Overview of payment aggregators for receiving payments

If you are the owner of an online store and want the buyer to be able to pay for goods conveniently for him, you have two ways: to connect and configure payment for each payment system separately - to suffer with integration, signing contracts ... or to do everything quickly and without unnecessary red tape - use the services of a company that is a payment aggregator. When choosing the latter option, you will need to sign only one contract, and your buyer will be able to choose a convenient payment method from dozens available. These are offline methods, and electronic wallets and, of course, payment by credit card. There are many payment aggregators.

If you are the owner of an online store and want the buyer to be able to pay for goods conveniently for him, you have two ways: to connect and configure payment for each payment system separately - to suffer with integration, signing contracts ... or to do everything quickly and without unnecessary red tape - use the services of a company that is a payment aggregator. When choosing the latter option, you will need to sign only one contract, and your buyer will be able to choose a convenient payment method from dozens available. These are offline methods, and electronic wallets and, of course, payment by credit card. There are many payment aggregators.This study, conducted over several months, covers companies that provide payment acceptance services not only with credit cards, but also through electronic wallets, as well as other payment methods.

How are payment aggregators different from each other, and what is worth paying attention to?

Each company was decided to consider ten parameters. Below is a detailed description of the parameter and why it is worth paying attention to.

1. Since what year the company has been operating in the market. Market discoverers have been able to earn a reputation and can boast of stability. This does not mean that young companies are unreliable. But the date of entry into the company’s market is worth paying attention to.

2. Who can connect. Legal entities, individual entrepreneurs, individuals - all can use the services of payment aggregators. But not all companies cooperate with individuals or non-residents. For individuals, other conditions are usually offered. Differences may be in tariffs or in the set of documents provided.

3. Rates. They are different for everyone, depending on the monthly turnover, the type of activity of your company and, possibly, will be individually tailored for you. The commission may be charged both from the buyer when making the payment, and from you when withdrawing funds. Do not chase the lowest rates. Perhaps such a company has some significant drawbacks. Some companies do not post tariff information on their website. I note that there are very few sites that host all the necessary information. At the time of writing this review, I often had to call and communicate with managers to clarify details.

4. Chips . The most interesting section. This is how a payment aggregator can stand out, except for tariffs. These are functions that competitors do not have, or few of them have.

Let's consider some of them:

4.1 Manual billing. This function allows you to send the buyer a link to email / sms / icq, clicking on which, he will only have to choose a payment method and pay the bill. The amount and description of the goods will already be indicated. This service will be useful to those people who do not have their own website, or they have a group in a social network, and they want to accept payment.

4.2 SMS-notification - notification of the buyer and the owner of the online store of successful payment. Such a service can cost not cheaply. If you are not satisfied with the cost of the service, then perhaps it is worth thinking about using the services of third-party companies whose price for sms will be lower.

4.3 Logistics- A service for delivering your goods to customers. Payment aggregators who work with companies involved in the delivery of goods can offer you special conditions for the delivery of your goods.

4.4 Provision of CMS. You can use the engine for the online store, which will provide you with a payment aggregator. It remains only to fill out information about the goods (photos, descriptions, prices). The disadvantage of this proposal is that the capabilities of the CMS offered by the payment aggregator are not unlimited and may not meet your needs.

4.5 Acceptance of Bitcoin and other exotic currencies.Only a few companies can boast of this, but if their conditions do not suit you, you can always contact companies that only accept this currency, and to connect other payment methods, contact another company.

5. Cons . Everyone has them. Big and small. So let's see if this is a minus for you.

6. Support service . A 24-hour support service is mainly for payers only, although there are exceptions. For those aggregators whose website has online chat installed, the waiting time for a connection with a specialist did not exceed 5 seconds. You will have to contact the support service at the connection stage and in case of emergency situations. Therefore, the response time to a customer request is very important. If you are a large VIP client, then you can contact a personal manager, but if not? I did a little research. I sent out a message with a simple question and waited for an answer.

