How to choose a country to enter the international market and test the demand

We open the series of materials following the results of the Russian Startups Go Global conference with an article on how to choose a country to enter the international market. It makes no sense to give advice without knowing the specifics of a startup: its business model, industry, stage, team competencies. Therefore, under the cut you will not find any universal recommendations - only stories from the experience of the founders, whose IT companies are already working in the markets of other countries. In a conversation with them, we tried to find out by what criteria the founders choose a country to scale, how they test demand, and whether the difference in mentality does not bother them.

Dmitry Zaryuta, CEO and founder of Easy Ten:

Easy Ten at the moment - b2c, revenue of about $ 1.7 million per year, mobile application No. 3 on iOS in the language learning category in the world. With the help of the service, more than 3 million users in 140 countries learn words in 7 languages, the application is localized in 12 languages of the world. A graduate of the IIDF accelerators and 500 startups.

“Before entering the international market, we asked ourselves two questions: “ Why are we doing this? ” and “How do we do this?” . In my opinion, there are two adequate answers to the first question:

- Earn money;

- Raise investment.

We worked for both purposes. If the company plans to attract investment in the USA, it is necessary to show local investors that the team is able to work and grow in this market - it is advisable to have sales and traction by key metrics. But today I’ll tell you more about point number 1.

To enter the market to make money means investing the amount N and getting a larger amount after some time. In fact, you need to reduce the unit-economy in the channels (to earn more on the client than it costs to attract him).

The answers “we enter the market of another country because there is a crisis in Russia” or “because the market is bigger there” are rather dangerous: it is not clear what exactly we will do to achieve the goal, and on the basis of what criteria we decide to enter the market precisely of this country. To do this, you first need to check the demand for the product - using data from analytics and customer development:

- View competitors and their numbers;

- Talk with people from the country and preferably experts from the market;

- View organic plants in the country and calculate market potential.

In our case, to check the demand in the country, it was necessary to know the main language of the inhabitants, whether they were interested in learning another language, and then to test the hypothesis that Easy Ten solves the problem of learning a language for these people.

It is not enough to focus on the results of customer development (consumer research through interviews) - it is important to have analytics data. Two years ago, to choose a country, we hid for a month: we didn’t spend money on marketing, but invested in ASO. With its help, we received a sufficient amount of traffic for new installations and watched how users behaved: we calculated retention rates, average check, user lifetime, and conversions. We already had traction in Russia, data on conversion to the first, second and third purchases, indicators on user retention. By comparing the indicators in Russia with those of organic plants in different countries, we could look and predict which country’s market is most interesting.

Based on these data, it was found that user activity is most in Brazil - even more than in Russia. Therefore, we started from Brazil - the Olympics took place in this country: people began to prepare for it in a few years, including learning English. We localized our application in a number of languages, including Portuguese, and launched soft-launch. Having invested in marketing in Brazil, two months later we got a plus in this market.

Now Brazil takes 30% of our revenue, followed by France, Spain, Portugal and Germany. There is no USA among these countries - it would seem that this is the largest market in the world in the mobile segment, but the audience is not ours: there is no pronounced interest in languages, there is no such problem and need. Learning a new language for Americans is a hobby that impresses friends. The knowledge of English to Americans is quite enough.

How we enter new markets: we buy traffic for our application, for example, in France or Germany, and during the first three months we see how many people made the first purchase, how many of them - the second and third. Knowing your internal indicators in the main market by three points, you can approximate the user exit curve and understand its Lifetime Valuec sufficiently high accuracy. Thus, we understand how much time it takes for investments in traffic to fend off, and when in the unit economy we come out on the plus in this market. Then it’s a matter of technology: with these numbers you can go to the investor, you can go to the bank. You know with great accuracy that on X money invested you will receive N * X in Y time. This is the basis for safely entering a b2c product on the market.

It is important to supplement analytics data from interviews with users and market experts. When we hit the 500 Startups, our initial plan was to go to Mexico. Our application was focused on iOS, we bought the first traffic there in the main channel of attracting users - Facebook. This social network is very popular in Mexico, so it was possible to cheaply look at the settings and conversions if Facebook worked what worked in Brazil. When we saw that the performance of Mexico is different, we began to interview experts. After 500 Startups, we went to an expert in Mexico who was asked the question, “How is it with studying Mexicans among Mexicans?” It turned out that a large percentage of iPhone owners in Mexico already know English, they do not need language learning. And Mexicans who need English can’t afford to pay for it: they don’t have an iPhone, they use cheap Android smartphones, where our economy will not converge. After an hour of conversation, we realized that Mexico was not a priority for us, and reoriented to Europe. Therefore, it is important to find a person who can prompt - this will save the time of the founders.

