Wonderful premine in DAG cryptocurrencies

Once, while sitting on a couch, I read about cryptocurrencies.

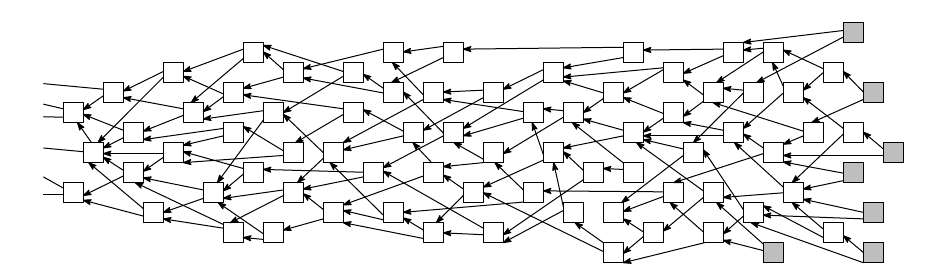

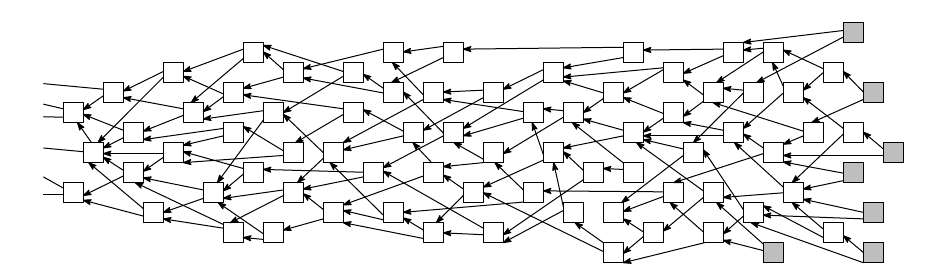

And I met such wonderful cryptocurrencies as IOTA, RaiBlocks, Byteball, and I admired the beauty of these technologies. After all, they use DAG instead of blockchain. And it looks something like this:

If you don’t go into details about what it is and why it is beautiful, the answer will be this: this wonderful technology allows you to solve the problem of transaction speed in cryptocurrencies.

But something was wrong here. Let's think that.

For many years, the emission of most cryptocurrencies used mining in order to distribute resources relatively fairly between people.

Good gnomes used holy electricity with all their might and received their reward for it (this is called Proof of work). Later, they began to condemn this approach, and increasingly began to use such alternative approaches as Proof of stake (this is when your money allows you to generate new money in the system).

However, someone in the wake of this hatred of proof of work decided to cut down cryptocurrencies in which there is no distributed emission, and the creators decided to transfer the entire emission to themselves, arguing that proof of work is bad, and they have a completely new cryptocurrency based on DAG (and it will be best to distract attention from all problems with words about quantum cryptography and a great future).

The whole idea boils down to the fact that all future users of this cryptocurrency should believe the creator that he honestly distributed his resources and distributed equally, however, if the creator is not an angel, then he can just take and transfer 95% of his cryptocurrency to his dog’s accounts (after all, nobody I don’t understand what is hidden behind the public keys of your cryptocurrency), and the remaining 5% will be distributed to people.

Further, you will understand that in fact the capitalization of this new cryptocurrency is one and a half kopecks, and with so much money, the owner of the cryptocurrency will be able to quite easily adjust the value of his coin.

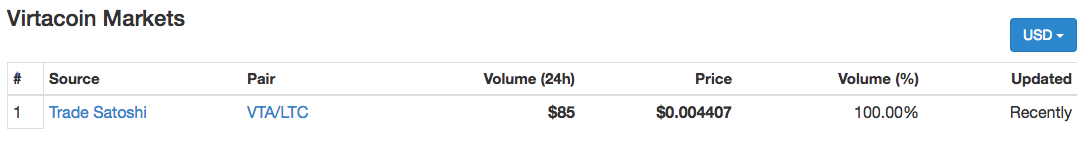

Here is an example of an unnecessary cryptocurrency that made a big jump up 100500% in a short time.

But with such indicators it is impossible to say that it is something of itself, because there is no turnover:

But in our case, this is not important. The owner of this malicious cryptocurrency will have to play a little with his own cryptocurrency in the market and determine for himself a slow but steady growth, and the rest of the people will not even know that in fact only one person plays on the exchanges that controls everything.

What we have at the moment:

RaiBlocks - users solved the captcha to get coins. Could something prevent the developers from giving all the coins to themselves and pretending that everything is honestly divided between everyone? Well, in general, it could not.

