How SoftBank invests $ 50 billion a year in start-ups, and why it baffles investors

Everyone in the business world knows this; you don’t even have to attend Robbins seminars. To make a profit, buy something cheaper and sell more. Enter a startup when it is at the beginning of its journey, and go out when (hopefully) it will become a big and multi-billion dollar company. But there is one investor who decided to put this "truism in truth" in question. The richest and most successful nesting in tech startups is Masayoshi Son.

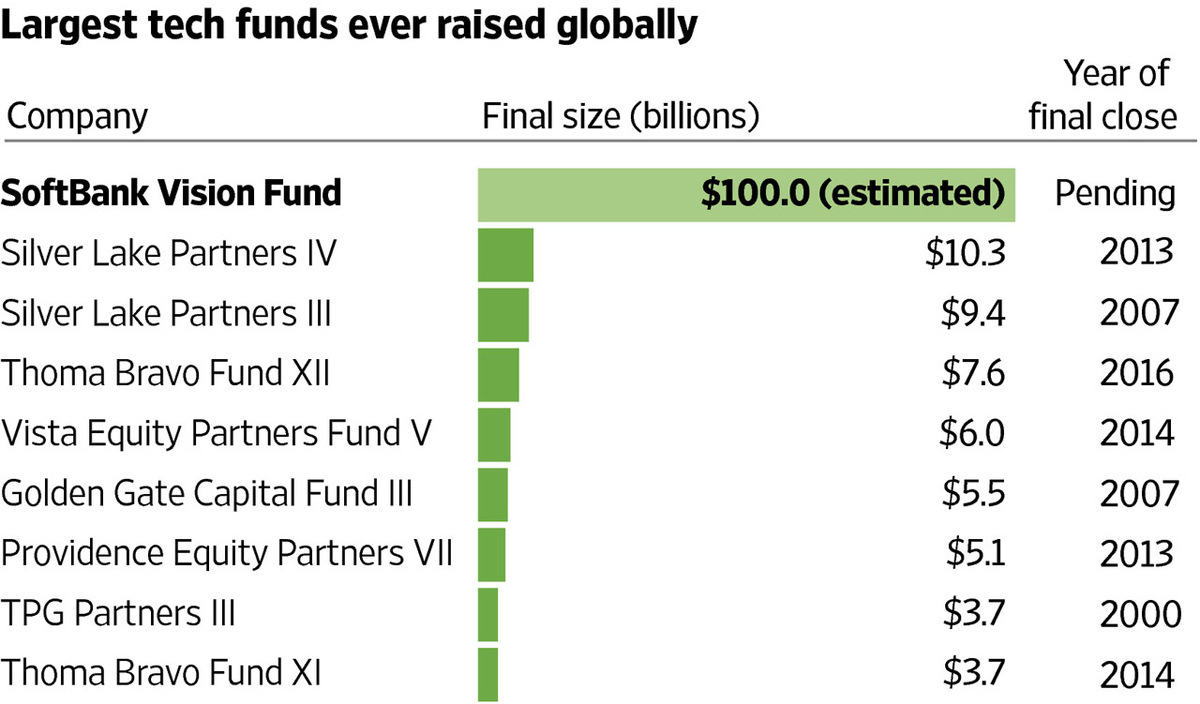

The Japanese announced that now his SoftBank will go the opposite way: to invest billions in companies that, it would seem, have already reached the peak of their development. Under this, he collects the largest investment fund in history. Few people understand how this can work, but certainly not according to the well-established canons of Silicon Valley.

Prior to this, Masayoshi Son was known just for his profitable investments at the start of the life cycle of companies. In 1996, his SoftBank fund invested $ 1 million in Yahoo, which in three years brought $ 3 billion. In 2000, it invested $ 20 million in Chinese Alibaba - and by September 2014, when it went into an IPO, they turned into $ 60 billion.

