IoT Market. Many ratings, no consensus

Alexander Prokhorov. Leading analyst at Huawei Russia, Ph.D.

Today the technologies of the Internet of things and prospects for the development of a market based on these technologies are actively discussed. It is impossible to judge how promising a technology is, how profitable are investments in its development without numerical estimates. Indeed, a considerable number of such estimates and forecasts appeared in the open press from various analytical agencies.

It would seem that there are enough sources in order to make an impression of the size of the market and its growth prospects. However, a more detailed study of the problem leads to the fact that with an abundance of estimates, there is practically no consistency between them. In the open press, market figures are often given without a description of the methodology for collecting data, determining the boundaries of the market, and its structure. The scatter in estimates confuses the reader and reduces the degree of confidence in the data.

For example, according to the IDC publication, spending on the Internet of Things (IoT) market in 2014 amounted to $ 655.8 billion and will grow to $ 1.7 trillion in 2020 with a CAGR of 16.9%. According to Harbor Research, in 2014 the IoT market amounted to $ 180 billion, and by 2020 its volume will exceed $ 1 trillion. According to Machina Research, the size of the IoT market in 2014 amounted to $ 900 billion, and it will grow to $ 4.3 trillion by the end of 2024. According to the analysis of Strategy Analytics, the total market of all elements of the IoT market will be $ 150 billion in 2016 and will grow up to $ 550 billion by 2025

In addition to the multiple differences in the estimates, it is noteworthy that the IoT market accounts for a very large share of total ICT expenses. For example, according to IDC and Gartner estimates, total ICT spending in 2015 will be about $ 3.5 trillion. How do such optimistic forecasts of IoT market growth come together with moderate forecasts of the ICT market? This article is an attempt to explain the reasons for the variance in the estimates, to provide a comparison in the approaches of different analysts, to help the reader in interpreting disparate data on the IoT market.

Quantification and interpretation of terms

At the beginning of the article, we presented the differences in financial market estimates. Indeed, the market can be considered differently, taking into account or not taking into account different parts of the IT infrastructure, including one or another set of services for the implementation and maintenance of solutions. But quantitative estimates of the number of connected IoT devices are directly related to the definition of the term IoT. Do analysts have a consistent view on this issue? How, for example, do they estimate the number of connected IoT devices in the world today and how many will appear by 2020? The IoT Analytics publication provides a comparative analysis of the forecasts of various companies on the number of connected devices in the world by 2020. According to this publication, opinions are clearly divided: Global Insight predicts that there will be 18 billion such devices; ABI Research and IDC - about 28 billion, Cisco and Ericsson estimate that there will be about 50 billion connected devices. It is interesting to note that these analysts not only give different forecasts for the distant future, but also evaluate the data for 2014 differently. For example, ABI Research indicates a figure of 6 billion, Cisco - 14 billion. What is the reason for so different estimates? Perhaps some of the misunderstandings arise in the not entirely correct use of terms related to IoT. For example, in some publications, IoT solutions are referred to as IoT / M2M, or the terms M2M and IoT are generally used synonymously. Sometimes the terms "industrial Internet", "Internet of people", "Internet of things", "Web of things", "Internet of everything" are used without specifying the boundaries of the concepts introduced. but they also evaluate the data for 2014 differently. For example, ABI Research points to a figure of 6 billion, Cisco 14 billion. What is the reason for such different estimates? Perhaps some of the misunderstandings arise in the not entirely correct use of terms related to IoT. For example, in some publications, IoT solutions are referred to as IoT / M2M, or the terms M2M and IoT are generally used synonymously. Sometimes the terms "industrial Internet", "Internet of people", "Internet of things", "Web of things", "Internet of everything" are used without specifying the boundaries of the concepts introduced. but they also evaluate the data for 2014 differently. For example, ABI Research points to a figure of 6 billion, Cisco 14 billion. What is the reason for such different estimates? Perhaps some of the misunderstandings arise in the not entirely correct use of terms related to IoT. For example, in some publications, IoT solutions are referred to as IoT / M2M, or the terms M2M and IoT are generally used synonymously. Sometimes the terms "industrial Internet", "Internet of people", "Internet of things", "Web of things", "Internet of everything" are used without specifying the boundaries of the concepts introduced. in some publications, IoT solutions are referred to as IoT / M2M, or the terms M2M and IoT are generally used synonymously. Sometimes the terms "industrial Internet", "Internet of people", "Internet of things", "Web of things", "Internet of everything" are used without specifying the boundaries of the concepts introduced. in some publications, IoT solutions are referred to as IoT / M2M, or the terms M2M and IoT are generally used synonymously. Sometimes the terms "industrial Internet", "Internet of people", "Internet of things", "Web of things", "Internet of everything" are used without specifying the boundaries of the concepts introduced.