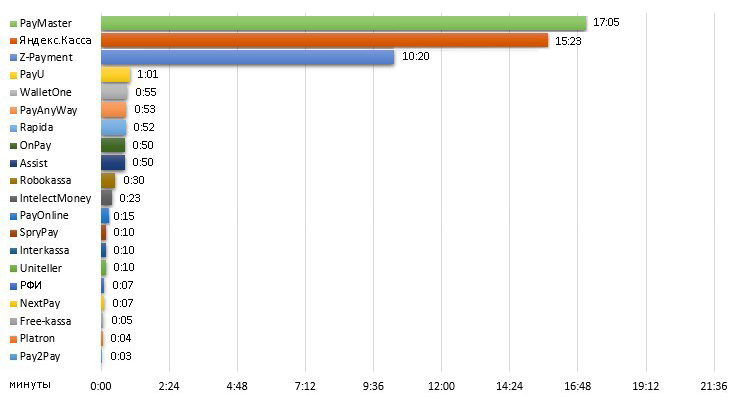

Request response time:

* You can call the support service by phone and try to persuade employees to consider the application out of turn.

7. Services . At this point, I noted only the presence of three services: recurring payments, mass payments and WS-integration:

7.1. Recurrent payments - periodic payments made in automatic mode, provided that the first payment was successful. Confirmation of the cardholder is necessary only during the first payment. Card data is not stored on the side of the online store. To make a recurring payment, the online store script passes the id of the parent (first) payment using the API. Such a service will be useful to Internet providers to automatically replenish their customers' accounts. Some companies connect this opportunity from the very beginning, some require a large turnover and work for a certain period without complaints from customers.

7.2 Mass payments- a service that allows you to make payments to your customers. You replenish the balance, and payments are made from it at the specified details. Not supported by all companies and on special conditions.

7.3 WS Integration- transparent integration of payment scripts into the website of the online store. The buyer will not be redirected to the payment aggregator page during payment. The advantages of this solution include the fact that the buyer stays on his usual online store website. This increases conversion since the buyer is not afraid of the “new” and “unfamiliar” interfaces of payment aggregators. Among the minuses: the owner of the online store must obtain a PCI DSS certificate, because the buyer will enter his card information not on the site of the payment aggregator. Not all companies and not all customers can offer such a technological solution.

8. Customization of the payment page . After clicking the "Pay" button on your website, the buyer will be redirected to the payment page of the payment aggregator. Customization allows you to change the design of this page to the design of your website: place a logo, change the background and much more. Each aggregator offers different options for changing the design, and some do not allow this at all.

9. VIP customers . Which of the large companies cooperates with this payment aggregator? This can be found in this section. Some large companies cooperate with several payment aggregators at once.

10. Commentary - important information about the company that does not fit into any section above. A small useful note.

FAQ

Is this a custom review?

No, objectivity is above all. Each company has pros and cons. And this is not a rating of aggregators.

Why is more written about this company than about that?

Perhaps the first company boasts a large set of chips and interesting features, and the second does not stand out among its competitors.

I know the payment aggregator% Name%, but it is not in the review, why?

These are 2-3 companies. Some companies expressed their disagreement to participate in the review, with others it was not possible to contact and communicate.

Was the text of the review agreed with the PR managers of the companies?

Some PR managers made small additions to the description of their company. As it turned out, call centers in most cases provided incorrect information. Most often it was reported that there is no WS integration or recurring payments. But no one removed the "Cons" section.

Why is there little information about tariffs, but more information about technical capabilities?

This review shows the presence or absence of technical capabilities of a particular aggregator.

What is the reason for payment aggregators located in the review?

Random order. Rather, it is not entirely random, but does not affect the perception of information.

How did the information gather?

The collection of information began with a visit to the site, then a call to the support service. The last step is to send the finished text to PR managers.

No, objectivity is above all. Each company has pros and cons. And this is not a rating of aggregators.

Why is more written about this company than about that?

Perhaps the first company boasts a large set of chips and interesting features, and the second does not stand out among its competitors.

I know the payment aggregator% Name%, but it is not in the review, why?

These are 2-3 companies. Some companies expressed their disagreement to participate in the review, with others it was not possible to contact and communicate.

Was the text of the review agreed with the PR managers of the companies?

Some PR managers made small additions to the description of their company. As it turned out, call centers in most cases provided incorrect information. Most often it was reported that there is no WS integration or recurring payments. But no one removed the "Cons" section.

