The battle for consumer check: an analysis of Walmart and Amazon

- Transfer

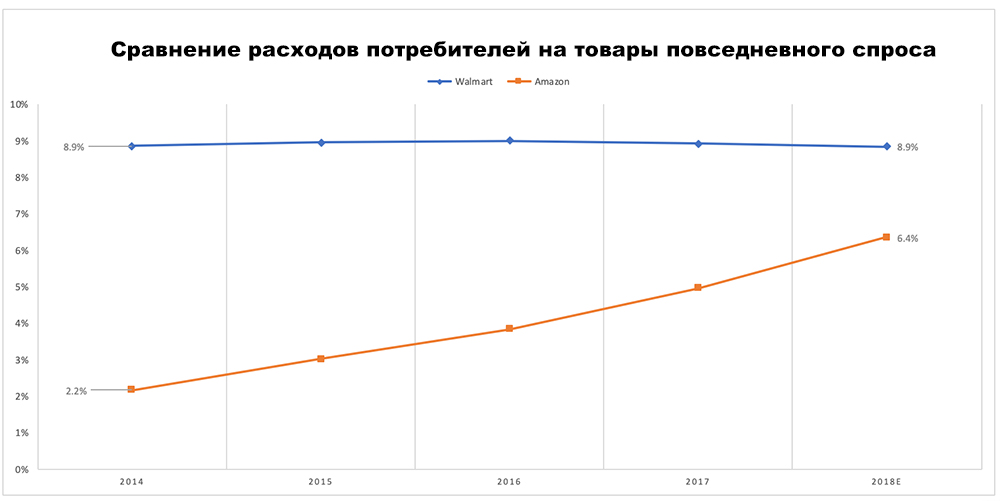

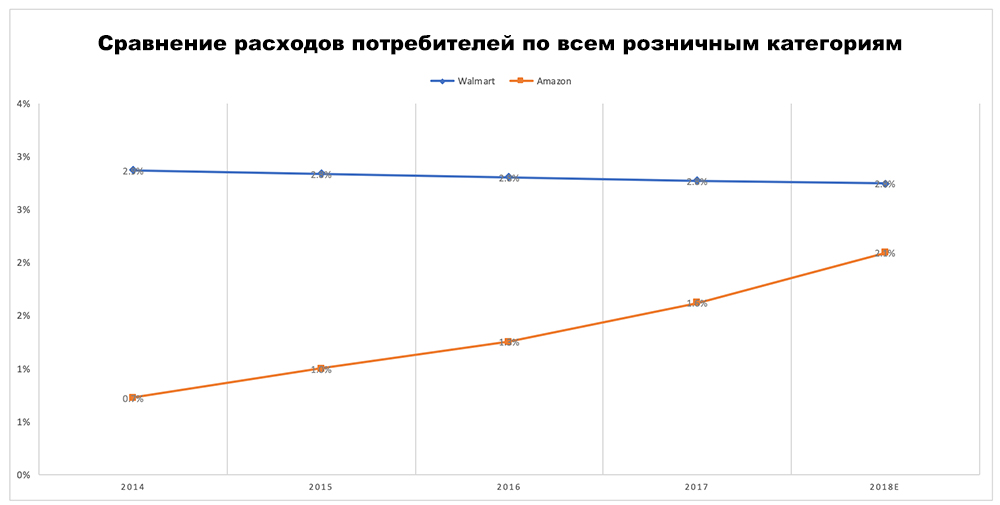

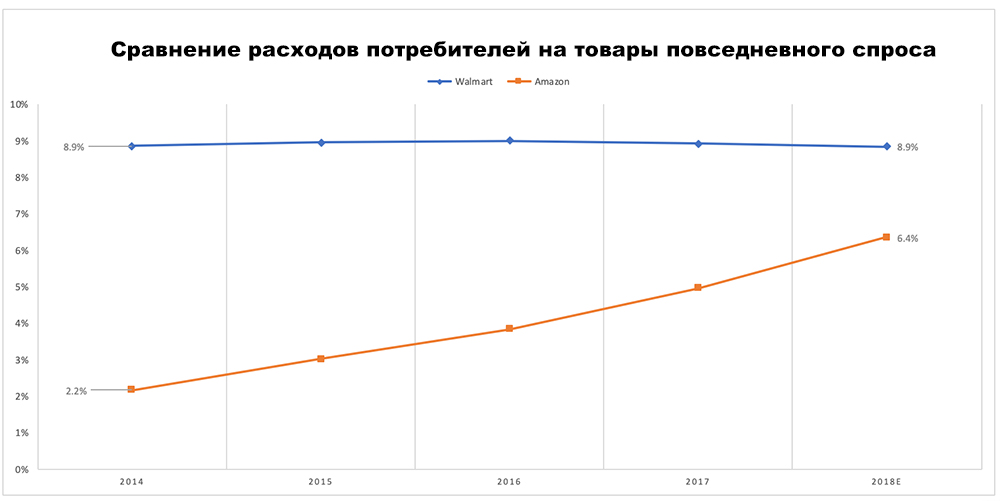

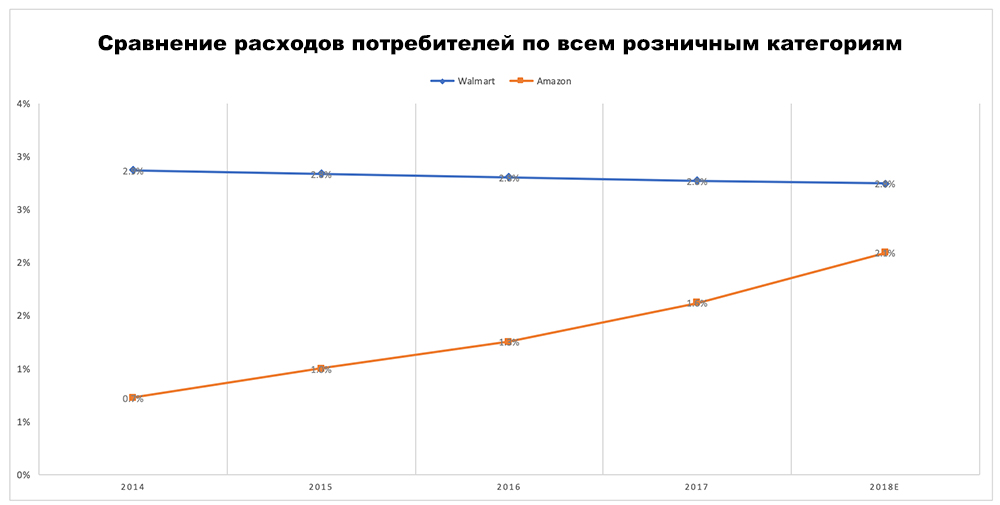

The analytic group PYMNTS conducted a new study and found that Walmart accounts for 8.9% of American spending on consumer goods. And in all retail categories, the company's figure is 2.8%. This is an impressive figure, but there is one thing.

On the heels of Walmart is the company Amazon with its shares of 6.4% and 2.1%. And, more importantly, the dynamics of changes in these indicators is clearly in favor of Amazon.

Comparison of consumer spending

Source: PYMNTS.com