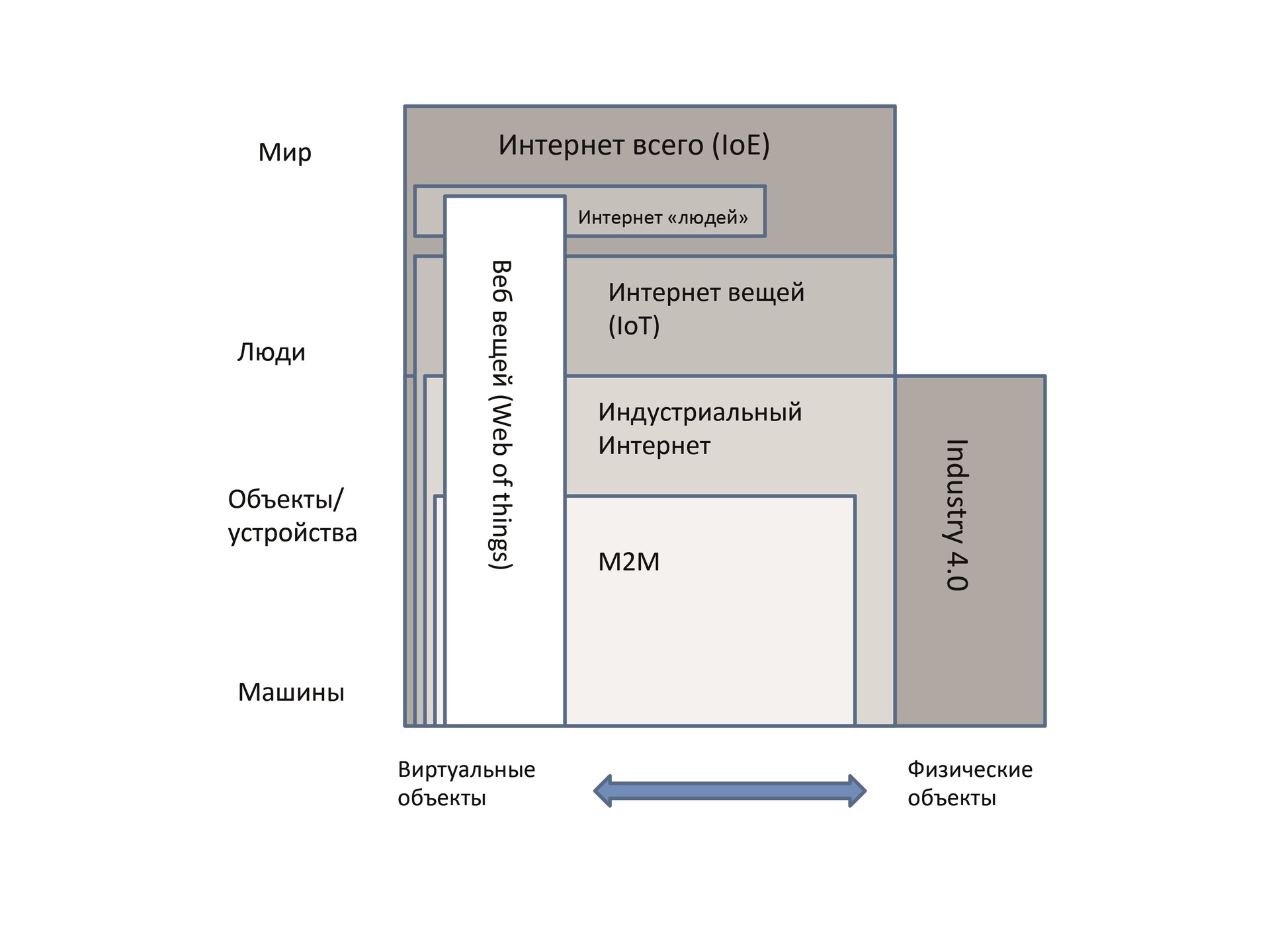

The most obvious distinction between the above terms is given by the diagram in Fig. 1 cited by IoT-Analytics.

