PayOnline experts on foreign acquiring, payment security, upsale and multiscreen world

From the speeches of Marat Abasaliyev, you will learn about the features of accepting payments through mobile devices and from desktop computers, get up-to-date statistics on mobile payments, who you need, what opportunities it gives and what pitfalls foreign internet acquires, how it works and where it works better apply this strategy. The expert also spoke about processing technologies for online MFIs and answered questions from users in an online interview. The speech by Boris Krivoshapkin is devoted to the security of Internet payments: chargeback, antifraud, 3DS, and how to find a balance between conversion and security. Olga Korneeva will help you choose a payment system. Kirill Ostrovsky will talk about the latest payment trends - payment mobilization and the multi-screen world. Artem Osokin will give brief instructions

For ease of navigation, we suggest using interactive content:

- Payment technology for upsale in online stores

- Billing Security on the Internet

- Online interview with Marat Abasaliev

- Foreign Internet Acquiring

- Black Friday and other dangerous days of the year.

- Processing Technologies for Online MFIs

- "Mobilization" of payments

- Acceptance of payments on the website and in the mobile application

- How to choose and connect the payment system

Payment technology for upsale in online stores

Upsale (upsale) is a technique that allows you to sell a service or item to your existing customer, usually complementary. Upsell is based on 3 main factors: the client's desire to save time, get a bargain price and emotions: style, beauty, self-expression, etc.

To the question of where and when to offer the upsale to the client - along with the order, together with the payment, before the stage of the formation of the full order or after he chose - you need to be very careful. So, for example, if you bring a client to the payment page of a purchase and offer something new there, there is a chance that he will leave to study this new, be distracted from the main purchase and it is not known whether he will pay at all. Conversely, if we are talking about complementary goods, it is better to offer them immediately. A vivid example is to offer the client food when ordering an air ticket. Or, for example, when buying a washing machine, on the page to switch to payment, offer installation services with a 20% discount.

In other cases (when it is not about complementary things), it is better to sell when the person has already bought what he needs. Not at the stage when he forms a basket to offer him a bunch of unnecessary or necessary services to him.

Where can I make an upsail? There are at least 3 scenarios: the person just made a purchase, and you immediately offer to buy more, but at a discount. The second scenario is in the letter, where you confirm that the client has successfully paid the order, again you are offering him something. The third scenario is that you will send letters over time (relevant for high margin products).

What kind of discount at upsile can we talk about? To attract a new client you spend money. By selling an old customer, you can give him a discount equivalent to the cost of attracting a new customer. Some numbers: the average bill of a new buyer in e-commerce in the US and Europe is 24 dollars. The average re-purchase check is $ 52. That is, the old buyer spends twice as much new. An increase in the customer return rate of just 2% has about the same effect as reducing costs by 10%.

Another small note. If you are not the first time selling to a customer, make payment easier, save him from having to enter payment information. Request, for example, only the CVV / CVC code.

Speaker : Marat Abasaliev , founder and CEO of PayOnline processing center; speaker and participant in round tables of the largest Russian conferences on e-commerce, online finance and Internet acquiring; He is the author of over 40 publications on Internet business and e-finance in online and offline editions.

Event : UPGRADE business breakfast.

Billing Security on the Internet

There is an opinion that security does not happen much. In fact, it happens. When it comes to accepting payments, security is sometimes redundant. Next, in what moments you need to focus on security, and where it is not needed.

According to the data of 2013, Russia was ranked 4th among European countries in terms of the turnover of fraudulent transactions and 11th in terms of their number. To date, the proportions in general remain similar. The threat level of fraud - the number of fraudulent transactions to the total number of payment transactions - in Russia amounted to 0.017%. At the same time, up to 90% of payment transactions fall on offline. That is, apparently, this large proportion of fraudulent transactions is still associated with offline. And what happens at the same time on the Internet?

On the Internet, the main threat that can be alloted to merchants is chargeback - operations to protest a transaction, when the cardholder comes to his issuing bank that issued the card and writes a statement that he did not commit any transaction, does not understand what it is about and asks him to return the money. This money without acceptance through the acquiring bank, which works with the Internet merchant, returns, and then the proceedings begin, how legitimately this operation was made. But the money has already been returned, and the burden of proof falls on the merchant. This follows from the rules of international payment systems.

