One hundred digital accounting recipes

A couple of years ago, big changes began in the financial services for small and medium-sized businesses. Non-core tasks for the overwhelming majority of entrepreneurs — banking, accounting and reporting — suddenly merged into one, and their solution acquired a convenient and understandable interface. Let's say you sit in an Internet bank and you need to create a payment. Once - created and sent in one click. It took an invoice - once, and put it. To those banks that began to offer this, customers are actively flowing.

In this publication we will talk about how we cross banking, accounting and reporting in a variety of ways.

So, some time ago, Promsvyazbank decided to create online accounting for customers. It could have been developed by her own team, but it would have taken too much time. Thinking, we turned to those who already offer something proven.

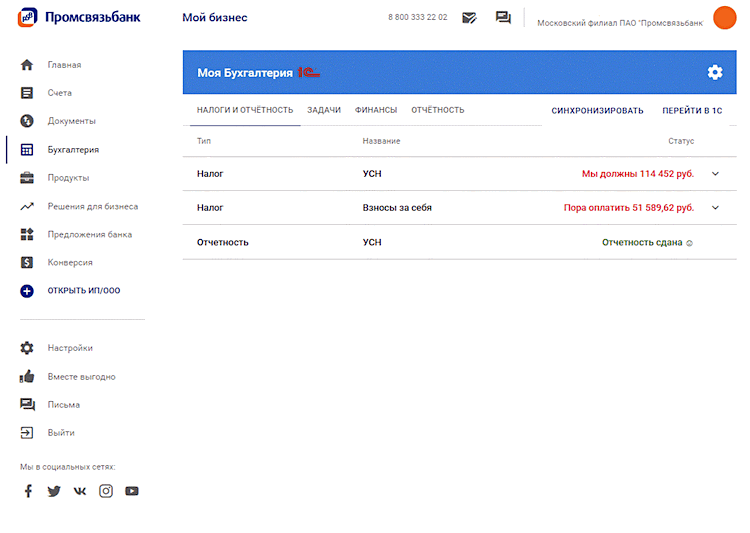

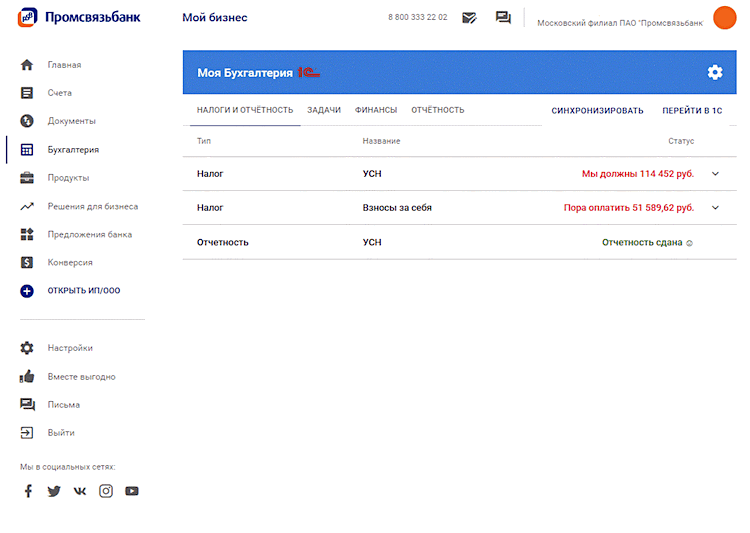

What first comes to mind when mentioning accounting? Correct, firm 1C. In fairness, we note that quite a lot of companies are engaged in the automation of accounting in Russia, but only 1C programs can boast such years of experience, popularity and prevalence. As a result of numerous meetings with the 1C team, we decided to develop a joint solution in which all the necessary functionality will be provided in a convenient, intuitive interface (including mobile devices) and work online.

Which of the accounting services will be the most popular? There is no unequivocal answer to this question, because small and large businesses have completely different accounting tasks. We needed to cover not only the microbusiness, small and medium business segment, but also those customers who are at the very top of this segment - and this is a large part of the target audience.

Dividing potential customers by the size of the business was considered unpromising. They came from the other side - they were divided into three groups, named after characteristic replicas that reflect basic needs.

This includes the smallest companies with the scenario “I’m an entrepreneur and don’t want to constantly bother, just remind me when I pay taxes.” Ideally, such an entrepreneur wants to sign automatically generated documents with one click and forget about reporting and taxes until the next reminder. Such a scenario is closed by fully automated accounting for individual entrepreneurs at the simplified tax system of 6% without employees and cash.