Source: PYMNTS.com

According to the findings of PYMTNS, further the difference between the companies will be reduced even more rapidly, considering how much of Amazon’s purchases was won back from Walmart in many of the key and most sought-after categories. Amazon’s investment is also supported by the company's investment in retail-related segments, partnership agreements and explicit plans to continue development in this direction.

Consumer check analysis

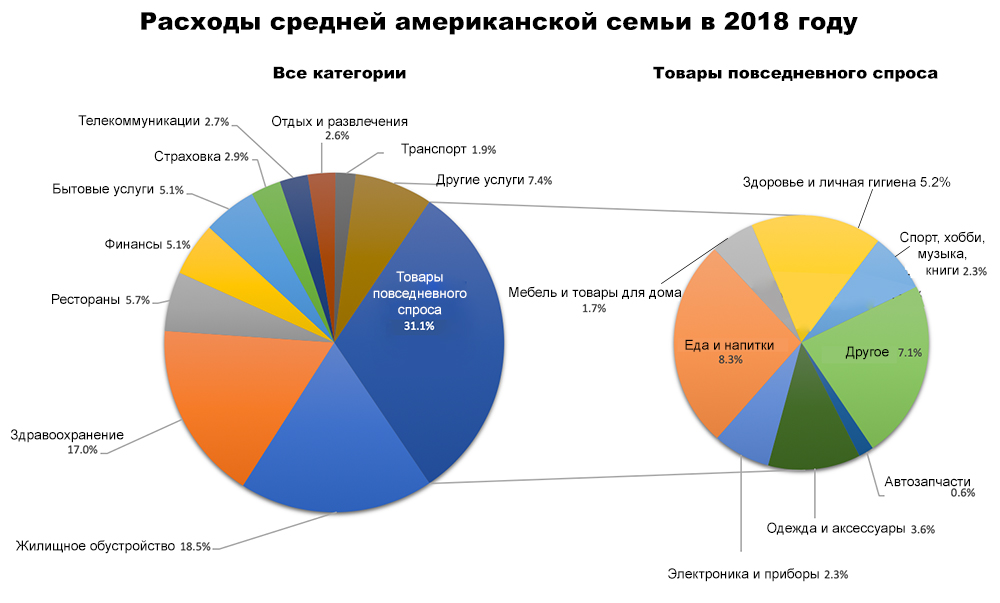

PYMNTS researchers first studied the data of sociological polls in order to estimate the sum of expenses of the average American family for all categories of goods in 2018.It turned out that it is 62 941 dollars.

