Overview of Banks and Internet Banking Systems

Khabravchians, as the most technically savvy part of the world's population, undoubtedly love to use modern technologies, in particular Internet banking systems. Because it is convenient, it saves a lot of time and money, it is a good step forward into the digital future, and in general it is just great to have complete control over your money from your computer. But not all banks and their Internet banking systems (hereinafter referred to as IB) are good, moreover, in my opinion, it is absolutely impossible to use many. This article is an overview of some of the most popular banks and information security systems in Russia. We will try to find out what is better and what is better not to use.

Will be considered: Raiffeisen, VTB24, Bank St. Petersburg, Bank Avangard, Promsvyazbank.

So let's go.

I actively used all these banks, and I continue to use some now. All the conclusions in the article are based on personal feelings and feedback from other Internet users, I tried to remember everything and write down as accurately and objectively as possible, but there may be errors and inaccuracies, excuse me.

I took into account factors that are interesting to me, although I think the majority of users, as well as ratings of banks and information security.

A few words about the ratings. There are official ratings of banks, we will not consider them, because they are mainly based on data that is understandable only to specialists, and I am not a financier, but a simple user. And there is also a wonderful site banki.ru , it hosts: National Bank Rating and Internet Bank Rating. These ratings are compiled by the same simple users who need the same thing from the bank as I do, and we will take them into account.

What is missing in the article is information about deposits, as I do not use them.

A little about the benefits of information security - suddenly someone does not know. Firstly, IB allows you to conveniently pay for most of the services. Personally, he completely saved me from going to Sberbank with lines and boors behind glass; from using payment terminals with their unscrupulous commissions, eternally absent checks, slowly reaching funds, and the inability to return money if I threw the check and the payment did not come.

I regularly pay using IB: landline phone, mobile phones, Internet, rent, electricity, SIP, traffic police fines, taxes, and a lot of less regular payments. I pay all this without a commission, and it’s very convenient - in order not to drive the details into each new one, it’s enough to create a template in IB one time.

Secondly, it’s convenient to look at the expenses on extracts.

Thirdly, it is safe. In order not to keep all the money on the card, with which, as you know, they can be easily withdrawn, you can put them through the IB to a bank account, and keep a small amount on the card for shopping. Or immediately before a major purchase from a laptop, right in front of the cashier, transfer the required amount to the card and pay immediately.

Well, there are many more minor amenities, such as transparent and convenient loan repayment, assistance in maintaining home accounting, etc.

Now the specifics of the banks.

Low positions in the rating - customers have a lot of complaints about the bank.

Pros

Developed network of offices and ATMs. In St. Petersburg, ATMs and branches at almost every step, in terms of ease of location and accessibility - are clearly in the lead.

Developed network of offices and ATMs. In St. Petersburg, ATMs and branches at almost every step, in terms of ease of location and accessibility - are clearly in the lead.

Good credit cards “My conditions” and “Mobile bonus” - a refund for purchases up to 5%.

Good credit cards “My conditions” and “Mobile bonus” - a refund for purchases up to 5%.

The ability to instantly replenish Yandex.Money, though with a commission of 1.5%

The ability to instantly replenish Yandex.Money, though with a commission of 1.5%

Cons

A big mess and bureaucracy in the bank. It is felt very much.

A big mess and bureaucracy in the bank. It is felt very much.

It is not recommended to deposit money through cash-in ATMs. VTB24 saves on them, and quite often there are complaints that the ATM jammed the banknote, but did not credit it to the account, and people wait for many days of this money until they sort it out and return it, but sort it out there for a long time. There were cases that did not return. So, if you deposit money - only through the cashier.

It is not recommended to deposit money through cash-in ATMs. VTB24 saves on them, and quite often there are complaints that the ATM jammed the banknote, but did not credit it to the account, and people wait for many days of this money until they sort it out and return it, but sort it out there for a long time. There were cases that did not return. So, if you deposit money - only through the cashier.

There are many offices, but they almost always have a sea of people, they have to wait their turn right like in Sberbank.

There are many offices, but they almost always have a sea of people, they have to wait their turn right like in Sberbank.

The service is not up to par - a little better than in the store. Incompetent and unfriendly employees are generally not uncommon.

The service is not up to par - a little better than in the store. Incompetent and unfriendly employees are generally not uncommon.

Calling is not easy - you have to wait a long time.

Calling is not easy - you have to wait a long time.

IB Telebank

Telebank is perhaps the most functional and sophisticated of all information security.

SMS informing costs from 100 to 300 rubles per year, depending on the number of SMS.

Security is provided through variable code cards.

Pros

Nice, user-friendly interface. The design was made by Artemy Lebedev’s studio, I like it, it’s quite convenient, but for many it will seem too clever and overloaded. It works fast.

Nice, user-friendly interface. The design was made by Artemy Lebedev’s studio, I like it, it’s quite convenient, but for many it will seem too clever and overloaded. It works fast.

A fairly large selection of payment service providers.

A fairly large selection of payment service providers.

You can create regular and deferred payments.

You can create regular and deferred payments.

Transfers inside the account and inside the bank are instant.

Transfers inside the account and inside the bank are instant.

You can set up alerts about any actions in the IB by email.

You can set up alerts about any actions in the IB by email.

There are regular payments.

There are regular payments.

Another telebank has two unique features:

1. Multicard, i.e. one card is attached to 3 accounts, ruble, dollar and euro - in theory it is very convenient, you do not need to make 3 cards for each account, just one - if the transaction is in rubles, it is withdrawn from the ruble account, if in dollars - from the dollar account. True, I heard that in reality it does not work as it should, and there are problems with the correct choice of currencies, unfortunately I do not remember the details.

1. Multicard, i.e. one card is attached to 3 accounts, ruble, dollar and euro - in theory it is very convenient, you do not need to make 3 cards for each account, just one - if the transaction is in rubles, it is withdrawn from the ruble account, if in dollars - from the dollar account. True, I heard that in reality it does not work as it should, and there are problems with the correct choice of currencies, unfortunately I do not remember the details.

2. The ability to link a third-party bank card and credit money from it to an account with VTB24 online. They take 0.5% for this. Such a link opens up a ton of possibilities. For example, you can instantly replenish your account at VTB24. Or, some people cash out credit cards this way, falling into the grace period and do not pay interest (not all banks allow this to be done). And with the help of this binding with a minimum of effort you can earn a pretty penny from the air, but this is a topic for a separate article.

2. The ability to link a third-party bank card and credit money from it to an account with VTB24 online. They take 0.5% for this. Such a link opens up a ton of possibilities. For example, you can instantly replenish your account at VTB24. Or, some people cash out credit cards this way, falling into the grace period and do not pay interest (not all banks allow this to be done). And with the help of this binding with a minimum of effort you can earn a pretty penny from the air, but this is a topic for a separate article.

Minuses

Recently, VTB24 did an absurd thing from a security point of view - they allowed only numbers to be used as a password. They also have login numbers, it is easy to guess how quickly such a combination of login-password can be hacked. True, then thought better of it, and introduced additional. security level - now you can log in only by entering the code from the card. It may have become safer, but it’s personally inconvenient for me to scrub this card every time, just to see the account or statement, it’s very inconvenient. Insanity in general is.

Recently, VTB24 did an absurd thing from a security point of view - they allowed only numbers to be used as a password. They also have login numbers, it is easy to guess how quickly such a combination of login-password can be hacked. True, then thought better of it, and introduced additional. security level - now you can log in only by entering the code from the card. It may have become safer, but it’s personally inconvenient for me to scrub this card every time, just to see the account or statement, it’s very inconvenient. Insanity in general is.

