Automatic accrual of fines according to the EGAIS: fiction or reality?

On April 26, 2018, thousands of EGAIS users selling beer received a letter of the same content through the personal account of the system: “An information message about the accounting for the remains of unmarked products in the EGAIS”. The essence of this long message was reduced to one suggestion: on the basis of the declaration company of the 1st quarter of 2018, it was revealed that, as of 01.04.2018, your organization recorded the remains of unmarked alcoholic beverages (beer, beer drinks, cider, pouare and mead) in volumes that are inappropriate volume declarations. According to the EGAIS system, the remainder of the products is - (X) gave, according to the volume of declarations - (Y) gave, the difference is - (XY) gave.

The rest is quite simple:“Rosalkogolregulirovanie draws attention to the fact that these discrepancies may indicate a violation of the accounting or declaration procedure. This violation provides for penalties in accordance with the Code of Administrative Offenses ... ... Please note that after the expiration of the period for submitting corrective declarations for the 1st quarter of 2018, all existing discrepancies will be sent for control measures to the constituent entities of the Russian Federation. Rosalkogolregulirovanie will continue to conduct similar reconciliations in the future . ”

Such a message, received on April 26, on Thursday, and even before the long May holidays, did not improve the mood. Moreover, it is not at all clear what needs to be done in order not to get the same fine under the Code of Administrative Offenses on 14.17.1, and this is from 100 to 150 thousand rubles. Because experienced market players are well aware that sales data in the declaration and in the Unified State Automated Information System must be entered according to different algorithms and can only coincide completely by miracle.

A slight panic reigned in the alcohol market until May 3, when it became clear:

1. The Federal Service for the Control of Political Affairs sent such a letter to everyone who had more than 100 liters of unlabelled alcohol between the data on the declaration and the Unified State Automated Information System. These 100 liters were left to error due to different methods of registering sales.

2. According to the first quarter, no one will be fined and the second quarter will be given to restore order. But the discrepancy in the balances according to the second quarter will immediately turn into fines.

A slight panic gave way to a dull melancholy.

The FSRAR was able to combine the data of two different state alcohol accounting systems (declarations and EGAIS) and he did this only to identify those who do not write off unmarked alcohol sales to the EGAIS or do it incorrectly. The mechanism for declaring alcohol sales has been working for several years, everyone is used to it. In addition, it has internal algorithms for end-to-end reconciliation of the data provided between wholesalers and retailers, so you can submit “left-handed” data only if you agree with the entire chain of your suppliers, which is unlikely. But the data in EGAIS used to be nothing special to compare. How to understand how much the data that is reflected in the system is correct? Do you have such large reserves of alcohol or you simply do not write off it? It’s about unlabelled alcohol that cannot be scanned at the box office - draft beer, cider, mead. Such alcohol is written off in manual mode daily according to the results of sales, but not all do it.

For us, this “special operation” of the FSRAR has become another example of the movement of government bodies towards a system of fully automatic control over entrepreneurs. Various marking systems, electronic reporting and fiscal documents are becoming more and more. And along with them, there are mechanisms for working with the “big data” that accumulate in them. In terms of retail, the next step towards such a global control system was Federal Law dated December 31, 2017 No. 487-ФЗ, which comes into force on 01.01.19 and allows you to supplement the cash receipt with a new mandatory requisite “product code”. This attribute will allow the identification of the marked product or product nomenclature. In addition to the order of the Government of April 28, 2018 No. 792-r, defining the list of goods, subject to mandatory labeling by means of identification and also coming into force on 01.01.19, it becomes clear that it will be very difficult to avoid fiscal supervision. The control will be double - both from the side of the labeling operator and from the Federal Tax Service with its huge base of fiscal checks.