After they traced how these funds are distributed in various categories. The lion's share of money (31%) was spent on consumer goods (food, clothing, electronics). In addition, products and services for housing (18.5%) and healthcare (17%) were in the top three.

Using various data sources and statistical techniques, analysts created their own data model and with its help calculated the “check index” for Amazon and Walmart. We have previously published PYMNTS material on Amazon check analysis .

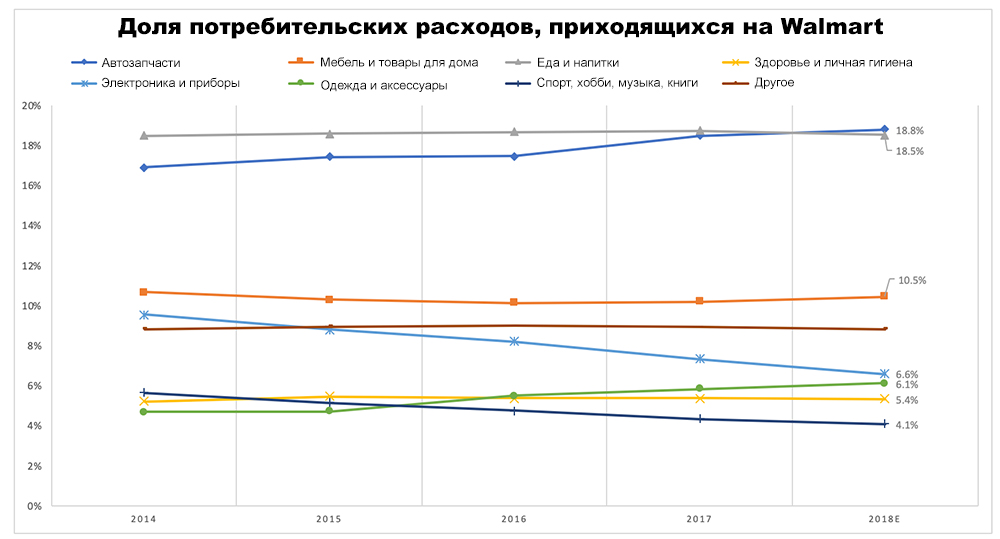

And this is what Walmart’s share of consumer spending is in all retail categories.

At first glance, the graph shows a positive trend. If we consider the segments in which consumers spend the most, such as food, auto parts, household goods, clothing and even health and hygiene products, here at Walmart things are going uphill.

Food and healthcare accounts for up to 44% of American retail spending. If we add to them the other sections listed, in which Walmart has positive results, then in general these segments account for about two thirds of all consumer spending. And the position of Walmart in these categories looks impressive.

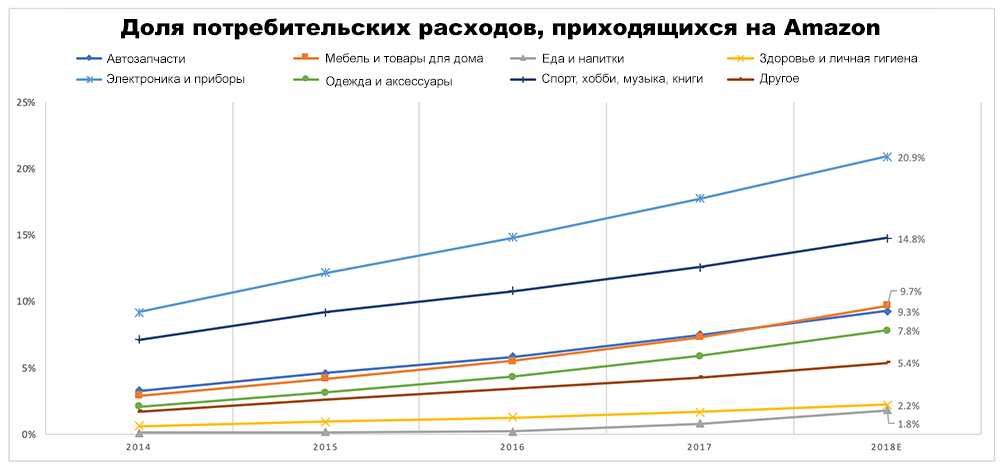

However, if you compare the results with the same chart Amazon, then the situation is not so rosy.