Abon payment for the Telebank system - 300 rubles. in year. All other IB banks examined here are free.

Abon payment for the Telebank system - 300 rubles. in year. All other IB banks examined here are free.

VTB24 is probably the only bank in the country that takes a fee for transfers within the bank made through Telebank - 0.1% of the amount (min. 5 rubles, max. 1500 rubles). In my opinion, this is redneck. External transfers are also not the cheapest - 0.3% of the amount (min. 15 rubles, max. 1500 rubles).

VTB24 is probably the only bank in the country that takes a fee for transfers within the bank made through Telebank - 0.1% of the amount (min. 5 rubles, max. 1500 rubles). In my opinion, this is redneck. External transfers are also not the cheapest - 0.3% of the amount (min. 15 rubles, max. 1500 rubles).

The system is damp, quite often server errors are poured, and on the most common operations, or even does not allow logging in.

The system is damp, quite often server errors are poured, and on the most common operations, or even does not allow logging in.

Statements are not informative enough.

Statements are not informative enough.

The general impression of

VTB24 is not the best choice, but if you mainly use cash withdrawals at ATMs, or the unique capabilities of a telebank, it will do.

Let's start with the minuses.

The most common misconception about the Russian Raiffeisen is that it is an Austrian bank. Maybe among the shareholders there is an Austrian raiff, and the name converges, and the appearance, but in reality there is little in common. For example, if you withdraw cash using a Raiffeisen card at Raiff's ATMs abroad, a commission will be taken, as if withdrawing from someone else's bank. And for example, Unicredit or Citibank does not charge a fee for withdrawing from its ATMs in any country in the world.

The most common misconception about the Russian Raiffeisen is that it is an Austrian bank. Maybe among the shareholders there is an Austrian raiff, and the name converges, and the appearance, but in reality there is little in common. For example, if you withdraw cash using a Raiffeisen card at Raiff's ATMs abroad, a commission will be taken, as if withdrawing from someone else's bank. And for example, Unicredit or Citibank does not charge a fee for withdrawing from its ATMs in any country in the world.

Raiff's rating is extremely low. The main claim for increased complexity is to return your money in case of problems. If a problem occurs, then it will be solved for a long time, if the maximum term for solving the problem is determined, then often it is solved only at the end of this period. I couldn’t pay for my mobile phone a couple of times - the status “Operation error” was displayed in the information security. 1000r was debited from the account, but was not received on the phone. Returned both times on the very last day of the maximum review period (45 or 60 days). And if the transfer for a large amount would freeze, I should sit for 2 months without this money.

Raiff's rating is extremely low. The main claim for increased complexity is to return your money in case of problems. If a problem occurs, then it will be solved for a long time, if the maximum term for solving the problem is determined, then often it is solved only at the end of this period. I couldn’t pay for my mobile phone a couple of times - the status “Operation error” was displayed in the information security. 1000r was debited from the account, but was not received on the phone. Returned both times on the very last day of the maximum review period (45 or 60 days). And if the transfer for a large amount would freeze, I should sit for 2 months without this money.

And if, God forbid, money was stolen from you from a card, from an ATM, in a store, or an online store, it will be very difficult to make a chargeback, according to reviews, it will be very difficult to make a chargeback. There were times when stolen money was returned only through the courts. And because of the poor security system of Raiff (about it below), it is not difficult to steal money from the account.

Separately, it should be said about dialing to support services. This is just a song. If you have stolen a card and urgently need to block it, or some simple question, it will almost always look like this: A call - music plays for a long time, there is an advertisement, finally girl number 1 picks up the phone - "Hello, how can I help?" You tell your problem for a long time, she listens carefully, does not interrupt, and then it turns out that the whole function of this girl is to switch clients between cities. Having learned where you are from, he switches. Then there’s an even longer wait - girl number 2 picks up the phone, again you tell everything from and to again, it doesn’t interrupt, but it turns out that the function of this girl is only to switch between departments, your story is again not interesting to her. Switches to the 3rd employee. Here it is completely indecent a long wait and someone who is more or less capable is already picking up the phone. I couldn’t get through with a trivial question faster than in 15 minutes, and during this time you can take a lot of things away with a stolen card.

Separately, it should be said about dialing to support services. This is just a song. If you have stolen a card and urgently need to block it, or some simple question, it will almost always look like this: A call - music plays for a long time, there is an advertisement, finally girl number 1 picks up the phone - "Hello, how can I help?" You tell your problem for a long time, she listens carefully, does not interrupt, and then it turns out that the whole function of this girl is to switch clients between cities. Having learned where you are from, he switches. Then there’s an even longer wait - girl number 2 picks up the phone, again you tell everything from and to again, it doesn’t interrupt, but it turns out that the function of this girl is only to switch between departments, your story is again not interesting to her. Switches to the 3rd employee. Here it is completely indecent a long wait and someone who is more or less capable is already picking up the phone. I couldn’t get through with a trivial question faster than in 15 minutes, and during this time you can take a lot of things away with a stolen card.

Pros

A large network of branches and ATMs in St. Petersburg, beautiful offices

A large network of branches and ATMs in St. Petersburg, beautiful offices

Polite staff, lack of lines

Polite staff, lack of lines

A lot of good quality cash machines with cash-in. Probably no one else has such a number of cash-ins in St. Petersburg - there are Okay in every hypermarket, in every office, and almost all of them are around the clock.

A lot of good quality cash machines with cash-in. Probably no one else has such a number of cash-ins in St. Petersburg - there are Okay in every hypermarket, in every office, and almost all of them are around the clock.

At an ATM, you can change the currency, or throw dollars on a ruble card, which will immediately be converted into rubles. True, the course is bad, in the connection it is different and better. But the connection will be converted in day 2. The

At an ATM, you can change the currency, or throw dollars on a ruble card, which will immediately be converted into rubles. True, the course is bad, in the connection it is different and better. But the connection will be converted in day 2. The

ability to replenish Yandex.Money without commission, though not instantly, 1-2 days

ability to replenish Yandex.Money without commission, though not instantly, 1-2 days

Support for 3D-secure technology.

Support for 3D-secure technology.

IB Raiffeisen connect

The most common misconception about Raiffeisen connect is that it is an Internet banking system :)

A big minus is inhibition. Of course, through the connection you can make operations, transfers, pay for the phone, watch the statement, but as they call it, it is a remote interface to the operator, and not a full-fledged information security. Instantly, only payment for services is carried out, everything else is done manually by the operator during business hours, and through the connection you can only submit an application. This is terribly uncomfortable. For example, you need to exchange rubles for euros. You come into a connection, order an exchange. If ordered in the evening, then only tomorrow the rubles will be withdrawn from the ruble account, and only the day after tomorrow they will come to the euro account. And if today is Friday 17:00, then the money will come only on Tuesday. The same goes for all other operations. The minimum payment by credit card must also be made a few days before the deadline, otherwise you fly out of the grace period and get interest. I won’t be surprised

A big minus is inhibition. Of course, through the connection you can make operations, transfers, pay for the phone, watch the statement, but as they call it, it is a remote interface to the operator, and not a full-fledged information security. Instantly, only payment for services is carried out, everything else is done manually by the operator during business hours, and through the connection you can only submit an application. This is terribly uncomfortable. For example, you need to exchange rubles for euros. You come into a connection, order an exchange. If ordered in the evening, then only tomorrow the rubles will be withdrawn from the ruble account, and only the day after tomorrow they will come to the euro account. And if today is Friday 17:00, then the money will come only on Tuesday. The same goes for all other operations. The minimum payment by credit card must also be made a few days before the deadline, otherwise you fly out of the grace period and get interest. I won’t be surprised

External payment can easily go 2-3 days.