IOTA - as far as I know, they collected 1337 bitcoins as a donate for the development of their cryptocurrency. What could stop them from taking 1330 bitcoins from Satoshik Nakamoto, transferring them to themselves, giving them to Satoshik, and paying the commission with the remaining 7 bitcoins that people drove them on a wave of hype? Nothing here either.

Byteball - the owner gives it free to all Bitcoin owners who have confirmed their wallet on the Byteball network. This is actually not bad, but it’s worth clarifying the actual distribution procedure (I will be glad to comment).

Obviously there are others using DAG, and I have no idea how they attracted investment. I would be glad to hear comments on this subject and the opinion of people.

Based on the foregoing, you can safely speak in person to the creators of IOTA or RaiBlocksthat their cryptocurrencies are scam, because he gave 95% to his dog, and they can’t prove the opposite, even if this is not so. And despite the fact that cryptocurrencies such as Bitcoin, Litecoin, Ethereum have problems with transaction speed, they remain mostly honest, which cannot be said about what they are now doing on the basis of DAG.

I will be glad to comment.

And I met such wonderful cryptocurrencies as IOTA, RaiBlocks, Byteball, and I admired the beauty of these technologies. After all, they use DAG instead of blockchain. And it looks something like this:

If you don’t go into details about what it is and why it is beautiful, the answer will be this: this wonderful technology allows you to solve the problem of transaction speed in cryptocurrencies.

But something was wrong here. Let's think that.

For many years, the emission of most cryptocurrencies used mining in order to distribute resources relatively fairly between people.

Good gnomes used holy electricity with all their might and received their reward for it (this is called Proof of work). Later, they began to condemn this approach, and increasingly began to use such alternative approaches as Proof of stake (this is when your money allows you to generate new money in the system).

However, someone in the wake of this hatred of proof of work decided to cut down cryptocurrencies in which there is no distributed emission, and the creators decided to transfer the entire emission to themselves, arguing that proof of work is bad, and they have a completely new cryptocurrency based on DAG (and it will be best to distract attention from all problems with words about quantum cryptography and a great future).

The whole idea boils down to the fact that all future users of this cryptocurrency should believe the creator that he honestly distributed his resources and distributed equally, however, if the creator is not an angel, then he can just take and transfer 95% of his cryptocurrency to his dog’s accounts (after all, nobody I don’t understand what is hidden behind the public keys of your cryptocurrency), and the remaining 5% will be distributed to people.

Further, you will understand that in fact the capitalization of this new cryptocurrency is one and a half kopecks, and with so much money, the owner of the cryptocurrency will be able to quite easily adjust the value of his coin.

Here is an example of an unnecessary cryptocurrency that made a big jump up 100500% in a short time.

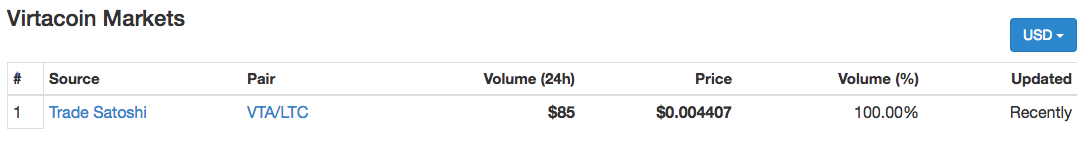

But with such indicators it is impossible to say that it is something of itself, because there is no turnover:

But in our case, this is not important. The owner of this malicious cryptocurrency will have to play a little with his own cryptocurrency in the market and determine for himself a slow but steady growth, and the rest of the people will not even know that in fact only one person plays on the exchanges that controls everything.

What we have at the moment:

RaiBlocks - users solved the captcha to get coins. Could something prevent the developers from giving all the coins to themselves and pretending that everything is honestly divided between everyone? Well, in general, it could not.

IOTA - as far as I know, they collected 1337 bitcoins as a donate for the development of their cryptocurrency. What could stop them from taking 1330 bitcoins from Satoshik Nakamoto, transferring them to themselves, giving them to Satoshik, and paying the commission with the remaining 7 bitcoins that people drove them on a wave of hype? Nothing here either.

Byteball - the owner gives it free to all Bitcoin owners who have confirmed their wallet on the Byteball network. This is actually not bad, but it’s worth clarifying the actual distribution procedure (I will be glad to comment).

Obviously there are others using DAG, and I have no idea how they attracted investment. I would be glad to hear comments on this subject and the opinion of people.

Based on the foregoing, you can safely speak in person to the creators of IOTA or RaiBlocksthat their cryptocurrencies are scam, because he gave 95% to his dog, and they can’t prove the opposite, even if this is not so. And despite the fact that cryptocurrencies such as Bitcoin, Litecoin, Ethereum have problems with transaction speed, they remain mostly honest, which cannot be said about what they are now doing on the basis of DAG.

I will be glad to comment.