The difference in dynamics is visible to the naked eye. The curves on the Walmart chart are almost straight, while Amazon is seeing steady growth, including categories that will allow the company to quickly reduce the distance from Walmart.

It is obvious that the percentages of each company fade into the background. Ultimately, 2.1% of the size of all purchases and 6.4% in the segment of consumer goods are values that can be assessed differently. But, if we look at Amazon’s average annual growth rate over the past four years, it turns out that the company has steadily developed in the most sought-after segments, such as food (106%), car parts (32.7%), furniture and household goods (41, 8%), clothing (43%), electronics (27%), health and personal hygiene (43%).

More about the difference

The difference between Walmart, the largest retailer in the US by market capitalization, and Amazon, the largest digital retailer in the world, is declining due to several factors.

This is, above all, rapid growth in online sales, where Amazon has already won a 50% share.

Modern consumers prefer to order products online whenever the buying process does not cause them difficulties. And in 50% of cases, Americans do it on Amazon. Purchases are made either on the Amazon marketplace, or from one of the subsidiary brands, such as Zappos or Shopbop, or thanks to one of the 80 specialized brand brands that the company manages.

Walmart ranks third in the world ranking of the largest digital retailers. It sounds impressive, but only until the depth of the abyss between it and player number one is found - Amazon.

When comparing the success of the two giants, Amazon acquisitions and deals in different segments should be considered. Some allowed the company to improve its performance, while others, on the contrary, made Walmart stores a more attractive place to buy certain goods. In particular, we are talking about the acquisition of Whole Foods (food) and the purchase of PillPack (health care, prescription drugs) for $ 1 billion in June 2018.

Also, a certain role is played by the prevalence of Alexa and the growing popularity of voice control as a positive commercial factor. RecentThe PYMNTS study , conducted jointly with Visa, clearly demonstrated the attractiveness of voice systems. According to its results, almost a third of American consumers have at least one voice device, and 27% of them use it for shopping. Voice control systems are becoming more popular, and this factor will play into the hands of Amazon in the future, as Alexa expands its network.

As for Walmart, the company is completely dependent on the speed of popularization of Google voice assistant and his chances of winning the voice race from Alexa.

For Walmart this is a serious reason to think.

According to the study, Walmart has already ceded its position to Amazon in categories such as clothing, electronics, as well as sports, books and music. In the home goods segment, companies are almost on par with 10.5% of Walmart and 9.7% of Amazon. The latter achieved these results thanks to a four-year expansion and the recent launch of the branded furniture catalog.

Ultimately, this rivalry of giants comes down to the struggle for the title of the best company in the segments of food and health-related services. It is these categories that provide almost half (44%) of all consumer spending in physical stores.

Where the main struggle will unfold

Groceries for Walmart have always been the daily bread. But over the past four years, the share of Walmart in consumer spending in this segment has remained almost unchanged - 18.5%.

However, food products provide more than half (56%) of the company's sales, and in monetary terms this figure is huge. It also includes acquisitions under the American Concession Purchase Program. According to some reports, Walmart is the main place where beneficiaries pay off their food stamps.

Walmart's top management, of course, is well aware that groceries and competitive prices are one of the main drivers of sales and sources of investment in innovation, ensuring that consumers return for shopping tomorrow.

For example, a relatively new opportunity for self-shipment purchases will soon be available in 40% of all stores in the US, and the acquisition of Jet.com helped Walmart to improve online grocery sales. In addition, the company's investment in partner services helped Walmart significantly improve logistics in the final stages of delivery.

From the graph it becomes clear why Walmart pays so much attention to groceries and groceries. And why Amazon, in turn, acquired Whole Foods. In order to somehow shift the situation in the grocery segment to its advantage, Amazon needed a network of offline stores with streamlined logistics and convenient, affordable delivery options.

Now the difference in the volume of grocery sales between the two rivals is huge.

There is one more thing. Although the proportion of consumers who prefer to buy food and drinks online is growing in all age groups, the profit in this segment does not always depend on trips to offline or online stores. Restaurant services of ready-made food, weekly food packages and delivery contribute to the work of the market, forcing the giants Walmart and Amazon to adapt their offers to modern realities.

