What network monitoring tools have become leaders in the version of Gartner

In February 2019, Gartner released the new Magic Quadrant for Network Performance Monitoring and Diagnostics (MQ for NPMD). NPMD tools are solutions for monitoring network traffic and infrastructure metrics of network devices. Most vendors provide complete solutions and network monitoring - one of the components of such solutions. In the article, I will compare the new NPMD quadrant of 2019 with the previous one and see what has changed there. At the end of the article there are links to the original reports, where you can find out details about the changes for each vendor.

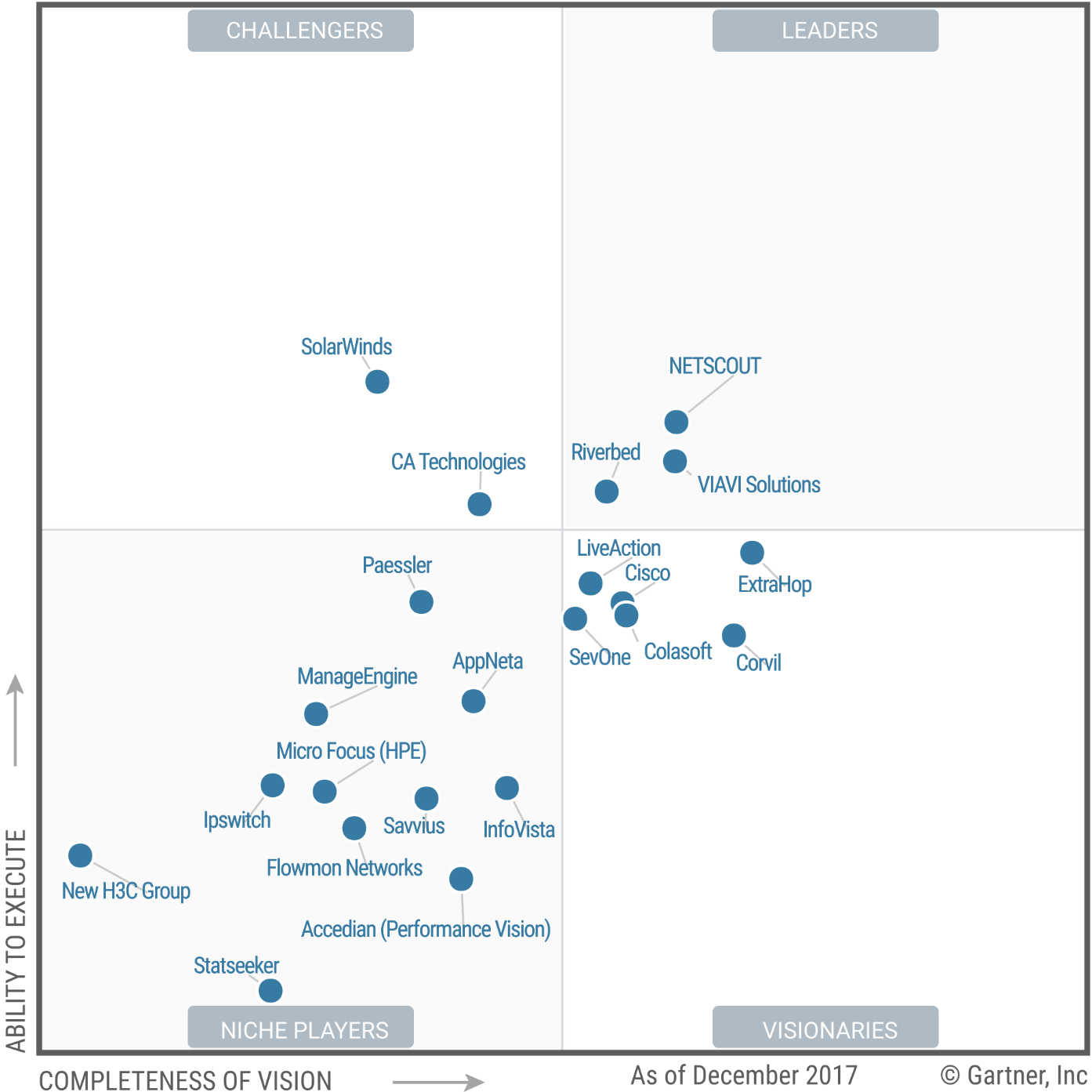

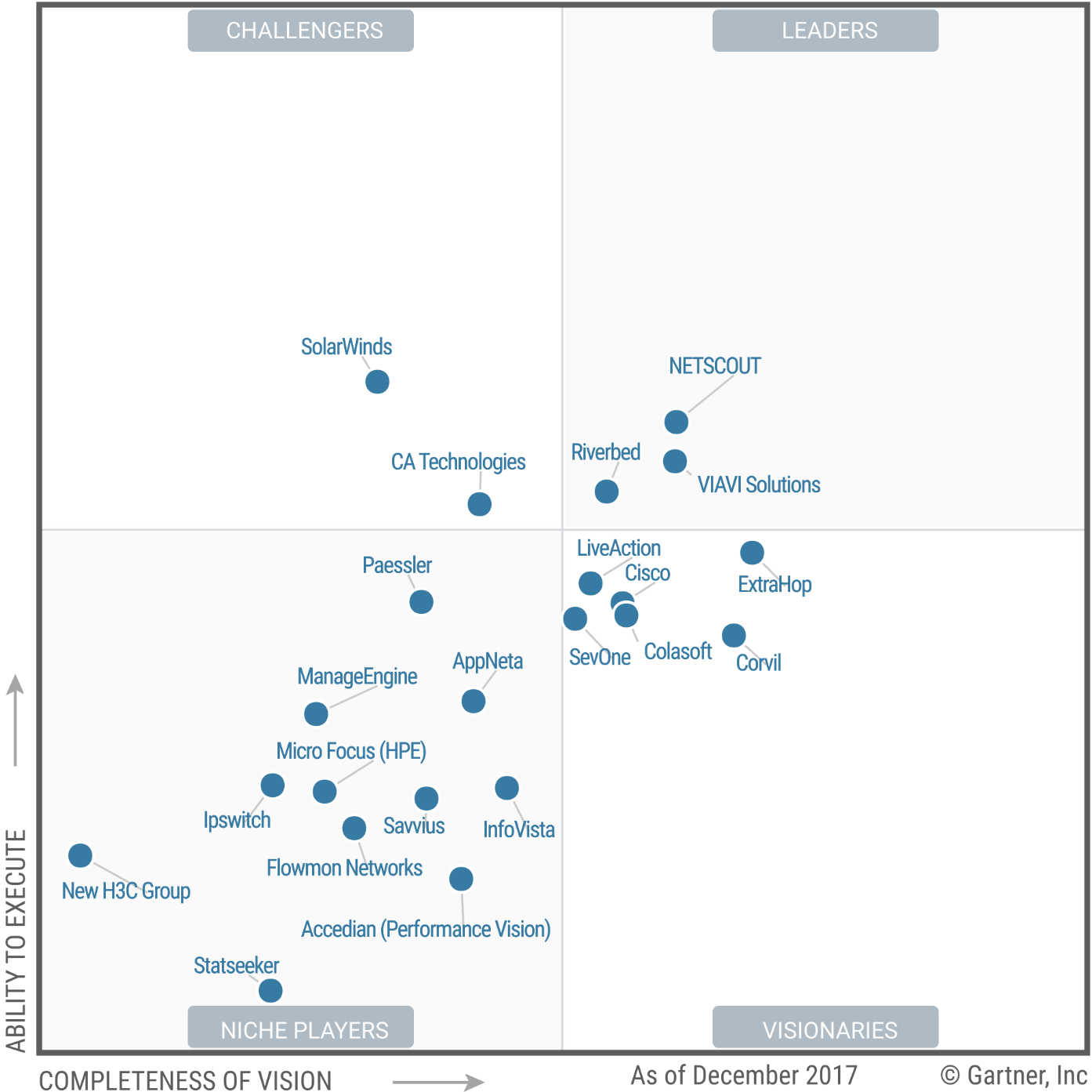

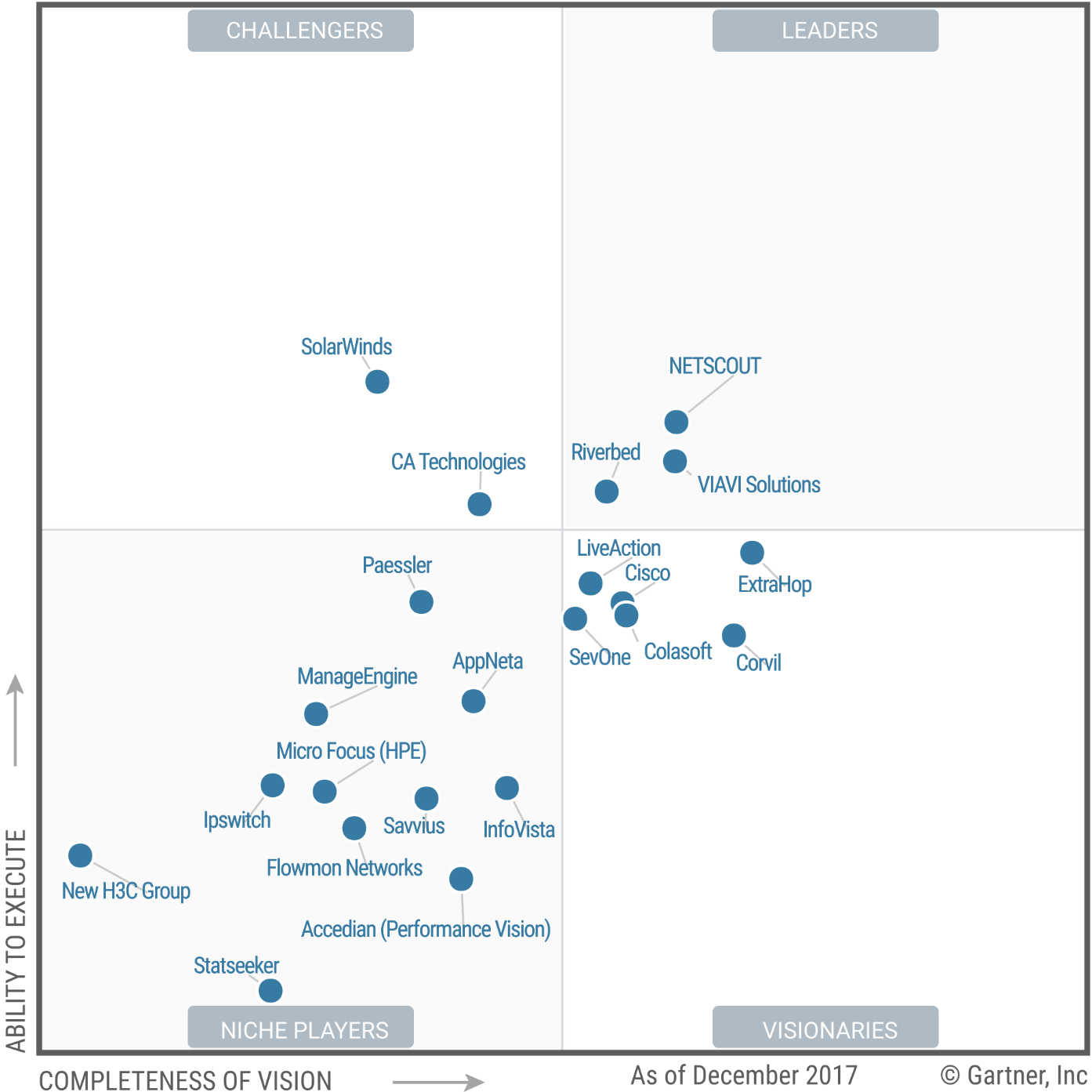

