Why bitcoin failed: end of the experiment with bitcoins

- Transfer

I spent more than five years as a Bitcoin system developer. Millions of users and hundreds of developers used my programs, and my lectures led to the creation of several startups. I talked about bitcoin on Sky TV and BBC News . I was quoted by the Economist as a Bitcoin expert and renowned developer. I explained this topic to the SEC, to bankers and ordinary people in a cafe.

And from the very beginning, I argued that Bitcoin is an experiment, and like any experiment, it can fail. Do not invest what you are not ready to lose. I talked about this in interviews , on reports and wrote in the mail. As did other well-known developers - Gavin Andresen and Jeff Garzik.

But, despite the fact that I always knew about the possibility of failure, the inevitable conclusion about its occurrence really upsets me. The fundamentals have fallen, and no matter what happens to prices in the short run, they will obviously go down in the long run. I am no longer going to take part in the development and sold all my cue ball.

Why did bitcoin fail? Because the community failed. What was supposed to be a new, decentralized kind of money that did not use “important system institutions” and was “too big to fail” became something more terrible - namely, a system controlled by a small group of people. Moreover, the network is close to technical collapse. The mechanisms that were supposed to prevent this collapse broke down, and as a result, it makes no sense to dream that bitcoin could become better than the existing financial system.

Think about it. If you had never heard of Bitcoin before, would you like a payment network that:

I would venture to suggest that the answer is no.

If you have not followed the Bitcoin network, then here is how it looks in January 2016. The block chain is full. You think how it is possible to “fill in” what is a sequence of files. The answer is that since the absolutely artificial limitation of the capacity of 1 MB per block, which was introduced a long time ago as a software stub , was not removed, as a result, the network capacity is almost exhausted.

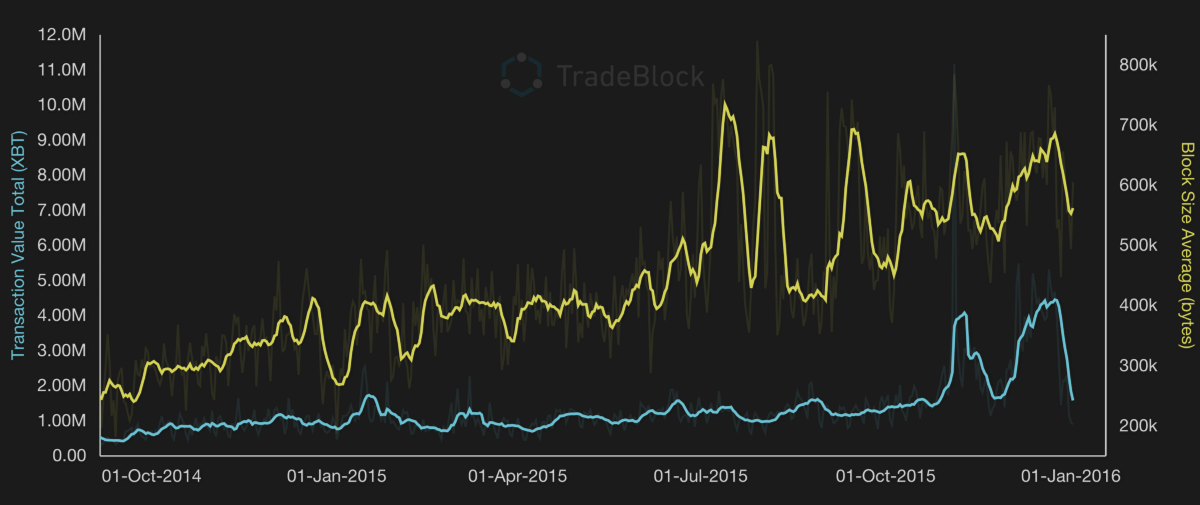

Here's a graph of block sizes: The

July peak was reached during a DOS attack, when someone populated the network with transactions in order to break it, and called it a “strength test”. Therefore, it is this level, 700 kb of transactions (less than 3 payments per second) that is the practical limitation of the network.

The real limit turned out to be 700 kb instead of the theoretically predicted 1000. This is because miners sometimes produce smaller blocks, and even zero blocks, instead of confirming transactions. This, apparently, is the result of the influence of the censorship system called the Great Chinese Firewall. I’ll talk about him a little later.

If you look closely, you can see that traffic has been growing since the end of summer 2015. It was predictable, and in March I wrote about seasonal patterns of network growth.

