Accounting for Kiosaki money in the AceMoney program.

Accounting for money is the first action in all financial management systems. I have been doing it since 2004. After trying a lot of programs, I stopped at AceMoney. My report can be viewed at http://nkozlov.ru/distance/s203/d2663/Since that time, he repeatedly achieved specific financial goals for earning or accumulating - he changed a couple of cars, lived on savings for half a year. In general, to achieve the cumulative goals, my system worked perfectly. At some point, I got into the hands of Kiyosaki's book on finding financial freedom. It proposed a non-standard technique for determining assets and liabilities, which initially did not fit into the logic of the previous scheme. It is time to take the next step and set up a system to account for passive incomes that have begun to emerge. C filing by Ilya Stremovsky decided to share knowledge. So:

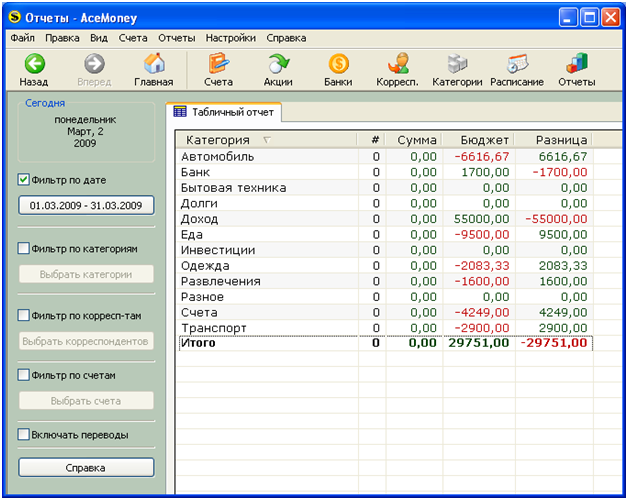

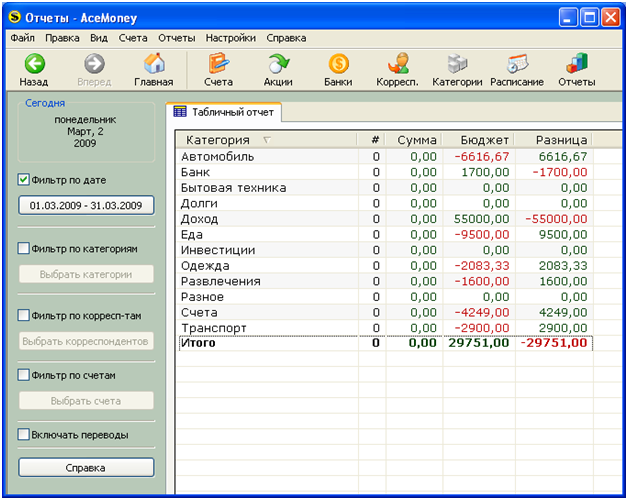

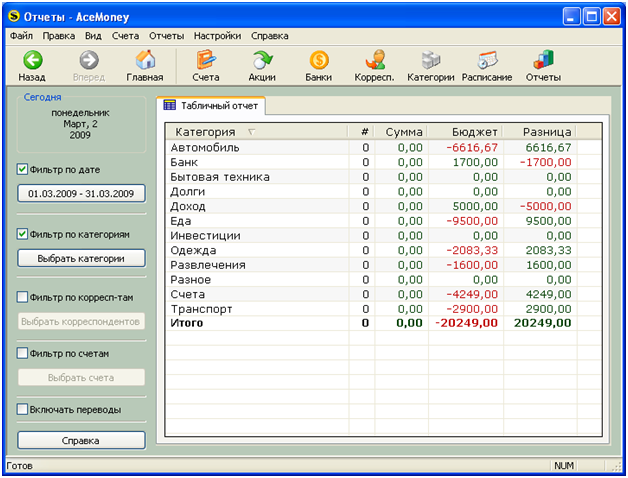

First, let’s try what flow passes through us in a month. We select a report by category and see:

