How to stand on the shoulders of a giant. Manual for fintech startups

Today we decided to speak with Sergey SergeyMaksimchuk Maksimchuk, he is responsible for working with promising partners in the Innovation Team of the Alpha Laboratory, which is designed to seek and bring innovations to the Alfa Bank from the outside world. It is through him that startups can offer their ideas to the bank. The task of the Innovation team is to evaluate the project, find a customer inside Alfa Bank and make the project fly. Is it that hard? What does Alfa-Bank want from startups? What should teams do to make the partnership happen? Sergey reveals all the secrets.

- How can banks and fintech startups generally be friends? What is the use of this? Aren't they competitors to each other?

Yes, sometimes the theses sound that fintech startups will eat up banks and talk about some kind of confrontation between new technology companies and classic representatives of the financial market. In fact, it turns out an amazing thing: cooperation between banks and startups benefits both parties.

Startups are interested in the bank in terms of new technologies that can simplify the bank’s internal processes or generate new client products. Due to its scale, the bank is not always sensitive to some narrow, niche solutions, or some barely emerging technologies. Collaboration with startups allows the bank to be more synchronized with the surrounding changes. Why is it for startups? Firstly, we are a major customer. Secondly, the flow of customers. The bank has a lot of customers, startups, as a rule, are few. In other words, the bank is able to give a huge scale for certain decisions. And also, of course, experience. Starting to work with us, startups begin to delve into banking processes, they learn a lot from us. For example, they begin to delve into issues of state regulation or understand in detail the process,

We can also give some startups our own technologies, we have a lot of processing, we can make various types of payments, we finally have a banking license. We can provide our technology platform to startups who can use it inside their product.

Well, one should not forget that startups are closely connected with the venture capital market, and after successful projects with large customers, their capitalization tends to increase. They get financing.

- Well, if you buy a startup yourself? Or invest money in it? Will it go to such a bank?

Last year we had a case when we carried out due diligence of one startup in order to acquire it. We agreed that we would buy the software product that they developed, their customer base and invite the startup team to work at Alfa Bank. This year we are already conducting an audit of one well-known company and are ready to consider one or two more companies in order to acquire a share.

And about money ... If we see that it is economically or strategically feasible, we will definitely invest in such a company. We are at the level of maturity when the bank is ready for this.

- And many startups manage to "vacuum" in our market?

Many. Over the past year, we analyzed 315 startups, worked closely with 65 of them when evaluating the value and scale. Five startups came to piloting, as a result of which two later scaled to our client base.

So far, the numbers are. I think that in the next year or two the market will grow, because there are certain efforts from both private players and state development institutions: Skolkovo, IIDF, RVC, which conduct acceleration programs, provide grants, and invest in startups. There are more and more new faces, teams that create new products.

- How and where are startups searched for?

There are many tools for collecting startups, from a simple press release to a complex multi-month acceleration program. And we, in principle, have already tried all the tools.

In 2014, we were the first bank to conduct an acceleration program for fintech startups - Alfa Camp. Within its framework, the teams were trained for two months, their task was to conduct research and create a prototype of the product, and to present it to the jury of our experts in the final.

The response from the market was great. For the first program, we received 370 applications, and for the second - 888! Now I am working on the launch of the third Camp. We want to launch it in 2017

We also conduct hackathons for teams. With Microsoft, we held a virtual hackathon, where we exposed our API software, connecting to a card-to-card payment service, and asked the teams to come up with various client services using our platform.

Just now, on August 5-6, our hackathon took place in Moscow, where teams developed products for wealthy customers and the middle class. A! Hack turned out to be a powerful event. It announced about 80 teams from Russia, Belarus, Ukraine, Israel, Poland, Great Britain and the USA. The hackathon participants used high-tech solutions, and their level in a good way surprised us.

We also support key events. This year we were one of the organizers of the FinTech Russia forum. After that, by the way, two projects found their business customer with us at Alfa Bank. We were an official partner of Startup Village, the largest startup conference held by the Skolkovo Foundation.