External payment can easily go 2-3 days.

It is impossible to transfer money from a card account to a current one, nor can it be prohibited to deny withdrawal from a card. It turns out that if there is money on the account, then they can all be withdrawn, or to pay for the purchase, including on the Internet. This is a big security hole. Typically, a large amount is stored in the current account, or deposit, and on the card they keep a small amount needed for everyday spending and periodically replenish through the IB.

It is impossible to transfer money from a card account to a current one, nor can it be prohibited to deny withdrawal from a card. It turns out that if there is money on the account, then they can all be withdrawn, or to pay for the purchase, including on the Internet. This is a big security hole. Typically, a large amount is stored in the current account, or deposit, and on the card they keep a small amount needed for everyday spending and periodically replenish through the IB.

The set of service providers is very meager.

The set of service providers is very meager.

Security is weak. All operations are protected only by EDS, there are no cards with codes, i.e. it’s enough to settle an intelligent trojan, and you can withdraw all the money from the account.

Security is weak. All operations are protected only by EDS, there are no cards with codes, i.e. it’s enough to settle an intelligent trojan, and you can withdraw all the money from the account.

Rates are horse.

Rates are horse.

SMS informing - unscrupulous 720p per year, and there is little sense from it - sms often come with a delay of 2, 5, 10, 60 minutes, or they may not come at all.

Ruble transfer to an external bank: 1.5% min. 50 rubles max. 1,500 rubles, and it seems to me that more recently there was a minimum of 150 rubles.

Ruble transfer to an external bank: 1.5% min. 50 rubles max. 1,500 rubles, and it seems to me that more recently there was a minimum of 150 rubles.

For issuing cash at its cash desks, the bank also takes a commission.

For issuing cash at its cash desks, the bank also takes a commission.

The exchange rate is far from the best.

The exchange rate is far from the best.

When paying with a Visa ruble card abroad - 2% of the amount is withdrawn and converted at the best exchange rate. A mastercard is cheaper, but still unprofitable due to the course, and some hidden commissions are still being taken, I could not find out which ones.

When paying with a Visa ruble card abroad - 2% of the amount is withdrawn and converted at the best exchange rate. A mastercard is cheaper, but still unprofitable due to the course, and some hidden commissions are still being taken, I could not find out which ones.

The statement is extremely uninformative. For example, you can’t even see who the transfer came from, only the purpose of the payment is visible.

The statement is extremely uninformative. For example, you can’t even see who the transfer came from, only the purpose of the payment is visible.

You cannot remotely open a contribution.

You cannot remotely open a contribution.

Pros

Nice interface The

Nice interface The

ability to import statements into CSV, QIF

ability to import statements into CSV, QIF

The presence of a feedback form, though instead of making a full-fledged ticket system via SSL channel, this form simply sends a request, and the answer already comes to an insecure email. And not earlier than in a day, even on trifling issues.

The presence of a feedback form, though instead of making a full-fledged ticket system via SSL channel, this form simply sends a request, and the answer already comes to an insecure email. And not earlier than in a day, even on trifling issues.

Weak security has one plus: convenience - no need to scrape the code for payments, everything is done in a few clicks of the mouse.

Weak security has one plus: convenience - no need to scrape the code for payments, everything is done in a few clicks of the mouse.

The general impression: you can only use it if you often need cash-in ATMs, you do not need instant transactions, and it’s not scary that you will hack the computer and steal money. But it’s better to choose a different bank.

In short: in my opinion, this is the best choice. It takes the second place in the national rating, although quite recently it has been in the first place for a long time. Now on the first one is a little-known bank.

Vanguard - medium-sized, somewhere in the 50th place in the ranking of the largest banks in Russia. As a result, he is deprived of many problems inherent in fat banks - bureaucracy, slowness, and inattention to the client. And it is endowed with many advantages, such as a really working individual approach to the client, the ability to directly contact senior management and get a qualified answer on their problem, a fast-response support service, etc.

In the classical sense, Vanguard has few offices. Instead of them - something like a cash register and a counter with one operator somewhere in the supermarket. But for me personally this was not a problem, because I never saw the queues, and the staff is very competent and works quickly. Anyway, it’s better IMHO than in a crowded, beautiful VTB24 office with incompetent employees.

Pros

The best phone support I have ever seen. No music, no expectations, no switching between specialists. All my calls went like this: 2 beeps, the specialist picks up the phone and quickly and expertly answers all my questions. The level of training of TP employees is IMHO on the head of most other banks. True, it should be noted that I did not call often.

The best phone support I have ever seen. No music, no expectations, no switching between specialists. All my calls went like this: 2 beeps, the specialist picks up the phone and quickly and expertly answers all my questions. The level of training of TP employees is IMHO on the head of most other banks. True, it should be noted that I did not call often.

A giant plus to the bank for the fact that it has been communicating with users on the forum of a third-party site for a long time and regularly . It looks like this: a forum has been created on the forum, in which 2 high-ranking bank employees are constantly present and give qualified answers. You can for example find out the news before the official announcement firsthand. Or speed up the resolution of a non-standard issue. An established and open dialogue with the client is very convenient and modern.

A giant plus to the bank for the fact that it has been communicating with users on the forum of a third-party site for a long time and regularly . It looks like this: a forum has been created on the forum, in which 2 high-ranking bank employees are constantly present and give qualified answers. You can for example find out the news before the official announcement firsthand. Or speed up the resolution of a non-standard issue. An established and open dialogue with the client is very convenient and modern.

No less big plus to the bank for tariff policy. Visa electron card - free of charge, Visa classic and Mastercard - free of charge if there is a relatively small turnover (84,000 rubles per year), IB - free of charge, external ruble transfers - 10 rubles per transfer, SMS informing - free of charge. Such is communism.

No less big plus to the bank for tariff policy. Visa electron card - free of charge, Visa classic and Mastercard - free of charge if there is a relatively small turnover (84,000 rubles per year), IB - free of charge, external ruble transfers - 10 rubles per transfer, SMS informing - free of charge. Such is communism.

The presence of a practically unique service is not named express cards. It looks like this: for example, it took an urgent need to get a card, and there is no time to wait 5-7 business days for it to be produced, or pay 3000 for an emergency issue to some banks (and an emergency issue is all the same 1 business day, or at least several hours ), you can go to the vanguard. In 5 minutes, they will open an account, make access to the IB, give a USB flash drive with certificates, and cards with variable codes, and immediately give a full-fledged, unnamed visa electron, which can even be paid on the Internet. It is all free.

The presence of a practically unique service is not named express cards. It looks like this: for example, it took an urgent need to get a card, and there is no time to wait 5-7 business days for it to be produced, or pay 3000 for an emergency issue to some banks (and an emergency issue is all the same 1 business day, or at least several hours ), you can go to the vanguard. In 5 minutes, they will open an account, make access to the IB, give a USB flash drive with certificates, and cards with variable codes, and immediately give a full-fledged, unnamed visa electron, which can even be paid on the Internet. It is all free.

SMS informing works flawlessly - even before the end the check did not come out, but SMS has already arrived. I have never seen delays, even abroad.

SMS informing works flawlessly - even before the end the check did not come out, but SMS has already arrived. I have never seen delays, even abroad.

Paying with a ruble card abroad is not as profitable as in PSB, but enough to not worry about it. It is removed at the rate of the bank + 0.75%. And in the extract everything is completely transparently visible, all courses, all commissions.