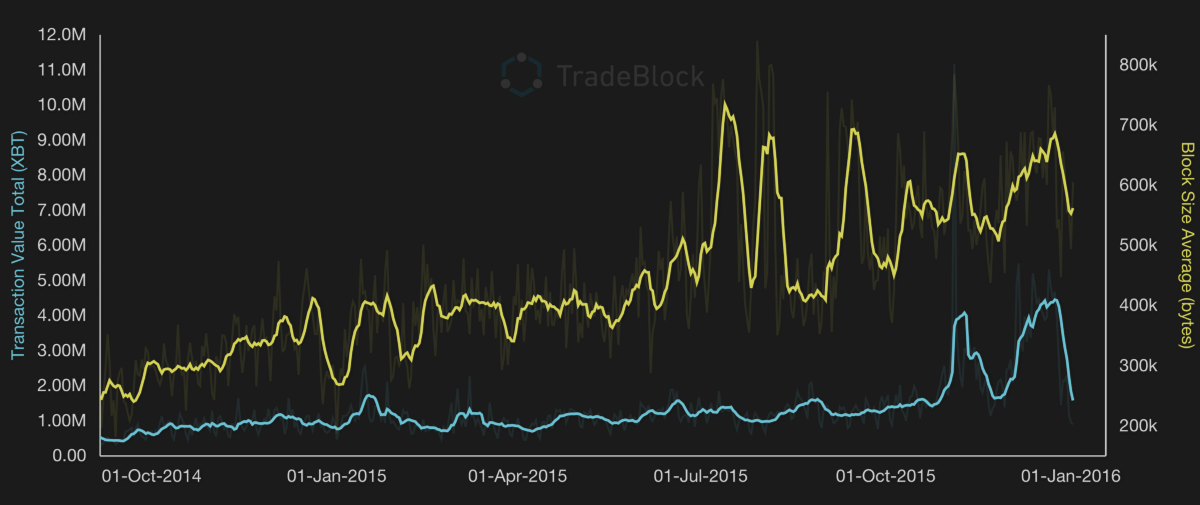

Weekly average block size chart:

That is, the average value approached the upper limit. It is not surprising that now such moments often happen when Bitcoin is not able to cope with transactions, and their turn increases. This is visible in the size column. The list contains 750 Kb blocks - these are blocks from miners who incorrectly configured software.

When networks reach maximum capacity , they become unreliable. Therefore, a lot of attacks are simply based on traffic congestion on the target computers. Of course, shortly before Christmas, payments began to go poorly and at peak times , backlogs began to appear .

To quote the news from the company ProHashing, working with bitcoins:

ProHashing faced another problem between Christmas and New Year - when the payment from the exchange to their wallet was delayed.

The Bitcoin network should automatically respond to such things, increasing the cost of commissions, and although the mechanisms of this function very badly, they somehow work. Using the network is becoming more and more expensive. The network once had a huge advantage of zero and extremely low fees, but now it has become the norm to demand a higher payment for a transfer than when transferring from one bank card to another.

Why not raise the network capacity? The block chain is controlled by Chinese miners, only two of them control more than 50% of the hash power. A recent conference was attended by several peoplethat control over 95% of the network capacity. Miners do not allow the chain to grow.

Why don't they let her grow? There are several reasons for this. For example, the developers of the “Bitcoin core” refused to make the necessary changes. Miners also refuse to switch to a competing product - they believe that it will be “disloyal”. And they are afraid of everything that could lead to news that will make investors panic. They decided to ignore the problem and hope that it goes away on its own.

And the last reason - the Chinese Internet is so corrupted by their firewallthat data transfer across the border almost does not work at all. The speed is less than that of mobile communications. Imagine that the whole country is connected to the rest of the Internet via cheap wifi in a hotel. Now, Chinese miners can barely maintain their connection to the global Internet and demand a reward of 25 BTC for each block created. They fear that if the network grows in popularity, continuing to participate in mining will become too difficult and they will lose revenue. It turns out that their financial interests make them hinder the popularization of the network.

Many users and people who are interested in the network believed that these problems would somehow solve themselves - and of course, the block size limit would be raised. In the end, why would the bitcoin community, which announced the block chain the future of the financial world, kill themselves by strangling this chain? But this is exactly what is happening now.

As a result of the civil war, the largest and most popular Bitcoin startup in the USA, Coinbase, was erased from the official Bitcoin website for choosing the “wrong side” in disputes and banned from community forums . If part of the community attacks people who have brought the idea of digital currencies to millions of users, this is where all the madness begins.

If you have heard little about it, you are not alone. The most disgusting thing that happened last year was the interruption of the flow of information that went to investors and users.

In just 8 months, Bitcoin has evolved from a transparent open community into a censorship-driven system that allows some Bitcoin enthusiasts to attack others. This is the worst thing I've seen in my life - and I no longer want to be associated with the Bitcoin community.