But on the Internet there is such a thing as CNP (Cardholder Not Present) operations, that is, without presenting a card. It is impossible to determine initially whether the real cardholder pays or is it a fraudulent operation. What to do in such cases, and what specific examples of fraud are the most obvious?

The first opportunity to protect yourself and prove that the operation was legitimate is to properly organize your business and have the necessary documentary evidence that this service or product was actually provided to the person who paid it. This can be done traditionally on paper carriers - invoices, acts of reception and transmission, etc., if there is a remote delivery of goods, as well as electronically - authorized zones, collecting personal data, checking customers at the entrance. In addition to the opportunities that an online merchant has, there are 2 more external factors: technologies offered by international payment systems, the main of which is 3DS technology and antifraud monitoring.

Antifraud monitoring is a scoring system, a software package that allows you to assess the degree of fraud in a transaction by a sufficiently large set of factors: order data from the Internet merchant, card data, purchase history, stop lists, some situational information. Based on this data, the anti-fraud monitoring scoring system makes a decision to skip a transaction, block it, or make an individual decision. Such a protection system is very effective, but it is quite expensive, so either a processing center or individual traders with high turnover can afford it.

3D-Secure is a technology offered by Visa and MasterCard international payment systems. It works as follows: at the time of payment, after filling in the data on the payment page of the payer, they are redirected to the page of the issuing bank that issued the card to him, and the code is entered on this page. The meaning of this technology lies in the fact that the data that is entered through the payment page goes through one channel, and the payers themselves receive the code via another communication channel. This separation of channels for obtaining information gives the desired degree of security, additional confirmation that the cardholder is paying for the payment. Another positive thing is that the technology allows you to accept cards that do not have CVV2 / CVC2 code (this is Visa Electron and Maestro).

At the same time, there are some features associated with the code: first, it needs to be generated and transferred to the payer, secondly, it needs to be entered correctly. This reduces conversion in some way. In addition, not all issuing banks support 3DS technology and not all users are subscribed to the technology. This card pool is not suitable for payment. When the code is transmitted via SMS, the phone may not see the network, may be discharged, may be forgotten at home, in the car or any other place. In mobile devices, due to the speed limits in the network, the page of the issuing bank takes a long time, with errors, sometimes in an unreadable form, and then there are difficulties when entering the code. According to statistics, up to 15% of the variance of operations occurs due to the incorrect introduction of the 3D-Secure code or because of its non-introduction in general.

So what to choose - to focus on security, or, if we are talking about the flow of money, the conversion is more important? The indicators that influence this are the average check of the merchant and his marginality. For example, if the marginality of online trading is 50%, then in theory you can skip every second order and work to zero. If you miss every third order, you will work in some kind of profit. The main thing here is not to overdo it with the game in conversion, because there are restrictions at the level of international payment systems, which say that the fraud's threshold should also be. For Visa it is 1%, for MasterCard - 1.5%. If a merchant goes beyond this limit, he has a big threat that he will be disconnected from Internet acquiring.

We give a specific example. Travel area - there is a large average check, the cost of tours or air travel can reach tens and hundreds of thousands of rubles. At the same time, they have very low margins, so this is one of the most characteristic examples where you need to concentrate on security. If the marginality, relatively speaking, in 1% you lose 1 payment, then you need to make another 100 error free payments to fight off this loss. Digital retail, where marzhitnalnost is at the level of 5-10%, the average check is lower, these merchants are also focused on security, but the criticality of the situation is somewhat lower. But in this kind of activity like Fashion, you can concentrate on conversion. Margins when selling shoes, clothes, accessories are dozens and sometimes even hundreds of percent. There you need to take the number of orders - the more you get orders

Speaker : PayOnline Commercial Director Boris Krivoshapkin .

Event : RIW-2015 (Russian Internet Week).

Online interview with Marat Abasaliev

During the interview, the CEO of PayOnline answered the following questions:

- What happens with the turnover of payments through electronic payment systems in Russia in 2016?

- What are the difficulties that arise for small and medium-sized businesses when setting up payment systems on the site?

- How are things with the payment terminals? How does the prevalence of electronic payments affect the development of this segment?

- What changes await us in the future in the Internet acquiring system?

- Why do payment systems deny online shopping?

- Is there a future for Russian companies in Europe?

- Is the decline in the cost of payments for the domestic market through the system NSPK?

- Will a bank card be present in the usual form of payments in 10-15 years?

- What innovative technology is PayOnline developing now?

