Counting money

Introduction

To begin with, I am an employee of Finobox . I would like to share my personal experience in accounting for finance, but as an ordinary user of the service.

The features of the service were described in some detail in the corporate blog of our company, so I don’t see much point in dwelling on the description of principles and technical aspects.

Perhaps my opinion will seem somewhat subjective, but surely, it could not be otherwise - after all, this post is in the “I PR” community. In addition to participating in the project, I have my own small business that is directly related to IT.

I am an individual entrepreneur and apply the simplified tax system (STS). That is, I have a pretty standard situation and buying an accounting program in a yellow box is like a gun on sparrows. But keeping records is still necessary.

I have some one-time projects, as well as subscription services for certain services. You must not forget to invoice customers on time, sign acts for work performed and pay salaries to employees. And most importantly, pay taxes on time. Over time, the number of such actions increases and it is simply impossible to keep everything in mind, but as practice shows, initially it was not worth relying only on your memory and notepad notes. From excel assistant also failed.

I was also worried about a rather trivial question - my income is clearly increasing, but where does all my money go?

History

And our project comes to the rescue - www.finobox.ru

At first, I just fixed all the income and expenses. And he also started assets, which are called: current account, plastic card, WMR, deposit.

Since the system allows you to create separate tabs based on payment filters, I have chosen for myself just this way of structuring income and expenses.

Payments can be recurring: in my case, it is payment of permanent services, salary to employees, rent of office and apartment.

For example, I have one large client (let's call it BigCash LLC) for which a large amount of various work has been carried out over time and in addition to income from this client, you need to see overhead costs. For this client it was convenient for me to create a separate panel (filter by the “big cache” label): For other regular customers, I just saved filters by the names of payers. For employees who are paid a monthly salary, their own separate tab. Here the filter was configured by the label "ЗП". Quite important and large expenses for me are renting an apartment and an office.

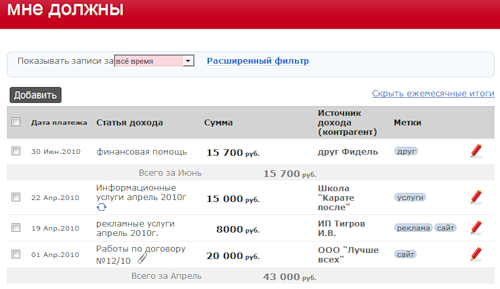

Debts

I, like many, have various debts. Unfortunately, it so happens that some customers delay payment, which in turn after a while already leads to the fact that I may not pay something on time. In this situation, of course, you could give some advice, but I would not want to leave the topic, so I would just advise interested people to read the book “Costs - down, sales - up” by Bob Fife.

To track those customers and people who owe me money, I created a panel based on a filter that displays income with the status of “unpaid” for all the time.

Documents

To generate documents, I use the application “accounts-acts”. After the formation of documents, this application puts payment tags - “account”, “act”. Besides the fact that I visually see the marks of payments, I can also, for example, create a filter that will show me payments that had an account, but the act has not yet been created:

With this filter, I can easily see transactions for which you should generate and sign a piece of paper, avoidance of punitive sanctions from tax authorities.

To generate documents, I use the application “accounts-acts”. After the formation of documents, this application puts payment tags - “account”, “act”. Besides the fact that I visually see the marks of payments, I can also, for example, create a filter that will show me payments that had an account, but the act has not yet been created:

With this filter, I can easily see transactions for which you should generate and sign a piece of paper, avoidance of punitive sanctions from tax authorities.

General form

But what about my personal finances and the answer to the question from the beginning of the article? In order to track which items my money is spent on, I assigned labels to payments: food, clothes, taxis, entertainment, etc. And, just filtering by tags, I can see the amounts by month. As it turned out, all the money goes to

Conclusion

My approach to finance accounting at Finobox is, of course, not the only one. I am sure that you can find many other ways, and possibly more convenient.

Since the system is extensible due to applications that can be created by third-party developers, all this opens up attractive opportunities for using the service. For example, I look forward to when the Piggy bank application appears, which will help me save money for flying into space.

PS Note Colombo - all the names of firms and contractors in the article are fictitious, coincidences are random.