Paying with a ruble card abroad is not as profitable as in PSB, but enough to not worry about it. It is removed at the rate of the bank + 0.75%. And in the extract everything is completely transparently visible, all courses, all commissions.

Vanguard is the only bank represented here that issues chip cards. In countries such as Germany, England, paying with a card without a chip is a real problem, they do not accept it almost anywhere. In addition, chip cards are safer and it is much easier for a client to dispute transactions with them than with magnetic ones. In general, the future for chip cards.

Vanguard is the only bank represented here that issues chip cards. In countries such as Germany, England, paying with a card without a chip is a real problem, they do not accept it almost anywhere. In addition, chip cards are safer and it is much easier for a client to dispute transactions with them than with magnetic ones. In general, the future for chip cards.

The lack of ATMs is compensated by a certain number of round-the-clock cash desks. Cash withdrawal in them without commission, by pin code or passport.

The lack of ATMs is compensated by a certain number of round-the-clock cash desks. Cash withdrawal in them without commission, by pin code or passport.

Cash deposit and withdrawal without commissions at operating cash desks and branches. Moreover, you can receive money from an account to which the card has not been issued, also without commissions. It is useful if you need, for example, to buy euros at a good rate - deposit rubles, exchange for euros in IB, withdrawn.

Cash deposit and withdrawal without commissions at operating cash desks and branches. Moreover, you can receive money from an account to which the card has not been issued, also without commissions. It is useful if you need, for example, to buy euros at a good rate - deposit rubles, exchange for euros in IB, withdrawn.

Free print transaction inquiries, account statements. For example, bailiffs accept such certificates as confirmation of payment of a fine with a bang. In many banks, this is a paid service, as far as I know.

Free print transaction inquiries, account statements. For example, bailiffs accept such certificates as confirmation of payment of a fine with a bang. In many banks, this is a paid service, as far as I know.

Credit cards with a grace period of 200 days - a unique service.

Credit cards with a grace period of 200 days - a unique service.

There is a program “Bring a friend”, give buns for new customers according to your recommendation. For example, for 5 given clients they give a 16GB flash drive.

There is a program “Bring a friend”, give buns for new customers according to your recommendation. For example, for 5 given clients they give a 16GB flash drive. (so if you liked the article, welcome to PM)

Support for 3D-secure technology.

Support for 3D-secure technology.

Minuses

There are few ATMs. True, I always pay with a card and rarely take money, and there is a 24-hour ticket office in front of the house, so the minus is insignificant for me.

There are few ATMs. True, I always pay with a card and rarely take money, and there is a 24-hour ticket office in front of the house, so the minus is insignificant for me.

Who thought of making cards of variable codes so thin - I do not know. They are illuminated with a good flashlight so that all hidden codes are visible, an unscrupulous bank employee or courier in theory can enlighten and rewrite them all. By the way, PSBs also show through, but not so much, and VTB24 has practically none.

Who thought of making cards of variable codes so thin - I do not know. They are illuminated with a good flashlight so that all hidden codes are visible, an unscrupulous bank employee or courier in theory can enlighten and rewrite them all. By the way, PSBs also show through, but not so much, and VTB24 has practically none.

Due to the fact that the bank is not large, all sorts of monsters like Aeroflot do not want to cooperate with their bonus miles, i.e. There are no co-branded cards. This is a serious minus, which many (including me) stops from the active use of avant-garde cards. But just the other day, some kind of cash back card is being issued with good conditions, until I know the details, we will watch.

Due to the fact that the bank is not large, all sorts of monsters like Aeroflot do not want to cooperate with their bonus miles, i.e. There are no co-branded cards. This is a serious minus, which many (including me) stops from the active use of avant-garde cards. But just the other day, some kind of cash back card is being issued with good conditions, until I know the details, we will watch.

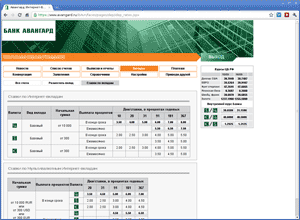

IB the avant-garde of

information security is in 4th place in the ranking, but this place is more due to the fact that until recently in Linux and Mac did not work without Vine EDS, have now been fixed. Most of the negative reviews were due to this.

Pros

The most informative information security. It does not differ in beauty and modernity, but it is convenient to use, all the necessary information is where it should be.

The most informative information security. It does not differ in beauty and modernity, but it is convenient to use, all the necessary information is where it should be.

The most adequate security system. At the entrance to the IB, only the login password is checked, all operations inside the account (conversion, transfer from card to account, etc.) - at choice, digital signature or code from the card, i.e. if you don’t want to - do not scrape the code. All operations on the withdrawal of funds from the account (including the payment of the mobile) - only through the code from the card. Thus, it is impossible to steal money without a card code, but at the same time it does not cause inconvenience.

The most adequate security system. At the entrance to the IB, only the login password is checked, all operations inside the account (conversion, transfer from card to account, etc.) - at choice, digital signature or code from the card, i.e. if you don’t want to - do not scrape the code. All operations on the withdrawal of funds from the account (including the payment of the mobile) - only through the code from the card. Thus, it is impossible to steal money without a card code, but at the same time it does not cause inconvenience.

The most informative account statement. Literally everything is visible. If the incoming payment - you can see from whom the transfer, processing time accurate to the second. If the outgoing payment - it is clear at what stage it is, whether it got stuck on the currency control, or left, what time it got to control, how much it was executed, the name of the operator. If the payment is by card, you can see separately what amount was blocked and how much was withdrawn, time to seconds. If the currency transaction is on the card, you can see how much was withdrawn in the currency, at what rate. If there was a double conversion, everything is also visible. And everything coincides with the official rates to the penny, which can not be said for example about Raiffeisen or Promsvyazbank.

The most informative account statement. Literally everything is visible. If the incoming payment - you can see from whom the transfer, processing time accurate to the second. If the outgoing payment - it is clear at what stage it is, whether it got stuck on the currency control, or left, what time it got to control, how much it was executed, the name of the operator. If the payment is by card, you can see separately what amount was blocked and how much was withdrawn, time to seconds. If the currency transaction is on the card, you can see how much was withdrawn in the currency, at what rate. If there was a double conversion, everything is also visible. And everything coincides with the official rates to the penny, which can not be said for example about Raiffeisen or Promsvyazbank.

The exchange rate is good.

The exchange rate is good.

It is developing quite quickly, new features are being introduced, and user wishes are taken into account.

It is developing quite quickly, new features are being introduced, and user wishes are taken into account.

You can open a deposit through IB.

You can open a deposit through IB.

Large selection of service providers.

Large selection of service providers.

Instant transfers within the account, inside the bank, and conversion.

Instant transfers within the account, inside the bank, and conversion.

External transfers fly very fast. At 9 ordered, at 11 it has already arrived.

External transfers fly very fast. At 9 ordered, at 11 it has already arrived.

There is an Iphone version.

There is an Iphone version.

Payment templates can be signed with EDS, and without deletion of a signature it will not be possible to change them. This ensures that if your password has been hijacked, without a digital signature they will not be able to quietly replace the template.

Payment templates can be signed with EDS, and without deletion of a signature it will not be possible to change them. This ensures that if your password has been hijacked, without a digital signature they will not be able to quietly replace the template.