Why is there little information about tariffs, but more information about technical capabilities?

This review shows the presence or absence of technical capabilities of a particular aggregator.

What is the reason for payment aggregators located in the review?

Random order. Rather, it is not entirely random, but does not affect the perception of information.

How did the information gather?

The collection of information began with a visit to the site, then a call to the support service. The last step is to send the finished text to PR managers.

Wallet One Cashier

Who can connect : individuals and legal entities, including non-residents.

Tariffs : Flexible tariff calculation system for different types of businesses. The commission may be charged both from the merchant and from the buyer. Legal entities-merchants can withdraw funds to a current account, individuals - to electronic wallets and bank cards.

Support service : for owners of online stores - around the clock.

Services : recurring payments, mass payments, WL-solutions.

Customization : it is possible only by API, you can not customize a page in your account.

VIP clients : Biglion, Stoloto, Planeta.ru, Photostrana, Slando.

Chips :

- Integration payment + delivery.

- Invoicing from your personal account by email or phone.

- Multi-currency cash desk - the ability to receive and withdraw money in different currencies.

- Individuals can withdraw funds to ACH Transfer, UKash USD, bank card.

- Placement of advertising banners in the buyer's wallet interface.

- Discount Club W1: discount section of online stores connected to Wallet One Wallet One.

Cons : no WS integration, customization of the payment page only by API.

Comment : mass payments are agreed upon only to legal entities.

Website : Walletone.com

Fondy

Works since : 2014.

Works since : 2014. Who can connect : legal entities, individuals and private individuals registered in Russia, Kazakhstan, Ukraine or any EU country.

Support service : for owners of online stores - around the clock.

Services : regular payments, p2p transfers, mass payments, automated reverses, white-lable for banks, IPSP, fintech projects, turnkey company opening services in Europe, international Internet acquiring.

Tariffs : The commission depends on the turnover of the business. The tariff varies from 3% and below. The commission may be charged both from the merchant and from the buyer. Legal entities-merchants can withdraw funds to a current account, individuals - to bank cards.

Customization: great opportunities to customize the payment page from your personal account, as well as through the JavaScript API.

Chips :

- White-label of both the payment page and the entire system.

- Technical integration with API.

- Own antifraud system.

- Purchases through server-to-server request for PCI DSS merchants.

- Two-stage scheme: pre-authorization and completion of payment.

- Detailed analytics: general statistics, statistics on payment methods, for reasons of refusals, for the circulation of funds, for chargebacks and fraud.

- A simple button builder, Ctrl + c Ctrl + v insert code into the site.

- Ready-made SDKs to simplify development: iOS, Android, Reac Native, PHP, JavaScript.

- Ready-made modules for the most popular CMS systems.

- Setting invoices by email.

- Financial and technological flexibility (development of technological, financial and legal models for a specific business).

- Affiliate program.

- Multi-currency payment acceptance on the site.

- Technical, financial and legal support.

VIP customers : information is not disclosed.

Website : Fondy.ru

Simple pay

Works since : 2014.

Works since : 2014. Who can connect : legal entities, individuals and individual entrepreneurs.

Support service : telephone support on working days from 10:00 to 18:00 and through tickets in your account.

Services : recurring payments, mass payments (since February 2016).

Customization : free placement of the logo on the page with a choice of payment method.

VIP clients : PDJ.com, GoPro.ru.

Tariffs : basic tariffs of a payment aggregator are presented in the table below. Connection on individual conditions is also possible. Individual rates are negotiated with the system manager when the store is connected or in the process of further interaction.

| Monthly turnover, rub | Plastic cards | Electronic Subscriber | Cash payments | Online banking |

| up to 500 thousand | 3.4 | up to 4.0 | 4.8 | from 3.4 |

| up to 1.0 million | 3.2 | up to 3.9 | 4.8 | from 3.2 |

| up to 2.5 million | 3.0 | up to 3.7 | 4.3 | from 3.0 |

| up to 5.0 million | 2,8 | up to 3.4 | 4.0 | from 2.8 |

| up to 6.0 million | 2.7 | up to 3.2 | 3,7 | from 2.8 |

| up to 7.0 million | 2.6 | up to 3.2 | 3,5 | from 2.8 |

| up to 8.0 million | 2,5 | up to 3.2 | 3,5 | from 2.7 |

| up to 10 million | 2,4 | up to 3.2 | from 3.0 | from 2.6 |

| from 10 million | 2,3 | up to 2.8 | from 2.8 | from 2.5 |

- Refund to the buyer without commission from the personal account of the seller.

