Proof-of-Stake: a new business model in 2019?

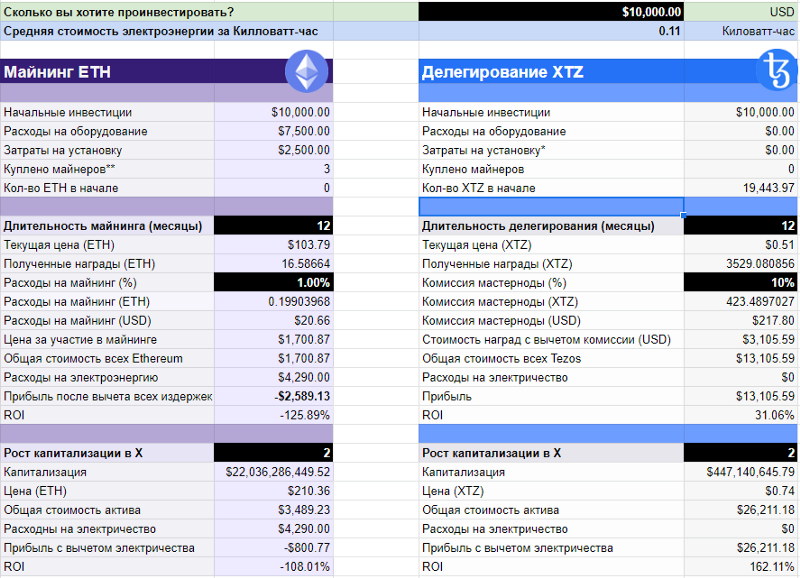

Many of us have heard what Proof-of-Work & Proof-of-Stake is, what are their main advantages and disadvantages, but let's try to calculate on real numbers what is the difference between PoW & PoS. In this article, we will “simulate” mining two assets: Ethereum (PoW) & Tezos (PoS), and then summarize.

What is the Proof-of-Work The

Proof-of-Work (proof of work) is an algorithm of consensus that is based on the proof of the work done. This process includes an attempt to find the hash of the block header, which contains a link to the previous block, and the total value of the transactions included in it.

Proof-of-Work involves the compulsory execution of labor-intensive calculations and at the same time quick and easy verification of results. This feature of the PoW algorithm is called time-wary asymmetry.

In the PoW technology, the decisive factor in finding a unit is the use of large computing power of its participants, and, therefore, there are problems associated with high energy costs.

The idea of the PoW mechanism appeared in 1993 to protect email from spam. The term Proof-of-Work itself appeared only in 1999. For the first time, PoW was implemented in 1997 in the HashCash project.

In a few words about Proof-of-Stake

Proof-of-Stake (confirmation of ownership) is a method of protection in cryptocurrencies, in which the probability of forming the next block in the blockchain is proportional to the proportion of cryptocurrency that belongs to the miner. Consequently, the miner with the highest balance is more likely to generate a new block.

In some networks using the PoS system, there is no reward for the unit, and the miners' income is only commissions per transaction. For mining in the PoS system there is a separate term - staking.

PoS is an alternative PoW mechanism, first implemented in 2012 in the PPCoin cryptocurrency (renamed PeerCoin). The idea of Proof-of-Stake is to solve the problem of Proof-of-Work associated with large amounts of electricity.

We learned the theory, now let's move to the practice of

Ethereum (ETH is a platform for creating decentralized blockchain-based online services operating on the basis of smart contracts.

Tezos (XTZ) is a software blockchain platform that can change and adapt through community consensus with minimal disruption network.

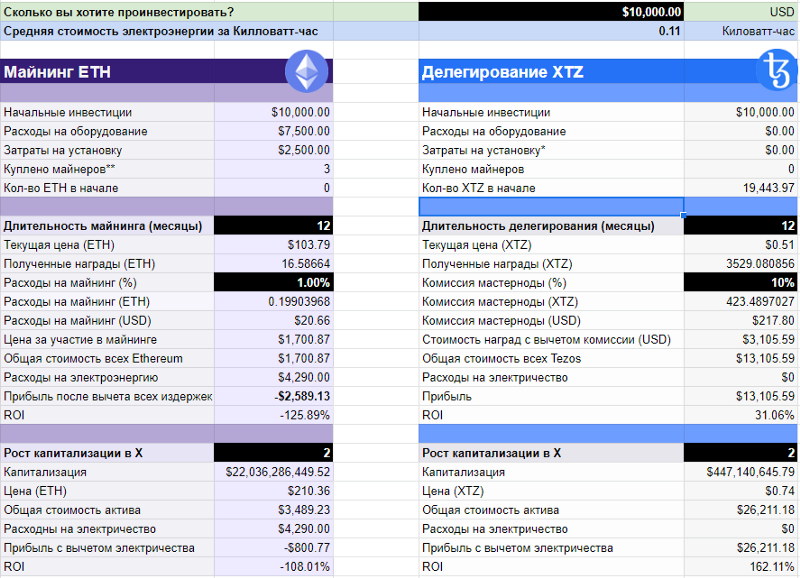

you can play around with the table on the link , go to the "File" and select "Duplicate", then change the values in these cells, and compare the results.