Credit cards have a combined balance, i.e. you can throw your own funds on it and it turns into a debit card with an overdraft. For example, a credit card has a limit of 20,000, threw 5,000 of its money on it and made a purchase for 10,000. 5,000 will withdraw their own, and 5,000 credit, which will then be followed by interest. The same Raiffeisen can’t do this

Credit cards have a combined balance, i.e. you can throw your own funds on it and it turns into a debit card with an overdraft. For example, a credit card has a limit of 20,000, threw 5,000 of its money on it and made a purchase for 10,000. 5,000 will withdraw their own, and 5,000 credit, which will then be followed by interest. The same Raiffeisen can’t do this

Ability to set limits on card transactions yourself. For example, if you are afraid that your number and CVV cards will be stolen and paid on the Internet, this is not a problem for debit - you can throw money into a current account. But you can’t throw off the loan funds, so for a credit card you can set the payment limit for purchases to zero.

Ability to set limits on card transactions yourself. For example, if you are afraid that your number and CVV cards will be stolen and paid on the Internet, this is not a problem for debit - you can throw money into a current account. But you can’t throw off the loan funds, so for a credit card you can set the payment limit for purchases to zero.

Cons

There are no regular payments (they promised to make them by the end of the year)

There are no regular payments (they promised to make them by the end of the year)

SMS messages do not come during operations with an account, for example, when executing an external ruble transfer. By the end of the year, they promised that they would come for all operations, incl. and unsuccessful withdrawal or payment attempts.

SMS messages do not come during operations with an account, for example, when executing an external ruble transfer. By the end of the year, they promised that they would come for all operations, incl. and unsuccessful withdrawal or payment attempts.

Functional features of the system will not allow to make multicards in the future, without serious software processing

Functional features of the system will not allow to make multicards in the future, without serious software processing

Not the most modern design

Not the most modern design

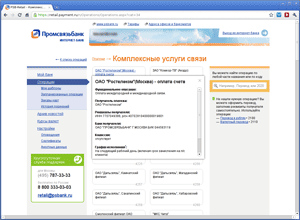

A large bank, a rather high position in the rating, and its IB (PSB-retail) is in first place in the rating of online banks.

Pros

The most profitable bank for paying abroad with a ruble card. However, it is beneficial only if the transaction was in euros or dollars (conversion is carried out at the Central Bank rate + 0.6% of the amount). This is often more profitable than having a euro card. But in operations where there is a double conversion (for example, purchases in British pounds), some hidden commissions are taken, about which the bank does not tell the client anything, referring to internal agreements with payment systems. This is minus the jar.

The most profitable bank for paying abroad with a ruble card. However, it is beneficial only if the transaction was in euros or dollars (conversion is carried out at the Central Bank rate + 0.6% of the amount). This is often more profitable than having a euro card. But in operations where there is a double conversion (for example, purchases in British pounds), some hidden commissions are taken, about which the bank does not tell the client anything, referring to internal agreements with payment systems. This is minus the jar.

The offices are spacious, there are practically no queues, the staff is friendly.

The offices are spacious, there are practically no queues, the staff is friendly.

You can open an account via the Internet, generate a certificate in the same place, and only go to the bank to show your passport - conveniently, saves time.

You can open an account via the Internet, generate a certificate in the same place, and only go to the bank to show your passport - conveniently, saves time.

You can call in about 5 minutes. The

You can call in about 5 minutes. The

ability to replenish Yandex.Money without a commission, though not instantly, 1-2 days

ability to replenish Yandex.Money without a commission, though not instantly, 1-2 days

Cons of

Offices in St. Petersburg are relatively few, there are few ATMs, I think there’s 1 cash-in for all of Peter, and he’s not around the clock.

Offices in St. Petersburg are relatively few, there are few ATMs, I think there’s 1 cash-in for all of Peter, and he’s not around the clock.

A virtual card - registered, plastic, is produced as much in time as a regular one, there are no instant ones.

A virtual card - registered, plastic, is produced as much in time as a regular one, there are no instant ones.

Not very professional employees, both in telephone support and in offices.

Not very professional employees, both in telephone support and in offices.

IB PSB-retail

Translation speed is average - at 9 in the morning I ordered, at 18 I arrived.

Pros of IB

PSB-retail is a modern, web-based, beautiful, intuitive interface, its responsiveness is just lightning fast, it feels like you are working on a desktop program, and not in a browser on the Internet.

PSB-retail is a modern, web-based, beautiful, intuitive interface, its responsiveness is just lightning fast, it feels like you are working on a desktop program, and not in a browser on the Internet.

During working hours, the most profitable currency conversion rate (the difference between the purchase and sale of euros: 20kop). However, in non-working hours it is completely disadvantageous.

During working hours, the most profitable currency conversion rate (the difference between the purchase and sale of euros: 20kop). However, in non-working hours it is completely disadvantageous.

A very large list of service providers.

A very large list of service providers.

There are regular payments.

There are regular payments.

Safe - transactions are confirmed by a choice with a card with variable codes, or EDS. You can check the key at the entrance, but unlike Telebank, this check can be disabled.

Safe - transactions are confirmed by a choice with a card with variable codes, or EDS. You can check the key at the entrance, but unlike Telebank, this check can be disabled.

You can set up alerts about any actions in the IB on the email - for example, when you login, you will receive a notification from which IP address you entered.

You can set up alerts about any actions in the IB on the email - for example, when you login, you will receive a notification from which IP address you entered.

It is possible to order any card through IB, incl. virtual

It is possible to order any card through IB, incl. virtual

Cons

Although this information security is in the top line, in my opinion it is not the best. Not enough functionality, not everything is logical and convenient.

Although this information security is in the top line, in my opinion it is not the best. Not enough functionality, not everything is logical and convenient.

Not very informative statement.

Not very informative statement.

You need to come to the office once a year to regenerate the certificate. By the way, it is not clear why it is needed at all. All the operations that I did were carried out through a card with codes.

You need to come to the office once a year to regenerate the certificate. By the way, it is not clear why it is needed at all. All the operations that I did were carried out through a card with codes.

You cannot open a deposit through IB.

You cannot open a deposit through IB.

Hidden fees for double conversion.

Hidden fees for double conversion.

Out of hours - an unfavorable exchange rate.

Out of hours - an unfavorable exchange rate.

General impression: The best bank for traveling to countries with the euro or dollars if you do not want to have a currency card. Beautiful and modern interface. The most favorable exchange rate. More or less good service. If not for Vanguard, I would advise this bank.

Good bank, occupies a rather high position in the ranking. I don’t know much about it, I used it a little.

The advantages of

Branches in St. Petersburg are many, there are also enough ATMs. In my opinion, there are no cash-ins at all.

Branches in St. Petersburg are many, there are also enough ATMs. In my opinion, there are no cash-ins at all.

This is the only bank where you can normally pay Petroelectrosbyt.

This is the only bank where you can normally pay Petroelectrosbyt.

And here they do not charge for an external ruble transfer - a rare occurrence.

And here they do not charge for an external ruble transfer - a rare occurrence.

Cons

Queues - a frequent phenomenon, the staff is not always friendly, but competent.

Queues - a frequent phenomenon, the staff is not always friendly, but competent.

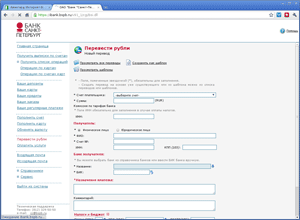

IS Information

security is very simple and non-modern, but at the same time quite functional.

The exchange rate is average.

SMS informing - 360 rubles per year.

IS pros The

set of service providers is small, mainly focused on St. Petersburg, but there is Petroelectrosbyt.

set of service providers is small, mainly focused on St. Petersburg, but there is Petroelectrosbyt.

Domestic payments are instant.

Domestic payments are instant.

External go very fast. You order at 9 a.m. a transfer to another bank, at 11 the same day he has already arrived.

External go very fast. You order at 9 a.m. a transfer to another bank, at 11 the same day he has already arrived.