Our conclusion: there are two ways to confirm demand in the international market and to scale.

- Product development for the audience and market. It is long enough and expensive.

- Make a product, localize it to most possible audiences and see which one will ultimately respond best.

We went the second way. It is much cheaper and essentially easier to develop the product under the imaginary founders of the ideal user. It’s better to bring the product as early as possible to the widest possible audience and see who the user is for whom we have created value. ”

Daniil Brodovich, CEO Cookstream and CPO Just:

Started with the b2c segment with TalkToChef, the company operates worldwide in English and Spanish. A graduate of Startup Next and accelerators Founders Space and Start-Up Chile. Now we are focusing on b2b - Cookstream operates in the markets of the USA, UAE, Europe.

“We started in the United States because we studied at a business school in San Francisco with the other founders. One of the ideas that arose during the training stuck in our head - these were video broadcasts on various topics, cooking was one of them. We decided to test the potential of the idea at Startup weekend - and won. Unlike a hackathon, when you make a prototype for a naked idea in two days, the conditions for winning this event are the first customers and the results of an interview with them. In the process of this event, we have already begun to do customer development, and continued in the Startup Next program Steve Blanca - the founding father of this methodology. Steve Blank considered our idea too niche and suggested that we look more broadly at what problems exist on the market.

In the process of communicating with potential clients during the interview, we found a huge number of problems associated with distance consultations and cooking training. Problems with food delivery, with queues in restaurants, problems of finding professional chefs for culinary master classes and in restaurants. We started to collect all this in our product. Inspired by this layer of unsolved problems, we decided to make a revolution in culinary.

Our main mistake was that we swung at one stroke to solve all the problems. Only the development of a minimum product for our global idea took five months. During this time, part of the team fell off, potential investors. As a result, they encountered two obstacles:

- Lack of budget for the implementation of a global idea;

- Defocusing prevented our potential customers from understanding what the product is for and what problem it solves.

Beta scores were mediocre. Steve Blank did not have time to tell us that we need to focus on one problem and solve it best on the market. But we understood this from our own experience - therefore, we began to look for a competitive advantage for our product, which no one else has. We realized that the most sought-after feature is a hotline with video communication experts, and the first segment was chefs and cooking enthusiasts. With a heavy heart, we threw out all our achievements and focused on this value. By repacking the product for this problem, we attracted investment. But this is a separate story, which we will discuss in the next article.

Regarding the verification of demand based on my own experience, I can say that the founders should study their clients themselves. I am against any outsourcing of customer development in any form to any employees. Yes, employees can act as an auxiliary force - it is impossible to do everything yourself. We had American employees who helped study consumers for some time, but we didn’t get values or insights that we couldn’t understand ourselves.

When the founder starts from scratch, he has absolutely no prejudice about the market (other than what he read in the articles). This is both a minus and a plus for consumer research. We understood that culinary shows are very popular (105 million American families watch them every week), we saw statistics on people who want to learn how to cook. And we tried to understand exactly how they want to learn, whether our solution is convenient, how relevant it is for them to communicate with a video communication expert. We could check these kinds of questions ourselves - we had a free English and basic understanding of California culture, which was different from other states: Californians are open to innovations, are good with immigrants, and are ready to help and support in their endeavors.

However, consumption habits may not be known even after spending some time in the United States. We are faced with the problem of differences in consumer preferences: it is difficult to understand how Californians live and how much they are really interested in the product that they say “super”. In California, unlike Moscow or New York, even to complete nonsense, people will say, "the class, how interesting, I will definitely try or buy," is a simple politeness, not real interest. Therefore, Steve recommended immediately collecting checks and considering a purchase only the moment of prepayment.

For customer development, our level of integration into the environment was enough. But for the marketing promotion of a b2c product in the American market, in my opinion, it is better to involve local experts - in order to understand the mentality and increase speed. You can try it yourself, but mistakes will be inevitable. You can also “promerikaniziruetsya” quickly enough if you live in the USA for many years and communicate among Americans, not immigrants. For us, the salvation was work through industrial partners - American companies with experience in the professional consultation markets (tutors, lawyers, doctors, etc.) and an understanding of their features.

