Banks Credit Suisse and UBS accused of coordinating a boycott of Apple Pay and Samsung Pay

Image: Ben30 | CC BY-SA 2.0

Swiss Anti-Monopoly Service WEKO has launched an investigation into large banks. The agency suspects financial institutions are colluding to slow down the development of mobile payment technology in the country. Searches were conducted in searches of a number of banks, including Credit Suisse and UBS.

What's the matter

According to media reports, Swiss authorities suspect local banks of a coordinated boycott of mobile payment services, such as Apple pay and Samsung Pay.

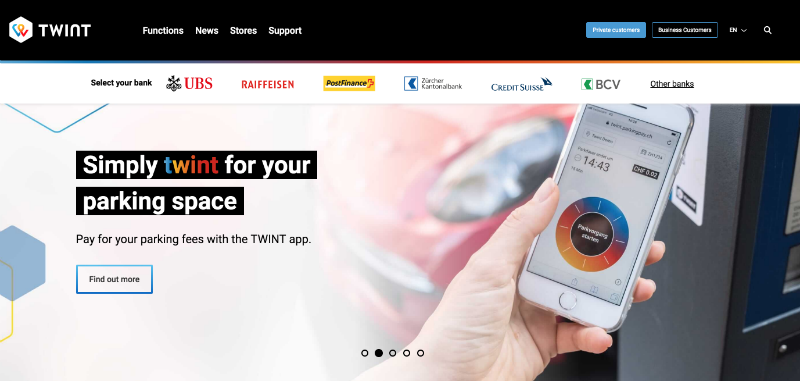

Financial companies could consistently block the possibility of using cards issued by them in such services. The local mobile payment service TWINT benefited from this decision . This project is a joint initiative of large Swiss banks.

TWINT said that the company’s offices were also searched, despite the fact that it’s at the moment the authorities are not investigating it. In addition, TWINT confirmed that they had previously filed a formal complaint against Apple because of unfair competition - in the opinion of the management of the payment service, the Cupertino-based company hampered “the trouble-free operation of TWINT apps in iOS”.

Bank response

Bank Credit Suisse issued a special statement: “We are surprised at the beginning of the investigation, and are convinced that it will not reveal our guilt. Our customers can use Apple Pay and Samsung Pay services through a subsidiary of Swisscard, 50% of which is owned by Credit Suisse. In addition, we spent several months talking to providers of mobile payment solutions, including Apple, Samsung, and Google. ” In addition, a company representative said that the bank will continue to work with the local mobile payment service Twint.

In UBS noted that they were negotiating with Apple, but they ended in vain.

“We do not comment on the current investigation, but we can report that in 2016 we tried to reach an agreement with Apple several times. We offered several alternative options for cooperation, but the agreement was never reached. ”

The Apple Pay system began operating in Switzerland in 2016, at the same time the TWINT project was launched. According to the service, at the moment the technology of mobile payments is not particularly developed in the country - it accounts for only about 0.2% of all transactions. However, by April 2018, TWINT was able to attract 750,000 users.

Switzerland is not the only country where banks are trying to counteract the development of popular mobile payment services. For example, last year, the Australian Anti-Monopoly Service forced large financial companies abandon the development and coordinated promotion of their own contactless payment solutions.

Other materials on finance and stock market from ITI Capital :

- Western securities analysis tool

- Analytics and market reviews

- Purchase of shares of American companies from Russia

- Huawei overtook Apple in terms of sales. The capitalization of the American company still reached $ 1 trillion

- Analysts: Microsoft's capitalization could reach $ 1 trillion

- Mass media: large-scale cyber attacks accelerated the growth of capitalization of companies from the information security industry

- Bloomberg: Hedge Funds Recognize Brexit Results Before Others And Earn Billions