It would seem that the strategy is not sickly fruit. Choose a small company, believe in it, invest. Then - earn a lot of money in a few years, so that you can, without worrying, invest in another hundred of such companies. With this method, SoftBank has accumulated assets of $ 220 billion. The fund has a stake in Uber, Nvidia, Slack, WeWork, Sprint and hundreds of other large American companies. Plus, he fully owns, for example, the same Boston Dynamics with all its funny robots. And the most successful investment Masayoshi Son considers the purchase of the British ARM Holdings, developer of processors for the vast majority of smartphones on the market. Sleep says that in the future it will become much more expensive than Google.

Large pocket fund

Two years ago, Masayoshi Son was sitting in his Gulfstream business jet, flying over the Arabian Gulf to meet potential investors. He prepared a presentation for them, explaining why it would be beneficial for them to invest in technology start-ups. He was assisted by a banker and the head of the SoftBank board of directors, Rajezha Mishra, and a team of trusted experts. One of the slides did not please Son. He stopped, pondered and corrected one figure: from 30 to 100. So the amount of the new investment fund, which they planned to create, increased from $ 30 billion to $ 100 billion.

Washington Post Data

Everything started to explain to “Grandpa Son” why this is unattainable. For them, this is just one single project, how can it be ten times more than the largest venture capital fund in history before? This is too much for direct investment. Where to put such money? For them, you can buy every new startup in San Francisco, and there will be more money left for Japan and China ...

The dream stood its ground. His argument: "One hundred billion is a beautiful and simple figure."

A few hours later, when the presentation reached this slide, investors representing the government of Saudi Arabia laughed. Masayoshi did not respond to this, and continued to present his project, as if nothing had happened. “He believed in this number, and that it was time to think in maximum categories,” says Misra.

As a result, the new fund, Vision Fund, raised $ 80 billion from Saudi Arabia, Apple, the government of Abu Dhabi and many others. The remaining billions, in order to reach the round figure, were getting loans from Japanese banks.

Less than a year after the foundation began its work, he spent over $ 65 on buying back large stakes in successful startups. And now, having checked his “concept”, the Dream goes to the territory of madness in general. He says he is going to collect such a new fund for $ 100 billion every two years (!) To spend $ 50 billion a year. For comparison, the entire US venture capital industry is estimated at about $ 75 billion a year. Other investors are in shock: at this rate, in fact, they will have nothing left.