Foreign Internet Acquiring

If you look at the Internet acquiring scheme, then it is clear that there is an issuer, there are payers, there is a merchant - the site on which the operation is performed - and the acquirer. Money through the issuer, through the acquirer, through the settlement banks of payment systems in each jurisdiction (in each country) fall into the merchant.

If we are talking about foreign Internet acquiring, the acquirer will be represented outside of Russia, and the foreign legal entity (merchant) will also be represented outside of Russia. Why Russian banks can not process such payments? The fact is that they do not have a crossboard license. Foreign banks, as a rule, have a more extended license.

What opportunities does foreign internet acquiring provide? It will allow you to write off dollars, euros, pounds or other currencies from the payer's card (for example, there are banks in Germany that support 125 currencies). Recently, foreign banks have learned to write off and rubles. These same acquirers credit the currency to your account.

Who needs foreign internet acquiring? If you provide services abroad, then it is important for you to be closer to your client. When, for example, the American issuer determines that you have a Russian acquirer, there will be much more refusals.

But it is worth considering that the connection process in Russia and abroad is slightly different. So, for example, abroad, risks are treated more carefully and you will most likely need to provide information about UBO (beneficiary), shareholders, billing statements and many other documents.

At the same time, transaction costs in Russia are among the cheapest. Internet acquiring abroad is generally expensive, primarily due to the different interchange (commissions that credit institutions involved in servicing bank cards pay to each other in the process of making transactions). So, for example, in America there are more than 200 types of interchange. It also gradually comes to Russia.

Summarize:

- If you have foreign clients, it is better to give them the opportunity to pay in national currency.

- If separation of the RF / non-RF streams is required, you can use “i.kvayring”.

- When choosing an acquirer, carefully look at the rates. They are opaque to almost all foreign acquirers, including due to the huge number of types of interchange on foreign cards.

- Be prepared to provide more information than in the Russian Federation.

- It is more convenient to work with IPSP (Internet Payment Service Provider) - a service provider than with a bank directly, the cost will not change significantly.

Speaker : Marat Abasaliev.

Event : The International Conference The Payment service of the future 2015.

Black Friday and other dangerous days of the year.

During sales, consider what the geography of payments will be (from which country the buyer will be), how many payments you plan, the turnover that will take place in your day. As part of sales to the region, it is very important to foresee that not all regional banks support 3DS technology. One of the most important things is to inform the managers of the online store in the framework of interaction with the payment system so that they can promptly advise buyers.

When you analyze which days will have a peak in sales, how high demand is expected, contact your payment partner and discuss an action plan. This should be done as early as possible, at least in 2-3 days.

What needs to be provided? Limits on payer bank cards, the number of purchases, the amount of payments, the amount of payments per day, geography - where we sell (Russia, CIS countries, Europe or other regions). In some cases, it is possible that you simply split accounts with the payment partner. You will have a separate account for large purchases, or purchases from abroad (Europe, America).

Speaker : Artem Osokin , commercial director of PayOnline electronic payment system.

Event : RIF + KIB 2016.

Processing Technologies for Online MFIs

Offline MFIs are offices, working with cash. The Internet also provides access to a larger audience (not only in the Russian market, but also in other countries), gives more information about the borrower (from publicly available sources, such as social networks, you can collect an impressive online file - where a person is, on what spends money, learn about his social connections and relationships). In addition, the entry threshold for the MFI market has recently declined substantially, which makes the industry very attractive for many entrepreneurs.

As for processing, in this area, as, indeed, in any other, has its own nuances. So, for example, it is necessary that processing at its level could cut off prepaid and virtual cards. This is done by being available to the BIN database with card types. Conveniently, if the processing provides the ability to save the token card. This will be necessary for the subsequent direct debit from the card.

How does the MFI interact with the processing center? What conditions of cooperation offer providers? And also a little about the “payment history” shared with the credit history bureau at the annual FinMicro forum was told by Marat Abasaliev.

Speaker : Marat Abasaliev.

Event : FinMicro annual forum.