Compared to December 2017 (and it was then that the last quadrant came out), Gartner changed the approach to evaluating vendors, which they could include in the comparison. If before the vendor needed to support all three monitoring technologies: infrastructure metrics, flow and packages, now two are enough.

Let me remind you that Gartner divides the magic quadrant into categories: leaders, challengers, strategists (visionaries), niche players. Vendors are evaluated according to their ability to perform (quality and effectiveness of internal processes, systems, methods or procedures that allow the competitiveness and effectiveness of a vendor to influence revenue and reputation) and completeness of vision (the ability to convincingly formulate statements about current and future market trends, innovations, customer needs and competitive strengths, and how well they compare with Gartner’s position).

Last year, there were 22 vendors in the quadrant, only 16 remained in this quadrant. 2 vendors were added: LogicMonitor and Broadcom, and 7 were dropped out: CA Technologies (acquired by Broadcom), Corvil, Infovista, Ipswitch, Paessler, Savvius (acquired by LiveAction) and Statseeker.

Over the past three years, leaders have been NetScout, Riverbed, and Viavi. They remained in this. But in 2019, ExtraHop moved from the strategist category here. The vendor has added AI (artificial intelligence) technology to its products and improved visualization.

In the pretend quadrant is the only vendor - Solarwinds. Compared to last year, CA Technologies (now Broadcom) has moved from here to the square of applicants. Solarwinds has consolidated all of its network monitoring tools into a single Network Automation Manager (NAM).