- Manual billing. The invoice is issued for an arbitrary amount with an arbitrary appointment to the payer's email.

- Ready-made modules for popular CMS.

- Buyer Information System.

- Intelligent merchant alert system.

- Affiliate program.

- Information service on the distribution of shares of payment systems in the electronic payment market.

- Anti-fraud protection system.

- The opportunity to work on the offer, without concluding a “paper” two-sided contract.

- Convenient and informative personal account with detailed statistics and transaction search.

Comment : Technical support specialists, if necessary, will conduct a free consultation on the integration of the online store by phone, through teamviewer or in another way. Payments of collected funds to the current account are carried out automatically and are configured by the client independently in your personal account.

Website : Simplepay.pro

PayOnline

Who can connect : Legal entities registered in Russia, Kazakhstan, Azerbaijan, Kyrgyzstan, Tajikistan, EU countries, Canada, USA.

Rates : The commission depends on the scope of your company and turnover. The site presents the rates for companies involved in the sale of airline tickets, e-commerce and housing services. The exact size of the commission can be found by contacting support.

| Pay start | Pay standard | |

| Connection cost | 3900 r. | 9900 r. |

| Withdrawal to current account | On the 6th day automatically | On the 1st or 2nd day automatically (depends on the partner bank and working conditions) |

- Buyer request processing time no more than 15 minutes.

- Pay-Mobile is a payment solution that allows you to integrate payment by credit cards into any device with Internet access. Integration is possible with devices running on Android, iOS, WindowsPhone, Symbian.

- Pay-Loan is a payment solution for microfinance organizations that allows you to issue loans to bank cards and return them online.

- Online payment search service (for buyers) is available without registration.

- Logging into the personal account of the store is possible using a certificate without entering a password.

- Mobile version of the payment page.

- Several roles of users of a personal account with different rights: administrator, manager, etc.

Cons : a long connection period (several weeks) in most cases. Do not cooperate with individuals. Paid connection.

Support service : 24/7 for site payers. For employees of online stores customer support by phone and mail is provided from 9 to 20 (on weekdays). A big plus is the presence of an online consultant on the site.

Services : Recurrent payments, WS-integration.

Customization : The design and structure of the payment page can be customized according to the design of your website. The form can also be integrated into your website through an iframe.

VIP clients : Avito, Hand in Hand, Nokia, MTS, Rostelecom, Litres, RIV GOSH, MGTS, Biblio-Globus.

A comment: The site contains comprehensive information, many presentations.

Website : Payonline.ru

Yandex Cashier

Who can connect : legal entities, including non-residents and individual entrepreneurs.

Support Service : 24/7.

Services : mass payments, recurring payments.

Customization : on request.

VIP clients : Aliexpress, Avito.ru, Concert.ru, Freelancer.ru, Key.ru, Ozon.ru, Softkey, Yota, Wargaming, Wildberries, Netology, Citylink, Tricolor and many others.

Rates : commission is charged to the store owner. Base rate ~ 3%. Premium tariff (turnover from 500 thousand) ~ 2.8-3%. Tariffs are presented in two versions - for companies with physical delivery and for companies that provide digital services and goods.

Chips :

- Iframe integration.

- Y.CMS is a universal module for integrating an online store with several Yandex services, including Y. Metrika (for data collection), Y. Market (for placing goods on CPC and CPA models), Y. Cash desk (for receiving payments) )

- Binding a card to a store - regular customers will be able to pay for purchases in 1 click.

- Offline payment acceptance using mPOS.

- API and SDK for connecting Yandex.Kassa to mobile applications

- Preauthorization.

Cons : an individual cannot connect Y. Cash, but can use other Yandex.Money tools to raise funds: special forms and buttons, as well as ready-made pages on yasobe.ru. Money will be credited to the electronic wallet.