We will consider the main reasons why we see such a noticeable difference between PoW and PoS.

1. Scaling

Acne and Arthur decided to argue which consensus algorithm is better: PoW or PoS. Acne loves Ethereum, so he decided to mine it, and Arthur is an adherent of Tezos.

Acne bought several GPUs and within a year he successfully confirmed the blocks and received awards, the lion’s share of Ethereum's inked funds went to cover the costs (electricity / maintenance of the GPU, etc.), also it is necessary to take into account possible technical problems that occur during the operation of the GPU (for example cards or failure of a separate component).

At the same time, Arthur bought Tezos, in which only the presence of coins (XTZ) is required to participate in the validation of the blocks. Arthur finds a suitable Tezos pool for him, where he can delegate his XTZ. After a month, he checks his balance and sees a gain on n-XTZ from his initial deposit. Arthur leaves his tokens in the pool and does not withdraw profits, because he knows about compound interest . After some time, Acne and Arthur meet to compare who earned more. Here's what they did:

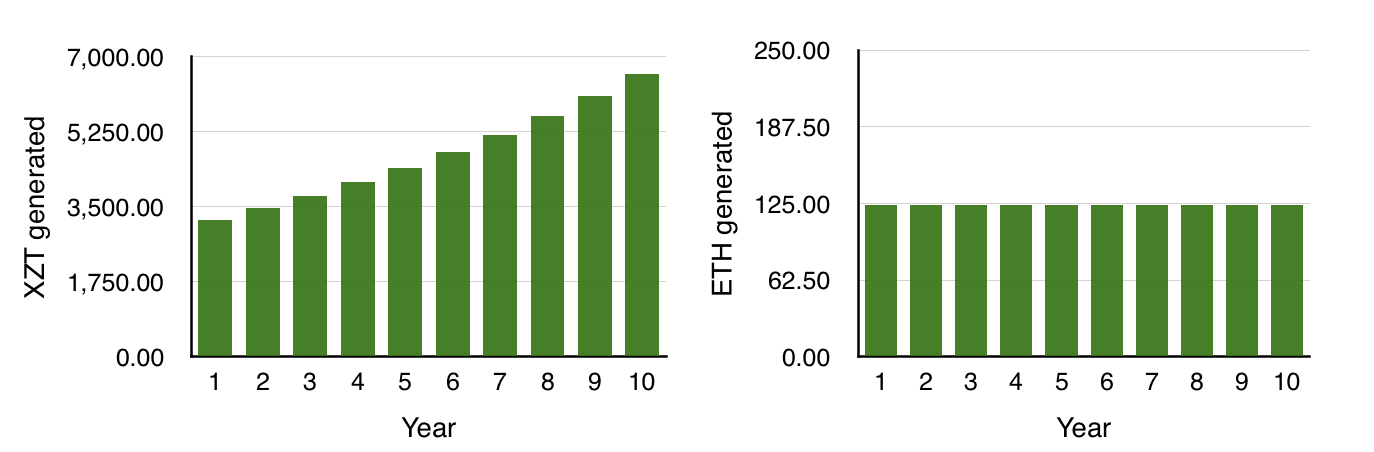

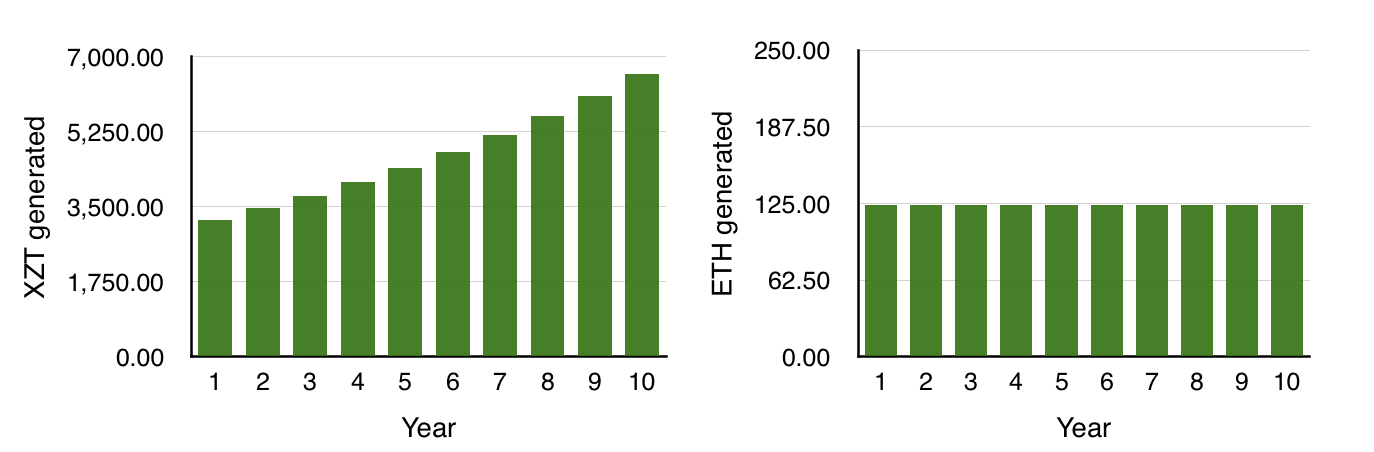

In the framework of the long-term strategy of both participants, for example, 10 years, their result will be very different.

Main reasons:The chance of creating a block in a PoS depends on the number of coins stored in the wallet, so if Arthur does not withdraw his earned rewards and leaves them in a steak, his chance of creating a block will increase each time.

In order to achieve the same result, Vitalik will have to invest in the purchase of equipment, his electricity consumption will grow, and in a more realistic scenario, he most likely will not have enough money to buy new GPUs with a net profit from PoW.

BUT! Not everything is so simple .... If each member of the network will act according to Arthur's strategy, then everyone will earn as much as they did at the beginning, because their share in the total steak does not increase in relation to the others.

The second important detail is Lock-up tokens and "Whales". For example, your share in the pool is 1%, which means you get 1% of all awards received by the pool. But then your share has dropped dramatically by 2 times! Why?

Firstly, it can be a large tokenholder who has passed the period of blocking tokens and he sent them to steak, thereby increasing his share and reducing yours.

