would advise you to ask yourself more questions in general, they stimulate thinking and action):

• What kind of business is this? Production, service, trade? What kind of product? Who are the buyers? What is the stage of your business industry (does your strategy depend on this)? Is this a startup? Expanding your current business? Merger?

• Type of organization? Partnership, SP? AO?

• Why will your business grow?

• HOW will it grow?

• When will it open?

• How much time can you devote to him?

• Is your business subject to seasonal influences ?

These are very difficult questions, and if general answers come to a head, after writing a business plan, you should know the exact answer to each of them.

For example, is it important to understand what your business industry looks like? A look at this diagram (I drew it myself, so please forgive minor flaws):

This understanding will help you determine your goals. The more specific the goal, the less time and money you will waste. This is really important - no further than today I had a presentation of the draft business plan (I and the team as speakers), and so, the first question of potential investors was “what is your goal, guys? You have a ten word limit . ”

A few additional questions for startups:

• Why do you think you will be successful?

• What is your experience in this area? (one of the main factors of failure is precisely the lack of experience in this area)

• Have you talked to people who are already in this business?

• Have you spoken to potential customers? By suppliers?

All these questions will help you write a short but understandable description of the business.

Let's look at an example of such a description (in a compressed version), which we will then analyze in detail:

“Company X specializes in the sale of extra-fresh (no more than one day from the moment of receipt from fishermen) seafood to wholesale and retail customers. Currently, 60% of sales are in retail. The company plans to focus more on wholesale trade, because, despite the low margin, labor costs are lower, turnover is higher. Retail demand is seasonal and fluctuates depending on the weather. Wholesale demand is stable and growing (there are offers from new customers). "The owner of the business is a former fisherman with connections among the rest of the fishermen, which gives confidence in a stable supply."

So, such a paragraph is often enough to make the first conclusions to an outside observer. For example, from the first sentence (the most important, the so-called elevator pitch ,The phrase you are catching attention to is clear of three important things - that they are engaged in seafood, that the products are distinguished by the freshness of an extra class, and that their market is wide. From the following proposals, the strategy becomes clear - wholesale. It becomes clear what is the key to potential success - a stable base of suppliers, and signed contracts from buyers.

That is, on the basis of these facts, it becomes clear that the business is stable and has growth potential. Of course, this is not enough to solve. But this is enough to attract attention.

So, today we have examined the most important questions, for the answer to which you will have to study, think and state a lot. To get the same elevator pitch (I can’t pick up the exact translation, but the point is that you should be able to tell the potential investor about the business while you are traveling with him in the elevator. Usually it is no more than 20-30 seconds. This phrase came from the scheme 30 seconds-30 minutes -3 hours, if you are interested in the investor during the trip in the elevator, he will invite you to the office, where you will have 30 minutes for a more detailed presentation of the business. If the investor remains interested afterwards, he will invite you later to the presentation, where he will gather his people who are interested in your area. This is a three hour meeting ).

I would like to complete the article as follows. A couple of days ago I witnessed a brilliant description of a businessand elevator pitch. No comment (for reasons of confidentiality, I have painted the essence of the business, but the essence of the reception should be clear to you):