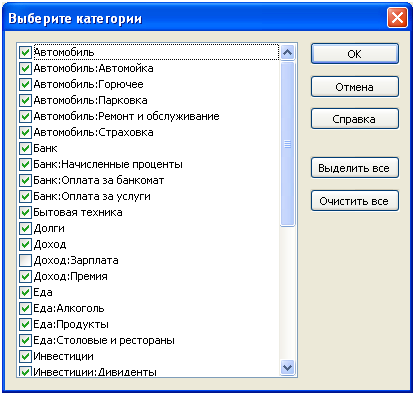

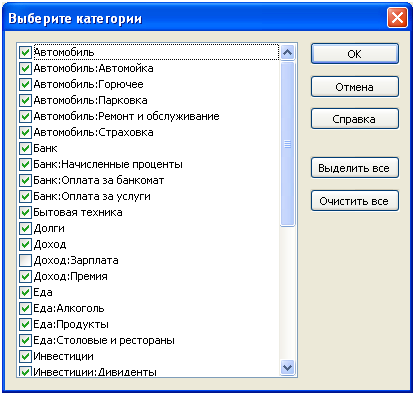

This means that we plan to have a balance of 29,571 rubles for a month. Now it’s interesting to see what happens if we lose our main income. We go to the filter by categories and uncheck the article Income: Salary.

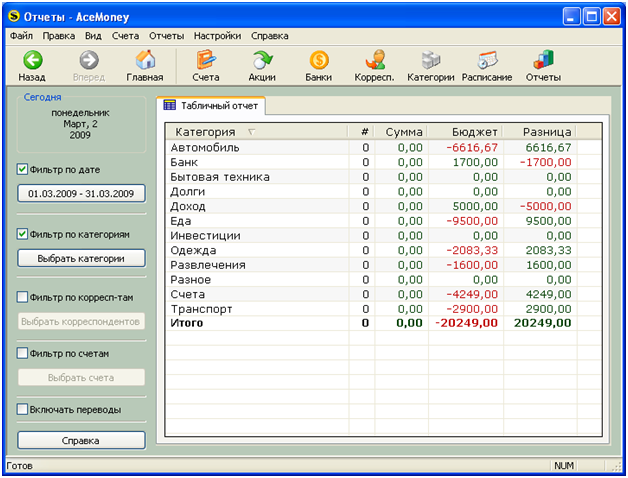

Click on OK, and see what happens:

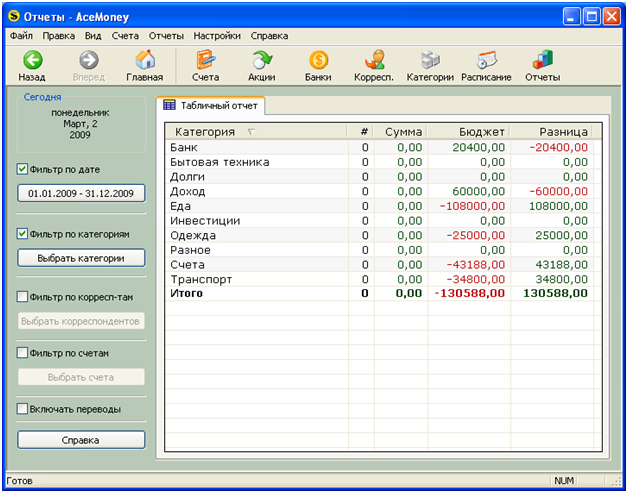

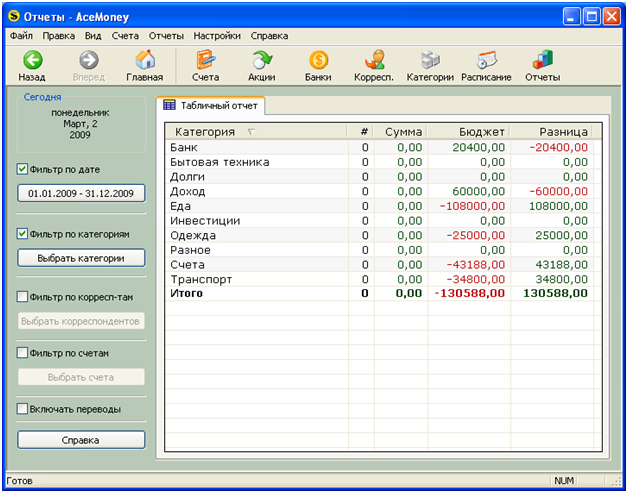

Yes, without a salary, it looks like we can’t maintain the current standard of living. Each month, 20,249 rubles of losses are counted. This amount of passive income is not enough for us in order to maintain the current standard of living. This is our task in the near future, but now, during the crisis, for example, we are faced with the question: can we live on our savings for a year. First we tighten our belts and go back to the category filter and remove everything we are ready to refuse: car, alcohol, entertainment. Click on OK and see that the result has become less sad. True, this is only a month, in order to see what will happen in a year, go to the filter by date and select the current year. Of course, the results are not encouraging, but there are still chances to hold out:

PS The data in all the tables are driven in approximate, they can differ significantly from you.

Tasks

- See the movement of money, taking into account factors such as passive income and changes in the value of assets.

- Understand how close is the payback point of fixed costs.

- Look at your picture of the movement of money on a different scale (month / year)

Decision.

We customize the program for ourselves.

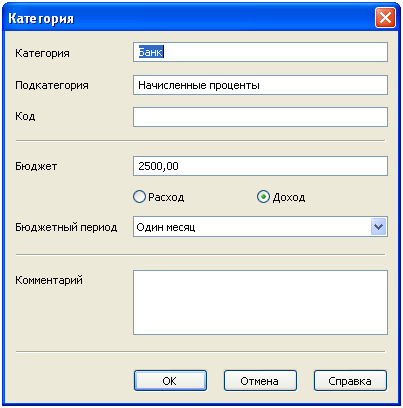

- We go to the list of categories and create those categories that are of interest to us.

- First enter the name of the category and subcategory. Carefully refer to the category name, then you can aggregate reports by subcategory and see the big picture.

- Decide on a budget by category: whether it will be an expense or an income (check the corresponding button), enter the amount in the budget field and select a period.

- If you have something to say to yourself, you can fill out the comment field.

- We complete the creation of the category with the OK button.

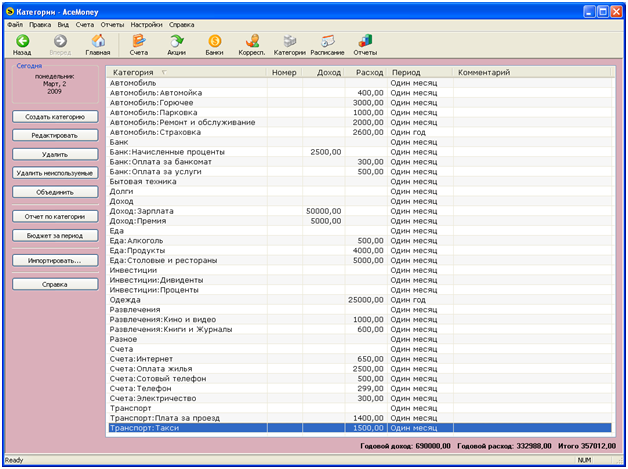

And so we go through all the categories that we have. Purely practically it is convenient to single out a separate category for which there is passive income. It is more convenient to spend insurance costs with a period of one year, the rest with a period of a month. When we finish creating the list of categories we will have something similar to:

First, let’s try what flow passes through us in a month. We select a report by category and see:

This means that we plan to have a balance of 29,571 rubles for a month. Now it’s interesting to see what happens if we lose our main income. We go to the filter by categories and uncheck the article Income: Salary.

Click on OK, and see what happens:

Yes, without a salary, it looks like we can’t maintain the current standard of living. Each month, 20,249 rubles of losses are counted. This amount of passive income is not enough for us in order to maintain the current standard of living. This is our task in the near future, but now, during the crisis, for example, we are faced with the question: can we live on our savings for a year. First we tighten our belts and go back to the category filter and remove everything we are ready to refuse: car, alcohol, entertainment. Click on OK and see that the result has become less sad. True, this is only a month, in order to see what will happen in a year, go to the filter by date and select the current year. Of course, the results are not encouraging, but there are still chances to hold out:

PS The data in all the tables are driven in approximate, they can differ significantly from you.