You can open a contribution through IB.

You can open a contribution through IB.

Rates are good.

Rates are good.

SMSki come instantly.

SMSki come instantly.

An external ruble transfer is 0 rubles , lovers will like to save money, with the help of this bank many will be able to pay all their payments with absolutely no commission.

An external ruble transfer is 0 rubles , lovers will like to save money, with the help of this bank many will be able to pay all their payments with absolutely no commission.

There are regular and deferred payments.

There are regular and deferred payments.

Informative statement.

Informative statement.

It’s quite safe, a code is sent to confirm transactions, and not a terrible abracadabra from multi-letters and numbers as in an alpha bank, but only 4 digits.

It’s quite safe, a code is sent to confirm transactions, and not a terrible abracadabra from multi-letters and numbers as in an alpha bank, but only 4 digits.

Cons

Not very stable, from time to time it does not allow to enter the system. But fortunately rarely.

Not very stable, from time to time it does not allow to enter the system. But fortunately rarely.

With each login, you must enter the code from SMSki, inconvenient.

With each login, you must enter the code from SMSki, inconvenient.

In general, in general, an SMS-based security system is not very convenient. Mobile operators do not always work like clockwork, sometimes they are delayed by SMS and do not enter the information security. And when you are abroad, they just linger on a regular basis.

In general, in general, an SMS-based security system is not very convenient. Mobile operators do not always work like clockwork, sometimes they are delayed by SMS and do not enter the information security. And when you are abroad, they just linger on a regular basis.

Paying with a ruble card abroad is not very profitable.

Paying with a ruble card abroad is not very profitable.

General impression: A good bank, if you are not confused by the lack of cash-ins, the presence of queues, and the security of SMS in IB, then a good choice. And if you want to make transfers as low as possible and pay for services - the best choice.

In my personal rating, according to a combination of factors, the places are distributed as follows:

1. Vanguard

2. Promsvyazbank

3. Bank Saint Petersburg

And do not forget that there are no universal and ideal banks, and there is nothing wrong with keeping accounts open in different banks and use what is more convenient.

If this topic will be of interest to the habrasociety, then in the next article you can go over such an interesting thing as cash back cards, search for the most profitable and convenient, about the real cost and profit from them, how to use them more profitably, etc.

Will be considered: Raiffeisen, VTB24, Bank St. Petersburg, Bank Avangard, Promsvyazbank.

So let's go.

I actively used all these banks, and I continue to use some now. All the conclusions in the article are based on personal feelings and feedback from other Internet users, I tried to remember everything and write down as accurately and objectively as possible, but there may be errors and inaccuracies, excuse me.

I took into account factors that are interesting to me, although I think the majority of users, as well as ratings of banks and information security.

A few words about the ratings. There are official ratings of banks, we will not consider them, because they are mainly based on data that is understandable only to specialists, and I am not a financier, but a simple user. And there is also a wonderful site banki.ru , it hosts: National Bank Rating and Internet Bank Rating. These ratings are compiled by the same simple users who need the same thing from the bank as I do, and we will take them into account.

What is missing in the article is information about deposits, as I do not use them.

A little about the benefits of information security - suddenly someone does not know. Firstly, IB allows you to conveniently pay for most of the services. Personally, he completely saved me from going to Sberbank with lines and boors behind glass; from using payment terminals with their unscrupulous commissions, eternally absent checks, slowly reaching funds, and the inability to return money if I threw the check and the payment did not come.

I regularly pay using IB: landline phone, mobile phones, Internet, rent, electricity, SIP, traffic police fines, taxes, and a lot of less regular payments. I pay all this without a commission, and it’s very convenient - in order not to drive the details into each new one, it’s enough to create a template in IB one time.

Secondly, it’s convenient to look at the expenses on extracts.

Thirdly, it is safe. In order not to keep all the money on the card, with which, as you know, they can be easily withdrawn, you can put them through the IB to a bank account, and keep a small amount on the card for shopping. Or immediately before a major purchase from a laptop, right in front of the cashier, transfer the required amount to the card and pay immediately.

Well, there are many more minor amenities, such as transparent and convenient loan repayment, assistance in maintaining home accounting, etc.

Now the specifics of the banks.

VTB 24

Low positions in the rating - customers have a lot of complaints about the bank.

Pros

Developed network of offices and ATMs. In St. Petersburg, ATMs and branches at almost every step, in terms of ease of location and accessibility - are clearly in the lead.

Developed network of offices and ATMs. In St. Petersburg, ATMs and branches at almost every step, in terms of ease of location and accessibility - are clearly in the lead.  Good credit cards “My conditions” and “Mobile bonus” - a refund for purchases up to 5%.

Good credit cards “My conditions” and “Mobile bonus” - a refund for purchases up to 5%.  The ability to instantly replenish Yandex.Money, though with a commission of 1.5%

The ability to instantly replenish Yandex.Money, though with a commission of 1.5% Cons

A big mess and bureaucracy in the bank. It is felt very much.

A big mess and bureaucracy in the bank. It is felt very much. It is not recommended to deposit money through cash-in ATMs. VTB24 saves on them, and quite often there are complaints that the ATM jammed the banknote, but did not credit it to the account, and people wait for many days of this money until they sort it out and return it, but sort it out there for a long time. There were cases that did not return. So, if you deposit money - only through the cashier.

It is not recommended to deposit money through cash-in ATMs. VTB24 saves on them, and quite often there are complaints that the ATM jammed the banknote, but did not credit it to the account, and people wait for many days of this money until they sort it out and return it, but sort it out there for a long time. There were cases that did not return. So, if you deposit money - only through the cashier.  There are many offices, but they almost always have a sea of people, they have to wait their turn right like in Sberbank.

There are many offices, but they almost always have a sea of people, they have to wait their turn right like in Sberbank.  The service is not up to par - a little better than in the store. Incompetent and unfriendly employees are generally not uncommon.

The service is not up to par - a little better than in the store. Incompetent and unfriendly employees are generally not uncommon.  Calling is not easy - you have to wait a long time.

Calling is not easy - you have to wait a long time. IB Telebank

Telebank is perhaps the most functional and sophisticated of all information security.

SMS informing costs from 100 to 300 rubles per year, depending on the number of SMS.

Security is provided through variable code cards.

Pros

Nice, user-friendly interface. The design was made by Artemy Lebedev’s studio, I like it, it’s quite convenient, but for many it will seem too clever and overloaded. It works fast.

Nice, user-friendly interface. The design was made by Artemy Lebedev’s studio, I like it, it’s quite convenient, but for many it will seem too clever and overloaded. It works fast.  A fairly large selection of payment service providers.

A fairly large selection of payment service providers.  You can create regular and deferred payments.

You can create regular and deferred payments.  Transfers inside the account and inside the bank are instant.

Transfers inside the account and inside the bank are instant.  You can set up alerts about any actions in the IB by email.

You can set up alerts about any actions in the IB by email.  There are regular payments.

There are regular payments. Another telebank has two unique features:

1. Multicard, i.e. one card is attached to 3 accounts, ruble, dollar and euro - in theory it is very convenient, you do not need to make 3 cards for each account, just one - if the transaction is in rubles, it is withdrawn from the ruble account, if in dollars - from the dollar account. True, I heard that in reality it does not work as it should, and there are problems with the correct choice of currencies, unfortunately I do not remember the details.