We are friends with all the players in the startup venture market. We are often called as experts, so that we tell startups about some products or technologies, share their expertise. If we have any request, we do a newsletter for our partners, and through their channels they convey information to their residents.

- Well, how is the selection, what are you looking at first?

At the first stage, we check the startup according to several basic criteria: the presence of a legal entity, legal activity, the presence of cash flow. It is important for us that the product that the startup offers us has real customers who pay real money for it.

And then we focus on the assessments of our internal experts. The expert evaluates the project from different points of view: market, team, business model. Based on these ratings, we infer the finalists. We always try to meet with several projects of similar subjects. It is important for us to get a cut, to understand who is on the market, and to choose the best.

- Let's say a startup went through this, who works with it further?

Each idea has its own business customer at the level of a top manager of one of the bank divisions. He is involved in the process, but we help, sometimes we make the project on our own. Now we are thinking about reinforcing this story, because it is difficult for a business customer to break away from their current affairs and get involved in another project. And this is reflected in the fact that projects are simply postponed. We bring an interesting story that can bring money to the bank, but managers do not have the time and resources to test this hypothesis.

We want to have internal teams that can pilot start-up solutions, and then transfer them to the business customer at the scaling stage.

- That is, with those who have passed the selection, the pilot project begins immediately? What does it look like?

Not really, there is a preparatory stage. First, we make a selection from the databases, identify those customers on which the piloting will be conducted. We check the project for compliance with all legal standards so that nothing is violated, data is compromised. If all issues have been resolved, and the costs of integrating a startup solution are justified by the estimated profit, we go ahead.

At this stage, a decent number of projects are being screened out. Either we understand that our scale is not that the required customers are not so many, or that this will not bring the desired financial effect.

If it comes to piloting, then it goes on the battlefield, it can be a scale from 10 thousand to 100 thousand customers.

