What could be a truly radical financial reform?

Those who studied at school remember that the usual geometry studied at school is called Euclidean geometry and is based on a small number of axioms. And if (which is usually not studied at school already) even one axiom is replaced by another - you get another and in many ways surprising non-Euclidean geometry.

The purpose of this short article is to formulate those “axioms” on which all modern monetary and financial systems are based, and then replace these axioms with others in order to see how theoretically the most radical reform of the existing monetary and financial system might look like.

The fundamentals or “axioms” on which the modern monetary and financial system is built

1. Each state has its own and one singleNational currency. Which is actually called money.

2. Money is scarce and their own intrinsic value is equal to the ratio of their deficit to their utility.

3. Money is always not only a means of payment , but also a means of accumulation and they themselves are a commodity.

4. Money is inseparable from banks and the banking system. And the banking system is always two-tier (these are commercial banks and the central bank above them as a lender of last resort in a system based on "partial reservation of deposits").

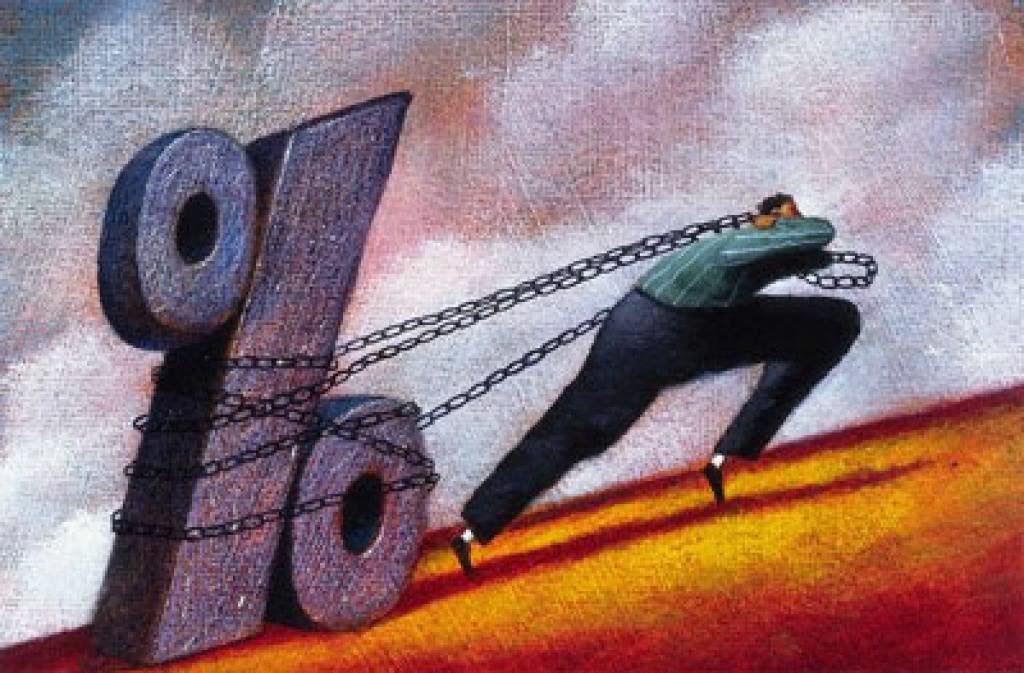

5. No one disputes the right of banks to take intereston loans issued and taken for granted, the right of depositors to receive interest income on their deposits. Those. you can (decently) talk and argue about the amount of interest on loans, but the very existence of loan interest in the economy is not disputed.

6. The only source of unambiguously non-inflationary financing of long-term investments is considered only long-term savings. Any other means of obtaining (or issuing) money for investment is at least potentially necessarily associated with the risk of increased inflation. This axiom, like the others given here, is considered practically unshakable.

7. Non-cash money (though cash involved in the turnover too) lives and moves exclusively within the framework of simple accounting entries - “debit-credit” - and these account entries are the movement, issue and availability of money. It can also be said that each monetary unit is always stored (recorded) in one specific place (in a bank, under a mattress, etc.).

From these axioms one can derive several interesting statements in themselves:

1. Since money is always the debts of some economic entities recognized by other entities and since the bulk of non-cash money is put into circulation through loans issued by commercial banks, your money is the debts of other people banks.

Thus, if all or even just many economic entities refuse to repay their loans, then the value of your personal money will immediately fall sharply.

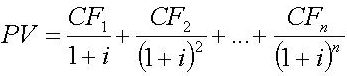

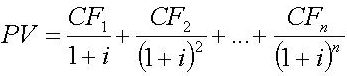

2. If having money can not only be saved, but also multiplied by receiving interest income on them for one reason or another, then this is equivalent to the fact that the value of the same amount of money today exceeds its value in the future (even if zero inflation).

This gives rise to the well-known method of estimating future cash flows with their discounting (the further into the future, the greater the discount).

But in this way, our money today makes us neglect the future . Do not believe?

Estimate for yourself the method of discounting the value of any constant cash flow over an interval of, say, 100 years. Perhaps you will immediately agree that it is much better to get all this money at once.

And if this stream is intended not only for you, but also for your children and grandchildren - will they agree with your desire to get everything immediately and leave nothing to them?