Comment : In addition to Yandex.Cash, legal entities can accept payments through Yandex.Money without a contract by setting a form for accepting payments on the website. Money will be credited to a bank account. We accept credit cards and funds from Yandex.Money wallets.

Website : Kassa.yandex.ru

Pay master

Works since : 2010.

Works since : 2010. Who can connect : legal entities.

Tariffs : two tariff plans - Start and Optimum (turnover from 800 thousand per month). Detailed tariff information is provided on the website.

Support service : for payers - around the clock, for owners of online stores - on business days.

Services : recurring payments, WS-integration.

Customization : it is possible to change the background and set the logo on the payment page.

VIP clients : VK.com, WarGaming.net, Runner, Beglion, Ozon, Softkey.

Chips :

- Cash on delivery.

- Opportunities for marketing promotion, including posting news and e-mail newsletter "Promotions and bonuses" for 7 million subscribers.

- In-depth conversion analysis in your account.

Comment : WS-integration is available only to large partners. This service is from the WebMoney system. The personal account of the owner of the online store contains many functions.

Website : Info.paymaster.ru

ROBOKASSA

Who can connect : legal entities and individual entrepreneurs.

Support : 24/7, including technical support.

Services : Mass payments, Recurrent payments, WS-integration.

Customization : If WS-integration is not used, legal entities can place their logo on the page with a choice of payment method. The logo will be placed in the upper left corner.

VIP clients : Seopult, Auto.ru, Sape, Dozhd TV channel, GosLoto, Mamba, Buy a Coupon, Groupon, 003ru.

Tariffs :

| For individuals | For legal entities | |

| Who pays the commission | Buyer | Online store |

| Commission amount | 2-15%, calculated at the time of payment. Depends on the amount and method of payment. It is possible to transfer the commission to the online store. | When connected - 5%. The commission can be reduced up to 1.5% (SHOK tariff - turnover from 50 million / month.) |

| Withdrawal of funds | No commission: ROBOKASSA, Qiwi, WebMoney, Yandex.Money card. With a commission of 2% - a third-party bank card (at least 2000 rubles) | Withdrawal to the current account of a legal entity in any Russian bank in a ruble account. |

- Bonuses are awarded to customers, which they can pay for part of the next purchase, if it is made through the ROBOKASSA system.

- On the payment pages it is possible to advertise your product in the form of a banner in automatic mode.

- ROBOSTORE is a flexible CMS that allows you to quickly configure and open your online store by simply copying the code to your website. If you do not have a website, you can open a store on a subdomain.

- If you order the development of an online store in one of the web studios (the list can be found on the website) and connect it to ROBOKASSA, you will be offered special terms of service for the first 3 months.

- The customer’s personal account, where you can see a list of previous payments, attach a bank card and much more.

- SMS service: API for sending SMS + notification about the successful payment of the owner of the online store.

Cons : individuals cannot refund, unlike legal entities.

Comment : not all customers can use the services of mass payments and WS-integration. You must have a turnover of 1 million, the company must be registered in Russia and successfully cooperate with ROBOKASSA for at least a year.

Website : Robokassa.ru

Z-payment

Who can connect : individuals and legal entities.

Support service : from 4:00 to 13:00 Moscow time.

Services : mass payments to accounts.

Customization : it is possible to upload your css file.

VIP clients : work-zilla.ru, Meshok.ru

Rates : the site provides a very detailed tariff schedule for various types of certificates.

Chips :

- Acceptance of payment Bitcoin, Dogecoin, Litecoin.

- Quick check of payment status without authorization.

- Withdrawal of accumulated funds to a Bitcoin wallet.

Website : Z-payment.com

Interkassa

Who can connect : Individuals and legal entities.

Rates : On request sent to the post office. There is a commission for accepting payments and withdrawals. On average, from 3% to 5%. Yandex.Money - 6-8%.

Support Service : General questions 8 to 20 Moscow time. Technical questions from Monday to Friday from 9 to 18 Kiev time. There is support in Skype.

Services : Mass payments, WS-integration

Customization : logo placement on the payment page.

VIP clients : ticketforevent.com, popunder.ru, Parimatch.

Chips :

- It is possible to distribute the commission of the payment aggregator (who will be charged) through your personal account.