The Bitcoin network was not supposed to be a subject of investment and was always advertised as an experimental currency, which you should not buy more than you can lose. But personally, this did not bother me, because all the information was always available to investors, and there was already a whole industry with its books, conferences, videos and websites explaining this system.

But now everything has changed.

Most Bitcoin owners find out about them through the media. When some kind of story appears in the media, prices start to jump, then articles on the growth rate appear, and a bubble happens.

Stories get to newspapers, starting in a community forum. Then they are picked up by technology-specific websites, then regular media journalists describe it in their own words. I often observed this and sometimes even took part in the process, talking with reporters.

In August 2015, it became clear that due to problems with managing the Bitcoin Core project, which manages a program that supports a p2p network, it will not release a version with an increased block size. But the community needed the ability to add new users. And then, several future-oriented developers got together and developed the necessary code. It was named BIP 101, and we released it as an updated version of the program, which we called Bitcoin XT. By launching XT, miners could thus vote to change the restriction. At a time when more than 75% of the blocks would vote for a change, the rules would change and it would be possible to work with blocks of a larger volume.

Bitcoin XT's release hit a small number of sick corns. One of them is the admin of bitcoin.org and the main forums of the project. At the forum, he often allowed the development of conversations of a clearly criminal tendency under the pretext of freedom of speech. But after the launch of Bitcoin XT, he suddenly announced that XT was not a “developer consensus”, and was not bitcoin. He considered voting to be a bad thing because:

Therefore, he set out to kill XT , starting with censorship of the main discussion channels. Any post mentioning XT was deleted from forums, XT could not be referenced on the bitcoin.org offsite, and, of course, anyone trying to direct users to other forums that were not censored was banned. A huge number of users just kicked out of the forums .

Naturally, it infuriated people. You can read the comments to feel the situation.

In the end, some users found uncensored forums . Reading them is sad. Every day I saw violent and evil posts against censors in which people swear to defeat censorship.

But the inability to spread XT news and censorship in itself led to sad consequences.

For the first time, investors cannot get a real picture of what is happening. Differing from official views are suppressed. Technical criticism of what is happening in the Bitcoin Core project is banned, instead of it there is some nonsense . It became clear that many who bought bitcoins do not have a clue that the system will soon run into an artificially created ceiling.

It bothers me a lot. For years, governments have passed securities and investment laws. Bitcoin does not apply to securities, and, in my opinion, does not fall under their action, but their essence is simple: investors have the right to be informed. When misinformed investors lose money, the attention of government agencies is drawn to these cases.

Human problems. After leaving, Satoshi handed over the reins of what is now called Bitcoin Core to Gavin Andresen, one of the early programmers. Gavin is a good and experienced leader, able to look broadly. Because of him, I decided to leave Google, where I worked 8 years before, and start full time work on bitcoin. There is only one problem: Satoshi did not ask if Gavin needed this work. But he didn’t really need her. Therefore, he gave access to the code to four other developers. They were chosen pretty quickly so that nothing would interfere with the development of the project. They were just some people who found themselves in the right place at the right time, and at the same time seemed useful.

One of them, Gregory Maxwell, had rather unusual looks. He once stated that he mathematically proved the impossibility of bitcoin. And more importantly, he did not share the original views of Satoshi.

After the announcement of the project, Satoshi was asked how the block chain can be scalable for a large number of payments. Should the amount of data gradually become too large if an idea develops? This was a popular topic among critics. Satoshi was expecting such a question, and said :

The logic is simple: look at what the existing payment processing system copes with, how many bitcoins it takes to occupy the same position, and explain that this cannot happen in one night. And of course, approximate calculations showed that the ceiling would not really be achieved , even if we consider other factors besides bandwidth.

Maxwell did not agree with this. From an interview from December 2014 :

The idea that Bitcoin is doomed, since an increase in the number of users leads to a decrease in decentralization, is inherently harmful. She ignores the fact that the network is not used so much, is growing slowly, and technology does not stand still. On the debunking of this myth, we spent a lot of time with Gavin . After all, it leads to a strange conclusion: if decentralization is good, and the growth of the network threatens it, then you do not need to allow the Bitcoin network to grow.

Instead, according to Maxwell, bitcoin should become some kind of layer for some kind of foggy, indefinite system, not based on a chain of blocks.

If someone in the company does not share the organization’s goals, they will fire him.

But Bitcoin Core is an open source project. When 5 developers with access to the code were selected, and Gavin decided to cease leadership of the project, no procedure was developed to remove one of the developers. And there were no procedures to verify that developers agree with the objectives of the project.

With the growing popularity of the network and the approach of traffic to a limit of 1 MB, the topic of increasing restrictions occasionally arose in the conversations of developers. But this topic turned into an emotional one. There were accusations of the excessive riskiness of such an increase, that it harms decentralization, etc. In small groups, people prefer to avoid conflicts, and things were put off the shelf.