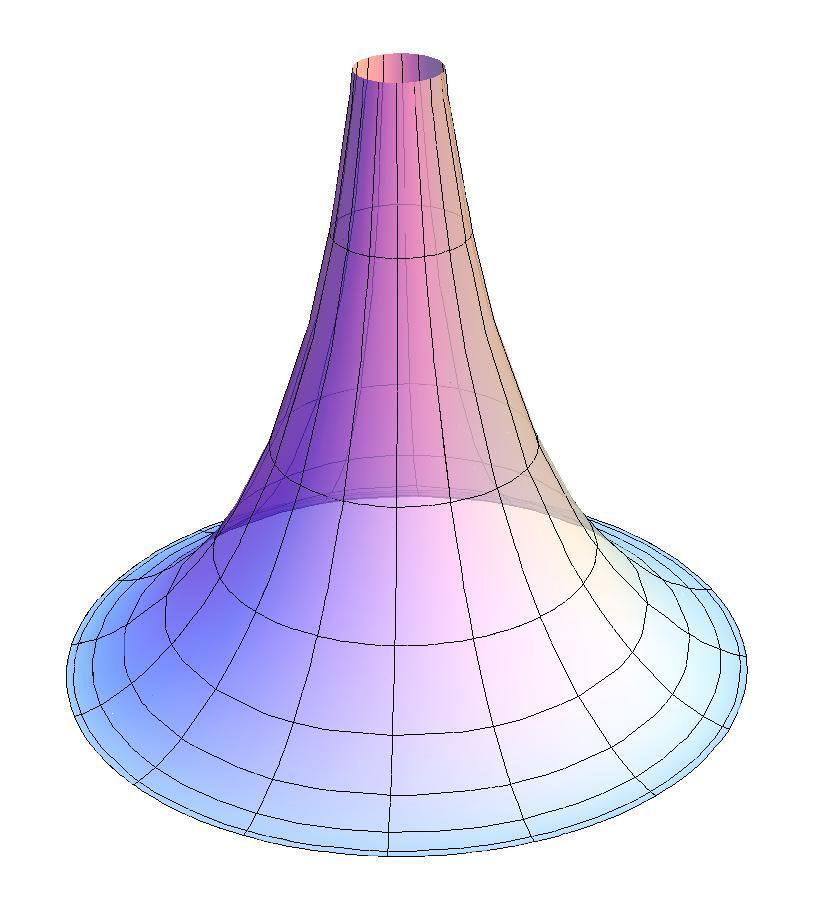

Now let’s imagine that the money is “getting old, worn out”, for possessing it you have to pay an amount proportional to the time of possession (this is a fee for simple or scientifically - demurrage).

Then a cash flow consisting of demurred money is much more interesting to stretch for 100 years than to grab it all at once. And the value of such money in the future becomes higher than its value today.

The importance of the axiomatization of the fundamentals of the monetary and financial system is, of course, connected not with these consequences-examples, but with the fact that it allows us to evaluate various proposals for reforms and improvements to the monetary system. And thereby distinguish real reforms from cosmetic improvements. And you can even (as stated at the beginning of this article) try to outline the contours of an effective reform of the financial system yourself.

As an example, let’s try to evaluate the proposals of the Stolypin Club from these positions - which are positioned as a development economy (authors: Titov, Glazyev and others).

The authors of the “development economy” suggest:

- create a system of concessional lending to the real sector of the economy at 5-6% per annum,

- reduce taxes on business,

- achieve stabilization of the ruble exchange rate,

- create new state "development institutions",

- reduce (limit more precisely) the number of inspections and freeze the tariffs of natural monopolies.

We will not criticize these proposals within the framework of the existing financial system. Such criticism has already been expressed enough. Let's look at only one thing - do they encroach on the basics? Hardly ever. They run into Axiom No. 6 only a little, claiming that it is not too conclusive for many that inflation will not increase from a small additional issue of “cheap” credit money. And actually all. No overthrow of the basics.

What is interesting - one of the authors - Glazyev is perceived by many as a conductor of the old and unsuccessful, according to probably the majority of socialist and communist ideas.

Only here he does not offer to use the best experience (and it is the most radical from the point of view of economics and finance) and the real experience of the past of our country.