"Mobilization" of payments

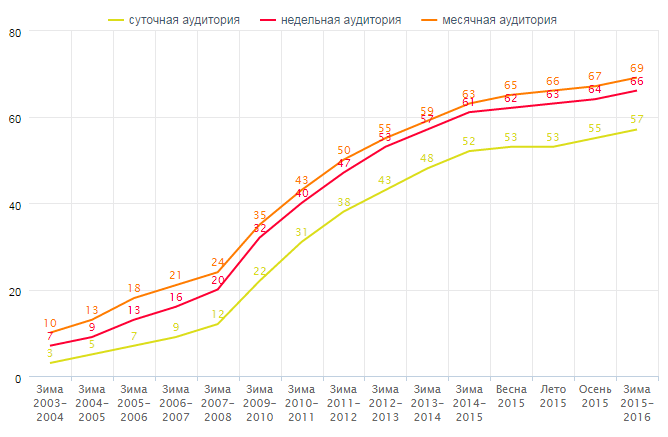

The share of the active audience is going online at least once a day - now it is 57% (66.5 million people). The annual growth of Internet users connecting to the network at least once a month was 9.2%, while for a daily audience this figure is 9.3%. POF

data . Winter 2015 - 2016

However, if you compare the growth of the audience 5-10 years ago with the dynamics of 2014-2106, it becomes clear that the rate of growth of the audience is not so high. This leads to the fact that now with the audience we need to work efficiently. Amount, if it is added, then a little.

Another trend is the multiscreen world. There is a pattern that 98% of users begin to search for goods or services on one device, and make a purchase from the search results on another. These are desktops, laptops, netbooks, tablets and smartphones. The search and consumer activity of a modern user is distributed between them. How does mobilization fall? Very simple. 65% of users begin to search for goods on the Internet from the phone, and 61% of them go to the desktop. Only 25% of users start searching from the desktop.

What is important mobile audience? 81% of purchases from a smartphone are made spontaneously, i.e. these are emotional purchases, they occur under the influence of the moment. Whereas from the desktop only 58%. It is all the more surprising that the sites of 80% of Russian online stores from the TOP 100 are not optimized for mobile Internet users.

Another question that arises now among users is trust. 46% of users are not sure about the security of mobile payments. 37% think it is easier to pay in cash or by card in the terminal. 33% did not think about the use of mobile payments. 18% do not see any benefit in mobile payments.

Speaker : Kirill Ostrovsky , PayOnline project office manager.

Event : RIF + CIB 2015.

Acceptance of payments on the website and in the mobile application

Over the past 3 years, sales of smartphones in Russia have grown by almost 2 times. There are 10 smartphones for 3 tablet computers sold. In general, the world for 1 tablet sold only 7 smartphones.

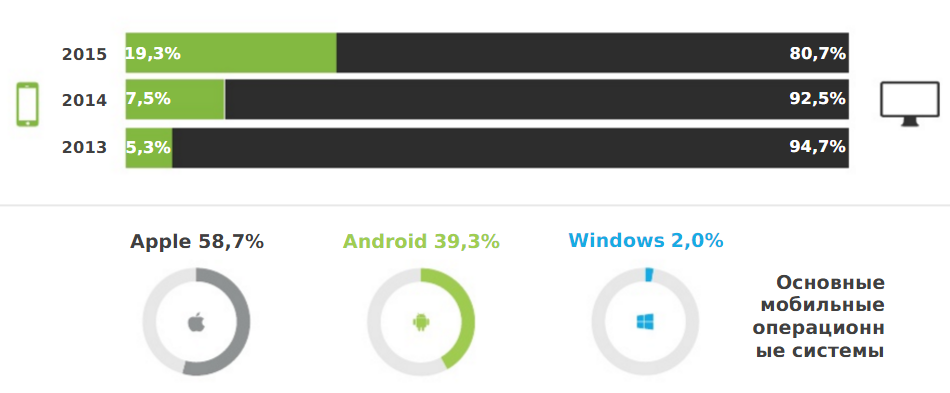

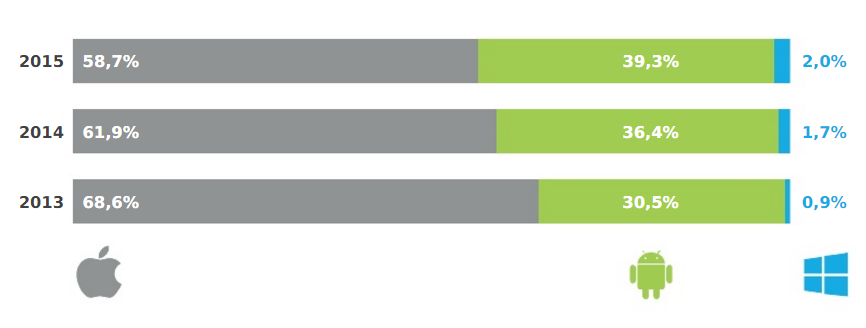

Mobile phones are changing our lives, not only in terms of consumption, but also our entire living space. If you sell online, you should know that almost 20% of payments are made using mobile devices: 58.7% from Apple, 39.3% from Android and 2% from Windows.