Making people switch from existing behavior to new is very difficult. To break the usual model of behavior, you need: “strong” positioning, opinion leaders, a base of “early followers”, the right steps to enter the market. Building it all yourself on a new market will take a lot of time, money and effort. Local partners with experience in the market have built an effective exit plan: they took the narrow niche of the deaf-mute and their parents and, due to their successful experience, were able to offer the product to universities as a way to increase the performance of their students. We wouldn’t have reached such a model ourselves - it’s hard for us to imagine an active and solvent association of deaf-mute people and universities that are willing to pay for tutors for students. But in the USA, the product is gradually gaining popularity and goes from a niche to a mass one.

The specifics of the US market is very different from ours: there are a huge number of players who solve all kinds of problems for you. The American consumer must understand in seconds what the company's mission is and what value the product gives. Wild competition for attention and people's wallet requires the founders to immediately feel what 5-7 words will convey the meaning to the client as clearly as possible so that he wants to spend a minute studying the product. When the user's interest is attracted, it is necessary to tell who we are and why our product should be credible.

Entering foreign markets may not work out the first time. When launching in the United States from scratch, our company survived four pivots before it came to a working business model. The main thing is to try until you can solve a significant problem in the market. And remember that problems can differ in different countries: often a problem in one country may not exist in another - there is no such need at all or it has already been solved by other players. ”