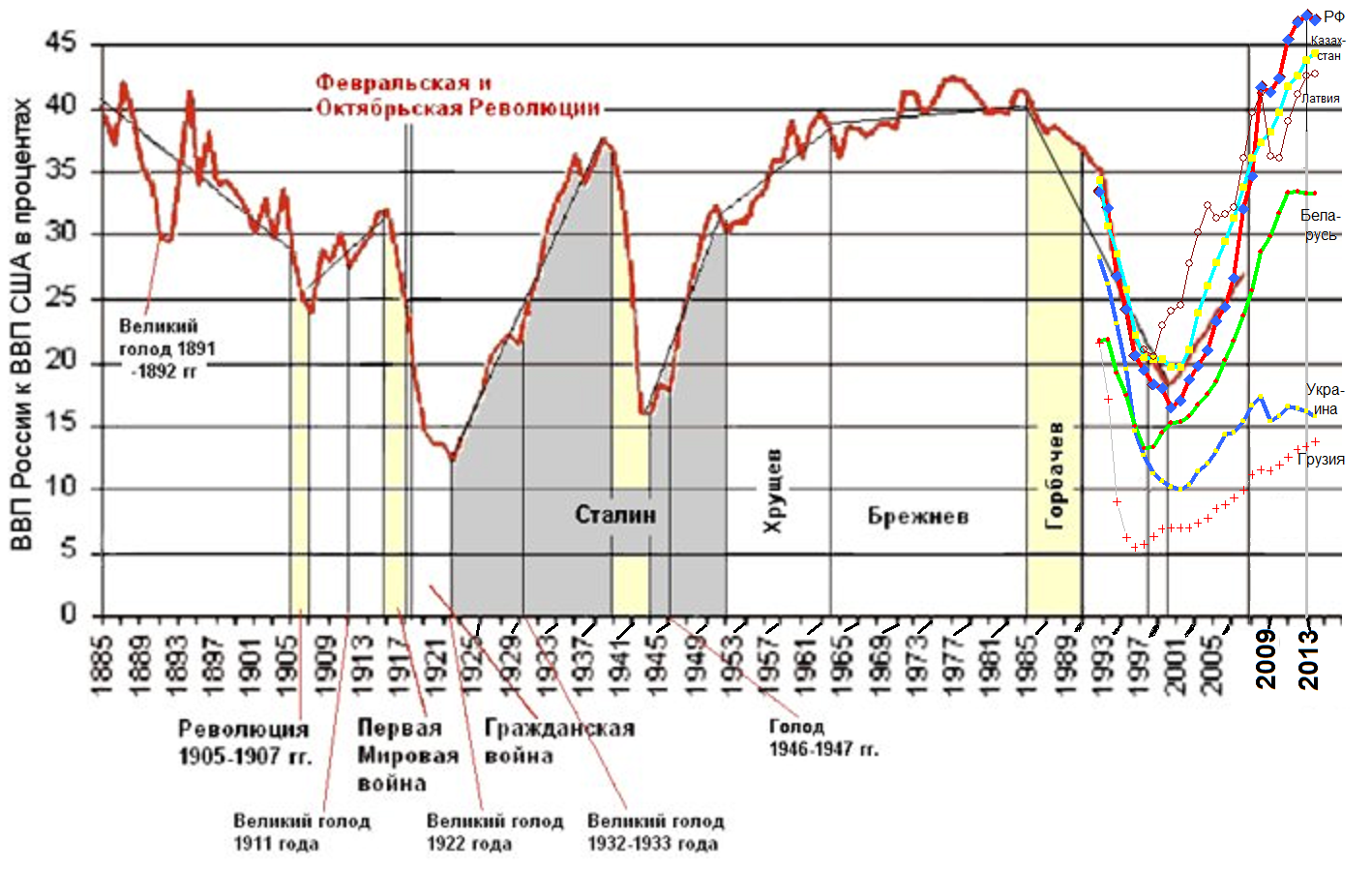

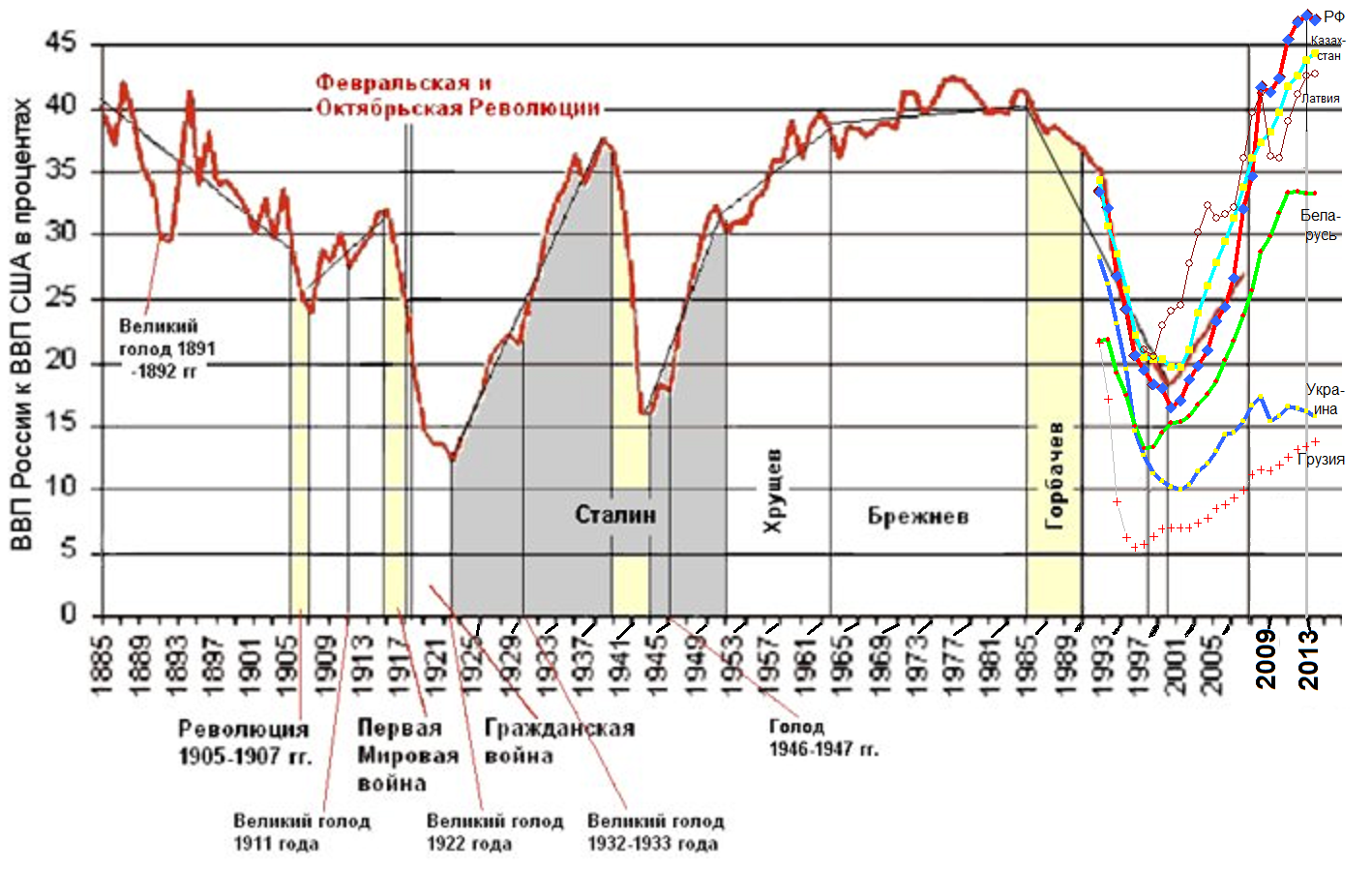

At the same time, in the 40-50s the monetary system was created in the USSR (purely empirically created, clever economists had no hands on it) the monetary system is completely different than now.