- In your account it is possible to disable some payment methods.

- In your account it is possible to transfer the commission of payment systems to the owner of the online store.

- Notification by SMS of the owner of an online store about successful payment.

- The ability to accept payment in rubles and hryvnias.

- Acceptance of payment Payeer, Perfect Money, Paxum.

Cons : Tariffs are not listed on the site. Sent tariffs on request by mail. There is no WS integration and recurring payments.

Comment : many methods of offline payment.

Website : Interkassa.com

Platron

Who can connect : legal entities and individual entrepreneurs, including non-residents.

Support service : general questions from 9 to 21:00, support for payers around the clock.

Services : recurring payments. WS integration.

Customization : it is possible to completely make up your payment page or place your own logo on the payment page.

VIP clients : Alpha insurance, Big ticket, Komus, Crocus, Chiptrip, VTB Insurance and other companies.

Tariffs :

| Up to 1,000,000 rubles. | Up to 5,000,000 rubles. | From 5 000 000 rub. | |

| Bank cards | 3,1 | 2.9 | 2.7 |

| Cash payments | 4 | 3.8 | 3.6 |

| Electronic money | 3,5 | 3.4 | 3.2 |

| Internet banking | 3 | 2,8 | 2,5 |

| Yandex money | 6 | 6 | 6 |

| Mobile payments | 6 | 6 | 6 |

Chips :

- Authorization through a cell phone without entering a password.

- Quick check of payment status for the buyer.

- Access control in the personal account of the merchant.

- Manual billing.

- Special solution for E-Travel.

- The ability to take the commission of payment systems on themselves.

- Acceptance of American Express, Diners Club, JCB 4 cards.

- 2-stage charge-off using the “holding” function.

- Ability to disable unnecessary payment methods.

- IFrame integration.

Cons : Standard conditions imply a monthly fee. Do not cooperate with individuals.

Comment : Platron works with PayPal.

Website : Platron.ru

Money online

Who can connect : legal entities and individual entrepreneurs (Russian and foreign).

Tariffs : the tariff schedule is sent to the post office. In most cases, this is 5%, a more accurate commission will be reported to you upon conclusion of the contract. The commission is charged from the owner of the online store. Cash withdrawals are made twice a week to a current account.

Chips :

- Special rates for online games, financial institutions and bookmakers.

- GSG is a special offer to payment systems.

- Affiliate program to connect.

- Connecting without a site - manual billing.

Cons : for the connection you need to send 9 documents. Withdrawal to the current account 2 times a week.

Support Service : around the clock. You can contact support by mail, phone or skype.

Services : repayments, recurring payments (as agreed).

Customization : Logo on the payment page.

VIP Clients : Yulmart, Ochkarik.

Website : Dengionline.com

PayAnyWay

Who can connect : legal entities (residents and non-residents).

Rates : mostly 2.9% commission.

Support Service : For customers - 24/7.

Services : mass payments, recurring payments.

Customization : It is possible to set your logo on the payment page, if integration via iframe is used, you can set your own design.

VIP clients : Severstal, Leon, RoboForex, GLAMBOX.

Chips :

- Special tariff "Housing and communal services enterprises".

- It is possible to disable unnecessary payment methods.

- Iframe integration.

- SMS and Jabber notifications of various events (entrance to the office / debit / credit of funds, etc.).

- Two-factor authorization and authorization using a certificate.

- Fast payment verification form.

Cons : do not cooperate with individuals.

Website : Payanyway.ru

Payu

Who can connect : legal entities and individual entrepreneurs, including non-residents.

Support service : support for payers - 24/7.

Services : recurring payments, WS-integration, mass payments to cards.

Customization : Designer of a payment page from blocks.

VIP clients : Avon, Eset NOD32, eTraction, Lacoste, Kupi-kolyasku, MyToys, Hilti, Aizel, BabySecret and other world and Russian brands.