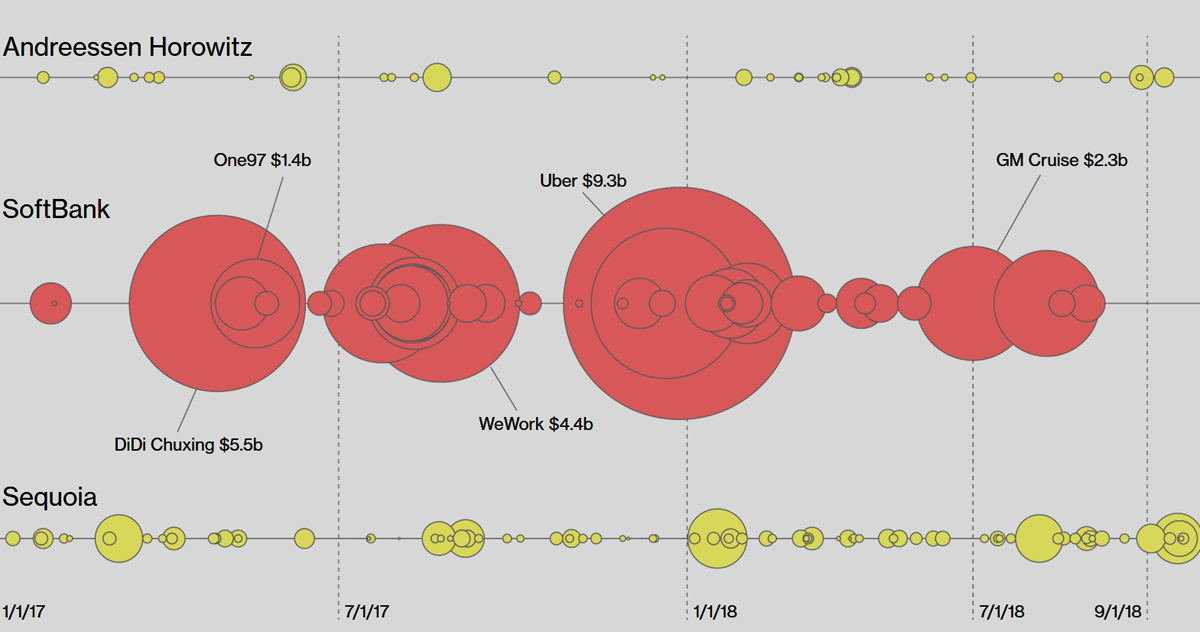

The scale of the project and the audacity of SoftBank put Silicon Valley to a standstill. Local experienced venture capitalists are accustomed to making small, calculated investments in small startups, and then determining the most successful among them and continuing to pour money into them in subsequent rounds as they grow. So did Masayoshi Son before. Now the strategy is changing: his foundation starts to pour huge amounts (up to $ 30 billion at a time) into the most successful and big startups in the selected category. Local venture capitalists are shocked, and startups are thrilled. They are beginning to be fed on an “all-inclusive” system. Any money, any requests, absolutely without restrictions.

The size of the investment of the largest funds in startups (from January 2017). Red color - SoftBank

The IT industry has never seen such a scale before. From this infusion of money received mainly from Arabic oil, the companies' calculated estimates quickly go up. Those startups that would have previously been glad to sell 20% of their shares for $ 100 million now don’t want to part with them for less than $ 2 billion - in the hope that soon they will fall under the program Vision Fund 2 or Vision Fund 3. Using the terms of poker, Between themselves, American capitalists now call the SoftBank big stack bully fund . Like, this player at the table holds more chips than everyone else, and it becomes impossible to play against him, he just interrupts any of your bets.

To stay in the game, Californian Sequoia Capital, known for its investments in Apple, Google, PayPal, YouTube, Instagram and WhatsApp, is raising a fund of $ 12 billion. So the company hopes to intercept at least a few "big fishes." For comparison, just five years ago, she needed $ 1.7 billion to create the same fund. But the investment company has no other option. Recently, Sequoia's former main competitor, Kleiner Perkins from Silicon Valley, which has invested in more than 850 startups (including Amazon, Google, Netscape, Snapchat, Twitter), announced the completion of its work. If you cannot continue to buy shares in projects that interest you, it makes no sense to engage in venture capitalism.

Sona's strategy

Vision Fund is managed by ten Sona partners. Five - in Silicon Valley, three in Japan, two in London. Many of these financiers are former immigrants from poor families. (Sona's parents came to Japan from Korea, and he was subjected to strong mockery in childhood, which, he says, hardened him and made him want to prove to everyone that he is capable of much). All partners, including Sona, call up weekly to discuss their plans. Masayoshi says he personally coached each of these “hunters” on how to find the right companies to invest. There are three main factors: what is the leader of the company, can its technology change the world, and is there a possibility to receive profit from it in the future?

