How the IBM and Red Hat deal at $ 34 billion will change the IT market: expert and analyst opinions

Image: Leonid Mamchenkov | CC BY 2.0

This week, IBM announced the largest transaction in its history - for $ 34 billion, it will buy open source software and the creator of Linux distributions, Red Hat. We collected information on the transaction and the reaction of market representatives and analysts to it.

Transaction Details

According to press reports, IBM will pay $ 190 for each Red Hat share. This is 63% more than their price at the close of the exchange on Friday October 26 - then Red Hat shares were trading at a price of $ 116.68 per share. The capitalization of Red Hat at that moment was estimated at $ 20.5 billion. At the same time, the head of IBM, Ginny Romette, said in a conversation with journalists that this is a “fair price”. The transaction will be the largest in the history of IBM and the third largest transaction in the sector of technology companies in the history of the United States.

The transaction will be fully closed in the second half of 2019. After that, Red Hat will become an independent unit within the IBM Hybrid Cloud structure. According to IBM, the new division will be engaged in the development of open source services and will maintain a high degree of independence. Jim Whitehurst will remain in the position of CEO, Ginny Rometti will be his immediate superior.

Whitehurst and Rometti. Photo: IBM

Why all this is needed: the opinions of analysts and market participants

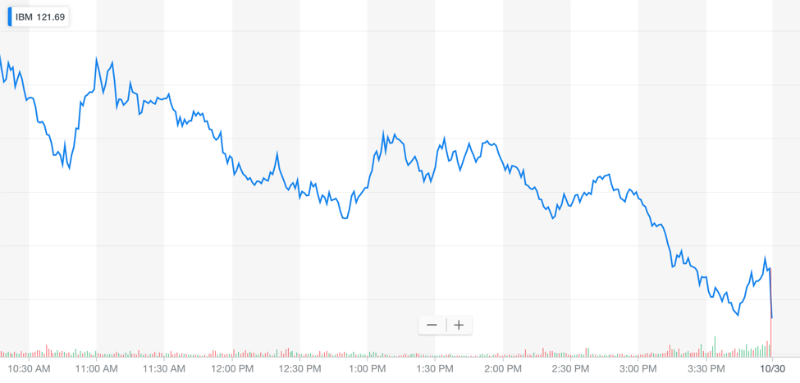

In recent months, IBM has evolved things in a bad way. The stock price of the company fell amid fierce competition with other suppliers of enterprise enterprise solutions, including Amazon, Microsoft and Google.

The purchase of Red Hat was perceived by the market unequivocally - it was an attempt to change the situation and impose a struggle on competitors. Despite the fact that this will not be easy, market representatives and analysts, on the whole, positively evaluated this move by IBM.

“This is a step of despair on the part of a company that has lost everything and everyone in the past five years,” said Joel Fishbein, managing director of BTIG financial company. “It's amazing not why they bought Red Hat, but why they were going to do it for so long.”

Network World Edition collectedQuotes from representatives of the largest analytical companies. For example, Gartner is confident that the deal with Red Hat will allow IBM to get its place in the niche of corporate hybrid clouds - according to forecasts, the volume of this market segment will be $ 240 billion next year.

“With this deal, IBM is trying to attract those enterprise customers that have not yet implemented hybrid cloud technologies or are at the beginning of the migration process,” said Gartner research department head Dennis Gaughan. “Despite the fact that many have already invested in the introduction of such technologies, companies have yet to adapt a large number of applications to work in the cloud.”

Forrester's vice president and principal analyst, Dave Bartoletti, believes that if IBM had previously found it difficult to cope with Amazon pressure from its Web Services, Microsoft and Google, now the company has chances in this confrontation.

“The company has Kubernetes and a leading platform for developing cloud-native services using containers, as well as a set of open-source tools that are more than any competitor IBM can offer individually. “Of course, it takes time to take the consequences of a takeover of this size, but it is already clear that the deal will change the market of open and cloud platforms for years to come.”

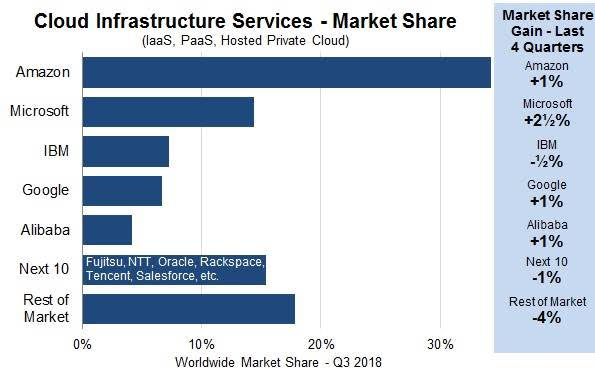

The deal will provide a good opportunity to increase market share and sales from cloud technologies (cloud power) and open source software (with open source). This is a very good deal, since apart from Microsoft Azure, almost all modern cloud technologies work on software with open source Linux code. At the current moment, IBM is the third largest in the world in terms of market share (8-10%) in the field of cloud technologies after Amazon AWS and Microsoft Azure.

Cloud technology will continue to grow. Growth in the third quarter of 2018 was 45% compared with the full year in 2017 and 50% compared with 2016. At the same time, the growth rates will decline - the main phase of increasing the capitalization of this segment is passed.

The goal and goal of an expensive purchase is not to become a leader in the field of cloud technologies, but a leader in the hybrid cloud technology segment. This is much less expensive, will allow to attract more customers and transfer more data to storage using cloud technologies. IBM will be the only company that can provide hybrid cloud technologies. Most companies transfer no more than 20% of infrastructure to the cloud, the remaining 80% will be covered using hybrid cloud technologies.

- Iskander Lutsko , Chief Investment Strategist at ITI Capital

Other materials on finance and stock market from ITI Capital :

- Western securities analysis tool

- Analytics and market reviews

- Purchase of shares of American companies from Russia

- Huawei overtook Apple in terms of sales. The capitalization of the American company still reached $ 1 trillion

- Analysts: Microsoft's capitalization could reach $ 1 trillion

- Mass media: large-scale cyber attacks accelerated the growth of capitalization of companies in the information security industry

- Bloomberg: Hedge Funds Recognize Brexit Results Before Others And Earn Billions