Santa Claus rally: how New Year holidays affect the stock market

The behavior of investors in the stock market is influenced by many factors - economic and political news, successes or failures of specific companies, and even just the time of year. For example, many market participants believe that in the period preceding the New Year holidays, growth is much more often observed on stock exchanges. This phenomenon is called the "Santa Claus Rally", and today we will consider such phenomena in more detail.

Seasonal Trends

Many researchers have focused on the existence of certain patterns in the behavior of markets at certain times of the year for many years. It should be understood that due to the aforementioned influence on the mood of investors of many factors, sometimes within the framework of a particular year the situation in the markets may go against the existing trends.

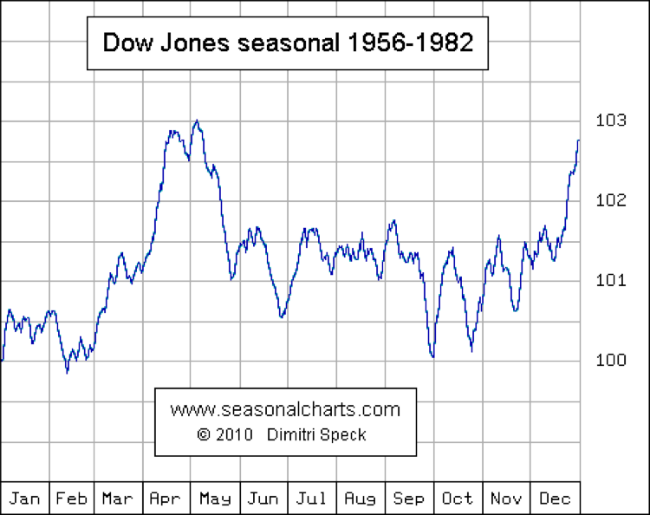

In addition, trends may change over time. For example, below is a graph of historical data on the growth of the Dow Jones index from 1956 to 1982. It is quite clearly seen that in those years at the end of spring, summer and early autumn, the market predominantly fell.

However, if you look at the chart from 1983 to 2010, which was characterized by a “bullish trend” (active growth) in the markets, you can see that the behavior of the index in the summer months became better. However, even in this situation, some patterns of seasonality are preserved - for example, the market weakness in the autumn months even increased somewhat.

The market growth trend in December also remains, especially before the Christmas and New Year holidays. Moreover, this trend is observed not only for the Dow Jones index. For example, here is a graph of the growth of the S&P 500 index from 2001 to 2010:

Image: squirrelers.com

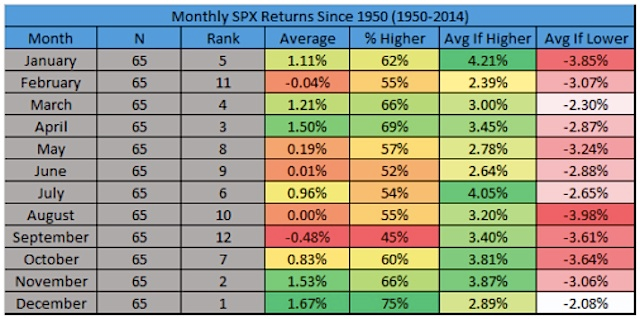

April and December are the most successful months, characterized by an increase in the index. If you look at the situation over a wider time frame, the picture, although changing for other months, directly for April and December remains the same:

Image: squirrelers.com

Historically, December has been the best month for the US stock market. Since 1950, the S&P 500 has grown at 75% with an average increase of 1.7%:

December has also historically been a good time for the English stock market. Such New Year’s growth of stock indices received the name of “Santa Claus rally” among Western players of the stock market.

Reason for growth in December

A clear explanation of the Santa Claus rally phenomenon does not exist. For example, in a conversation with the British edition of Express, senior analyst at Hargreaves Lansdown Laith Khalaf described this phenomenon as follows:

The history of the stock market suggests that Santa Claus indeed with surprising regularity gives investors gifts in December. Of course, investors rarely invest money for only one month, but December is a good month to start working, especially in years like 2015, when the market is already growing. However, no one can really explain the phenomenon of seasonality, so no need wonder if in a particular December no holiday miracles happen.

However, experts identify several reasons that may affect the improvement of stock market results:

- General elated investors before the holidays;

- Investing by top management of companies and the middle class in shares received in December of the total annual bonuses;

- "Window dressing" by funds that buy good-looking stocks to improve reporting;

- Psychological effect - the New Year rally phenomenon is widely known, therefore investors, as a whole, expect to see it every year.

The fact of waiting for the holiday rally should not be underestimated - on the eve of Christmas investors are inclined to see positive in many news. For example, the recent increase in the base rate by the US Federal Reserve has spurred the Santa Claus rally and the growth of stock indices. As a result, the falling S&P 500 index has been growing for several days in a row, and now analysts expect it to finish the year in the green zone.

What other rally periods are there?

As can be seen from the graphs above, December is not the only month marked by historical growth in the stock index. Next to it is April - this month stock markets also usually grow, which contributed to the term "Easter Bunny Rally".

What does all this mean for investors

In fact - nothing special. The periods of the New Year or Easter rally belong to the field of stock market legends, which, although indirectly affect the behavior of its participants, do not in themselves dictate the development of events. Under the influence of various factors, the situation may go against the existing long-term seasonal trends.

When working in the stock market, you must always adhere to the chosen strategy and "do not lay eggs in one basket." If there is not enough time to analyze the situation on the market, you can also use the help of consultants ( ITinvest has such a service ). If you do not believe in miracles and act according to a predetermined plan, the likelihood of the appearance of "New Year's gifts" will really increase.