75,000 futures

- Transfer

- Recovery mode

The global stock market has become an artificially created world inhabited by algorithms and exotic financial instruments. The scale of the economic rivalry of these creatures and the speed of their actions are beyond what the human mind can capture. But, in companies that analyze markets, there are people who look like zoologists who systematize new species. They, like detectives, look for traces that algorithms leave among market data. They build graphs, as Linnaeus painted animals and plants, make lists of strange and beautiful images, and, looking at them, often give them names. “75,000 Futures” is a project of Gunnar Green and Bernd Hopfengartner , inspired by the desire to understand new forms of digital “life”.

Sasha Pohflepp

When Gottfried Wilhelm Leibniz arrived in London in 1673, he, on the London Bridge, was immediately surrounded by a crowd of people. These people were little interested in German science. What they needed was news about the Dutch war, which Leibniz or his companions could learn during the trip. Leibniz, to the delight of others, was very talkative. And while he was sharing rumors and observations, some decided that he had learned quite enough.

“One pushed towards the stairs, and he was immediately surrounded by a horde of bouncing barefoot boys. The gentleman wrote something quickly on a piece of paper and gave it to the boy, who was jumping above the others. He made his way through the crowd of comrades, through three steps flew up the stairs, jumped over the cart, shoved the fish merchant and let him down the bridge. From here to the coast was a hundred and something yards and about six hundred more to the Exchange - at such a pace for about three minutes. ”

To an inexperienced observer, this scene from Neil Stevenson’s novel “Mercury” may seem like some kind of game, but what we see here is happening for economic reasons only. Valuable information is exchanged for money on the London Stock Exchange. Leibniz then told the crowd that he had heard shots, but he also added - after the boy had run away, that these were not simple shots: “ Rare. Most likely these were signals. The encrypted information spread through the fog, so impenetrable to light and so transparent to sound ... ”

On March 2, 1791, about eighty years after Leibniz's death, the Frenchman Claude Schapp invented and created the first working system for the optical transmission of messages over distances. “If you succeed, you will be covered in glory,” the system was successfully tested on such a text. The invention was called a telegraph.

By 1830, there were already about 1,000 telegraph towers throughout Europe. With their help it was possible, for example, to send messages from Paris to Amsterdam or from Brest to Vienna. At the peak of the prevalence of the new means of communication, in 1850, only the French telegraph system covered 29 cities. It consisted of 556 stations, the telegraph network spans about 4800 kilometers. In order for all this to work, good visibility was needed. If fog occurred, nothing could be transmitted by optical telegraph.

These days, conducting business operations “in thick fog” is a common thing. Trading algorithms are constantly competing with each other, chasing profit through the underground cables of global networks. Financial instruments are bought in one place, where their price is lower, in order to sell on the site where they cost more. And so - until the price in different places is equal.

Sometimes there is a direct interdependence between assets: for example, if the price of crude oil goes up, it is very likely that the value of the shares of oil companies will rise. If an algorithm wants to make money, it must be faster than its shop mates. So far, everything is simple. However, the matter becomes more complicated if the algorithms not only try to work as quickly as possible, but also observe the opponents, and try to hide from them the signs of their actions, while trying to identify patterns in the behavior of other algorithms.

Algorithms for digital trading systems have long been something more than just a set of rules regarding the purchase and sale of stocks. They study everything in search of correlations, driven by the need to adapt to the environment, they are becoming faster and more difficult.

One can only come to understand some things when they stop working properly or break down. Worldwide trading algorithm races, usually invisible to non-professionals, attracted widespread attention on May 6, 2010. Then there was an “instant collapse” of the market, one of the sharpest collapses in the history of the American stock exchange. He was triggered by the algorithmic sale of 75,000 E-mini futures. The market recovered very soon, but a precedent is important: for the first time, high-frequency trading was associated with similar events. It lasted only a few minutes, but in order to understand the reason for what happened, the researchers took years.

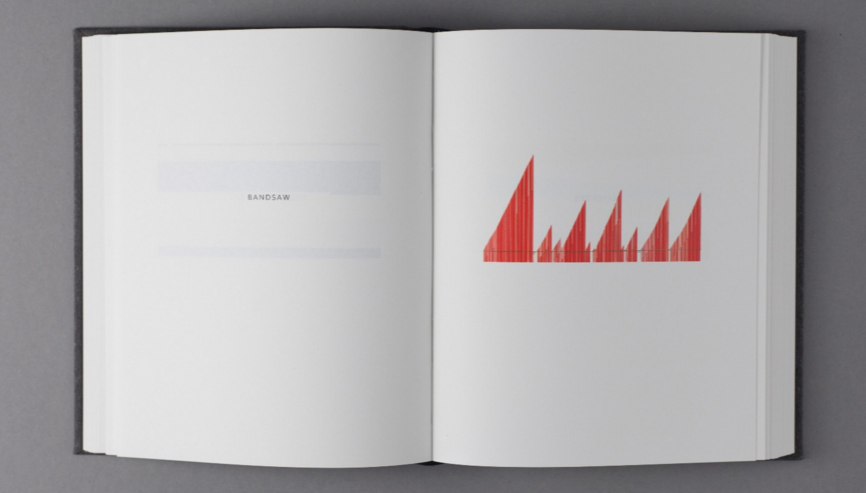

I must say that far from any unusual market activity can be quickly noticed. Algorithm trading causes microscopic price fluctuations in the millisecond ranges; these fluctuations resemble staccato that a person cannot play. Thus, usually, at the time of their occurrence, unusual actions go unnoticed. Company Nanex specializes in the study of historical trade data. In the course of such studies, unusual patterns of interesting algorithmic trading sequences were identified and collected. They were posted on the website and given them the names: “Castle Wall”, “To the moon, Alice!”, “Sunshowers”, “Broken Highway”.

From an economic point of view, these graphs are still inexplicable. We cannot read them as an open book, but this does not mean that they are useless. They are like poems of the Dadaists, when the main thing is form, rhythm, color, and not content. The names of the graphs turn them into pictures. For example, “Castle Wall”, or “Fortress Wall”. In the mind of the one who sees the schedule and reads the name, a crazy round dance of strokes slowly turns into fortress walls. Of course, there are no walls here, they are a product of our imagination and the desire to understand them, correlating them with what we know.

Charts are probably allusions to how the world of algorithms looks. After all, algorithms - in essence, they are very similar to us. When driven by a thirst for success, they walk through the fog, night birds may seem like robbers and monsters. Fantasy sometimes plays evil jokes with those who have it. Just as we, algorithms establish their orders and make connections, create pictures and see what is not. If a person and algorithm would rest on the lawn and look at the sky, then both of them would see faces in the outlines of clouds. It seems to us that the collapse of the market in 2010 is not only a financial, but also a semiotic problem.

We look at the charts, but we do not understand them. “They are beautiful,” we think. With each movement of the line millions of dollars pass from hand to hand. The only thing that can be said with certainty is that the graphs reflect certain events. But where exactly and exactly how they occurred is a mystery.

Our book, inspired by the beauty of graphs, tries to enhance the effect that their contemplation causes. We have removed all unnecessary. There are no names of financial instruments, no timestamps and numerical values. Only abstract images remain. Color, shape, space.

We have collected, on several hundred pages, traces of algorithms left by them in time. We have a kind of catalog of rarities. Our task is not to identify or classify finds. The most important thing is to show the life of the algorithms.

Looking again at these images, we realized that now they are talking to us differently than before. There are no more graphs of mysterious functions or curves of the recorder. Instead, we see unknown landscapes, space travel, sunsets and sunrises. These are 75,000 futures.