This experience was so strongly camouflaged by ideology (as then, and still now) that for a long time no one even analyzed it as an economic experience. Only relatively recently (Valentin Katasonov, Kurman Akhmetov) did individual attempts to begin an economic study of that period began to appear.

Then axioms No. 1 (the only currency), No. 2 (money is in short supply), No. 6 (the only source of financing investments - savings) were “violated” at the same time, and all other “axioms” were partially violated (except perhaps the last axiom). And this system worked roughly and roughly (of course very roughly and very roughly) like this:

- The means of production and in general the goods of group “A” could be bought and sold only for non-cash money. Saving, stealing this money was to some extent pointless.

- The transfer of non-cash money to the payroll and material incentive fund was practically prohibited. Thus, strictly speaking, various types of money acted with their individual ranges of circulation: non-cash rubles and cash rubles.

- Non-cash money The State Bank of the USSR could issue without thinking about inflation, and non-cash money seemed to be “drawn” strictly under the industrial production figures planned by the USSR State Planning Committee.

What economic results this led to can be found here http://www.sdelanounas.ru/blogs/9142.

Let us now look at other statements from the point of view of the “axiomatics” of the economy.

For example, Andrei Movchan is a representative of a good liberal school in my opinion (we will not talk about its bad representatives). In his opinion, it is necessary to focus on the following:

- To make our country attractive for investment and really protect property rights (of course !!!);

- Reduce the various risks of investors (of course !!!);

- Reduce the role of the state in the economy (more likely than not, but with reservations);

- Reduce regulation and supervision (yes too).

A good liberal program, though it does not promise quick successes, and again - essentially a cosmetic one, since it does not affect a single economic foundation at all.

Are there any more radical proposals in the monetary sphere in the world?

Yes there is. For example, many Western economists are promoting (for a long time and not the first time) the idea of abandoning partial reservations, making 100% reservation of deposits, and even possibly returning to the gold standard (axiom No. 4 is canceled). Radically? Yes. It is especially impressive that thereby canceling the fraud of banks that have been legalized for centuries, and which repeatedly issue the same deposit money on credit. I really have this idea - if it is considered as the only idea of reform - I do not like it at all. Because the scarcity of money will not disappear from this. As a result, the economy will not get better from such a reform.

Another thing worth mentioning is “helicopter” money (this is a complete move, even brought to a logical absurdity, a departure from money shortages) or, say, a currency backed by inventories (the currency of “Terra” by Bernard Lietar). However, in my opinion, it is more useful to go straight to the point for which it is all actually written.

What is the most radical reform of the financial system that can be conceived in order to abandon dogmas that seem unshakable and build a truly radically different monetary and financial system. Be sure to rely not on pure speculation, but on the experience that has already been accumulated by a variety of civilizations.

However, first you need to formulate the main goals of the Real Radical Reform of the Money System.

Strategic goals are to ensure that:

1. The money that is used as a means of settlement would always be enough in the economy. That there was no need to even discuss how much money the economy needs. So that the pace (and direction) of economic development is determined not by the ability to finance something, but only by the availability of available material resources and a little demand.

2. So that no one seeks to be rich in money, and no one believes that the sign of success is money.

3. That the economic activity of people as much as possible depended on themselves, and not on decisions of central government bodies.

In principle, these basic goals should be enough.

But besides strategic, a closer tactical goal is needed. And it is simple, it does not need to be reinvented: it is the accelerated (faster than in any other countries) growth of Gross Domestic Product - GDP.

We agree immediately that this goal is exclusively tactical. Having ensured accelerated GDP growth afterwards and on the basis of this, one might think on what exactly this growth (or growth) of GDP should be directed “to guns or oil”. It would be something to share.

And of course, you must at least give a general answer to the following question: is a radical reform really needed or is a good liberal program enough?

I believe now the situation in the Russian economy is partly reminiscent of the one that developed in our country in the 30s of the last century.

And then and now, accelerated modernization (then industrialization) of the economy is required (required). And then and now it was necessary to prepare for war at the fastest pace.

The only difference is that at that time it was an almost inevitable ordinary war, and now a new type of war is already going on and it cannot be defeated without creating a new civilization based on a solid economic foundation. About the need to build not only a new economy, but also a new civilization - I have to limit myself to this statement - otherwise we will go too far away from the topic.

Now let's start shattering the foundations of the financial system (joke).

It is almost obvious that a single national currency cannot solve all the problems of economic reform. Yes, the national currency must exist (it also unites the state, among other things), but certainly not one, but .... there can and should be many. This can be done as follows:

1. To finance investments in what is called heavy industry, in large infrastructure projects, in the development of natural monopolies, etc. - it is necessary (preferably) to use special money, limited in circulation (I wrote about this earlier (post 22268).

And this will be well combined with the experience of industrialization and post-war reconstruction in the USSR in the 40-50s.

Let me remind you again, then non-cash loans of the State Bank were used for financing, which were drawn in accordance with the plan of the State Planning Commission and which could not (or should not have been) influence the amount of money in wage and material incentive funds. And accordingly, they did not require the presence of population accumulations.

And as one of the mechanisms for putting these investment money into circulation, one can use the accounting of enterprise bills, i.e. to finance real transactions, as it was at first with the gold gold of the USSR. By the same Special Means of Settlements, you can pay the state share in project financing.

