Unicorn tech companies overestimated by an average of 48%: a study by scientists from Stanford

Image: TED Conference , CC BY-NC 2.0

In April 2017, an article by Will Gornall from the University of British Columbia and Ilya Strebulaev from Stanford was published entitled “ Making Business Venture Valuations Real”. In it, scientists analyzed the estimates of more than a hundred world-famous companies (including technology) with an estimate of a billion dollars or more (the so-called “unicorns”).

It turned out that these estimates do not always correspond to reality and can be repeatedly overstated. We publish the main findings of this study.

What is the problem

Venture capital is an important driver of economic growth and an important financial instrument. For example, since the end of the 1970s, 43% of American companies listed on the stock exchange were financed by venture investors prior to their IPO.

Historically, the most successful venture-financed companies have been listed for 3 to 8 years from the moment the first money was raised. However, over time, the situation has changed, and now more and more such companies prefer to remain private, and can grow to enormous size without access to the stock exchange - among them, for example, Uber, AirBnB and Pinterest, valued at tens of billions of dollars.

The growth of such companies gave rise to the term “unicorn” - this is the name of companies with venture financing, valuation of which exceeds $ 1 billion. The term should also reflect the rarity of such a phenomenon, but by the beginning of 2017 there were already 200 unicorns in the world, and 113 of these companies were located in the USA.

Despite the growing importance and accessibility of venture capital financing, valuation of unicorn companies is still a black box. This is partly due to the natural complexity of valuing fast-growing, liquid companies. However, in many respects the reason is the complexity of the financial structures of companies that attract venture financing. It is sometimes difficult to understand this not only to outside observers, but also to insiders who are as close to business as possible. Therefore, scientists from Stanford and the University of British Columbia decided to develop their own methodology for evaluating unicorn companies, which could show their real value.

Research Methodology

As Ilya Strebulaev told the Republic publication, the pricing model is based on the option pricing model. Researchers took into account the amount of recent investments and the valuation of companies, as well as financial contracts.

As a result, 116 companies were analyzed, including Airbnb, Lyft, Magic Leap, Snap, WhatsApp, Uber and many others. And so, what conclusions have scientists arrived at.

Unicorns are overrated by an average of 48%

The evaluation on the basis of the developed model was found that the average revaluation of-unicorns companies is 48% - the average assessment of the companies from the list kept at the level of $ 3.5 billion, while its "fair" value should not exceed $ 2.7 billion.

The figure The distribution of revaluation of the value of companies is shown. Overvaluation of ∆V is defined as the percentage by which the current valuation of a company exceeds its “fair” value, calculated according to the financial model of scientists.

As a result, 52 of 116 unicorn companies would have to lose their status if their valuation was brought to real numbers.

Thirteen unicorns from the list are overrated by more than 100%

A number of companies from the list were overrated by more than 100%. Among them:

- SolarCity - the company Ilona Mask in March 2012 was revalued by 178% ($ 1.9 billion)

- Square - the service of Twitter creator Jack Dorsey in September 2014 was estimated at $ 6 billion - this is 169% higher than its fair price;

- Box - in July 2014 it was worth $ 2.6 billion, while the real price should not have exceeded $ 800 million, the final revaluation of 200%;

- CloudFlare - a service in June 2015 was estimated at $ 3.2 billion - which is 103% higher than the fair price.

There are unicorns with an almost honest assessment.

Despite everything, the scientists managed to find companies whose estimates almost correspond to their real value. Among such projects, for example, the AirBnB service, which in 2015 was estimated at $ 30 billion, which is “only” 15% higher than the fair price. Scientists also mention Uber here - with a capitalization of $ 68 billion (May 2016), the excess of fair value was only 8%.

Conclusion

The American Securities and Exchange Commission (SEC) is not thrilled with the situation with exorbitantly hyped ratings of technology unicorns. As SEC Chairman Mary Joe White said: “We are afraid that the tail is wagging the dog here - that is, there are fears that in pursuit of the prestige of having a high rating, companies are trying to present themselves as a more valuable asset than it really is.”

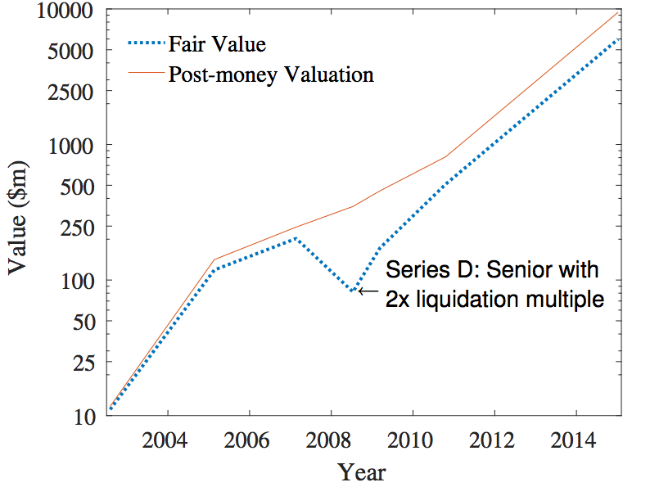

To illustrate the words of the functionary, the authors of the study give an example of the company Ilona Mask SpaceX. In 2008, the company raised money to develop a program to launch satellites and develop services for space travel. Despite the fact that this was the height of the financial crisis, and the NASDAQ was then seriously declining, the company managed to conduct a round of investments and raise money at a price of $ 3.88 per share, several months earlier during the previous round in March 2007, the price of one share determined at $ 3.

Since then, SpaceX has successfully developed, become a successful company, and recently attracted another round of investments at a price of $ 77.46 per share. However, in 2008, its shares were valued higher only because its management wanted to show its importance to new investors, and this appreciation was not due to anything, scientists say.

The correlation between the estimate and the real price (blue dotted line) of SpaceX - in 2008 there is a serious discrepancy.

As a result, as research co-author Ilya Strebulaev stated in his interview: “Both investors and entrepreneurs need to pay more attention to the conditions in which the market is located. It is very important to consider which securities are offered to you. In the world of venture capital investments there are many of them, and each involves a different cash flow and level of control. ”

Other materials on the topic of finance and stock market from ITI Capital :

- Analytics and market reviews

- Futures, Indices and IPOs: How Exchanges Are Actually Arranged and Why They Are Needed

- Top 10 books for understanding the structure of the stock market

- Futures, Indices and IPOs: How Exchanges Are Actually Arranged and Why They Are Needed

- Infrastructure of the Russian securities market (short educational program)

- How-to: robots and brokerage trading system API