Fig. 1. Correlation of terms related to the concept of “Internet of things” (source Wikipedia, McKinsey, IoT-Analytics)

At the center of the circuit is the M2M technology, which has been known for a long time and is defined in the most general terms as a technology that allows machines to exchange data using wired and wireless technologies. According to the figure, M2M is a subset of the Industrial Internet. The term “industrial Internet” is broader than M2M and describes technologies that focus not only on machine-to-machine communications, but also on providing an interface to humans. Many of the technologies described by Industry 4.0 (the term comes from the fourth industrial revolution) represent the development of the concept of the industrial Internet and involves the creation of smart industries based on digital technologies, including cloud computing, the Internet of things, 3D printers and augmented reality. The Internet of Things (Internet of Things (IoT)) is broader than the concept of the industrial Internet, since it includes consumer solutions, such as human-carried IoT devices. According to IoT-Analytics, the Internet of everything is still a rather vague concept that seeks to describe a set of technologies that provide all types of connections, and thus has the highest coverage in Fig. 1.

The picture is complemented by a box that describes many technologies that correspond to the term “Web of Things” (WoT), which intersects with all the blocks listed above. WoT is a set of application-level services for creating “IoT.” WoT includes principles, architectural styles, and software patterns that allow real-world objects to become part of the World Wide Web. In fig. 1 also shows the box “Internet of people” - a small boxing volume, apparently, emphasizes that the number of connected devices controlled with the direct participation of a person is an ever smaller volume. But even with the formal consistency of the above terms, discrepancies remain in the details. These discrepancies were most fully analyzed in the publication of IDTechEx.