Thus, first of all, it is possible to exclude a rigid connection between the amount of investment money and the accumulations of citizens and organizations.

For comparison, I note that in the current monetary system, remaining within the framework of liberal approaches, money for investments can only be accumulated, stolen, or taken away (for example, from other countries or from their own future). There are no other options for accelerating economic growth in the liberal paradigm.

2. Back to our mental reform.

We will not be limited to the introduction of one new additional state currency - Special Means of Settlement. In order to additionally overcome the money shortage syndrome and to mitigate the effect of the impossibility of accurately determining the amount of money needed by the economy, it is necessary to allow (and to begin with, just allow) the introduction of local additional currencies in one of two forms: either according to the time-money scheme, or as money with demurrage.

This proposal is again based both on the experience of many civilizations of both the past and our own current experience (for example, the local “money” of Shaimuratovo). In many countries, by the way, local local money has long been allowed (in Germany, for example).

Further. An effective barrier (obstruction, prohibition) should be put to the use of new funds for settlements as goods, including for currency speculation. Since speculation on the stock exchange is relatively harmless (the question of their usefulness is also a really big and interesting question), speculation on the foreign exchange market is a necessary evil, which does not bring any real benefit to the economy.

It may not even be necessary to introduce taxes on the purchase of foreign currency or other restrictions on the purchase and sale of foreign currency for the “main national currency” if you widely and consistently use money with demurrage.

Thus, along the way, the task of strengthening the ruble exchange rate will be partially solved. Strengthening for now will be enough - this should not be an independent goal.

Moving further along the list of axioms we come to the banking system. Now, after a real quantitative easing, based on the introduction of a multicurrency national monetary system, it's time to also refuse to partially reserve deposits (i.e. introduce 100% reserve deposits), which will give the following serious bonuses:

- legalized, as I wrote, is eliminated commercial bank fraud;

- there will be no need for many of the current functions of the Central Bank, and in the future it may be possible in it, at least in its current form;

- the stability of the banking system to any crises will increase;

- it will be possible to practically begin to destroy in the medium term the loan interest itself, which will remove the last objective reason for the lack of money - as a means of settlement.

However, if for new Settlement Means or other new money to finance investments (as well as for local currencies), 100% reservation must be entered and postulated immediately, then the transition to 100% reservation of the usual national currency can be gradual and smooth.

Limiting the scope of the ordinary currency issued by banks operating (as yet) under partial reservation conditions will make not only desirable, but also inevitable, a sharp decline in what the Bank of Russia calls the key rate. I cannot prove this thesis.

But the goal is to eliminate the destructive influence not only on the economy, but also on all people's behavior - loan interest - this goal must be achieved one way or another.

Monetary policy issues are closely linked to inflation. And inflation is not only of monetary nature. And therefore, there should be a separate reform subprogram aimed at eliminating the non-monetary causes of inflation. In particular, the growth of tariffs of natural monopolies.

Here, I would attribute the following to useful trifles:

different money for enterprises and individuals can allow not administratively but economically stop the growth of tariffs of natural monopolies. To do this, you can use the following technique: what the population pays is only for the salaries of the workers of these monopolies and can be quite simply regulated and limited. Those. tariffs will cover only live labor, and all development programs of natural monopolies are financed with special money for investment and are not included in the tariffs at all.

It wasn’t me who invented it, I read it somewhere and considered it right. And then if tariffs continue to rise, then only in proportion to (and even lagging behind) the growth of real cash incomes of the population (the entire population, including both working and pensioners, but without taking into account the narrow layer of the richest).

This will be the first stage of a radical reform. The second stage I would not undertake to describe yet, although it is obvious that it must be followed quickly enough so that the stated goals are fully realized. But first, it will be necessary to obtain and comprehend the experience of the implementation of the first stage.

However, I will make one remark. These notes do not touch on the last axiom - the money now existing is the numbers on bank accounts made by simple double entry. This money is always stored (recorded) strictly in one place. And it would be necessary to change this axiom, which can be done using cryptocurrency technologies.

But here it’s still difficult to make any real offers, because all the cryptocurrencies I know (let's say for definiteness Bitcoin and Dash) cannot, in principle, pretend to be the ideal money, because in everything else, apart from the mechanism of their issue and storage, they are based on those the same axioms as ordinary money. Although not, they have already abandoned the axiom of bank obligation. They do not need banks at all. Is that why they are trying to ban them? Is anonymity and the possibility of using it to finance terrorism and for other bad purposes more an excuse?

But now they are unfortunately much more exchange commodities than a means of settlement. And there are no prerequisites for them to cease to be a commodity and a means of accumulation. Although I look at Dash cryptocurrency with great interest. At least she solved the problem of self-financing her development.

Existing cryptocurrencies are also inherently deficient in nature like ordinary money. And their number has nothing to do with the needs of economic turnover.

I believe that the third or some future generations of cryptocurrencies can nevertheless begin to be widely used in the real economy, primarily as a means of calculation, and at the same time they (I would like to achieve this) will cease to be a commodity, will not be in short supply, will not be used for accumulation but they will retain and strengthen their advantages of distributed emission and distributed storage of information.

Of course, the above is not an economic program - it is only one of the methods for developing (or analyzing) economic programs (and / or currencies) with a little use of ideas and techniques from the natural sciences.

But if you saw in it the features of economic reform, then for the convenience of perception I summarize what exactly is proposed (or what it is proposed to think about):

1. We introduce a multicurrency national monetary system. In particular, we introduce certain types of new money to finance the modernization of the economy. Allow local additional currencies.

