There was no sadness - taxes were met: how and why Google had to pay $ 185 million in bills in the UK

As time goes on, nothing changes , at least with respect to the world's first Internet company and the second by market capitalization. Since the large (and it is tempting to write “oligarchic”, in the light of recent years) Internet business breaks the traditional notions about the structure of not only the corporate structure and management (and hence tax deductions), but also how the client consumes and where pays for a particular service or product — the schemes used in doing so (like the Bermuda-Irish structure of a legal entity with the pretty name “Irish Double Dutch Sandwich” ) are expected to annoy the states and the authorities in them.

“I like to sell Ireland. We have something to offer ”- these words were pronouncedin October 2013, Fergel O'Rourke, an Irishman, the father of one of the country's most famous women politicians, and by type of business, he is a tax lawyer who specializes in tax gaps in national laws.

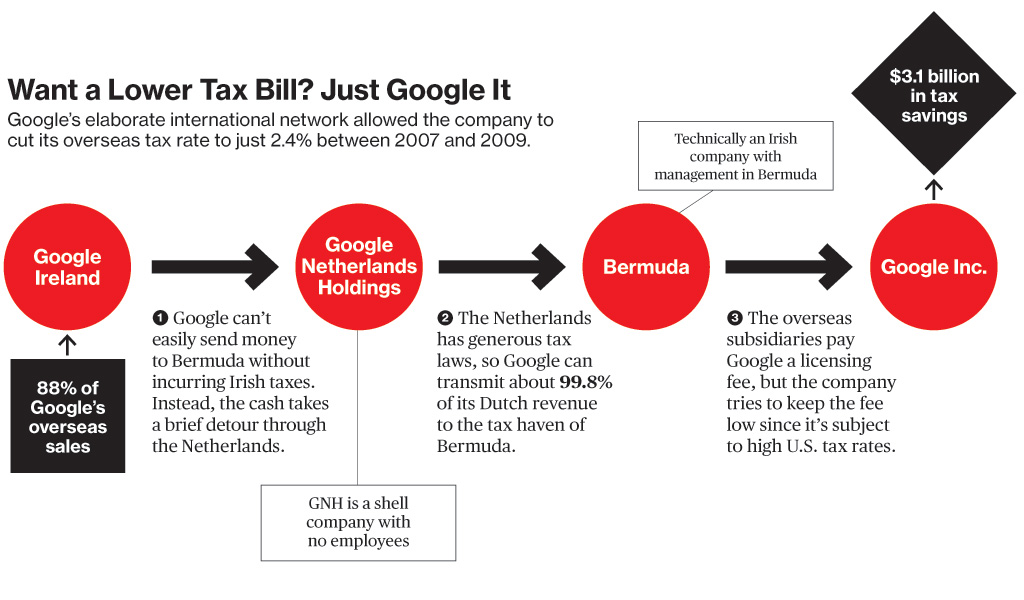

Now we know that it was O'Rourke who offered Google in Ireland - a double saving on corporate taxes. The effective rate in Ireland is 12.5% of revenue, versus 28% in the UK. Thus, over the past 10 years, Google has underpaid a fantastic amount ($ 3.1 billion) to the tax department of the country, which it promised to "reimburse in a reasonable amount."