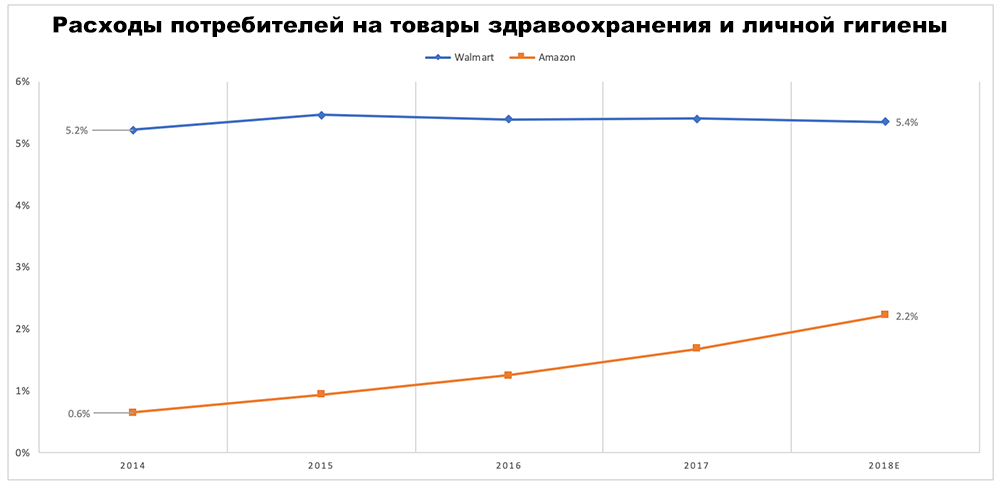

In addition to food and beverages, the category of “health care and personal hygiene” deserves special attention, which accounts for 5.2% of consumer spending. And this number is growing. So far, Walmart is leading the segment, but Amazon is quickly shortening the distance.

Today, Walmart is the fourth largest pharmaceutical supplier.in the US with annual sales of $ 20 million. Sale of prescription drugs not only increases profits, but also attracts more customers to stores, which is why the average bill is growing.

Walmart invests in improving service and simplifying the procedure for buying drugs. The retailer's application has become more tailor-made for prescription drugs, and express cash registers appeared in stores to expedite such purchases. There are 19 clinics in the retailer's network that offer typical, non-urgent medical care services.

Walmart has also implemented programs that motivate consumers to eat healthy foods and consult with doctors for several years. For example, women participating in the Medicaid program and following a doctor’s schedule before giving birth, get certain medicines at a more attractive price. There are similar incentives for other groups of patients, for example, those suffering from diabetes or hypertension. As the largest US employer, Walmart is working with insurance companies to reduce the cost of health care and insurance premiums for its 2.2 million employees by creating similar incentive programs.

Amazon's deal with PillPack, whose annual profit is $ 100 billion, will not soon allow the company to approach Walmart in this segment. But there is a reason why the total market capitalization of the largest suppliers of drugs fell by $ 13 billion after news of this deal. A similar fall, by the way, occurred with the shares of the largest grocery chains when Amazon announced the purchase of Whole Foods in June 2017.

Once the PillPack acquisition is completed, Amazon will receive an outlet for online sales of prescription drugs in 49 of the 50 US states. This creates a competitive threat to existing distributors, including Walmart, who, according to rumors, has long tried to achieve a similar deal with PillPack, but was refused every time.

The market reaction to the PillPack purchase news is linked to the expectation that Amazon will become a strong competitor by simplifying the online purchase of prescription drugs and offering delivery within one to two days.

Amazon, of course, also invests in other aspects of health care and products related to this area: from online sales of medical equipment to a joint venture venture with JPMorgan Chase and Berkshire Hathaway, aimed at revolutionizing the provision of medical services. At first, the pilot project will be launched only for its employees, and then, probably, it will become available for other volunteers.

Victory will be left to the consumer

Examining consumer spending in general and by category is an interesting way to see how Walmart and Amazon use their strengths and how they plan to increase the share of expenses that go to purchases in their stores.

Obviously, both companies understand that consumer preference will never be reduced only to choosing one or another channel of interaction. Rather, consumer sympathy will depend on which of the sites will provide the necessary goods with the least hassle for their purchase.

This trend is increasingly evident in the categories of products for which visiting a physical store was previously an important part of the buying process. To understand that significant changes in this segment have already occurred, just look at the share of Amazon in clothing and accessories or household goods.

For this reason, it is worth watching two large segments that can decide the outcome of this retail championship - groceries and health care. Pay attention to the investments of each company, aimed at improving positions in these categories, as well as the role that logistics will play. After all, both Walton himself and Jeff Bezos are well aware that the consumer is their boss, and that his word will be decisive.