2. All new types of money, both national and local, work with the requirement of 100% reservation of deposits. And to the maximum extent, demurrage is used as a means of preventing the leakage of money from settlements.

3. Banks are not (should not be) obligatory participants in settlement systems. Where you can do without them, we get by. If banks, on a competitive basis, try to integrate themselves into new settlement systems, please. But there should not be any initial legislative preferences for banks.

4. The role of project financing is increasing, and in a more general sense, the role of planning, including national planning.

5. The system for setting tariffs for natural monopolies is changing. Their growth cannot be higher than the growth of real cash income of the bulk of the population of a particular region (and, of course, without taking into account the growth of incomes of the richest), and all development and modernization programs are financed by special investment money.

6. Instead of fighting everything that is not the ruble, a policy of state support (not of indiscriminate course, but purposeful) is pursued for local currency systems, cryptocurrencies and other potential new means of payment. After all, you can fight against, and you can lead.

The purpose of this short article is to formulate those “axioms” on which all modern monetary and financial systems are based, and then replace these axioms with others in order to see how theoretically the most radical reform of the existing monetary and financial system might look like.

The fundamentals or “axioms” on which the modern monetary and financial system is built

1. Each state has its own and one singleNational currency. Which is actually called money.

2. Money is scarce and their own intrinsic value is equal to the ratio of their deficit to their utility.

3. Money is always not only a means of payment , but also a means of accumulation and they themselves are a commodity.

4. Money is inseparable from banks and the banking system. And the banking system is always two-tier (these are commercial banks and the central bank above them as a lender of last resort in a system based on "partial reservation of deposits").

5. No one disputes the right of banks to take intereston loans issued and taken for granted, the right of depositors to receive interest income on their deposits. Those. you can (decently) talk and argue about the amount of interest on loans, but the very existence of loan interest in the economy is not disputed.

6. The only source of unambiguously non-inflationary financing of long-term investments is considered only long-term savings. Any other means of obtaining (or issuing) money for investment is at least potentially necessarily associated with the risk of increased inflation. This axiom, like the others given here, is considered practically unshakable.

7. Non-cash money (though cash involved in the turnover too) lives and moves exclusively within the framework of simple accounting entries - “debit-credit” - and these account entries are the movement, issue and availability of money. It can also be said that each monetary unit is always stored (recorded) in one specific place (in a bank, under a mattress, etc.).

From these axioms one can derive several interesting statements in themselves:

1. Since money is always the debts of some economic entities recognized by other entities and since the bulk of non-cash money is put into circulation through loans issued by commercial banks, your money is the debts of other people banks.

Thus, if all or even just many economic entities refuse to repay their loans, then the value of your personal money will immediately fall sharply.

2. If having money can not only be saved, but also multiplied by receiving interest income on them for one reason or another, then this is equivalent to the fact that the value of the same amount of money today exceeds its value in the future (even if zero inflation).

This gives rise to the well-known method of estimating future cash flows with their discounting (the further into the future, the greater the discount).

But in this way, our money today makes us neglect the future . Do not believe?

Estimate for yourself the method of discounting the value of any constant cash flow over an interval of, say, 100 years. Perhaps you will immediately agree that it is much better to get all this money at once.

And if this stream is intended not only for you, but also for your children and grandchildren - will they agree with your desire to get everything immediately and leave nothing to them?

Now let’s imagine that the money is “getting old, worn out”, for possessing it you have to pay an amount proportional to the time of possession (this is a fee for simple or scientifically - demurrage).

Then a cash flow consisting of demurred money is much more interesting to stretch for 100 years than to grab it all at once. And the value of such money in the future becomes higher than its value today.

The importance of the axiomatization of the fundamentals of the monetary and financial system is, of course, connected not with these consequences-examples, but with the fact that it allows us to evaluate various proposals for reforms and improvements to the monetary system. And thereby distinguish real reforms from cosmetic improvements. And you can even (as stated at the beginning of this article) try to outline the contours of an effective reform of the financial system yourself.

As an example, let’s try to evaluate the proposals of the Stolypin Club from these positions - which are positioned as a development economy (authors: Titov, Glazyev and others).

The authors of the “development economy” suggest:

- create a system of concessional lending to the real sector of the economy at 5-6% per annum,

- reduce taxes on business,

- achieve stabilization of the ruble exchange rate,

- create new state "development institutions",

- reduce (limit more precisely) the number of inspections and freeze the tariffs of natural monopolies.

We will not criticize these proposals within the framework of the existing financial system. Such criticism has already been expressed enough. Let's look at only one thing - do they encroach on the basics? Hardly ever. They run into Axiom No. 6 only a little, claiming that it is not too conclusive for many that inflation will not increase from a small additional issue of “cheap” credit money. And actually all. No overthrow of the basics.

What is interesting - one of the authors - Glazyev is perceived by many as a conductor of the old and unsuccessful, according to probably the majority of socialist and communist ideas.

Only here he does not offer to use the best experience (and it is the most radical from the point of view of economics and finance) and the real experience of the past of our country.

At the same time, in the 40-50s the monetary system was created in the USSR (purely empirically created, clever economists had no hands on it) the monetary system is completely different than now.

This experience was so strongly camouflaged by ideology (as then, and still now) that for a long time no one even analyzed it as an economic experience. Only relatively recently (Valentin Katasonov, Kurman Akhmetov) did individual attempts to begin an economic study of that period began to appear.

Then axioms No. 1 (the only currency), No. 2 (money is in short supply), No. 6 (the only source of financing investments - savings) were “violated” at the same time, and all other “axioms” were partially violated (except perhaps the last axiom). And this system worked roughly and roughly (of course very roughly and very roughly) like this:

- The means of production and in general the goods of group “A” could be bought and sold only for non-cash money. Saving, stealing this money was to some extent pointless.