Maxwell complicated the problem by founding a company and hiring more developers. Naturally, their views began to coincide with the views of the boss.

Managing software updates takes time. In May 2015, Gavin decided that it was time to act - there was only 8 months left to resolve the issue. He began to write articles that considered the arguments against raising the limit, one by one .

But it soon became clear that the developers of Bitcoin Core could not agree. Maxwell and their developers refused to consider the issue of increasing the limit, and even even talk about it. They argued that nothing could be done without "consensus." And the developer responsible for the release of versions was so afraid of conflicts that he decided not to touch on those issues on which disputes could arise.

And, despite the fact that exchanges, users, wallet developers, miners - all were waiting for the restriction to increase, and they were already building entire business enterprises on the basis of what happened, 3 out of 5 developers decided not to raise it.

Dead end. And the watch is ticking.

Despite blocking news about XT, a few days after the launch, up to 15% of the network nodes already used it, and at least one large pool of miners began to offer BIP 101 voting.

And then the attacks began. They were so strong that they disconnected entire regions from the Internet :

In some cases, entire data centers were disconnected from the Internet as long as one XT node was working in them. A third of the nodes were attacked and disconnected from the Internet.

The miner pool offering BIP101 was also attacked and stopped. It became clear: everyone who supports the increase in blocks, or even allows people to vote for them, will be attacked.

And the attackers have not gone anywhere. When a few months later Coinbase announced that it had lost patience and launched XT, they too failed .

Despite all this, the XT was gaining momentum. Because this threatened the core-project, several developers have organized a series of conferences " scaling Bitcoin ". Their goal was announced to reach consensus on the issue of increasing the bloc. After all, everyone likes the consensus of experts, doesn't it?

It became clear to me that people who did not even want to speak on this topic are unlikely to change their minds from attending a conference. In addition, with the approach of the winter season, only a few months remained for the network upgrade. Losing time could jeopardize the operation of the entire network. Well, at the first conference, it was generally forbidden to make specific proposals.

Therefore, I did not go to them.

Unfortunately, the community believed in these conferences, and the failure to launch XT to miners and startups was always explained by "the expectation that core developers will increase the limit in December." They were afraid that after the "split" was advertised among developers, their network revenues would fall.

When the last conference was held, and the question of raising the restriction was not resolved, some companies realized that they had been deceived (Coinbase and BTCC). But it was too late. While everyone was waiting, network growth added another 250,000 transactions per day.

Jeff Garzik and Gavin Andresen, two of the five developers who supported the increase in block size (and the two most deserved ones), had a good reputation in the community. They recently wrote an article together, " Bitcoin is trying to come to an agreement by workarounds ."

Jeff and Gavin are usually softer than me. I prefer to call a spade a spade. Therefore, their letter turned out to be unexpectedly harsh:

And attempts to convey complete and honest information are becoming less common. For example, the plan that Gavin and Jeff wrote about was presented at the Scaling Bitcoin conference, but it did not include any steps to increase efficiency, and proposed increasing throughput by only 60% through some cosmetic changes. These edits required changes in almost all software that works with bitcoin. Instead of simply raising the limit, they chose a very difficult thing to implement that would help them gain months by force.

One of the problems with using commissions to control the number of users is that the payment for switching to the beginning of the queue may change after the payment has been completed. And the Bitcoin Core team made a “brilliant” solution to this problem - the ability to mark payments as “changeable” before they appear in the block chain. This was done so that people can change the transfer fee, but in fact it allows people to change the transfer so that the money comes back to them.

And this makes the Bitcoin network useless for payments - now you have to wait for the transaction to complete until it appears in the block chain. And at present, it can take hours, not minutes, as before.

The developers explain it this way: earlier, if you did not wait for the payment to appear in the chain, you were at the theoretical risk of running into fraud, and thus, you used Bitcoin incorrectly. Therefore, an increase in this risk to 100% does not particularly change anything.

This change in the protocol will be released in the next version of Core (0.12), and then the miner update will be activated. It was rejected by a huge number of community members , but developers do not care what other people think. So this change will take effect.

And if this does not convince you that Bitcoin has started to have problems, then nothing will convince you. How many people will believe that bitcoins cost hundreds of dollars apiece if they cannot be used in real stores?

Bitcoin has entered the risk zone. Previous crises like the bankruptcy of Mt Gox have been linked to services and companies. But this one is different - this is a crisis of the core of the system, the chain of blocks itself.

And in particular, this is a crisis reflecting deep philosophical differences in the vision of the world. Should it be driven by a consensus of experts, or through the choice of ordinary people who would evaluate which methods make sense to them.