From the square of strategists into niche players, Cisco disappeared and Corvil completely disappeared. Of the applicants, Broadcom has moved from niche players to AppNeta. It is suspected that Broadcom’s acquisition of CA Technologies will slow down product development and Broadcom’s position may change next year. AppNeta moved into this square mainly due to sales growth. NPMD solutions from ColaSoft, LiveAction, and SevOne remained in the same square as last year.

Since last year, Accedian, ManageEngine, Micro Focus and New H3C Group have remained in this square. A new LogicMonitor vendor, previously not present in the Gartner quadrant, was added here for ease of use of the product. Cisco moved from the square of strategists to niche players due to the lack of proper user awareness of the line of NPMD solutions of this vendor.

If you are looking for an NPMD solution to replace an existing one or have realized its necessity, do not immediately look towards the leaders. It is logical that the price for them is often higher, because there is more functionality. But perhaps this redundant functionality is not even necessary. First of all, decide on the tasks you want to solve, and only then look at the capabilities of products from different vendors. Although this advice sounds like a cap, they usually ask first about showing some of the famous vendors, and only then they talk about tasks.

Tell us in the comments how you chose a solution for network monitoring. At the end of the article is a short survey.

Compared to December 2017 (and it was then that the last quadrant came out), Gartner changed the approach to evaluating vendors, which they could include in the comparison. If before the vendor needed to support all three monitoring technologies: infrastructure metrics, flow and packages, now two are enough.

Let me remind you that Gartner divides the magic quadrant into categories: leaders, challengers, strategists (visionaries), niche players. Vendors are evaluated according to their ability to perform (quality and effectiveness of internal processes, systems, methods or procedures that allow the competitiveness and effectiveness of a vendor to influence revenue and reputation) and completeness of vision (the ability to convincingly formulate statements about current and future market trends, innovations, customer needs and competitive strengths, and how well they compare with Gartner’s position).

|  |

View 2018 (2017) Gartner Magic Square near

View 2019 Gartner Magic Square near

Last year, there were 22 vendors in the quadrant, only 16 remained in this quadrant. 2 vendors were added: LogicMonitor and Broadcom, and 7 were dropped out: CA Technologies (acquired by Broadcom), Corvil, Infovista, Ipswitch, Paessler, Savvius (acquired by LiveAction) and Statseeker.

The leaders

Over the past three years, leaders have been NetScout, Riverbed, and Viavi. They remained in this. But in 2019, ExtraHop moved from the strategist category here. The vendor has added AI (artificial intelligence) technology to its products and improved visualization.

Applicants

In the pretend quadrant is the only vendor - Solarwinds. Compared to last year, CA Technologies (now Broadcom) has moved from here to the square of applicants. Solarwinds has consolidated all of its network monitoring tools into a single Network Automation Manager (NAM).

Strategists

From the square of strategists into niche players, Cisco disappeared and Corvil completely disappeared. Of the applicants, Broadcom has moved from niche players to AppNeta. It is suspected that Broadcom’s acquisition of CA Technologies will slow down product development and Broadcom’s position may change next year. AppNeta moved into this square mainly due to sales growth. NPMD solutions from ColaSoft, LiveAction, and SevOne remained in the same square as last year.

Niche players

Since last year, Accedian, ManageEngine, Micro Focus and New H3C Group have remained in this square. A new LogicMonitor vendor, previously not present in the Gartner quadrant, was added here for ease of use of the product. Cisco moved from the square of strategists to niche players due to the lack of proper user awareness of the line of NPMD solutions of this vendor.

| Gartner Report 2017 (2018) | Gartner Report 2019 |

Tell us in the comments how you chose a solution for network monitoring. At the end of the article is a short survey.

Only registered users can participate in the survey. Please come in.

What network monitoring tool do you use?

- 0% Accedian 0

- 0% AppNeta 0

- 0% Broadcom (CA Technologies) 0

- 2.9% Cisco 1

- 0% Colasoft 0

- 0% ExtraHop 0

- 0% LiveAction 0

- 0% LogicMonitor 0

- 8.8% ManageEngine 3

- 2.9% Micro Focus 1

- 0% NETSCOUT 0

- 0% New H3C Group 0

- 2.9% Riverbed 1

- 2.9% SevOne 1

- 17.6% SolarWinds 6

- 0% VIAVI Solutions 0

- 11.7% Other commercial product 4

- 50% Another free product 17