- The transfer of non-cash money to the payroll and material incentive fund was practically prohibited. Thus, strictly speaking, various types of money acted with their individual ranges of circulation: non-cash rubles and cash rubles.

- Non-cash money The State Bank of the USSR could issue without thinking about inflation, and non-cash money seemed to be “drawn” strictly under the industrial production figures planned by the USSR State Planning Committee.

What economic results this led to can be found here http://www.sdelanounas.ru/blogs/9142.

Let us now look at other statements from the point of view of the “axiomatics” of the economy.

For example, Andrei Movchan is a representative of a good liberal school in my opinion (we will not talk about its bad representatives). In his opinion, it is necessary to focus on the following:

- To make our country attractive for investment and really protect property rights (of course !!!);

- Reduce the various risks of investors (of course !!!);

- Reduce the role of the state in the economy (more likely than not, but with reservations);

- Reduce regulation and supervision (yes too).

A good liberal program, though it does not promise quick successes, and again - essentially a cosmetic one, since it does not affect a single economic foundation at all.

Are there any more radical proposals in the monetary sphere in the world?

Yes there is. For example, many Western economists are promoting (for a long time and not the first time) the idea of abandoning partial reservations, making 100% reservation of deposits, and even possibly returning to the gold standard (axiom No. 4 is canceled). Radically? Yes. It is especially impressive that thereby canceling the fraud of banks that have been legalized for centuries, and which repeatedly issue the same deposit money on credit. I really have this idea - if it is considered as the only idea of reform - I do not like it at all. Because the scarcity of money will not disappear from this. As a result, the economy will not get better from such a reform.

Another thing worth mentioning is “helicopter” money (this is a complete move, even brought to a logical absurdity, a departure from money shortages) or, say, a currency backed by inventories (the currency of “Terra” by Bernard Lietar). However, in my opinion, it is more useful to go straight to the point for which it is all actually written.

What is the most radical reform of the financial system that can be conceived in order to abandon dogmas that seem unshakable and build a truly radically different monetary and financial system. Be sure to rely not on pure speculation, but on the experience that has already been accumulated by a variety of civilizations.

However, first you need to formulate the main goals of the Real Radical Reform of the Money System.

Strategic goals are to ensure that:

1. The money that is used as a means of settlement would always be enough in the economy. That there was no need to even discuss how much money the economy needs. So that the pace (and direction) of economic development is determined not by the ability to finance something, but only by the availability of available material resources and a little demand.

2. So that no one seeks to be rich in money, and no one believes that the sign of success is money.

3. That the economic activity of people as much as possible depended on themselves, and not on decisions of central government bodies.

In principle, these basic goals should be enough.

But besides strategic, a closer tactical goal is needed. And it is simple, it does not need to be reinvented: it is the accelerated (faster than in any other countries) growth of Gross Domestic Product - GDP.

We agree immediately that this goal is exclusively tactical. Having ensured accelerated GDP growth afterwards and on the basis of this, one might think on what exactly this growth (or growth) of GDP should be directed “to guns or oil”. It would be something to share.

And of course, you must at least give a general answer to the following question: is a radical reform really needed or is a good liberal program enough?

I believe now the situation in the Russian economy is partly reminiscent of the one that developed in our country in the 30s of the last century.

And then and now, accelerated modernization (then industrialization) of the economy is required (required). And then and now it was necessary to prepare for war at the fastest pace.

The only difference is that at that time it was an almost inevitable ordinary war, and now a new type of war is already going on and it cannot be defeated without creating a new civilization based on a solid economic foundation. About the need to build not only a new economy, but also a new civilization - I have to limit myself to this statement - otherwise we will go too far away from the topic.

Now let's start shattering the foundations of the financial system (joke).

It is almost obvious that a single national currency cannot solve all the problems of economic reform. Yes, the national currency must exist (it also unites the state, among other things), but certainly not one, but .... there can and should be many. This can be done as follows:

1. To finance investments in what is called heavy industry, in large infrastructure projects, in the development of natural monopolies, etc. - it is necessary (preferably) to use special money, limited in circulation (I wrote about this earlier (post 22268).

And this will be well combined with the experience of industrialization and post-war reconstruction in the USSR in the 40-50s.

Let me remind you again, then non-cash loans of the State Bank were used for financing, which were drawn in accordance with the plan of the State Planning Commission and which could not (or should not have been) influence the amount of money in wage and material incentive funds. And accordingly, they did not require the presence of population accumulations.

And as one of the mechanisms for putting these investment money into circulation, one can use the accounting of enterprise bills, i.e. to finance real transactions, as it was at first with the gold gold of the USSR. By the same Special Means of Settlements, you can pay the state share in project financing.

Thus, first of all, it is possible to exclude a rigid connection between the amount of investment money and the accumulations of citizens and organizations.

For comparison, I note that in the current monetary system, remaining within the framework of liberal approaches, money for investments can only be accumulated, stolen, or taken away (for example, from other countries or from their own future). There are no other options for accelerating economic growth in the liberal paradigm.

2. Back to our mental reform.

We will not be limited to the introduction of one new additional state currency - Special Means of Settlement. In order to additionally overcome the money shortage syndrome and to mitigate the effect of the impossibility of accurately determining the amount of money needed by the economy, it is necessary to allow (and to begin with, just allow) the introduction of local additional currencies in one of two forms: either according to the time-money scheme, or as money with demurrage.

This proposal is again based both on the experience of many civilizations of both the past and our own current experience (for example, the local “money” of Shaimuratovo). In many countries, by the way, local local money has long been allowed (in Germany, for example).