Even if you build a new team to replace Bitcoin Core, the problem of concentration of miners' power behind the Chinese firewall will remain. Bitcoin has no future, while less than 10 people control it. No solution to the problem is foreseen - no one even has suggestions. For the community that was most worried that control over the chain of blocks would be seized by some government, this is a terrible irony.

Not everything is lost. Despite everything that has happened, in recent weeks more and more community members have followed my path. There are already two new forks (Bitcoin Classic and Bitcoin Unlimited). So far they have faced the same problems as XT, but it is possible that new people will find new ways for development.

In the world of bitcoin, many talented and energetic people work. Over the past 5 years, I have had the pleasure of meeting many of them. Their entrepreneurial spirit and unique views on the monetary system, economy and politics were very interesting. Despite everything that happened, I do not regret the time spent on the project. When I woke up in the morning, I found that many people wish me all the best in an uncensored forum., and are asked to stay. I'm afraid that I have already taken up other things. I say to those people: good luck, do not lose your strength, and all the best to you.

And from the very beginning, I argued that Bitcoin is an experiment, and like any experiment, it can fail. Do not invest what you are not ready to lose. I talked about this in interviews , on reports and wrote in the mail. As did other well-known developers - Gavin Andresen and Jeff Garzik.

But, despite the fact that I always knew about the possibility of failure, the inevitable conclusion about its occurrence really upsets me. The fundamentals have fallen, and no matter what happens to prices in the short run, they will obviously go down in the long run. I am no longer going to take part in the development and sold all my cue ball.

Why did bitcoin fail? Because the community failed. What was supposed to be a new, decentralized kind of money that did not use “important system institutions” and was “too big to fail” became something more terrible - namely, a system controlled by a small group of people. Moreover, the network is close to technical collapse. The mechanisms that were supposed to prevent this collapse broke down, and as a result, it makes no sense to dream that bitcoin could become better than the existing financial system.

Think about it. If you had never heard of Bitcoin before, would you like a payment network that:

- cannot transfer your existing funds

- has unpredictable transfer fees that are growing fast

- allows customers to cancel payments after leaving the store with a simple click of a button (if you are not aware of this “opportunity” - this is because bitcoin just entered it)

- suffers outstanding and unstable payments

- controlled by China

- in which the companies and people involved in its development are in the civil war phase

I would venture to suggest that the answer is no.

At a standstill

If you have not followed the Bitcoin network, then here is how it looks in January 2016. The block chain is full. You think how it is possible to “fill in” what is a sequence of files. The answer is that since the absolutely artificial limitation of the capacity of 1 MB per block, which was introduced a long time ago as a software stub , was not removed, as a result, the network capacity is almost exhausted.

Here's a graph of block sizes: The

July peak was reached during a DOS attack, when someone populated the network with transactions in order to break it, and called it a “strength test”. Therefore, it is this level, 700 kb of transactions (less than 3 payments per second) that is the practical limitation of the network.

You may have heard that the limit is 7 payments per second. These are old figures from 2011 - since then, transactions have become much more complicated, therefore the possible number of payments has decreased.

The real limit turned out to be 700 kb instead of the theoretically predicted 1000. This is because miners sometimes produce smaller blocks, and even zero blocks, instead of confirming transactions. This, apparently, is the result of the influence of the censorship system called the Great Chinese Firewall. I’ll talk about him a little later.

If you look closely, you can see that traffic has been growing since the end of summer 2015. It was predictable, and in March I wrote about seasonal patterns of network growth.

Weekly average block size chart:

That is, the average value approached the upper limit. It is not surprising that now such moments often happen when Bitcoin is not able to cope with transactions, and their turn increases. This is visible in the size column. The list contains 750 Kb blocks - these are blocks from miners who incorrectly configured software.

When networks reach maximum capacity , they become unreliable. Therefore, a lot of attacks are simply based on traffic congestion on the target computers. Of course, shortly before Christmas, payments began to go poorly and at peak times , backlogs began to appear .

To quote the news from the company ProHashing, working with bitcoins:

Some clients contacted Chris with questions about why payments do not go through ...

The problem is that now, quite officially, the Bitcoin network has become unreliable and it has become impossible to say when, and if at all, your payment will go through. The ability to digest payments has deteriorated so much that even small peak values in terms of payments critically affect the state of the network. Who agrees to wait for the payment to go from 60 minutes to 14 hours, and in advance it is not even known how long it will be necessary to wait?

It’s just funny to read reddit posts where people write that there’s no crisis. My post yesterday was criticized for allegedly inflating the seriousness of the situation. Do these critics generally use the bitcoin network on a daily basis?

