Weekdays of programmers: how we modified cash software after the release of the new law

Not always software improvements are the result of user requirements or the desire to implement new functionality. Sometimes, external circumstances force the developers to work, for example, the changed requirements of the legislation for a particular business area.

It was in such a situation that we found ourselves with our cashier solution for Profi-T retail chains - it needed to be modified to comply with the changed norms of the “law on online cash registers” (FZ-54) . In our today's material - a story about what exactly had to be changed and the difficulties of modernization.

Software at the checkout: what does he usually do

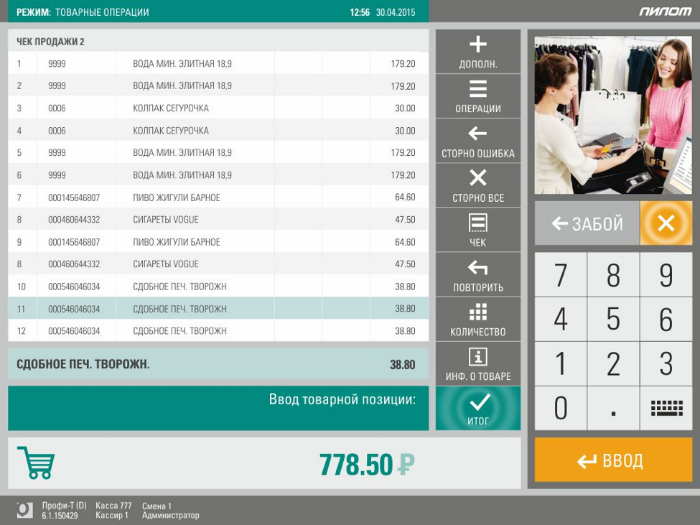

Cash register software should provide high-quality and fast customer service. Among the main functions are scanning the product, adding it to the check, applying discounts. Usually such programs are as simple as possible - working with the interface should require a minimum of effort from the cashier so that the employee does not get confused. That is exactly how, for example, the cash solution for Profi-T retail chains developed by Pilot works.

As everything worked before - retailers used cash desks that do not connect to the Internet, but with the help of a special electronic tape (EKLZ) they store all copies of checks for the last 13-14 months. These data must be in the store for five years after the cash desk is replaced, and it is their tax that is required during inspections. This was until recently, but already this year in the Russian sphere of trade there will be big changes that will affect software.

What is changing

According to the new edition of FZ-54 - read more about it in this article - Russian companies and entrepreneurs should switch from regular cash registers to online cash registers. From February 1 of this year, equipment without an Internet connection can no longer be registered with the Federal Tax Service, but so far they can work for them, and from July 1 it will be necessary to completely switch to new equipment. For this, existing cash desks will need to be seriously upgraded or replaced.

The essence of the law can be briefly described as follows: the state wants to see all sales in stores online, this should increase the collection of taxes and exclude any fraud in this area. The new scheme allows businesses to reduce the cost of maintaining cash registers, as well as get rid of a large number of checks.

The changes are quite large-scale, and they relate to both hardware and software.

How should cash register software work now?

According to the new scheme, data from fiscal registrars of online cash desks must be sent to a special intermediary - the fiscal data operator, who transfers them to the Federal Tax Service online.

One of the main difficulties from the point of view of the software developer in this whole situation is the changed requirements for the transmitted data. There are several new parameters that were not there before. For example, the VAT rate should be printed on the check for each product - in retail there are goods for which the tax rate can be 0%, 10% and 18%. If before tax had to be reported in the final declarations, now cash software working with new equipment must transmit this data - and then they go online to the Federal Tax Service.

In addition, to comply with the new requirements of the law, the cash register equipment itself is changing, with which the software interacts. Store owners must either install new online cash desks or upgrade old ones - in any case, the protocol for the interaction of equipment and software is changing. Manufacturers of equipment to comply with the new law seriously modified their products, as a result of which the drivers for interacting with software changed.

Separately, we can say that in this situation, those retailers who used foreign software to work most experience inconvenience - the developers of such systems often make changes for a long time, so they risk not having time to carry out all the necessary procedures until July 1, when the execution of FZ-54 becomes mandatory .

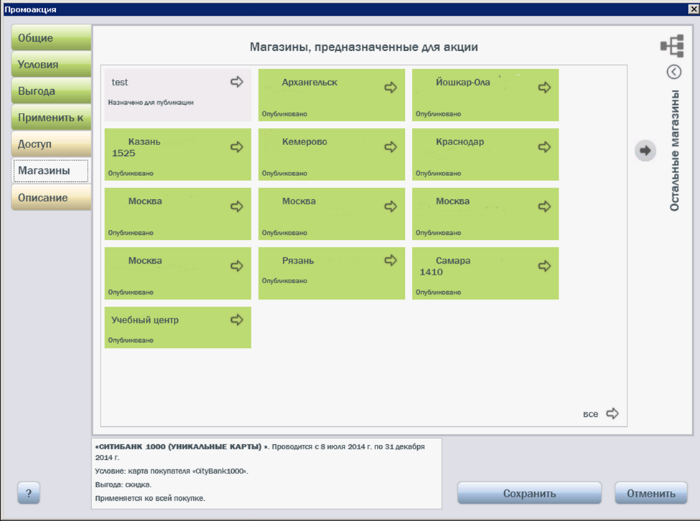

In addition, the format of the check is changing - its appearance is unified. Previously, stores that used loyalty programs or worked at a discount formed checks in their own formats. This led to the fact that the buyer was not always clear what exactly the discount was accrued for, how it was applied to a particular product. Now, according to the requirements of the law, the receipt must contain information about the price of the goods, taking into account all applied discounts (social, discount card, bonus points). So, the cash program should now not only draw up a check, but also immediately recalculate it taking into account the existing bonus or discount programs, as well as the shares entered in the store.

Another innovation of the law, requiring software refinement - now customers can require the store to send an electronic copy of the check to their email or mobile phone.

What we had to change

First of all, we had to expand the protocol for interaction between the cash program and the fiscal registrar - our customers use various equipment, so we had to spend time integrating with each of them.

The second important stage of improvements is the introduction of commodity fixation of sales taking into account discounts and tax rates and the implementation of new types of fiscal documents.

In addition, we continue testing various SMS gateways for delivering electronic copies of receipts to customers' phones.

The task of changing software to the realities of the new law was facilitated by the fact that the Profi-T system initially had extensive functionality. Many of the points that are necessary according to the requirements of FZ-54 in one form or another have already been implemented - for example, software already knew how to work with “mixed VAT”, that is, the program understood that the tax rate for different products may be different.

What's next

At the moment, the first stage of the transition to new requirements continues - the FZ-54 will start working in full force in July this year. In parallel with the refinement of the hardware and equipment infrastructure of retail, new bylaws appear that regulate various aspects of the business according to the new scheme. This means that cash register manufacturers will continue to upgrade their products - and software developers will have to respond to all this.

Want to know more about how we changed our cash register software as part of FZ-54 compliance and how it now works? Take part in the free webinar “The Truth About FZ-54 in 40 Minutes”, which will be held on March 14 at 11:00 by Pilot Group of Companies experts. To do this, leave a request on the site .