Secondly, I have $ 20,000 and I decided to buy an XTZ to also take part in the PoS, when I send tokens to steak, I will blur your share in the distribution of pool rewards, thereby reducing your profitability.

2. Difficulties when selling a GPU

If you refer to the reports of Nvidia and other video card manufacturers, or even to the manufacturer of ASIC miners Bitmain, you will notice: mining equipment gets cheaper by 10% -40% annually, in some cases, it may fail at all.

Another important detail, you need to find a buyer who is ready to buy your GPU from you for an exhibited price, if you urgently need money - you can simply not get it. Also, in order for you to “mine” the same amount of Ethereum, you will have to “upgrade your fleet” with more powerful equipment.

In the case of PoS, you can withdraw an asset to the exchange and sell it in 15 minutes! (In some cases it is longer if there is some delay in withdrawal of awards in the protocol).

3. Losses from the fall of the asset are all, but with a slight difference ...

When Ethereum fell significantly in price, its mining became not just “not profitable”, it became unprofitable.

When you bought a GPU and started confirming blocks, you get a monthly bill for electricity, and the more GPU you have, the bigger the bill. It is at this moment that you can feel all the “pain” of your scale ... In fact, your farm, which brought you income. starts to grind you into debt ...

If you are a member of the PoS pool - your only loss is to reduce the cost of your steak in $, if you bought Tezos at $ 1, and tomorrow it is estimated at $ 0.5, in that case, The liquidity value of your asset has lost 50%, but you have no fixed costs, because you do not have the cost of electricity and the maintenance of the "farm". You can safely keep your assets in the pool and earn (XTZ).

If you are a PoS member who does not want to use the pool and keeps a full node on his own, then this is 1 VPS on Amazon Web Services or Digital Ocean. At the same time, your expenses are always on the same level and do not change on how many tokens you have on your wallet. When Tezos drops in price, you will suffer a loss, but it will be ~ $ 100 if you rent a powerful enough server. I use a DO Linux server with 8 GB of RAM / 160 SSD and it costs me $ 40 a month.

And what about safety, you ask ...