For such clients, accounting does not require a rich set of functions, convenience is more important here. So that you can log in from any device, check the correctness of filling out and send reports, create and send a payment order. If suddenly there are difficulties in accounting, the bank client has full access to the "cloud" version of accounting 1C directly from the RBS - for this we have a button "Go to 1C". There you can already turn around and perform any necessary operations. Or provide access to the program to your accountant - he will be in the familiar 1C application environment and will fix everything. If this does not help, our support service will explain where to click so that everything works as it should.

Our plans include the release of accounting for individual entrepreneurs at the simplified taxation system of 15%, a patent and UTII, where several additional functions will appear: not only work with employees, but also integration with the cash register, support of acquiring, a salary project, etc. Also, our plans include not only support of the solution itself, but also advice for the clients themselves on specific accounting issues.

This is a classic outsourcing scenario. When a client's business grows up, the “problem of primary documentation” appears. The head of the company is constantly tugging at the accountant, requesting numbers of contractors, contracts, closing documents on them, etc. All this translates into many similar, routine operations. Their implementation without a convenient interface takes a lot of time, and the probability of an error increases in proportion to the number of actions.

We plan to streamline this process using the reminder mechanism in our Internet bank. The user will receive a notification on the operations, see what documents are required, take a photo of them and send it to the accountant in an outsourcing. This part of the work of the head will be completed. And all the original documents once a month will be picked up by the outsourcer's courier.

This scenario and similar to it we plan to implement through the panel (dashboard) with tasks and the ability to track the timing of their implementation. For example, you asked the accountant to make an act of reconciliation, set the appropriate task, and after some time the act of reconciliation is ready. The accountant saw that he was soon to submit reports - he set himself a task by a certain date to deal with the primary documentation.

This is a scenario of advanced non-financial services. We want to offer not only accounting. We build a platform for various systems - personnel records, warehouse management, creation of contracts and other business documents, CRM (sales accounting), cash desk integration, etc. In general, we want together with the partners of the bank to automate almost all the business processes of medium and large businesses.

All that is required to automate the work of the organization will be integrated into our system of remote banking, all our software interfaces will be available on all platforms. The solution should be customized to the needs of specific customers, now we are working on these opportunities.

All client’s employees will be able to work with our customized RBS system - they will be able to access operations such as adding payroll projects, cash desks, contractors and many others. For all automation blocks, you can install KPI and track their execution. Access to the system is flexibly configured, its individual modules can be provided to employees of other organizations. We pay special attention to the protection and reliability of data synchronization mechanisms between the outsourcer, employees and the client. This is the responsibility of our special unit.

In online mode it will be possible to reduce the data on accounts in different banks. You no longer need to log into each Internet bank, remember the desired token, etc. You simply upload the data of other banks, and we in our Internet bank display information on accounts in a single interface. Soon you will not need to pull an accountant to understand the overall financial condition of the organization. Similarly, we consolidate information on all deferred payments, which makes it possible to implement a simplified version of management and financial reporting in real time.

Of course, ideally separate all users according to their needs will not work. Small business clients can benefit from paid advice. For example, to start foreign economic activity you need at least a minimal understanding of currency transactions that have their own specifics. In this case, we are ready to offer assistance at any time.

A hybrid of accounting and banking is an open field for UX experiments. Without the constant development of user experience, any such online accounting will be abandoned - for the sake of this very experience, and go to such solutions. So we test different hypotheses using the UX-lab. Is it more convenient to pay through notifications or commands of a separate menu? Download statement by pressing a button or in some section? Tests, tests, tests.

Finally, online accounting, as a new class of solutions, will require a powerful support service. For now, we’re trying to figure out how much we can manage with the bank’s forces, and aim at maintaining the functionality — after all, if something starts falling off already at an early stage, the reputation of the solution will immediately suffer.

No matter how complete, intuitive and convenient the automation of accounting, customers still want to communicate with a living person. As a result, we want to come to a hybrid from an automatic accounting system and a “live” accountant who will take on the role of a client manager with the necessary competencies and competent support service behind him.

In this publication we will talk about how we cross banking, accounting and reporting in a variety of ways.

So, some time ago, Promsvyazbank decided to create online accounting for customers. It could have been developed by her own team, but it would have taken too much time. Thinking, we turned to those who already offer something proven.

What first comes to mind when mentioning accounting? Correct, firm 1C. In fairness, we note that quite a lot of companies are engaged in the automation of accounting in Russia, but only 1C programs can boast such years of experience, popularity and prevalence. As a result of numerous meetings with the 1C team, we decided to develop a joint solution in which all the necessary functionality will be provided in a convenient, intuitive interface (including mobile devices) and work online.

Which of the accounting services will be the most popular? There is no unequivocal answer to this question, because small and large businesses have completely different accounting tasks. We needed to cover not only the microbusiness, small and medium business segment, but also those customers who are at the very top of this segment - and this is a large part of the target audience.