ProHashing faced another problem between Christmas and New Year - when the payment from the exchange to their wallet was delayed.

The Bitcoin network should automatically respond to such things, increasing the cost of commissions, and although the mechanisms of this function very badly, they somehow work. Using the network is becoming more and more expensive. The network once had a huge advantage of zero and extremely low fees, but now it has become the norm to demand a higher payment for a transfer than when transferring from one bank card to another.

Why not raise the network capacity? The block chain is controlled by Chinese miners, only two of them control more than 50% of the hash power. A recent conference was attended by several peoplethat control over 95% of the network capacity. Miners do not allow the chain to grow.

Why don't they let her grow? There are several reasons for this. For example, the developers of the “Bitcoin core” refused to make the necessary changes. Miners also refuse to switch to a competing product - they believe that it will be “disloyal”. And they are afraid of everything that could lead to news that will make investors panic. They decided to ignore the problem and hope that it goes away on its own.

And the last reason - the Chinese Internet is so corrupted by their firewallthat data transfer across the border almost does not work at all. The speed is less than that of mobile communications. Imagine that the whole country is connected to the rest of the Internet via cheap wifi in a hotel. Now, Chinese miners can barely maintain their connection to the global Internet and demand a reward of 25 BTC for each block created. They fear that if the network grows in popularity, continuing to participate in mining will become too difficult and they will lose revenue. It turns out that their financial interests make them hinder the popularization of the network.

Many users and people who are interested in the network believed that these problems would somehow solve themselves - and of course, the block size limit would be raised. In the end, why would the bitcoin community, which announced the block chain the future of the financial world, kill themselves by strangling this chain? But this is exactly what is happening now.

As a result of the civil war, the largest and most popular Bitcoin startup in the USA, Coinbase, was erased from the official Bitcoin website for choosing the “wrong side” in disputes and banned from community forums . If part of the community attacks people who have brought the idea of digital currencies to millions of users, this is where all the madness begins.

No one knows what's going on

If you have heard little about it, you are not alone. The most disgusting thing that happened last year was the interruption of the flow of information that went to investors and users.

In just 8 months, Bitcoin has evolved from a transparent open community into a censorship-driven system that allows some Bitcoin enthusiasts to attack others. This is the worst thing I've seen in my life - and I no longer want to be associated with the Bitcoin community.

The Bitcoin network was not supposed to be a subject of investment and was always advertised as an experimental currency, which you should not buy more than you can lose. But personally, this did not bother me, because all the information was always available to investors, and there was already a whole industry with its books, conferences, videos and websites explaining this system.

But now everything has changed.

Most Bitcoin owners find out about them through the media. When some kind of story appears in the media, prices start to jump, then articles on the growth rate appear, and a bubble happens.

Stories get to newspapers, starting in a community forum. Then they are picked up by technology-specific websites, then regular media journalists describe it in their own words. I often observed this and sometimes even took part in the process, talking with reporters.

In August 2015, it became clear that due to problems with managing the Bitcoin Core project, which manages a program that supports a p2p network, it will not release a version with an increased block size. But the community needed the ability to add new users. And then, several future-oriented developers got together and developed the necessary code. It was named BIP 101, and we released it as an updated version of the program, which we called Bitcoin XT. By launching XT, miners could thus vote to change the restriction. At a time when more than 75% of the blocks would vote for a change, the rules would change and it would be possible to work with blocks of a larger volume.

Bitcoin XT's release hit a small number of sick corns. One of them is the admin of bitcoin.org and the main forums of the project. At the forum, he often allowed the development of conversations of a clearly criminal tendency under the pretext of freedom of speech. But after the launch of Bitcoin XT, he suddenly announced that XT was not a “developer consensus”, and was not bitcoin. He considered voting to be a bad thing because:

one of the great things about bitcoin is the lack of democracy

Therefore, he set out to kill XT , starting with censorship of the main discussion channels. Any post mentioning XT was deleted from forums, XT could not be referenced on the bitcoin.org offsite, and, of course, anyone trying to direct users to other forums that were not censored was banned. A huge number of users just kicked out of the forums .

Naturally, it infuriated people. You can read the comments to feel the situation.

In the end, some users found uncensored forums . Reading them is sad. Every day I saw violent and evil posts against censors in which people swear to defeat censorship.

But the inability to spread XT news and censorship in itself led to sad consequences.

For the first time, investors cannot get a real picture of what is happening. Differing from official views are suppressed. Technical criticism of what is happening in the Bitcoin Core project is banned, instead of it there is some nonsense . It became clear that many who bought bitcoins do not have a clue that the system will soon run into an artificially created ceiling.

