How to determine the best time for a transaction on the exchange

Understanding when it is worth buying, and when to sell stocks on the stock exchange is the most important task of any investor. From the correct choice of time depends on the fact of the presence of profit, and its size.

The trend of recent years is the emergence of automated tools that help to catch such a moment based on Big Data analysis and machine learning. We at ITI Capital have also developed such a product called ITI Global , and in today's material we’ll tell you what data analyzes such systems.

Actions of major players and insiders

One of the most important elements of market analysis, which is difficult for private investors to use on their own, is an analysis of the volume of purchases and sales of hedge funds and insiders in comparison with the average indicators for the sector. For example, if funds get rid of a certain stock, then the probability of reducing the price of this stock increases, even though the other players do not yet follow the emerging trend.

Our ITI Global system provides data not only on activity of hedge funds. Investment companies are ranked according to the price and profitability of their portfolios - these data are tracked quarterly since 2014. As a result, users can easily track the success of the fund, its most visible transactions and get all the details, including the name of the asset manager. This allows you to understand the actions of which the company to give more attention.

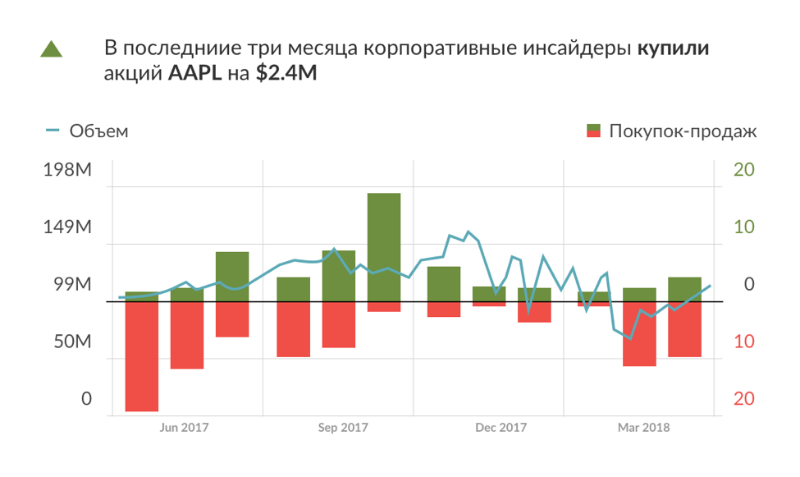

Another category of market participants, whose activity is to be monitored, is insiders. As a rule, this is the name of people associated with a company whose shares are traded on the exchange. These insiders must report on their stock exchange transactions. For example, in the USA, insiders are employees of the company, top managers and shareholders who own more than 10% of the share capital of the company.

Searching for insider reporting and analyzing it manually is extremely time-consuming. Our service also notes the most vivid sales and purchases of recent times automatically. The algorithm can separate ordinary, planned transactions from sales and purchases that demonstrate confidence in the future of the company.

We see and show users the volume of shares bought and sold by insiders for the last quarter. Thanks to these figures, it is possible to assess insiders' confidence in the stability of the situation around their company.

Using Big Data

Financial markets are a collection of different data. Their analysis provides detailed information on making financial decisions on a global scale. However, the market only reflects the final decision of the investor that he buys the stock or sells it.

Usually, a limited amount of trading data is available to a private investor who is armed only with a trading terminal. He can see the volume, analyze charts, supply and demand in the stock exchange and so on. However, he cannot accurately determine the level of confidence of other market players in a particular stock.

In an effort to solve this problem, some traders even tried to develop their own analysis systems. Example - Google Trends based systemto determine market sentiment, where the frequency of search queries is taken into account. However, in practice, this method does not show high efficiency.

The Big Data algorithms make it possible to obtain much more accurate forecasts by analyzing the aggregated information on tens of thousands of investment portfolios and highlighting the general purchases-sales of securities for a certain period. For example, ITI Global shows transactions in 30 days - this allows an investor to see the level of trust in various financial assets (how many investors bought or sell a security), group them into blocks and more precisely plan a strategy.

In addition, our scoring algorithm allows us to assign a rating to successful investors and highlight the trading signals generated based on their actions.

News Analysis

News can seriously affect the stock market - there are plenty of examples. Human psychology is such that when he sees a threat, he begins to act, often without taking the time to verify the reality of the threat. Therefore, when seeing news about the problems of the company, whose shares it holds in its portfolio, the investor is more likely to want to get rid of them.

These are even used by scammers, such as the Scottish trader Alan Craig , who became famous a couple of years ago. He fell for creating fake accounts of two analytic companies on Twitter. In them, he published false information about the opening of investigations against companies Audience Inc. and Sarepta Therapeutics. As a result, their shares fell by 28% and 16%, respectively, and the trader managed to buy them at the peak of the fall.

It is because of such a serious impact of news that public companies are trying to minimize the leakage of negative business in the media. For example, they often hide information about cyber attacks on their infrastructure.

Obviously, to create a successful strategy for working in the market, it is extremely important to analyze the news agenda. To do this, our system follows the news with an assessment of growth and decline. The conversational language handler (NLP) handles news by recommending a sale or purchase.

The robot scans thematic resources and collects data on the resonance in the media for a security or the sector as a whole. The system tracks the frequency of references to the company and compares this figure with the average rating of the paper by week. This tool helps to assess the impact of recent events on the general background.

Reviews of opinion of analysts and opinion leaders

The activity of opinion leaders - financial analysts and bloggers - can also shape the attitude of the audience to a particular action. There are algorithms that analyze the publications made by representatives of this group of people - one of them is implemented in ITI Global.

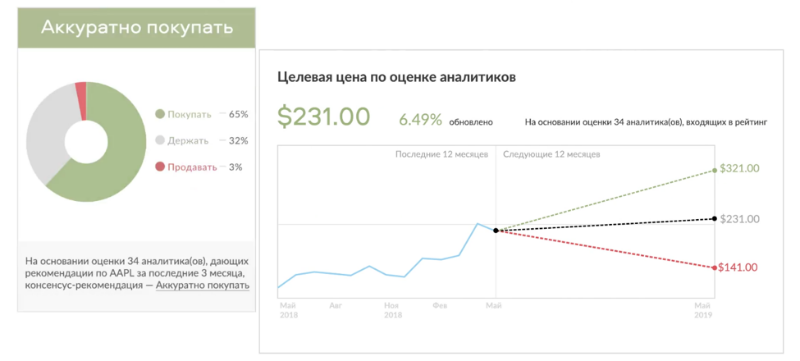

For each paper, the system collects analyst ratings for the past three months and determines a consensus forecast, which varies from “Immediate Sale” to “Immediate Purchase”. Analysts give a forecast for the average target price with an eye on the next 12 months, as well as a forecast for growth and decline.

The service also monitors the statements of opinion leaders and quotes them. Only opinions of independent bloggers, ratings and comments on specialized sites are taken into account. Such analytical material allows the investor to get acquainted with a detailed forecast. In addition, bloggers can be sorted by the success of their previous theses and predictions.

Get access to ITI Global

Other materials on finance and stock market from ITI Capital :

- Analytics and market reviews

- Purchase of shares of American companies from Russia

- Huawei overtook Apple in terms of sales. The capitalization of the American company still reached $ 1 trillion

- Analysts: Microsoft's capitalization could reach $ 1 trillion

- Mass media: large-scale cyber attacks accelerated the growth of capitalization of companies in the information security industry

- Bloomberg: Hedge Funds Recognize Brexit Results Before Others And Earn Billions