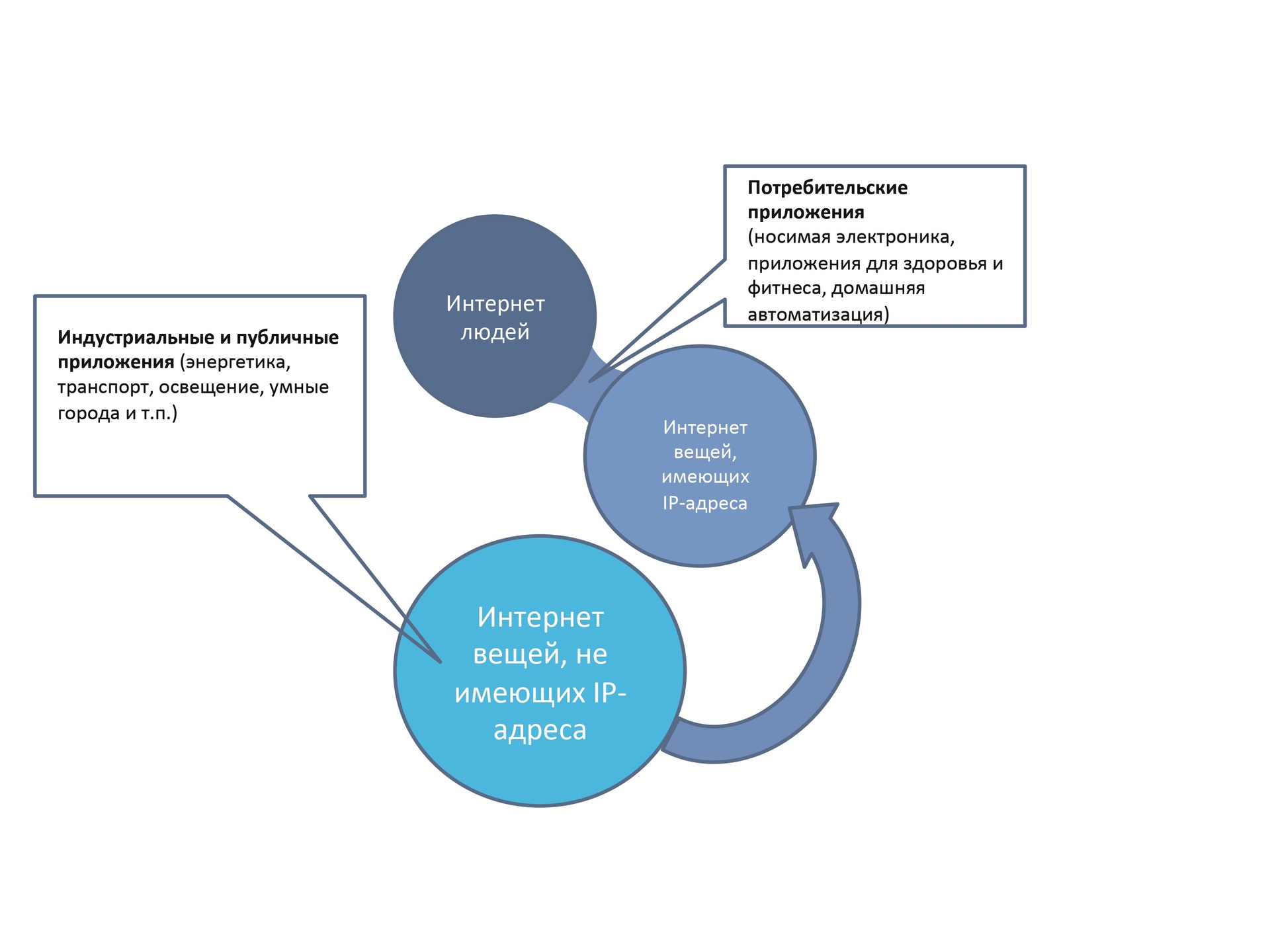

Fig. 2. Taxonomy of the IoT market according to IDTechEx

In fig. 2. A simplified diagram is shown (the complete diagram can be found in the paper) - three subsets are shown here. The first, of the smallest volume, is the so-called Internet of People (IoP), this set includes smartphones and other personal electronic devices with Internet access. The next circle in radius characterizes solutions based on intelligent devices (things), which include various kinds of sensors for fixing data and microcontrollers for local processing of this data. The key point is that these devices have an IP address and can interact with other things without human intervention. As can be seen from the figure, the first and second circles are connected by a jumper, denoting the transition region, which has the properties of both sets, but does not formally belong to them. Consumer applications, such as wearable electronics, applications for health and fitness, home automation, are related to this area. Some analysts attribute these solutions to the IoT market, and some do not, referring to the fact that in most of these solutions communications require human participation. It should be noted that solutions based on IP sensors are not always required. For example, there are very cheap solutions based on passive RFID tags, which are much cheaper compared to classic IoT devices. And there are a great many solutions using “non-IP things”. Therefore, the third, largest circle defines a lot of specialized “things” that do not have an IP address at the level of these “things” and use other networks and other data exchange protocols. They cannot be fully attributed to IoT, although some analysts attribute them to this category, which leads to different estimates of the IoT market. Nevertheless, as can be seen from Fig. 2, the general tendency is such that the transition from solutions based on “non-IP sensors” (which have a number of limitations, including the problem of dependence on a specific vendor) to universal solutions based on IP sensors is gradually happening. In fig. 2, this process is indicated by an arrow.

Financial valuations and market structuring

In the previous section, we examined differences in the interpretation of the term IoT and noted that these discrepancies can lead to different estimates of the volume of connected IoT devices. When we move from analyzing the number of deliveries of connected things to describing the market for IoT solutions, analysts add an additional “degree of freedom” in how to describe the market. First of all, it should be recalled that analytical companies use two types of market segmentation. The first type includes an approach in which all segments of the market share it according to some functionality, so that all these segments make up 100%. For example, the markets for hardware, software, and IT services together comprise 100% of the IT market. When we speak, for example, of the cloud services markets, the big data market, the IoT market - as a rule, we are talking about intersecting markets. That is, the same servers, programs, IT services and telecom services can be calculated both within the framework of the big data market and within the framework of the Internet of things or cloud services market. Therefore, describing the market of IoT solutions, each of the analytical agencies, in principle, can decide for itself which base markets and which share should be included in the IoT solutions market. And with comparable estimates for the total volume of the ICT market, dividing it into mutually intersecting parts can be very different. As a confirmation of this thesis, let us consider how different analytical companies determine the boundaries of the IoT market and which segments include it. Therefore, describing the market of IoT solutions, each of the analytical agencies, in principle, can decide for itself which base markets and which share should be included in the IoT solutions market. And with comparable estimates for the total volume of the ICT market, dividing it into mutually intersecting parts can be very different. As a confirmation of this thesis, let us consider how different analytical companies determine the boundaries of the IoT market and which segments include it. Therefore, describing the market of IoT solutions, each of the analytical agencies, in principle, can decide for itself which base markets and which share should be included in the IoT solutions market. And with comparable estimates for the total volume of the ICT market, dividing it into mutually intersecting parts can be very different. As a confirmation of this thesis, let us consider how different analytical companies determine the boundaries of the IoT market and which segments include it.