It bothers me a lot. For years, governments have passed securities and investment laws. Bitcoin does not apply to securities, and, in my opinion, does not fall under their action, but their essence is simple: investors have the right to be informed. When misinformed investors lose money, the attention of government agencies is drawn to these cases.

Why don't Bitcoin Core raise the limit?

Human problems. After leaving, Satoshi handed over the reins of what is now called Bitcoin Core to Gavin Andresen, one of the early programmers. Gavin is a good and experienced leader, able to look broadly. Because of him, I decided to leave Google, where I worked 8 years before, and start full time work on bitcoin. There is only one problem: Satoshi did not ask if Gavin needed this work. But he didn’t really need her. Therefore, he gave access to the code to four other developers. They were chosen pretty quickly so that nothing would interfere with the development of the project. They were just some people who found themselves in the right place at the right time, and at the same time seemed useful.

One of them, Gregory Maxwell, had rather unusual looks. He once stated that he mathematically proved the impossibility of bitcoin. And more importantly, he did not share the original views of Satoshi.

After the announcement of the project, Satoshi was asked how the block chain can be scalable for a large number of payments. Should the amount of data gradually become too large if an idea develops? This was a popular topic among critics. Satoshi was expecting such a question, and said :

Bandwidth is not as small as you think. If the network becomes as large as VISA, this will happen no earlier than in a few years, and then sending the equivalent of a pair of films in HD resolution over the Internet will no longer seem such a difficult thing.

The logic is simple: look at what the existing payment processing system copes with, how many bitcoins it takes to occupy the same position, and explain that this cannot happen in one night. And of course, approximate calculations showed that the ceiling would not really be achieved , even if we consider other factors besides bandwidth.

Maxwell did not agree with this. From an interview from December 2014 :

Problems with decentralization as bitcoin grows will not disappear. Maxwell says that “there is an inherent compromise between scale and decentralization when it comes to network transactions.”

He said that the problem is that with the increase in bitcoin transactions, only large companies will manage bitcoin nodes, due to the overhead inherent in this process.

The idea that Bitcoin is doomed, since an increase in the number of users leads to a decrease in decentralization, is inherently harmful. She ignores the fact that the network is not used so much, is growing slowly, and technology does not stand still. On the debunking of this myth, we spent a lot of time with Gavin . After all, it leads to a strange conclusion: if decentralization is good, and the growth of the network threatens it, then you do not need to allow the Bitcoin network to grow.

Instead, according to Maxwell, bitcoin should become some kind of layer for some kind of foggy, indefinite system, not based on a chain of blocks.

The beginning of the death spiral

If someone in the company does not share the organization’s goals, they will fire him.

But Bitcoin Core is an open source project. When 5 developers with access to the code were selected, and Gavin decided to cease leadership of the project, no procedure was developed to remove one of the developers. And there were no procedures to verify that developers agree with the objectives of the project.

With the growing popularity of the network and the approach of traffic to a limit of 1 MB, the topic of increasing restrictions occasionally arose in the conversations of developers. But this topic turned into an emotional one. There were accusations of the excessive riskiness of such an increase, that it harms decentralization, etc. In small groups, people prefer to avoid conflicts, and things were put off the shelf.

Maxwell complicated the problem by founding a company and hiring more developers. Naturally, their views began to coincide with the views of the boss.

Managing software updates takes time. In May 2015, Gavin decided that it was time to act - there was only 8 months left to resolve the issue. He began to write articles that considered the arguments against raising the limit, one by one .

But it soon became clear that the developers of Bitcoin Core could not agree. Maxwell and their developers refused to consider the issue of increasing the limit, and even even talk about it. They argued that nothing could be done without "consensus." And the developer responsible for the release of versions was so afraid of conflicts that he decided not to touch on those issues on which disputes could arise.

And, despite the fact that exchanges, users, wallet developers, miners - all were waiting for the restriction to increase, and they were already building entire business enterprises on the basis of what happened, 3 out of 5 developers decided not to raise it.

Dead end. And the watch is ticking.

Massive DDoS attacks on XT users

Despite blocking news about XT, a few days after the launch, up to 15% of the network nodes already used it, and at least one large pool of miners began to offer BIP 101 voting.

And then the attacks began. They were so strong that they disconnected entire regions from the Internet :

I was dumbfounded. It was a massive DDoS attack, putting the entire provider. Residents of five cities were disconnected from the Internet for several hours because of these criminals. Naturally, this opposed me to hosting the nodes.

In some cases, entire data centers were disconnected from the Internet as long as one XT node was working in them. A third of the nodes were attacked and disconnected from the Internet.

The miner pool offering BIP101 was also attacked and stopped. It became clear: everyone who supports the increase in blocks, or even allows people to vote for them, will be attacked.