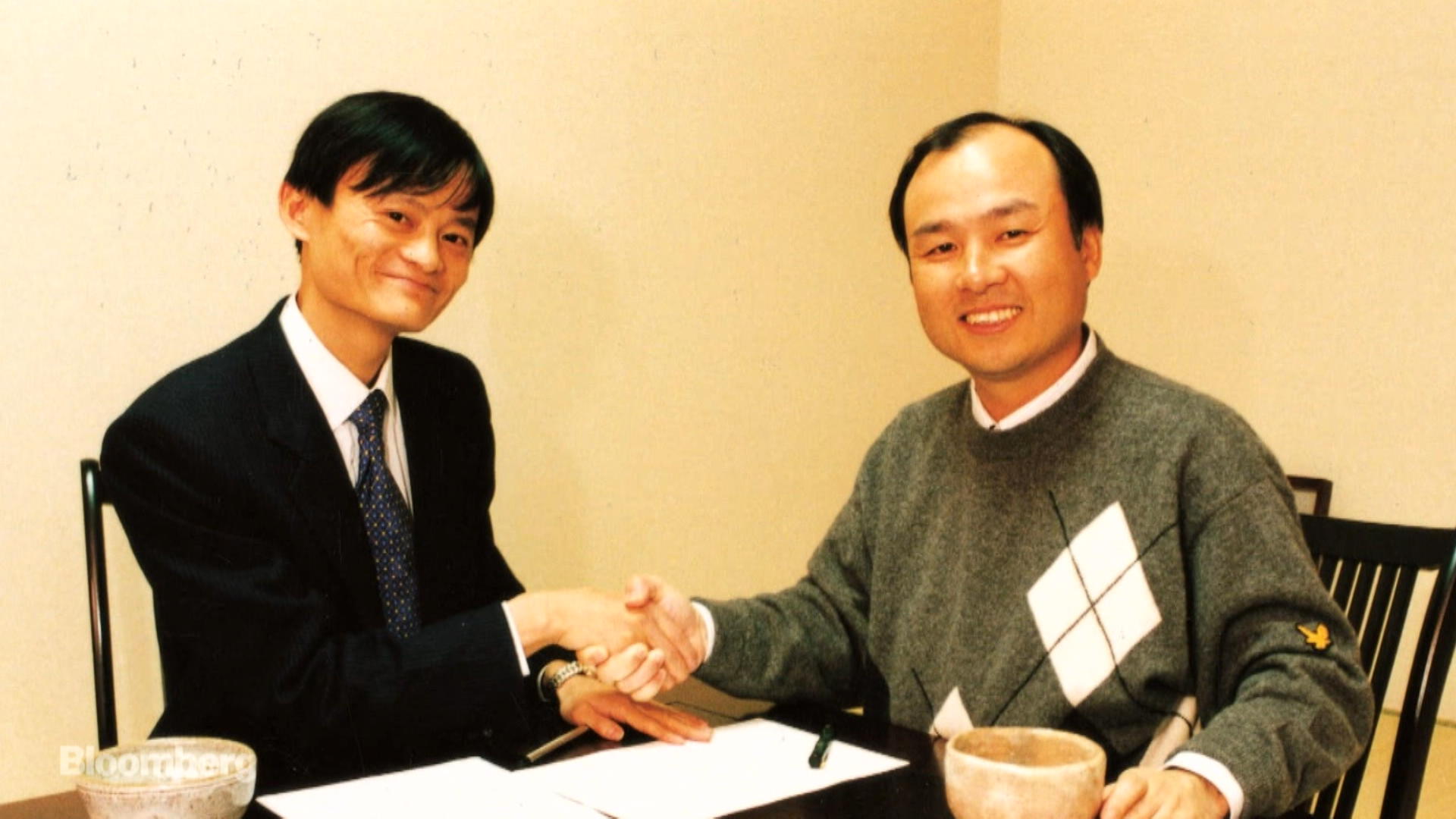

The first of these factors is the most important. At a meeting with Jack Ma and Yahoo founder David Filo, Masayoshi himself decided to invest millions in their company during the first minutes. As he says, “they had no business plan, they had nothing, their plans were terrible. But I saw that their eyes were burning and that they could gather and lead the best people. ”

Jack Ma and Masayoshi Dream in 2000

Explaining his strategy for the Vision Fund, Dream describes a flock of birds. He hopes that all companies in his portfolio will be able to stick together, help each other, use each other’s technologies and dodge enemies. Such a flock flies faster than any single birds, and at the same time spends less energy on its flight. But the system only works if each individual bird is strong enough to fight enemies, and at the same time it can fly at the speed of the rest of the flock.