According to IDC, expenditures on the global IoT market in 2014 amounted to $ 655.8 billion and will grow to $ 1.7 trillion. The cost of connecting the Internet of things and IT services will make up the bulk of the IoT market in 2020. And together they will make up more than 2/3 of the IoT market in 2020. Devices (modules / sensors) will make up the bulk of the market (31.8%).

IDC defines IoT as a network of networks of uniquely identifiable connected devices (or “things”) that exchange data based on IP connections without human intervention. IDC emphasizes that offline connectivity is a key attribute in the definition, and does not take smartphones, tablets and PCs as IoT devices. What horizontal segments of the IoT market does IDC highlight? According to the company's publications, the IoT market, in addition to hardware and software, includes both IT services and telecom services. That is, the IoT market is at the junction of the IT and telecom markets. Telecom services are the cost of the services of wire and wireless providers for connecting IoT devices. IT services include consulting, hardware and software installation services, system integration, support and maintenance services, training,

IDC refers to various kinds of connected IoT devices as hardware in the IoT market (controllers, sensors, RFID tags and other wired or wireless IoT devices). Moreover, if a device, a “thing” or a sensor has an IP address and is autonomously connected to the network at some point during its life cycle, it falls under the definition of IoT. The hardware segment also includes other elements of the ICT infrastructure (servers, storage systems, network equipment, including switches and routers, as well as hardware security systems). The software category includes a wide range of software:

- analytical software that uses data collected using connected things to translate them into information for making management decisions;

- application software that provides an interface to the user, works with analytical applications, provides functions of various kinds of industry specifics;

- IoT platforms are specialized applications that integrate a number of functions and usually include: monitoring and managing connected devices; collecting IoT data, converting and managing this data, as well as developing IoT applications; part of the functionality of IoT platforms may overlap with the above categories of software;

- security software.