Dividing potential customers by the size of the business was considered unpromising. They came from the other side - they were divided into three groups, named after characteristic replicas that reflect basic needs.

"Remind me a reminder"

This includes the smallest companies with the scenario “I’m an entrepreneur and don’t want to constantly bother, just remind me when I pay taxes.” Ideally, such an entrepreneur wants to sign automatically generated documents with one click and forget about reporting and taxes until the next reminder. Such a scenario is closed by fully automated accounting for individual entrepreneurs at the simplified tax system of 6% without employees and cash.

For such clients, accounting does not require a rich set of functions, convenience is more important here. So that you can log in from any device, check the correctness of filling out and send reports, create and send a payment order. If suddenly there are difficulties in accounting, the bank client has full access to the "cloud" version of accounting 1C directly from the RBS - for this we have a button "Go to 1C". There you can already turn around and perform any necessary operations. Or provide access to the program to your accountant - he will be in the familiar 1C application environment and will fix everything. If this does not help, our support service will explain where to click so that everything works as it should.

Our plans include the release of accounting for individual entrepreneurs at the simplified taxation system of 15%, a patent and UTII, where several additional functions will appear: not only work with employees, but also integration with the cash register, support of acquiring, a salary project, etc. Also, our plans include not only support of the solution itself, but also advice for the clients themselves on specific accounting issues.

"Do everything for me"

This is a classic outsourcing scenario. When a client's business grows up, the “problem of primary documentation” appears. The head of the company is constantly tugging at the accountant, requesting numbers of contractors, contracts, closing documents on them, etc. All this translates into many similar, routine operations. Their implementation without a convenient interface takes a lot of time, and the probability of an error increases in proportion to the number of actions.

We plan to streamline this process using the reminder mechanism in our Internet bank. The user will receive a notification on the operations, see what documents are required, take a photo of them and send it to the accountant in an outsourcing. This part of the work of the head will be completed. And all the original documents once a month will be picked up by the outsourcer's courier.

This scenario and similar to it we plan to implement through the panel (dashboard) with tasks and the ability to track the timing of their implementation. For example, you asked the accountant to make an act of reconciliation, set the appropriate task, and after some time the act of reconciliation is ready. The accountant saw that he was soon to submit reports - he set himself a task by a certain date to deal with the primary documentation.

"Put everything at home"

This is a scenario of advanced non-financial services. We want to offer not only accounting. We build a platform for various systems - personnel records, warehouse management, creation of contracts and other business documents, CRM (sales accounting), cash desk integration, etc. In general, we want together with the partners of the bank to automate almost all the business processes of medium and large businesses.

All that is required to automate the work of the organization will be integrated into our system of remote banking, all our software interfaces will be available on all platforms. The solution should be customized to the needs of specific customers, now we are working on these opportunities.

All client’s employees will be able to work with our customized RBS system - they will be able to access operations such as adding payroll projects, cash desks, contractors and many others. For all automation blocks, you can install KPI and track their execution. Access to the system is flexibly configured, its individual modules can be provided to employees of other organizations. We pay special attention to the protection and reliability of data synchronization mechanisms between the outsourcer, employees and the client. This is the responsibility of our special unit.

In online mode it will be possible to reduce the data on accounts in different banks. You no longer need to log into each Internet bank, remember the desired token, etc. You simply upload the data of other banks, and we in our Internet bank display information on accounts in a single interface. Soon you will not need to pull an accountant to understand the overall financial condition of the organization. Similarly, we consolidate information on all deferred payments, which makes it possible to implement a simplified version of management and financial reporting in real time.

Of course, ideally separate all users according to their needs will not work. Small business clients can benefit from paid advice. For example, to start foreign economic activity you need at least a minimal understanding of currency transactions that have their own specifics. In this case, we are ready to offer assistance at any time.

Instead of conclusion

A hybrid of accounting and banking is an open field for UX experiments. Without the constant development of user experience, any such online accounting will be abandoned - for the sake of this very experience, and go to such solutions. So we test different hypotheses using the UX-lab. Is it more convenient to pay through notifications or commands of a separate menu? Download statement by pressing a button or in some section? Tests, tests, tests.

Finally, online accounting, as a new class of solutions, will require a powerful support service. For now, we’re trying to figure out how much we can manage with the bank’s forces, and aim at maintaining the functionality — after all, if something starts falling off already at an early stage, the reputation of the solution will immediately suffer.

No matter how complete, intuitive and convenient the automation of accounting, customers still want to communicate with a living person. As a result, we want to come to a hybrid from an automatic accounting system and a “live” accountant who will take on the role of a client manager with the necessary competencies and competent support service behind him.