The strategy has other advantages. A big-blooded bull can easily make other capitalists not invest in those start-ups that compete with firms in his pack. Venture financiers of the valley know that they will have little chance of direct competition, and prefer to choose some other, safer place to invest.

Masayoshi Son explains his strategy and life principle:

I do not need to create a Ferrari or Honda. I can build a highway for all cars. I can create an ecosystem in which those who travel on my roads will flourish.

The success of companies under the wing of SoftBank, from Alibaba to Slack, allow Son to dictate his terms when making deals. At a meeting with the founders of firms, he can say, “you want to start exploring China? We have Alibaba, it will help you. ” Such an offer is hard to refuse.

Sleep is always looking for a way to take as many of the company’s shares as possible, achieving its goal of 20% +, whatever the cost. For example, in 2015, he entered the online lending startup Social Finance (SoFi) from San Francisco. He wanted to get only two or three hundred million - to continue to expand. Dream wanted to invest much more. SoFi's founder, Mike Kegni, recalls, as he told the Japanese investor, that he was not ready to give even 10% of his company's shares into the wrong hands, especially since he had enough other offers. To this, Son replied that in any case he would invest $ 1 billion in online lending. And Mike can only choose whether this money will go to his company, or to his competitors. Fearing such an outcome, Mike decided to accept the deal.

Reasons for anxiety

Experts are not sure that SoftBank's megabunds will be profitable for Sone in the long term. Still, $ 20 billion in money of the first Vision Fund is a debt, on which a percentage drips. Even for an experienced venture capitalist, this is an unusually risky asset structure.

Already considered that start-ups "under the wing" Sona will have to show an increase of 15-20% per year for the fund to be successful. And that means SoftBank will need to grow quite a few companies with a capitalization of $ 10 billion, and at least two with a capitalization above $ 100 billion. The task is very ambitious, but Sone is sure that it will be quite easy to achieve these goals. He says that since 2001 his investments have shown an average growth of 44% per year.

But do not forget that it was before 2001. Despite the obvious talent of the Japanese investor, he is far from a visionary. Masayoshi Son invested all his money in 600 IT companies in 1999-2001. And lost more than $ 72 billion in personal capital during the dot-com crash. This is the biggest loss of personal status in history. Before blowing the bubble, Sleep was one of the five richest people on the planet. And for three days even overtook Bill Gates. Due to the bankruptcy of most of the companies in which he invested, he lost 93% of his investment. Even now, after 17 years, Son still has not reached the previous level, and he owns “only” $ 20 billion. Masayoshi continued investing, believing in the future of the Internet, and now his SoftBank fund has more capital than in 1999. But this does not mean that he is insured against making the same mistakes.

Analysts believe that now - just one of these critical moments. Alibaba and Nvidia’s shares in SoftBank’s portfolio are lax, and Saudi Arabia may withdraw from the fund amid geopolitical risks due to the murder of journalist Jamal Hashkaji. If the next “dot-com crash” happens, even in a mini-scale, Sona’s overly ambitious strategy can crack the seams.

On the other hand, if the idea works, and SoftBank will be able to consistently invest $ 50 billion a year in large projects, its leadership in the field will be consolidated. According to the plan, the fund will own 20–40% of the shares of several dozen “strategic” companies, each of which will be the largest in its industry. Then no one will pass these companies (thanks to unlimited money, they, if anything, can simply buy out all the promising start-ups in their field, as Facebook already does). And Masayoshi Son will be able to grow on his investments, so that in a few years, maybe, bypass Jeff Bezos. This time is no longer for three days.

PS Clothing and new gadgets are much more profitable to order in the US (Macy's, Amazon, 6PM!). And we will help you bring them to Russia at Pochtoy.com. Free personal address in the States, free collection of parcels from different stores. Users who register with us with the HABR code receive a 7% discount. And until November 5, we have a steep action , in which delivery of a kilogram from the United States costs only $ 16 $ 11.