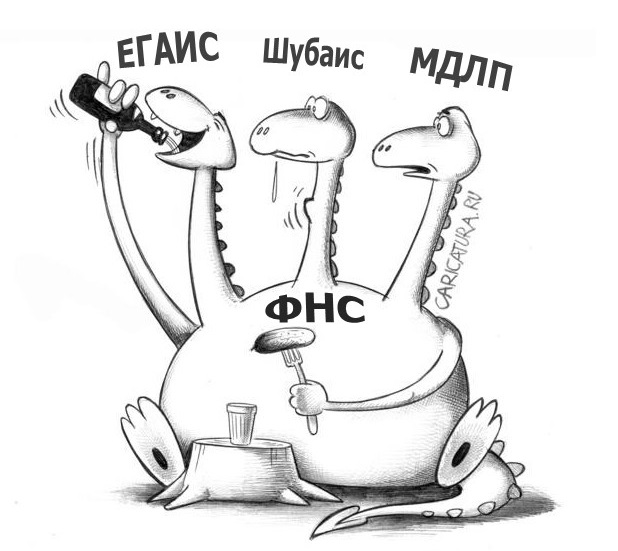

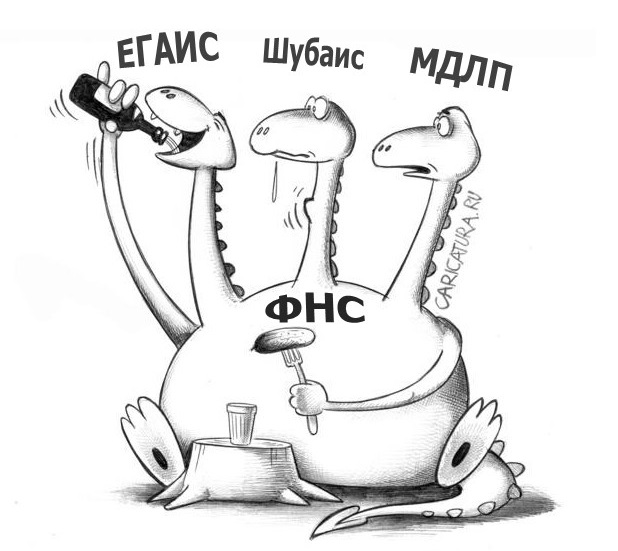

Such a move on the part of the state allows us to solve a complex technological problem associated with that zoo of “Egaisov”, “Shubais”, “Pharmaceutical Egaisis” and various other “... Ises” created by various departments in recent years. Now we have several global operators of federal state information systems (FSIS) and each with its own "big data" in its original formats. The unique identifier of the marked product (bottles of alcohol, a fur coat, a pack of cigarettes, a package of medicines, sneakers, diamond rings, etc.) will be recorded in the cash receipt and sent to the OFD in parallel with registration in the native FSIS. Thus, the global database of fiscal documents will unite departmental "eGayis" through the accounting unit. Fantasy about the analytical capabilities of such a system can be infinite.

Increasing the collection of various taxes, excises and fees has become a universal answer to all economic issues in our country. One can argue with this, disagree, come up with new schemes for bypassing control systems or completely go “into the shadows”. So far, it seems that the government is gathering some kind of global analytical system for tax administration. Life will be more precisely more fun!

The rest is quite simple:“Rosalkogolregulirovanie draws attention to the fact that these discrepancies may indicate a violation of the accounting or declaration procedure. This violation provides for penalties in accordance with the Code of Administrative Offenses ... ... Please note that after the expiration of the period for submitting corrective declarations for the 1st quarter of 2018, all existing discrepancies will be sent for control measures to the constituent entities of the Russian Federation. Rosalkogolregulirovanie will continue to conduct similar reconciliations in the future . ”

Such a message, received on April 26, on Thursday, and even before the long May holidays, did not improve the mood. Moreover, it is not at all clear what needs to be done in order not to get the same fine under the Code of Administrative Offenses on 14.17.1, and this is from 100 to 150 thousand rubles. Because experienced market players are well aware that sales data in the declaration and in the Unified State Automated Information System must be entered according to different algorithms and can only coincide completely by miracle.

A slight panic reigned in the alcohol market until May 3, when it became clear:

1. The Federal Service for the Control of Political Affairs sent such a letter to everyone who had more than 100 liters of unlabelled alcohol between the data on the declaration and the Unified State Automated Information System. These 100 liters were left to error due to different methods of registering sales.

2. According to the first quarter, no one will be fined and the second quarter will be given to restore order. But the discrepancy in the balances according to the second quarter will immediately turn into fines.

A slight panic gave way to a dull melancholy.

The FSRAR was able to combine the data of two different state alcohol accounting systems (declarations and EGAIS) and he did this only to identify those who do not write off unmarked alcohol sales to the EGAIS or do it incorrectly. The mechanism for declaring alcohol sales has been working for several years, everyone is used to it. In addition, it has internal algorithms for end-to-end reconciliation of the data provided between wholesalers and retailers, so you can submit “left-handed” data only if you agree with the entire chain of your suppliers, which is unlikely. But the data in EGAIS used to be nothing special to compare. How to understand how much the data that is reflected in the system is correct? Do you have such large reserves of alcohol or you simply do not write off it? It’s about unlabelled alcohol that cannot be scanned at the box office - draft beer, cider, mead. Such alcohol is written off in manual mode daily according to the results of sales, but not all do it.

For us, this “special operation” of the FSRAR has become another example of the movement of government bodies towards a system of fully automatic control over entrepreneurs. Various marking systems, electronic reporting and fiscal documents are becoming more and more. And along with them, there are mechanisms for working with the “big data” that accumulate in them. In terms of retail, the next step towards such a global control system was Federal Law dated December 31, 2017 No. 487-ФЗ, which comes into force on 01.01.19 and allows you to supplement the cash receipt with a new mandatory requisite “product code”. This attribute will allow the identification of the marked product or product nomenclature. In addition to the order of the Government of April 28, 2018 No. 792-r, defining the list of goods, subject to mandatory labeling by means of identification and also coming into force on 01.01.19, it becomes clear that it will be very difficult to avoid fiscal supervision. The control will be double - both from the side of the labeling operator and from the Federal Tax Service with its huge base of fiscal checks.

Such a move on the part of the state allows us to solve a complex technological problem associated with that zoo of “Egaisov”, “Shubais”, “Pharmaceutical Egaisis” and various other “... Ises” created by various departments in recent years. Now we have several global operators of federal state information systems (FSIS) and each with its own "big data" in its original formats. The unique identifier of the marked product (bottles of alcohol, a fur coat, a pack of cigarettes, a package of medicines, sneakers, diamond rings, etc.) will be recorded in the cash receipt and sent to the OFD in parallel with registration in the native FSIS. Thus, the global database of fiscal documents will unite departmental "eGayis" through the accounting unit. Fantasy about the analytical capabilities of such a system can be infinite.

Increasing the collection of various taxes, excises and fees has become a universal answer to all economic issues in our country. One can argue with this, disagree, come up with new schemes for bypassing control systems or completely go “into the shadows”. So far, it seems that the government is gathering some kind of global analytical system for tax administration. Life will be more precisely more fun!