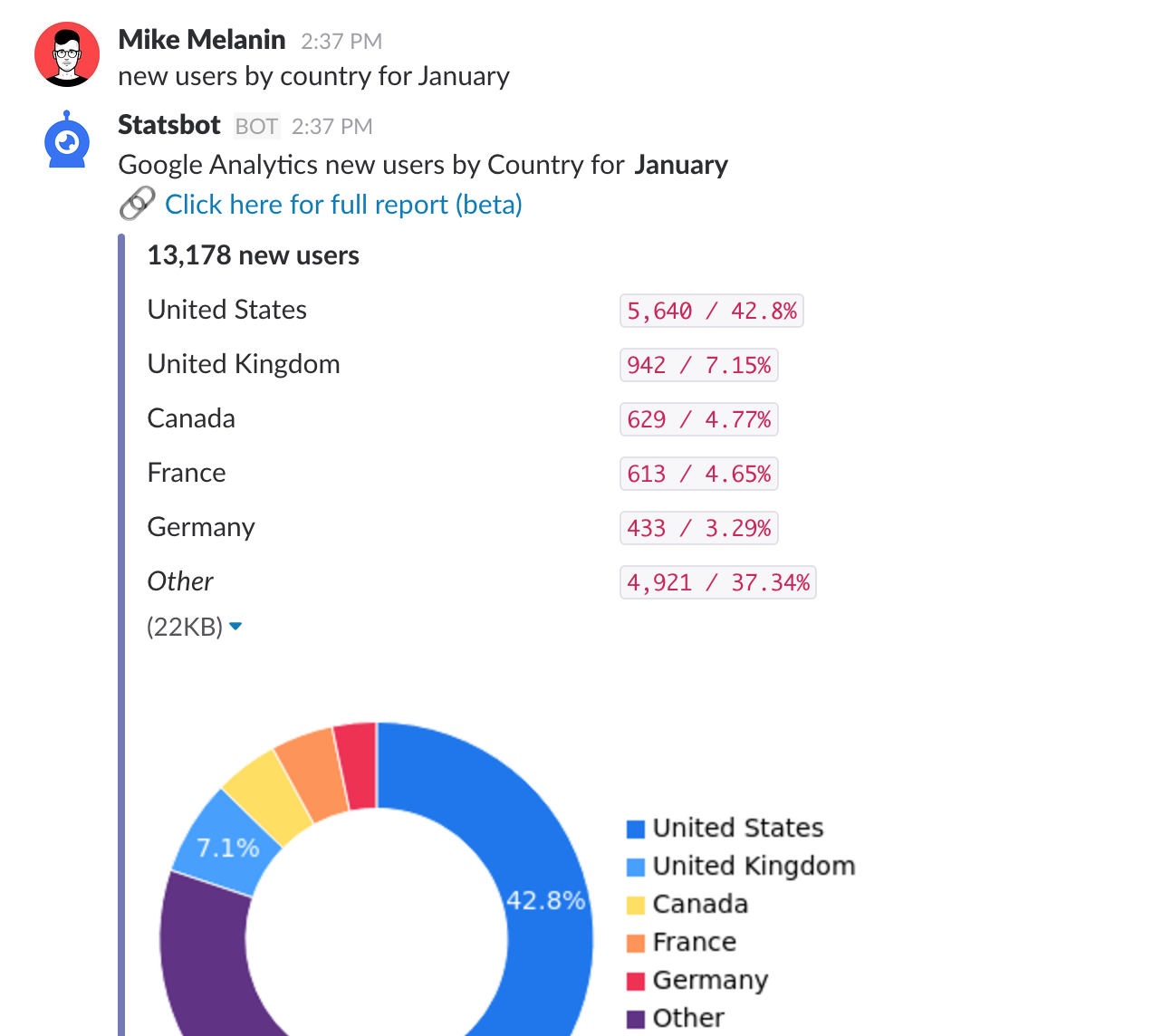

Mike Melanyin, co-founder of Statsbot:

Statsbot currently has 25,000 b2b users, 80% of which are in the USA, a graduate of 500 startups and Betaworks Bootcamp.

“We are making an analytical bot for Slack, the first version of the product was launched in December 2015. The launch on the market began with the dissemination of information throughout the community - the first users were attracted from open thematic Slack channels, from groups on Facebook. We immediately focused on the global market, so Statsbot was originally in English. We constantly corresponded with interested people by e-mail, asked questions.

We officially launched in January 2016, after launching the Slack app store and finalizing the product based on feedback from the first users and the Slack team. Then they went to Product Hunt, where they received one and a half thousand Statsbot installations in two days from the moment of official launch, and other open and free sites. In this way, we recruited a user base to gain access to companies and have real numbers on them. At that time, we were locally in Russia. The US market chose us, not we chose it - according to the results of testing the first version of the product and analytics data collected after the official launch, it became clear that the majority of users are concentrated there.

The advantage of the US market - the audience there is much easier to contact than in Russia, ready to try new products and pay for them.

Having decided on the target market, we began to enter into personal communication with users. Customer development as a tool for checking demand has already become an abusive word in Russia. Of course, we talked a lot with the first users, including meeting in person when we went to the USA. After almost a year, I can say that it is necessary to study your client, but it’s better to listen to it through your fingers: people say one thing, do another, and pay for the third.

It’s better to show the client a work product and watch analytics than listen to hallucinations of people. ”

Konstantin Dubinin, CEO and founder of Countbox:

Countbox at the moment - b2b, offices in Moscow, Chicago and Dublin and representatives around the world, revenue of about 50 million rubles for 2015.

“I started selling abroad in 2014, I hired a person with a good level of English in Moscow who sold abroad in b2b through resellers. Hiring a person from Russia and trying to sell through cold calls, letters, LinkedIn, exhibitions - in my opinion, the best strategy for monitoring the market and checking demand is cheap (a person with a good level of English can even be hired for 50 thousand rubles in Moscow). There were some problems associated with entering a new market: poor English translation of the product, unprofessional vocabulary. We did not understand who makes the decision in the companies of our clients, we spent a lot of time on incorrect activities. For example, they tried to sell to customer segments that they buy from us in Russia. But abroad, they did not have a need for our product. However, in my opinion

In 2015, paying $ 1,500 per year, we became members of the ICSC (International Council of Shopping Centers) and gained access to our potential customers database. This helped us understand that the US market is the largest for us, and therefore a promising one: in the USA there are more than 4 million locations where we can install our product. At that time, our first sales were just beginning. In the b2b sector, sales are often asked for a personal meeting. When a critical mass of such requests accumulates, it's time to open an office. As a result, at the beginning of 2015, we opened an office in Chicago - my co-founder lived there.

In 2016, we opened an office in Dublin - this was a condition for attracting money from the second investor, the state fund of Ireland Enterprise Ireland. Before that, Europe was a dark spot for me; this market seemed to me small and uninteresting. The investor convinced me that this is a big market where our products will be in demand. I listened to the professionals who have worked in this market all my life. And he did not regret it: it turned out that in Europe business is easier to conduct than in the United States. In Europe, people are open to dialogue and to everything new, ready to listen to what you tell them. They just don’t know how to criticize - the British generally never say no, that’s their trouble. And it’s a misfortune for an entrepreneur if he has not learned to recognize this hidden “no” at an early stage.