Further. An effective barrier (obstruction, prohibition) should be put to the use of new funds for settlements as goods, including for currency speculation. Since speculation on the stock exchange is relatively harmless (the question of their usefulness is also a really big and interesting question), speculation on the foreign exchange market is a necessary evil, which does not bring any real benefit to the economy.

It may not even be necessary to introduce taxes on the purchase of foreign currency or other restrictions on the purchase and sale of foreign currency for the “main national currency” if you widely and consistently use money with demurrage.

Thus, along the way, the task of strengthening the ruble exchange rate will be partially solved. Strengthening for now will be enough - this should not be an independent goal.

Moving further along the list of axioms we come to the banking system. Now, after a real quantitative easing, based on the introduction of a multicurrency national monetary system, it's time to also refuse to partially reserve deposits (i.e. introduce 100% reserve deposits), which will give the following serious bonuses:

- legalized, as I wrote, is eliminated commercial bank fraud;

- there will be no need for many of the current functions of the Central Bank, and in the future it may be possible in it, at least in its current form;

- the stability of the banking system to any crises will increase;

- it will be possible to practically begin to destroy in the medium term the loan interest itself, which will remove the last objective reason for the lack of money - as a means of settlement.

However, if for new Settlement Means or other new money to finance investments (as well as for local currencies), 100% reservation must be entered and postulated immediately, then the transition to 100% reservation of the usual national currency can be gradual and smooth.

Limiting the scope of the ordinary currency issued by banks operating (as yet) under partial reservation conditions will make not only desirable, but also inevitable, a sharp decline in what the Bank of Russia calls the key rate. I cannot prove this thesis.

But the goal is to eliminate the destructive influence not only on the economy, but also on all people's behavior - loan interest - this goal must be achieved one way or another.

Monetary policy issues are closely linked to inflation. And inflation is not only of monetary nature. And therefore, there should be a separate reform subprogram aimed at eliminating the non-monetary causes of inflation. In particular, the growth of tariffs of natural monopolies.

Here, I would attribute the following to useful trifles:

different money for enterprises and individuals can allow not administratively but economically stop the growth of tariffs of natural monopolies. To do this, you can use the following technique: what the population pays is only for the salaries of the workers of these monopolies and can be quite simply regulated and limited. Those. tariffs will cover only live labor, and all development programs of natural monopolies are financed with special money for investment and are not included in the tariffs at all.

It wasn’t me who invented it, I read it somewhere and considered it right. And then if tariffs continue to rise, then only in proportion to (and even lagging behind) the growth of real cash incomes of the population (the entire population, including both working and pensioners, but without taking into account the narrow layer of the richest).

This will be the first stage of a radical reform. The second stage I would not undertake to describe yet, although it is obvious that it must be followed quickly enough so that the stated goals are fully realized. But first, it will be necessary to obtain and comprehend the experience of the implementation of the first stage.

However, I will make one remark. These notes do not touch on the last axiom - the money now existing is the numbers on bank accounts made by simple double entry. This money is always stored (recorded) strictly in one place. And it would be necessary to change this axiom, which can be done using cryptocurrency technologies.

But here it’s still difficult to make any real offers, because all the cryptocurrencies I know (let's say for definiteness Bitcoin and Dash) cannot, in principle, pretend to be the ideal money, because in everything else, apart from the mechanism of their issue and storage, they are based on those the same axioms as ordinary money. Although not, they have already abandoned the axiom of bank obligation. They do not need banks at all. Is that why they are trying to ban them? Is anonymity and the possibility of using it to finance terrorism and for other bad purposes more an excuse?

But now they are unfortunately much more exchange commodities than a means of settlement. And there are no prerequisites for them to cease to be a commodity and a means of accumulation. Although I look at Dash cryptocurrency with great interest. At least she solved the problem of self-financing her development.

Existing cryptocurrencies are also inherently deficient in nature like ordinary money. And their number has nothing to do with the needs of economic turnover.

I believe that the third or some future generations of cryptocurrencies can nevertheless begin to be widely used in the real economy, primarily as a means of calculation, and at the same time they (I would like to achieve this) will cease to be a commodity, will not be in short supply, will not be used for accumulation but they will retain and strengthen their advantages of distributed emission and distributed storage of information.

Of course, the above is not an economic program - it is only one of the methods for developing (or analyzing) economic programs (and / or currencies) with a little use of ideas and techniques from the natural sciences.

But if you saw in it the features of economic reform, then for the convenience of perception I summarize what exactly is proposed (or what it is proposed to think about):

1. We introduce a multicurrency national monetary system. In particular, we introduce certain types of new money to finance the modernization of the economy. Allow local additional currencies.

2. All new types of money, both national and local, work with the requirement of 100% reservation of deposits. And to the maximum extent, demurrage is used as a means of preventing the leakage of money from settlements.

3. Banks are not (should not be) obligatory participants in settlement systems. Where you can do without them, we get by. If banks, on a competitive basis, try to integrate themselves into new settlement systems, please. But there should not be any initial legislative preferences for banks.

4. The role of project financing is increasing, and in a more general sense, the role of planning, including national planning.

5. The system for setting tariffs for natural monopolies is changing. Their growth cannot be higher than the growth of real cash income of the bulk of the population of a particular region (and, of course, without taking into account the growth of incomes of the richest), and all development and modernization programs are financed by special investment money.

6. Instead of fighting everything that is not the ruble, a policy of state support (not of indiscriminate course, but purposeful) is pursued for local currency systems, cryptocurrencies and other potential new means of payment. After all, you can fight against, and you can lead.