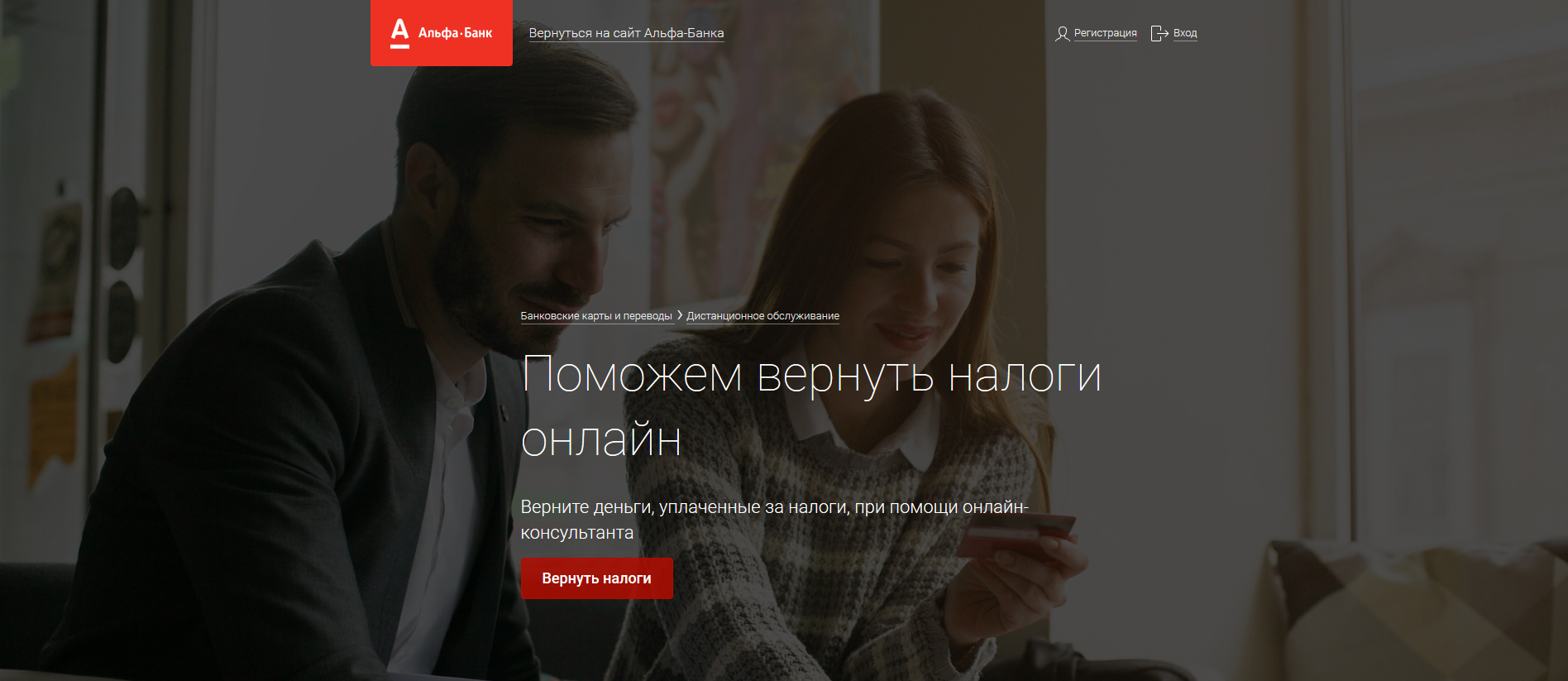

I will tell you an interesting example. At the beginning of this year, we launched a service for registering and receiving a tax return on personal income. It is now integrated into Alfa-Bank’s website, there is a section through which the client can, by filling out the form, receive a tax refund from the state on his card.

This service is paid, there are two tariffs, there is help in filling out the questionnaire, which you need to print out and refer to the tax yourself, or you can even call the courier home, who will fill in and take everything for you. When we tested, we didn’t intentionally make either zero commission or discounts - nothing. It was important for us to understand whether people were willing to pay such an amount. The cost is always important, it may turn out that every second person will respond to the free service, and when you enter the cost, the customers run away.

- You said that last year two projects got to the sale. The first is tax refund. And second?