There are very strong unions in North America and Europe, they form associations. If the startup team plans to work in an industry in these regions, it is important to get acquainted with the associations in order to evaluate the market. We entered into different groups, opened dialogs at a professional level with potential customers, partners and competitors, looked at who and how is developing. It is very important to see if there are competitors in the market, even if they are indirect, because it means an opportunity to succeed in this market. And if a startup has obvious advantages over competitors, which are easy to explain and demonstrate to potential buyers, then winning is much easier. Creating a market for a product from scratch is much more difficult than entering a ready-made one. It’s easier to find a market where someone is already doing this. For example, in Belarus I don’t work, because there is no my market, competitors. Say, if a company produces medical devices / equipment, it is much easier to go to those countries where more hospitals and medicine are more expensive than to those where medicine is low and there are no technologies.

I now have new products that I want to test in new markets. Great Britain will become the “Sandbox”, because it is close to Ireland, they speak English, and it is convenient for me to work with the British. At the Russian Startups Go Global conference, we learned about the opportunity to get support from the British Embassy, for this they are ready to do market research at their expense. It’s convenient for me to take the market of a country close to me, test products on it, and get feedback from the first customers. It’s better to make mistakes in the not the largest and most promising market, so as to be able to correct them and avoid mistakes when entering a more promising market. ”

Sergey Klimentyev, BizDev and founder of Texel:

Texel is currently a b2b segment, the company's 3D scanners are now sold in France, Germany, Austria, Greece, Spain, Saudi Arabia, and China. Revenue $ 320k for the second half of 2016.

“Having made the first sales in Russia, we switched to Europe. Now customers are in Europe and China (Hong Kong and Macau). We are also working on the countries of the Middle East and Latin America - with Qatar, Saudi Arabia, Mexico. We started from Europe for a simple reason - it is close to Russia: we have an “iron” project, and logistics has a certain impact on the region of presence.

We thought about where to go after Europe - in the USA or in China. The second largest market in our segment is the United States, but eventually came to China. To some extent, this decision was made for us by our customers - they themselves came to us by watching the videoabout the product on YouTube.

We try to produce a high-tech product that speaks for itself, in this regard we share the point of view of Elon Musk: it is better to spend money on a product than on marketing. Product specifications without marketing costs attract attention. Several journalists wrote about us in the cited international publications on 3D printing and 3D scanning; we won the Seedstars contest in Russia. Forbes came to us himself, another journalist was introduced to us by Seedstars. At Slush, TechCrunch's editor-in-chief asked him to send him his scanned 3D model. It was from these events that our development in Europe began, and exhibitions and the further development of the distribution network consolidated it.

Thus, we are trying to organically convey information about the product to new customers due to the online presence on virtually all 3D printing and 3D scanning resources, as well as about startups. Customers who do market research and find information about us understand that our solution for key indicators (scanning speed, processing speed, cost, availability of additional functions - 3D photos, animation) is much better than competitors, and decide to purchase it .

To summarize, we select countries for further product promotion based on customer requests. We receive these requests following the results of media publications and participation in international exhibitions such as Formnext Frankfurt, Siggraph, CES. Not so long ago, customers from Qatar, Saudi Arabia, and Mexico found out about us - therefore, we are now working on building a distribution network in these countries. ”

Brief Summary

To test the demand in foreign markets, the founders use:

- Figures by competitors and the market (including those obtained from relevant associations and trade unions, official reports);

- Online sites where you can post product information for free (such as Product Hunt), and user feedback from these sites;

- Analytics data - on the organic settings of the product: retention rates, average check, user lifetime, conversion to purchase;

- International exhibitions and media publications, following which the founders collect the requests of potential customers;

- Customer development results - interviews with potential customers and market experts;

- Cold calls and letters to potential customers in another country.

Factors that influenced the choice of the founders of the country to go abroad:

- More requests from potential customers come from the country than from other countries;

- There are competitors in the country - the market is ready to promote the product;

- The founder or investor has expertise in entering the country's market;

- The founder or investor has an understanding of the mentality and culture of consumption in the country;

- The country is convenient for exit in terms of logistics;

- Large (= promising) market.

Well, based on the results of our communication with the founders, we were once again convinced that in order to enter the international market, first of all, the same two things are needed as for launching a startup in Russia:

- Potential customers in the country have a problem that the product solves;

- The product has clear competitive advantages over alternative solutions to the problem on the country's market.

In the following materials, the founders will share their experience in attracting investments from foreign investors, hiring a team to enter the international market and testing channels to attract customers in other countries. If there are other aspects of a startup’s entry into the markets of other countries, which we can cover in articles, offer in the comments.