Any delegation of assets to the pool in the PoS systems, in most cases does not require the actual transfer of the asset to the owners of the pool, you transfer the “right” to validate the blocks by “freezing” your tokens. At any time you can stop this process, and no one except you has access to them. For example, Tezos has a smart contract that automatically distributes the reward to the pool members.

Will Proof-of-Stake replace its predecessor Proof-of-Work?

I do not have an answer to this question, at the moment we can only watch it from the side. And so far I have noticed how PoS is beginning to gain popularity, and more specifically StaaS (Staking-as-a-Service), when a company / foundation creates an infrastructure solution from scratch (servers, secure communication channels, secure key storage, etc.).

PoS is not a panacea, it is not better in all PoW, any choice carries with it a certain set of compromises.

This article does not describe attack vectors that can be conducted on PoS, does not consider options for “network capture” by a richer group and other fundamental parts. This article aims to explain why proof-of-stake reduces mining costs and potentially brings more profit than PoW.

Recently it became known that the Winkloss Fund, Pantera Capital and other large investment crypto funds invested $ 4,500,000 in a startup that provides StaaS-service (Staking-as-a-Service).

In America (the startup Staked was launched in New York), staking as a potential form of earnings on PoS-cryptocurrency is gaining rapid momentum.

Write why you think that PoS is the future of cryptocurrency? Or vice versa, why PoS cannot become a favorite among consensus algorithms.

What is the Proof-of-Work The

Proof-of-Work (proof of work) is an algorithm of consensus that is based on the proof of the work done. This process includes an attempt to find the hash of the block header, which contains a link to the previous block, and the total value of the transactions included in it.

Proof-of-Work involves the compulsory execution of labor-intensive calculations and at the same time quick and easy verification of results. This feature of the PoW algorithm is called time-wary asymmetry.

In the PoW technology, the decisive factor in finding a unit is the use of large computing power of its participants, and, therefore, there are problems associated with high energy costs.

The idea of the PoW mechanism appeared in 1993 to protect email from spam. The term Proof-of-Work itself appeared only in 1999. For the first time, PoW was implemented in 1997 in the HashCash project.

In a few words about Proof-of-Stake

Proof-of-Stake (confirmation of ownership) is a method of protection in cryptocurrencies, in which the probability of forming the next block in the blockchain is proportional to the proportion of cryptocurrency that belongs to the miner. Consequently, the miner with the highest balance is more likely to generate a new block.

In some networks using the PoS system, there is no reward for the unit, and the miners' income is only commissions per transaction. For mining in the PoS system there is a separate term - staking.

PoS is an alternative PoW mechanism, first implemented in 2012 in the PPCoin cryptocurrency (renamed PeerCoin). The idea of Proof-of-Stake is to solve the problem of Proof-of-Work associated with large amounts of electricity.

We learned the theory, now let's move to the practice of

Ethereum (ETH is a platform for creating decentralized blockchain-based online services operating on the basis of smart contracts.

Tezos (XTZ) is a software blockchain platform that can change and adapt through community consensus with minimal disruption network.

you can play around with the table on the link , go to the "File" and select "Duplicate", then change the values in these cells, and compare the results.

We will consider the main reasons why we see such a noticeable difference between PoW and PoS.

1. Scaling

Acne and Arthur decided to argue which consensus algorithm is better: PoW or PoS. Acne loves Ethereum, so he decided to mine it, and Arthur is an adherent of Tezos.

Acne bought several GPUs and within a year he successfully confirmed the blocks and received awards, the lion’s share of Ethereum's inked funds went to cover the costs (electricity / maintenance of the GPU, etc.), also it is necessary to take into account possible technical problems that occur during the operation of the GPU (for example cards or failure of a separate component).

At the same time, Arthur bought Tezos, in which only the presence of coins (XTZ) is required to participate in the validation of the blocks. Arthur finds a suitable Tezos pool for him, where he can delegate his XTZ. After a month, he checks his balance and sees a gain on n-XTZ from his initial deposit. Arthur leaves his tokens in the pool and does not withdraw profits, because he knows about compound interest . After some time, Acne and Arthur meet to compare who earned more. Here's what they did:

In the framework of the long-term strategy of both participants, for example, 10 years, their result will be very different.

Main reasons:The chance of creating a block in a PoS depends on the number of coins stored in the wallet, so if Arthur does not withdraw his earned rewards and leaves them in a steak, his chance of creating a block will increase each time.