And the attackers have not gone anywhere. When a few months later Coinbase announced that it had lost patience and launched XT, they too failed .

Dummy Conferences

Despite all this, the XT was gaining momentum. Because this threatened the core-project, several developers have organized a series of conferences " scaling Bitcoin ". Their goal was announced to reach consensus on the issue of increasing the bloc. After all, everyone likes the consensus of experts, doesn't it?

It became clear to me that people who did not even want to speak on this topic are unlikely to change their minds from attending a conference. In addition, with the approach of the winter season, only a few months remained for the network upgrade. Losing time could jeopardize the operation of the entire network. Well, at the first conference, it was generally forbidden to make specific proposals.

Therefore, I did not go to them.

Unfortunately, the community believed in these conferences, and the failure to launch XT to miners and startups was always explained by "the expectation that core developers will increase the limit in December." They were afraid that after the "split" was advertised among developers, their network revenues would fall.

When the last conference was held, and the question of raising the restriction was not resolved, some companies realized that they had been deceived (Coinbase and BTCC). But it was too late. While everyone was waiting, network growth added another 250,000 transactions per day.

Lack of development plan

Jeff Garzik and Gavin Andresen, two of the five developers who supported the increase in block size (and the two most deserved ones), had a good reputation in the community. They recently wrote an article together, " Bitcoin is trying to come to an agreement by workarounds ."

Jeff and Gavin are usually softer than me. I prefer to call a spade a spade. Therefore, their letter turned out to be unexpectedly harsh:

The proposed development plan , which is being discussed in the community, has good points - but it does not cope with the task of conveying to the Bitcoin users all the information clearly and clearly, especially the shortcomings of the proposed activities.

The block size does not change - there are no compromises.

In an optimal, transparent open source development environment, BIP would be released . This is not observed here.

One of the main goals was to turn a chaotic discussion of block size into an orderly decision-making process. That did not happen.

And attempts to convey complete and honest information are becoming less common. For example, the plan that Gavin and Jeff wrote about was presented at the Scaling Bitcoin conference, but it did not include any steps to increase efficiency, and proposed increasing throughput by only 60% through some cosmetic changes. These edits required changes in almost all software that works with bitcoin. Instead of simply raising the limit, they chose a very difficult thing to implement that would help them gain months by force.

Replacement for commission

One of the problems with using commissions to control the number of users is that the payment for switching to the beginning of the queue may change after the payment has been completed. And the Bitcoin Core team made a “brilliant” solution to this problem - the ability to mark payments as “changeable” before they appear in the block chain. This was done so that people can change the transfer fee, but in fact it allows people to change the transfer so that the money comes back to them.

And this makes the Bitcoin network useless for payments - now you have to wait for the transaction to complete until it appears in the block chain. And at present, it can take hours, not minutes, as before.

The developers explain it this way: earlier, if you did not wait for the payment to appear in the chain, you were at the theoretical risk of running into fraud, and thus, you used Bitcoin incorrectly. Therefore, an increase in this risk to 100% does not particularly change anything.

This change in the protocol will be released in the next version of Core (0.12), and then the miner update will be activated. It was rejected by a huge number of community members , but developers do not care what other people think. So this change will take effect.

And if this does not convince you that Bitcoin has started to have problems, then nothing will convince you. How many people will believe that bitcoins cost hundreds of dollars apiece if they cannot be used in real stores?

Conclusions

Bitcoin has entered the risk zone. Previous crises like the bankruptcy of Mt Gox have been linked to services and companies. But this one is different - this is a crisis of the core of the system, the chain of blocks itself.

And in particular, this is a crisis reflecting deep philosophical differences in the vision of the world. Should it be driven by a consensus of experts, or through the choice of ordinary people who would evaluate which methods make sense to them.

Even if you build a new team to replace Bitcoin Core, the problem of concentration of miners' power behind the Chinese firewall will remain. Bitcoin has no future, while less than 10 people control it. No solution to the problem is foreseen - no one even has suggestions. For the community that was most worried that control over the chain of blocks would be seized by some government, this is a terrible irony.

Not everything is lost. Despite everything that has happened, in recent weeks more and more community members have followed my path. There are already two new forks (Bitcoin Classic and Bitcoin Unlimited). So far they have faced the same problems as XT, but it is possible that new people will find new ways for development.

In the world of bitcoin, many talented and energetic people work. Over the past 5 years, I have had the pleasure of meeting many of them. Their entrepreneurial spirit and unique views on the monetary system, economy and politics were very interesting. Despite everything that happened, I do not regret the time spent on the project. When I woke up in the morning, I found that many people wish me all the best in an uncensored forum., and are asked to stay. I'm afraid that I have already taken up other things. I say to those people: good luck, do not lose your strength, and all the best to you.