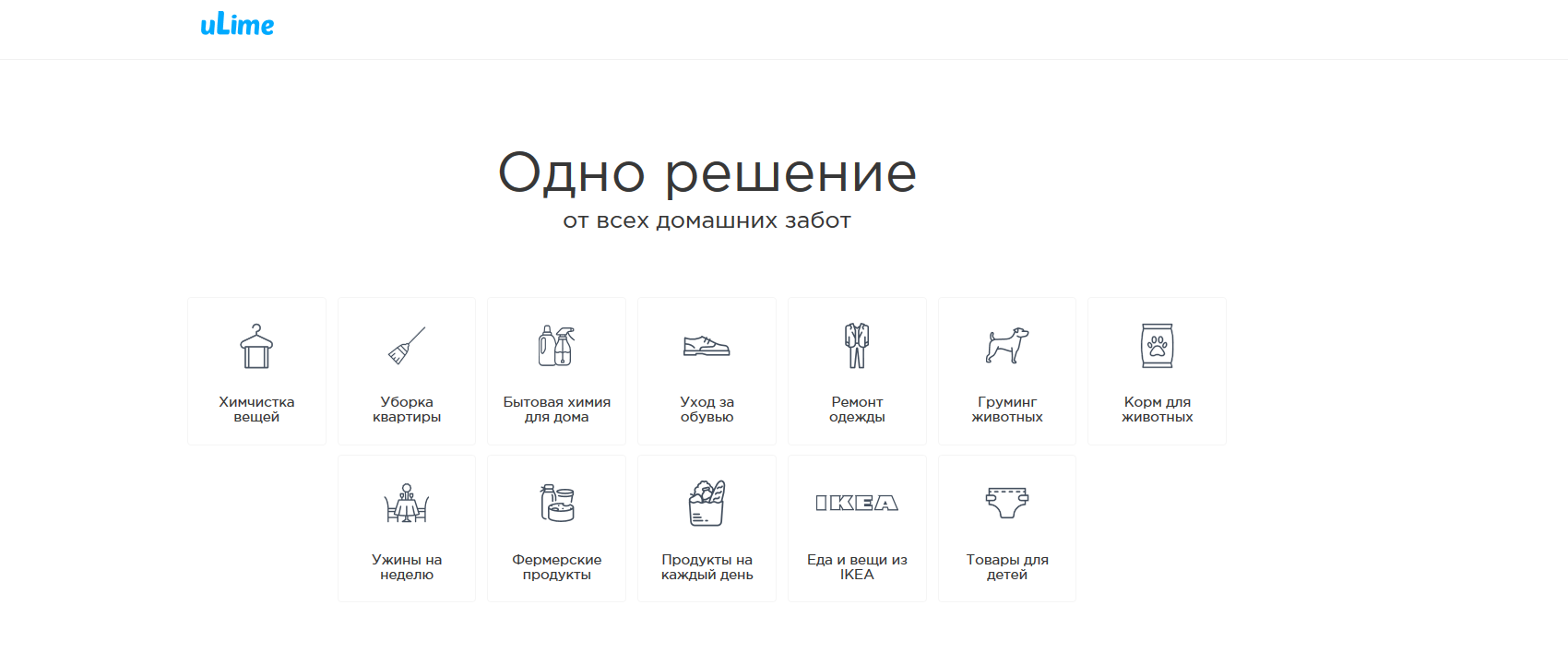

The second is the uLime service, they came to us for an acceleration program, they already had a product, we pumped them from the point of view of mutual settlements. With the help of this service it was possible to order the services of a housekeeper. They had a problem how to conduct settlements, money from the client to the service, and then to their executors. And we helped with this circuit.

Then we piloted their solution on our customers on a limited scale. Now they are on our Alpha Market, this is such a showcase for customers where you can get discounted services.

They have expanded the list of services, they are engaged in the delivery of dry cleaning items, products from supermarkets and offer other services that people often use in everyday life. We are also planning a deeper integration now. Suppose some services can be included in salary projects, there is an interesting hypothesis that if you offer employers to pay their employees for house cleaning, their labor productivity will increase significantly.

- Something is not very believable ...

Well this is a hypothesis, we think in hypotheses. In principle, the hypothesis needs to be checked, the startup allows you to test it cheaper, since the bank does not need to collect the product from scratch, there is already something ready. And a startup has its own benefits from such cooperation.

- Are there any verified signs that a startup is unlikely to take off?

You can understand whether the startup will succeed or not, after the first meeting, sometimes after reading the presentation. Well, not 100%, but 70%. I always look at the team. If the founder confidently talks about the market, gives all the numbers, knows what his exact number of customers is, this is a good sign.

A bad team can immediately be recognized by the presentation. From the slide about competitors, I often understand how well people know their market. When, let’s say, they do not indicate competitors at all, but they exist, or indicate incorrect competitors. This is a signal for me that the guys do not know their client, and they are unlikely to succeed.

- I heard you are developing a platform for quick evaluation of startups. What kind of beast will it be?

This is a completely new story. We have a large bank, many branches, startups are trying to convey information about themselves from different angles. We want to streamline this work. To do this, we are creating a platform in which, on the one hand, startups will write what they have, and on the other hand, our experts will evaluate applications.

As everything is happening now: projects get to us through different channels - through mail, social networks, forms on the site and even a call center. Somewhere there is a presentation, somewhere not. All this needs to be stored somewhere, to request additional information, to send to colleagues. Then control colleagues so that they all appreciate, immerse themselves in the project. This disorder affects timing and indirectly quality.

The pilot version of the product will appear in August, it will be a web platform. With its help, we will be able to form open requests for the market, collect orders, structuring information in a form that will be convenient for evaluation. Applications will be automatically routed. It is important, for example, that a project related to investments should go to an expert at a corporate investment bank, which can objectively evaluate it taking into account its expertise. Through this platform, all processes will go faster and more controlled.

If you still have any questions about how the bank works with startups, or you want to talk about your own, we will be glad to hear your comments.