In order to achieve the same result, Vitalik will have to invest in the purchase of equipment, his electricity consumption will grow, and in a more realistic scenario, he most likely will not have enough money to buy new GPUs with a net profit from PoW.

BUT! Not everything is so simple .... If each member of the network will act according to Arthur's strategy, then everyone will earn as much as they did at the beginning, because their share in the total steak does not increase in relation to the others.

The second important detail is Lock-up tokens and "Whales". For example, your share in the pool is 1%, which means you get 1% of all awards received by the pool. But then your share has dropped dramatically by 2 times! Why?

Firstly, it can be a large tokenholder who has passed the period of blocking tokens and he sent them to steak, thereby increasing his share and reducing yours.

Secondly, I have $ 20,000 and I decided to buy an XTZ to also take part in the PoS, when I send tokens to steak, I will blur your share in the distribution of pool rewards, thereby reducing your profitability.

2. Difficulties when selling a GPU

If you refer to the reports of Nvidia and other video card manufacturers, or even to the manufacturer of ASIC miners Bitmain, you will notice: mining equipment gets cheaper by 10% -40% annually, in some cases, it may fail at all.

Another important detail, you need to find a buyer who is ready to buy your GPU from you for an exhibited price, if you urgently need money - you can simply not get it. Also, in order for you to “mine” the same amount of Ethereum, you will have to “upgrade your fleet” with more powerful equipment.

In the case of PoS, you can withdraw an asset to the exchange and sell it in 15 minutes! (In some cases it is longer if there is some delay in withdrawal of awards in the protocol).

3. Losses from the fall of the asset are all, but with a slight difference ...

When Ethereum fell significantly in price, its mining became not just “not profitable”, it became unprofitable.

When you bought a GPU and started confirming blocks, you get a monthly bill for electricity, and the more GPU you have, the bigger the bill. It is at this moment that you can feel all the “pain” of your scale ... In fact, your farm, which brought you income. starts to grind you into debt ...

If you are a member of the PoS pool - your only loss is to reduce the cost of your steak in $, if you bought Tezos at $ 1, and tomorrow it is estimated at $ 0.5, in that case, The liquidity value of your asset has lost 50%, but you have no fixed costs, because you do not have the cost of electricity and the maintenance of the "farm". You can safely keep your assets in the pool and earn (XTZ).

If you are a PoS member who does not want to use the pool and keeps a full node on his own, then this is 1 VPS on Amazon Web Services or Digital Ocean. At the same time, your expenses are always on the same level and do not change on how many tokens you have on your wallet. When Tezos drops in price, you will suffer a loss, but it will be ~ $ 100 if you rent a powerful enough server. I use a DO Linux server with 8 GB of RAM / 160 SSD and it costs me $ 40 a month.

And what about safety, you ask ...

Any delegation of assets to the pool in the PoS systems, in most cases does not require the actual transfer of the asset to the owners of the pool, you transfer the “right” to validate the blocks by “freezing” your tokens. At any time you can stop this process, and no one except you has access to them. For example, Tezos has a smart contract that automatically distributes the reward to the pool members.

Will Proof-of-Stake replace its predecessor Proof-of-Work?

I do not have an answer to this question, at the moment we can only watch it from the side. And so far I have noticed how PoS is beginning to gain popularity, and more specifically StaaS (Staking-as-a-Service), when a company / foundation creates an infrastructure solution from scratch (servers, secure communication channels, secure key storage, etc.).

PoS is not a panacea, it is not better in all PoW, any choice carries with it a certain set of compromises.

PoW in Bitcoin allows anyone to send 1 BTC and go down confident that the transaction will reach the recipient, and the most important thing is that everyone can do it, thus PoW of Bitcoin creates social scalability, but sacrifices transaction processing speed.

PoS has a lower level of trust, but it provides more bandwidth. (For example, Tezos processes 1 block in 60 seconds).

This article does not describe attack vectors that can be conducted on PoS, does not consider options for “network capture” by a richer group and other fundamental parts. This article aims to explain why proof-of-stake reduces mining costs and potentially brings more profit than PoW.

Recently it became known that the Winkloss Fund, Pantera Capital and other large investment crypto funds invested $ 4,500,000 in a startup that provides StaaS-service (Staking-as-a-Service).

In America (the startup Staked was launched in New York), staking as a potential form of earnings on PoS-cryptocurrency is gaining rapid momentum.

Write why you think that PoS is the future of cryptocurrency? Or vice versa, why PoS cannot become a favorite among consensus algorithms.

Only registered users can participate in the survey. Sign in , please.