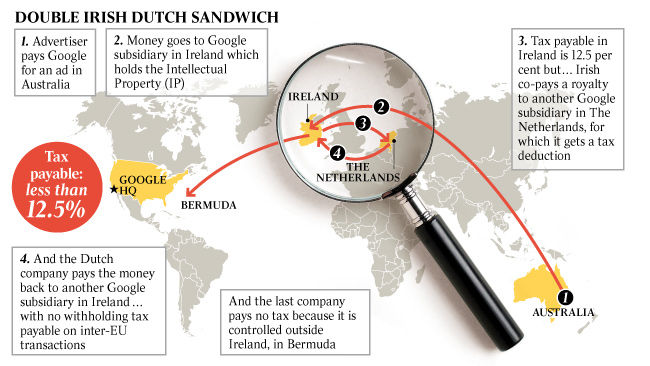

Because in 2013 in the tax, probably, no one received a bonus, at the moment when the news reached the authorities - for £ 3.8 billion (± 5.4 billion dollars) of revenue, the company paid £ 20 million of taxes in the UK. In Australia, where in 2014 Google transferred $ 9.4 million to the tax authority (at a rate of 16%), they also ask questions: “Why is it so little?” And “Where is the money?”. In France, tax officials are claiming it up to 1 billion euros - officials are unhappy that business profits in this country are accounted for in Ireland.

Because any lord, having heard such news, instantly drops the snuffbox on the floor and falls into righteous anger both regarding Google specifically and reprinting books for free, as well as with all similar companies, along with the notorious Irish separatists who are exposed in exactly such the light.

And after all, Google is far from the only one - since 2008, when Ireland carried out reforms in response to the growing economic crisis in the country, its corporate income rate attracted all the giants, from Apple, Facebook, Blizzard, Amazon and Microsoft, to transnational giants in traditional industries: trade (look at the map below - the first and largest commodity exchange is still operating in Amsterdam), energy, transportation and logistics (Ireland is the largest “hangar” in the world), metallurgy.

The scheme, by the way, is quite simple: an Irish company that accumulates profit at a rate of 12.5% minus royalties (additional royalties) in favor of a company from the Netherlands (minus because the state returns a tax deduction for this, since the Dutch company holds a part of intellectual property) , representing the lion's share of revenue, which is subsequently transferred to another Irish company that does not pay any taxes for transactions within the European Union.All these companies use Irish jurisdiction to accumulate profits from Europe, the Middle East and Africa - this is a known fact. The fact that the British auditors took so much time to scrupulously calculate only proves that “everything goes according to plan”, and the statements of Lord Chancellor George Osborne in Parliament that this is “the first important victory in the struggle that the government is leading to to force companies to pay fair taxes on business in the United Kingdom "looks at least strange after the announcement of the introduction of a special" diversified "income tax for companies trying to optimize in March-April last year tax payments in the UK with the help of offshore zones (way, Ireland, from a UK perspective, is). The tax, by the way, is called: "on Google."

“The total actual revenue per legal entity - corporate tax rate - license (in the second case, taken into account in the total revenue per legal entity) = 1.5 1.5 net profit (double taxation gives one and a half total load on revenue)"

“It seems that the parties have once again concluded an amicable agreement,” the BBC said on Saturday. Because for these comfortable 10 years, the company will pay only $ 185 million.

We have been observing the same thing over the past few years in the United States, where President Barack Obama has publicly expressed gratitude to companies that "returned the money back to their homeland." This is the deoffshorization trend that the O'Rourke family is laughing at. At this moment, Mark Zuckerberg hurriedly finds out from the financial director whether the proceeds from the United States go only to the American account and whether she alone, and Jeff Bezos has a drone.

The question is who is next in line. Law enforcement on the island works fine no matter what, and the general theatrical background, rather, helps to hide the main movement of the play - no one will escape justice, whether it concerns taxes or something else. Yes, decisions can be slow, yes, in the course of events a huge number of questions arise that need to be answered. But the fact that the bill should be paid, the parties converge quickly enough.

In England, Google agreed that these decisions are retroactive in the future, and although the amount of tax payments for the company has increased, it will continue to use the “double Irish” scheme, paying less taxes in Ireland due to the need to pay royalties to the company registered in Bermuda. That is, as in that joke: “it’s easier to give you a hundredth than to knock your hand down”, and $ 18 million a year looks disproportionate against the background of a cash register of $ 5 billion. But, Lords, they’re either tired of fighting, or they understand that if you don’t overdo it, it will come off well, it’s good that they agreed on even the future.

The Irish government says it intends to eradicate such schemes in the future. In the meantime, drink at our expense (on which the profit of half the world is vacuumed).