1. Multicard, i.e. one card is attached to 3 accounts, ruble, dollar and euro - in theory it is very convenient, you do not need to make 3 cards for each account, just one - if the transaction is in rubles, it is withdrawn from the ruble account, if in dollars - from the dollar account. True, I heard that in reality it does not work as it should, and there are problems with the correct choice of currencies, unfortunately I do not remember the details. 2. The ability to link a third-party bank card and credit money from it to an account with VTB24 online. They take 0.5% for this. Such a link opens up a ton of possibilities. For example, you can instantly replenish your account at VTB24. Or, some people cash out credit cards this way, falling into the grace period and do not pay interest (not all banks allow this to be done). And with the help of this binding with a minimum of effort you can earn a pretty penny from the air, but this is a topic for a separate article.

2. The ability to link a third-party bank card and credit money from it to an account with VTB24 online. They take 0.5% for this. Such a link opens up a ton of possibilities. For example, you can instantly replenish your account at VTB24. Or, some people cash out credit cards this way, falling into the grace period and do not pay interest (not all banks allow this to be done). And with the help of this binding with a minimum of effort you can earn a pretty penny from the air, but this is a topic for a separate article. Minuses

Recently, VTB24 did an absurd thing from a security point of view - they allowed only numbers to be used as a password. They also have login numbers, it is easy to guess how quickly such a combination of login-password can be hacked. True, then thought better of it, and introduced additional. security level - now you can log in only by entering the code from the card. It may have become safer, but it’s personally inconvenient for me to scrub this card every time, just to see the account or statement, it’s very inconvenient. Insanity in general is.

Recently, VTB24 did an absurd thing from a security point of view - they allowed only numbers to be used as a password. They also have login numbers, it is easy to guess how quickly such a combination of login-password can be hacked. True, then thought better of it, and introduced additional. security level - now you can log in only by entering the code from the card. It may have become safer, but it’s personally inconvenient for me to scrub this card every time, just to see the account or statement, it’s very inconvenient. Insanity in general is.  Abon payment for the Telebank system - 300 rubles. in year. All other IB banks examined here are free.

Abon payment for the Telebank system - 300 rubles. in year. All other IB banks examined here are free. VTB24 is probably the only bank in the country that takes a fee for transfers within the bank made through Telebank - 0.1% of the amount (min. 5 rubles, max. 1500 rubles). In my opinion, this is redneck. External transfers are also not the cheapest - 0.3% of the amount (min. 15 rubles, max. 1500 rubles).

VTB24 is probably the only bank in the country that takes a fee for transfers within the bank made through Telebank - 0.1% of the amount (min. 5 rubles, max. 1500 rubles). In my opinion, this is redneck. External transfers are also not the cheapest - 0.3% of the amount (min. 15 rubles, max. 1500 rubles).  The system is damp, quite often server errors are poured, and on the most common operations, or even does not allow logging in.

The system is damp, quite often server errors are poured, and on the most common operations, or even does not allow logging in.  Statements are not informative enough.

Statements are not informative enough. The general impression of

VTB24 is not the best choice, but if you mainly use cash withdrawals at ATMs, or the unique capabilities of a telebank, it will do.

Raiffeisen Bank

Let's start with the minuses.

The most common misconception about the Russian Raiffeisen is that it is an Austrian bank. Maybe among the shareholders there is an Austrian raiff, and the name converges, and the appearance, but in reality there is little in common. For example, if you withdraw cash using a Raiffeisen card at Raiff's ATMs abroad, a commission will be taken, as if withdrawing from someone else's bank. And for example, Unicredit or Citibank does not charge a fee for withdrawing from its ATMs in any country in the world.

The most common misconception about the Russian Raiffeisen is that it is an Austrian bank. Maybe among the shareholders there is an Austrian raiff, and the name converges, and the appearance, but in reality there is little in common. For example, if you withdraw cash using a Raiffeisen card at Raiff's ATMs abroad, a commission will be taken, as if withdrawing from someone else's bank. And for example, Unicredit or Citibank does not charge a fee for withdrawing from its ATMs in any country in the world. Raiff's rating is extremely low. The main claim for increased complexity is to return your money in case of problems. If a problem occurs, then it will be solved for a long time, if the maximum term for solving the problem is determined, then often it is solved only at the end of this period. I couldn’t pay for my mobile phone a couple of times - the status “Operation error” was displayed in the information security. 1000r was debited from the account, but was not received on the phone. Returned both times on the very last day of the maximum review period (45 or 60 days). And if the transfer for a large amount would freeze, I should sit for 2 months without this money.

Raiff's rating is extremely low. The main claim for increased complexity is to return your money in case of problems. If a problem occurs, then it will be solved for a long time, if the maximum term for solving the problem is determined, then often it is solved only at the end of this period. I couldn’t pay for my mobile phone a couple of times - the status “Operation error” was displayed in the information security. 1000r was debited from the account, but was not received on the phone. Returned both times on the very last day of the maximum review period (45 or 60 days). And if the transfer for a large amount would freeze, I should sit for 2 months without this money.And if, God forbid, money was stolen from you from a card, from an ATM, in a store, or an online store, it will be very difficult to make a chargeback, according to reviews, it will be very difficult to make a chargeback. There were times when stolen money was returned only through the courts. And because of the poor security system of Raiff (about it below), it is not difficult to steal money from the account.

Separately, it should be said about dialing to support services. This is just a song. If you have stolen a card and urgently need to block it, or some simple question, it will almost always look like this: A call - music plays for a long time, there is an advertisement, finally girl number 1 picks up the phone - "Hello, how can I help?" You tell your problem for a long time, she listens carefully, does not interrupt, and then it turns out that the whole function of this girl is to switch clients between cities. Having learned where you are from, he switches. Then there’s an even longer wait - girl number 2 picks up the phone, again you tell everything from and to again, it doesn’t interrupt, but it turns out that the function of this girl is only to switch between departments, your story is again not interesting to her. Switches to the 3rd employee. Here it is completely indecent a long wait and someone who is more or less capable is already picking up the phone. I couldn’t get through with a trivial question faster than in 15 minutes, and during this time you can take a lot of things away with a stolen card.

Separately, it should be said about dialing to support services. This is just a song. If you have stolen a card and urgently need to block it, or some simple question, it will almost always look like this: A call - music plays for a long time, there is an advertisement, finally girl number 1 picks up the phone - "Hello, how can I help?" You tell your problem for a long time, she listens carefully, does not interrupt, and then it turns out that the whole function of this girl is to switch clients between cities. Having learned where you are from, he switches. Then there’s an even longer wait - girl number 2 picks up the phone, again you tell everything from and to again, it doesn’t interrupt, but it turns out that the function of this girl is only to switch between departments, your story is again not interesting to her. Switches to the 3rd employee. Here it is completely indecent a long wait and someone who is more or less capable is already picking up the phone. I couldn’t get through with a trivial question faster than in 15 minutes, and during this time you can take a lot of things away with a stolen card.Pros

A large network of branches and ATMs in St. Petersburg, beautiful offices

A large network of branches and ATMs in St. Petersburg, beautiful offices  Polite staff, lack of lines

Polite staff, lack of lines  A lot of good quality cash machines with cash-in. Probably no one else has such a number of cash-ins in St. Petersburg - there are Okay in every hypermarket, in every office, and almost all of them are around the clock.

A lot of good quality cash machines with cash-in. Probably no one else has such a number of cash-ins in St. Petersburg - there are Okay in every hypermarket, in every office, and almost all of them are around the clock.  At an ATM, you can change the currency, or throw dollars on a ruble card, which will immediately be converted into rubles. True, the course is bad, in the connection it is different and better. But the connection will be converted in day 2. The

At an ATM, you can change the currency, or throw dollars on a ruble card, which will immediately be converted into rubles. True, the course is bad, in the connection it is different and better. But the connection will be converted in day 2. The  ability to replenish Yandex.Money without commission, though not instantly, 1-2 days

ability to replenish Yandex.Money without commission, though not instantly, 1-2 days  Support for 3D-secure technology.