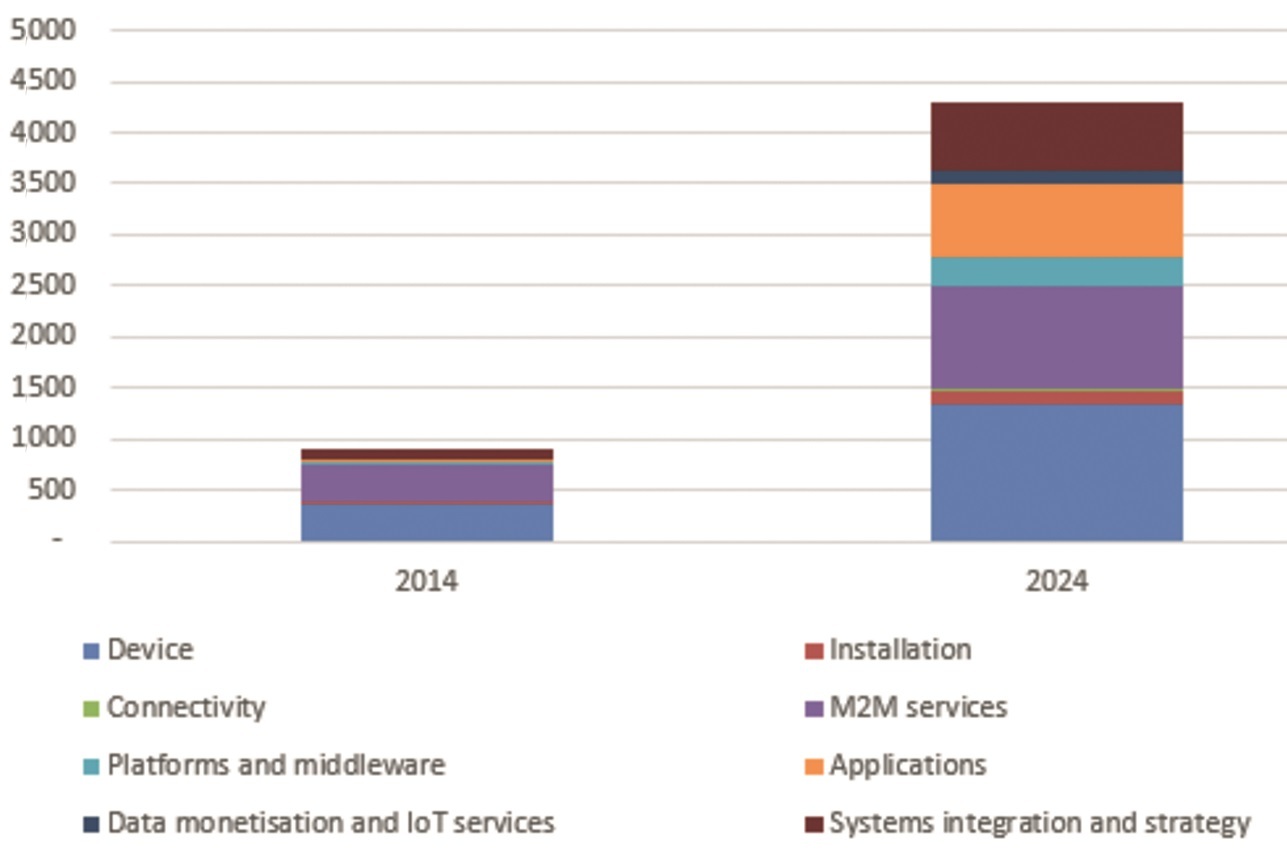

Fig. 3. Forecasts of the global IoT market, $ billion (source by Machina Research, 2015)

Machina Research uses different market segmentation (see Figure 3). According to Machina Research, the IoT market will grow to $ 4.3 trillion by the end of 2024, which reflects a significant increase compared to $ 900 billion in 2014. According to Machina Research, the main expenses for IoT include applications, professional services, M2M -services and devices. As can be seen from fig. 3, the company uses market segmentation different from IDC: Device - devices; Connectivity - communication costs; Platforms and Middleware - platform software and middleware; Data Monetization and IoT Services - monetization tools and IoT services; Installation - installation services; M2M Services - M2M services; Applications - applications; Systems Integration and Strategy - systems integration and strategy development services.

Table 1. IoT market development forecast, $ million according to Harbor Research.

Here, the hardware category in 2014 is only 9%, and its share will decrease over time. Apparently, in this methodology, the part that is provided in the managed services mode, namely as IaaS, is not included in the hardware infrastructure.

So far, we have looked at the horizontal structure of the IoT market. Analysis of publications on the vertical market structure shows that the data of various analysts also rely on different taxonomy. As an example, in table. 2 and 3 show forecasts by Harbor Research and McKinsey.

Table 2. The vertical structure of the IoT market according to Harbor Research

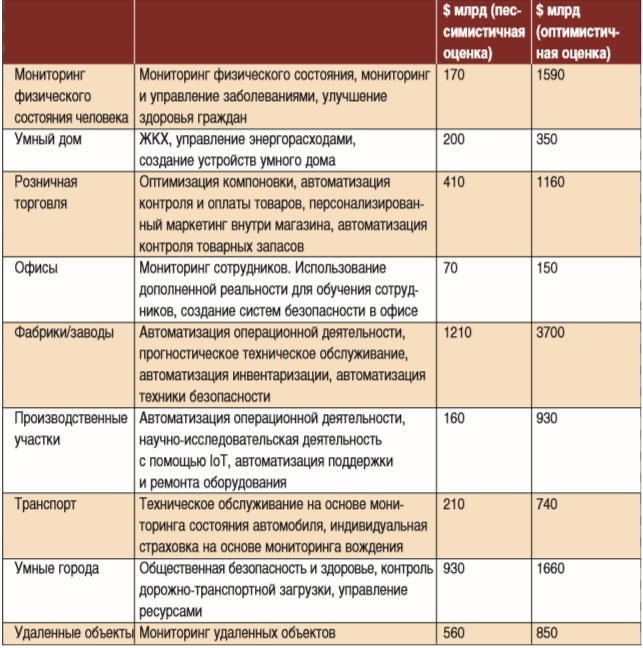

Table 3. The vertical structure of the IoT market by 2025 according to McKinse

As can be seen from table 3, the McKinsey forecast is the only one of the above given with a scatter, and for some categories the pessimistic and optimistic estimates differ significantly.

conclusions

To date, the IoT market estimates provided by various analytical companies are inconsistent. Market size may vary several times. Structuring the market is carried out according to internal methods, which makes it difficult to compare data from different analysts. Publications related to the size of the IoT market, as a rule, do not provide a methodology for evaluating the market and its structure, which aggravates the confusion. Given the importance of quantitatively describing the IoT market, the attention of the IoT community should be drawn to the problem. Vendors who are clients of analytical agencies should have a greater influence on the development of taxonomy, on the degree of its consistency between different providers of consulting services. This will make it possible to clarify market assessments, the role of vendors,

» Full article