Statistics covers more than 30 million transactions per year and more than 3.5 thousand online stores. Since 2013, the share of payments from smartphones has grown almost 4 times.

PayOnline statistics for 2013-2015

The share of payments from Android devices is growing at 3-5% per year. This is mainly due to the fact that Android devices are selling more.

The world becomes multi-screen. How in this multi-screen world to accept payments? First of all, it makes sense to make your website adaptive in order to sell goods in different devices. And it is better to make a mobile site and application.

The fundamental differences between a mobile smartphone and a desktop computer are: the size of the screen, the ease of entry, the time spent on the purchase and other criteria.

All these factors affect how your online store will be on the desktop and on the mobile. You can not have the same site for a smartphone and a PC. If you have the same site on your mobile as on the desktop, the client will most likely be dissatisfied with his work. And this, as already noted, every 5th buyer.

Speaker : Marat Abasaliev.

Event : Ural Internet Week 2016.

How to choose and connect the payment system

What should I look for when choosing a payment partner?

- Reliability (availability of certificates, certificates), security and stability in receiving payments.

- Service and functionality: the ability to accept all types of online payments, the number of acquiring banks, the ability to choose the right one, availability of support for payers 24/7, a convenient, understandable payment form, additional services, the ability to test the system.

- The level of client-oriented partner (manager response time to requests, quality and completeness of answers, customer support and maintenance, complexity and cost of technical integration and availability of ready-made payment modules, marketing support).

- Cost of services (cost of acquisition and ownership - the amount of commission, the ability to change the tariff with an increase in turnover).

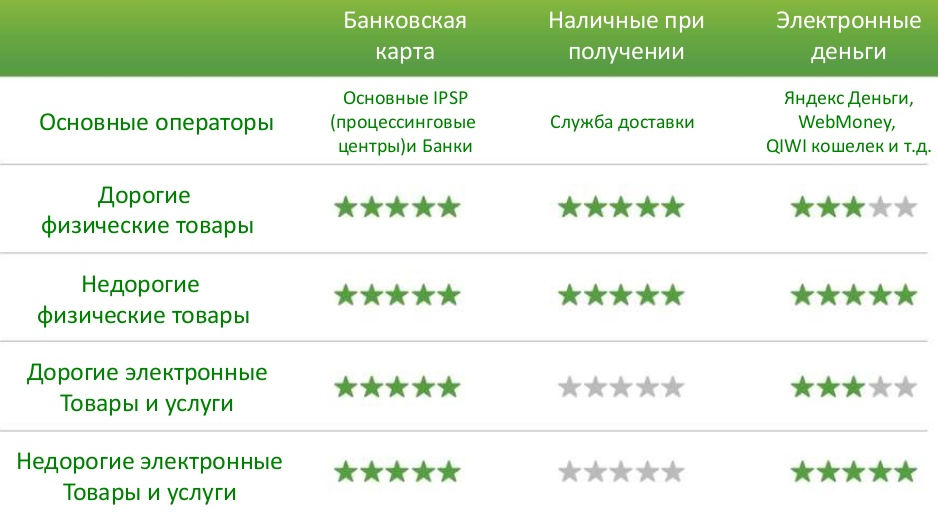

For various products there are one or another, the most suitable payment methods. Conventionally, all products that are sold online can be divided into 4 categories. At cost: expensive and inexpensive. In essence: physical and electronic. Depending on the category of goods, the most preferred types of payment are:

Why do customers go to competitors? How to organize the acceptance of payments by credit card and in other ways: Where to start? How long will it take? What documents will need to be collected? What difficulties will you encounter on the way? How to solve or prevent them? And these and other questions answered Olga Korneeva.

Speaker : Olga Korneeva, PayOnline Marketing Director.

Event : webinar “We accept money. How to choose and connect the payment system ".

If you have any questions or you are looking for a turnkey solution for accepting payments on the website or in a mobile application, please contact us , we will be happy to answer any questions and select a payment solution taking into account the specifics of your business.