Support for 3D-secure technology. IB Raiffeisen connect

The most common misconception about Raiffeisen connect is that it is an Internet banking system :)

A big minus is inhibition. Of course, through the connection you can make operations, transfers, pay for the phone, watch the statement, but as they call it, it is a remote interface to the operator, and not a full-fledged information security. Instantly, only payment for services is carried out, everything else is done manually by the operator during business hours, and through the connection you can only submit an application. This is terribly uncomfortable. For example, you need to exchange rubles for euros. You come into a connection, order an exchange. If ordered in the evening, then only tomorrow the rubles will be withdrawn from the ruble account, and only the day after tomorrow they will come to the euro account. And if today is Friday 17:00, then the money will come only on Tuesday. The same goes for all other operations. The minimum payment by credit card must also be made a few days before the deadline, otherwise you fly out of the grace period and get interest. I won’t be surprised

A big minus is inhibition. Of course, through the connection you can make operations, transfers, pay for the phone, watch the statement, but as they call it, it is a remote interface to the operator, and not a full-fledged information security. Instantly, only payment for services is carried out, everything else is done manually by the operator during business hours, and through the connection you can only submit an application. This is terribly uncomfortable. For example, you need to exchange rubles for euros. You come into a connection, order an exchange. If ordered in the evening, then only tomorrow the rubles will be withdrawn from the ruble account, and only the day after tomorrow they will come to the euro account. And if today is Friday 17:00, then the money will come only on Tuesday. The same goes for all other operations. The minimum payment by credit card must also be made a few days before the deadline, otherwise you fly out of the grace period and get interest. I won’t be surprised External payment can easily go 2-3 days.

External payment can easily go 2-3 days.  It is impossible to transfer money from a card account to a current one, nor can it be prohibited to deny withdrawal from a card. It turns out that if there is money on the account, then they can all be withdrawn, or to pay for the purchase, including on the Internet. This is a big security hole. Typically, a large amount is stored in the current account, or deposit, and on the card they keep a small amount needed for everyday spending and periodically replenish through the IB.

It is impossible to transfer money from a card account to a current one, nor can it be prohibited to deny withdrawal from a card. It turns out that if there is money on the account, then they can all be withdrawn, or to pay for the purchase, including on the Internet. This is a big security hole. Typically, a large amount is stored in the current account, or deposit, and on the card they keep a small amount needed for everyday spending and periodically replenish through the IB.  The set of service providers is very meager.

The set of service providers is very meager.  Security is weak. All operations are protected only by EDS, there are no cards with codes, i.e. it’s enough to settle an intelligent trojan, and you can withdraw all the money from the account.

Security is weak. All operations are protected only by EDS, there are no cards with codes, i.e. it’s enough to settle an intelligent trojan, and you can withdraw all the money from the account.  Rates are horse.

Rates are horse.SMS informing - unscrupulous 720p per year, and there is little sense from it - sms often come with a delay of 2, 5, 10, 60 minutes, or they may not come at all.

Ruble transfer to an external bank: 1.5% min. 50 rubles max. 1,500 rubles, and it seems to me that more recently there was a minimum of 150 rubles.

Ruble transfer to an external bank: 1.5% min. 50 rubles max. 1,500 rubles, and it seems to me that more recently there was a minimum of 150 rubles.  For issuing cash at its cash desks, the bank also takes a commission.

For issuing cash at its cash desks, the bank also takes a commission.  The exchange rate is far from the best.

The exchange rate is far from the best.  When paying with a Visa ruble card abroad - 2% of the amount is withdrawn and converted at the best exchange rate. A mastercard is cheaper, but still unprofitable due to the course, and some hidden commissions are still being taken, I could not find out which ones.

When paying with a Visa ruble card abroad - 2% of the amount is withdrawn and converted at the best exchange rate. A mastercard is cheaper, but still unprofitable due to the course, and some hidden commissions are still being taken, I could not find out which ones.  The statement is extremely uninformative. For example, you can’t even see who the transfer came from, only the purpose of the payment is visible.

The statement is extremely uninformative. For example, you can’t even see who the transfer came from, only the purpose of the payment is visible.  You cannot remotely open a contribution.

You cannot remotely open a contribution.Pros

Nice interface The

Nice interface The  ability to import statements into CSV, QIF

ability to import statements into CSV, QIF  The presence of a feedback form, though instead of making a full-fledged ticket system via SSL channel, this form simply sends a request, and the answer already comes to an insecure email. And not earlier than in a day, even on trifling issues.

The presence of a feedback form, though instead of making a full-fledged ticket system via SSL channel, this form simply sends a request, and the answer already comes to an insecure email. And not earlier than in a day, even on trifling issues.  Weak security has one plus: convenience - no need to scrape the code for payments, everything is done in a few clicks of the mouse.

Weak security has one plus: convenience - no need to scrape the code for payments, everything is done in a few clicks of the mouse. The general impression: you can only use it if you often need cash-in ATMs, you do not need instant transactions, and it’s not scary that you will hack the computer and steal money. But it’s better to choose a different bank.

Bank Vanguard

In short: in my opinion, this is the best choice. It takes the second place in the national rating, although quite recently it has been in the first place for a long time. Now on the first one is a little-known bank.

Vanguard - medium-sized, somewhere in the 50th place in the ranking of the largest banks in Russia. As a result, he is deprived of many problems inherent in fat banks - bureaucracy, slowness, and inattention to the client. And it is endowed with many advantages, such as a really working individual approach to the client, the ability to directly contact senior management and get a qualified answer on their problem, a fast-response support service, etc.

In the classical sense, Vanguard has few offices. Instead of them - something like a cash register and a counter with one operator somewhere in the supermarket. But for me personally this was not a problem, because I never saw the queues, and the staff is very competent and works quickly. Anyway, it’s better IMHO than in a crowded, beautiful VTB24 office with incompetent employees.

Pros

The best phone support I have ever seen. No music, no expectations, no switching between specialists. All my calls went like this: 2 beeps, the specialist picks up the phone and quickly and expertly answers all my questions. The level of training of TP employees is IMHO on the head of most other banks. True, it should be noted that I did not call often.

The best phone support I have ever seen. No music, no expectations, no switching between specialists. All my calls went like this: 2 beeps, the specialist picks up the phone and quickly and expertly answers all my questions. The level of training of TP employees is IMHO on the head of most other banks. True, it should be noted that I did not call often. A giant plus to the bank for the fact that it has been communicating with users on the forum of a third-party site for a long time and regularly . It looks like this: a forum has been created on the forum, in which 2 high-ranking bank employees are constantly present and give qualified answers. You can for example find out the news before the official announcement firsthand. Or speed up the resolution of a non-standard issue. An established and open dialogue with the client is very convenient and modern.

A giant plus to the bank for the fact that it has been communicating with users on the forum of a third-party site for a long time and regularly . It looks like this: a forum has been created on the forum, in which 2 high-ranking bank employees are constantly present and give qualified answers. You can for example find out the news before the official announcement firsthand. Or speed up the resolution of a non-standard issue. An established and open dialogue with the client is very convenient and modern.  No less big plus to the bank for tariff policy. Visa electron card - free of charge, Visa classic and Mastercard - free of charge if there is a relatively small turnover (84,000 rubles per year), IB - free of charge, external ruble transfers - 10 rubles per transfer, SMS informing - free of charge. Such is communism.