Rates : commission is charged from the merchant:

| Parameter / Turn | Up to 500 tr | From 500 TR up to 5 million rubles | From 5 to 10 million rubles. | From 10 million rubles. |

| Internet Acquiring | 4% | 3.5% | 2.8-3% | 2.8% and below |

| Webmoney | 4% | 3.5% | 3% | 2.5% |

| QIWI WALLET | 8% | 7% | 5-6% | 5-6% |

| Cash payment at Euroset / Svyaznoy terminals | 4% | 4% | 3.5% | 3.5% |

| Payments Alpha Click | 4% | 3.5% | 3% | 2.5% |

| Online lending | 1% | 1% | 1% | 1% |

| One-time connection fee | 5 000 p. | Is free | Is free | Is free |

| Date of receipt den. funds to the current account (days) | from 1 to 3 days | from 1 to 3 days | from 1 to 3 days | 1 banking day |

- Special rates for eTravel, MFIs, Marketplaces, housing and communal services.

- PayPartner is an affiliate program for designers, web-studio owners, CMS developers.

- Buyer Protection Program.

- Real-time transaction fraud monitoring

- Two-stage authorization of funds (holding at the time of order, debiting - upon confirmation of the merchant).

- Solution for payment through the mobile application.

- Block page constructor.

- Ability to disable 3D Secure.

- Bilingual 24/7 24-hour support service (Russian / English).

Comment : the set of services provided depends on the tariff. The company works with 4 different acquiring banks. If the transaction is rejected in one bank, the payment is sent for authorization to the next, until the transaction is confirmed. Customers of online stores connected to PayU can get to pay for the order after confirming stock balances. At the same time, additional payment methods are available to customers - online lending and installments.

Website : Payu.ru

Maxkassa

Who can connect : IP, legal entities.

Support : 24/7, including technical support.

VIP clients : RosBusinessTour, Valeryst, Banketof, Meranom.

Tariffs:

| Turnover | Bank cards | Yandex money | Webmoney | Qiwi | Mobile operators |

| - | 2.7% | 4,5% | 4,5% | 5.8% | from 4.3% * |

| from 500 000 rub. | 2.5% | 4.2% | 3.9% | 5.6% | from 4.0% * |

| from 1 500 000 rub. | 2.4% | 3.9% | 3,7% | 5.0% | from 3.7% * |

| from 5 000 000 rub. | 2.1% | 3.5% | 2.6% | 4,5% | From 3.2% * |

Chips :

- Minimum refusal of payment. Card data entry - only on the bank’s website.

- Ready-made modules for popular CMS.

- The online store notification system about the status of the payment.

- Refund to the buyer on the cards without commission from the seller’s personal account.

- The program of rewards for referred customers.

- It is possible to disable unnecessary payment methods.

- Offline-reception of payments using POS, mPOS terminals.

- Payments by details without concluding a banking service agreement with an online store or service.

- Personal account with detailed statistics, report uploads.

- Free connection and subscription service

- Free installation by technical specialists of a ready-made payment module in an online store.

Comment : the commission is paid by the online store or the buyer. The withdrawal of funds is carried out to the current account in a Russian bank the next day.

Website : MaxKassa.ru

RBK Money

Who can connect : legal entities and individual entrepreneurs.

Rates : From 2.5%. Flexible tariff calculation system for different types of businesses. Individual bets are possible. You can familiarize yourself with the tariff schedule here .

Support service : 24/7 phone, mail, chat, online calls, social networks.

Services : acquiring, electronic money, offline payment.

Customization : provided.

VIP clients : Technosila, 1C-Interest, Trajectory, Rendez-Vous, Give Life.

Chips :

- Full statistics of payments;

- Multicurrency;

- Refunds

- Customization of payment pages;

- Recurring payments;

- Payouts to the card;

- Live support for individuals and legal entities by phone and online around the clock.

Comment : The RBK Money payment service is a modern platform for making transfers in various popular ways, including VISA and Mastercard bank cards, mobile and online payments, a wide network of offline branches and terminals, and many other payment methods. RBK Money provides technical reliability and guaranteed protection from chargebacks and fraud when paying with cards and in any other way.

Website : RBKmoney.com

Intellect money

Who can connect : legal entities.

Support service : from 9 to 18.

Services : recurring payments, mass payments, WS-integration.

Customization : from your personal account it is possible to change the background of the payment page, indentation, embed your own style sheet and javascript code.

VIP clients : Megaflowers.ru, Zebta Telecom.

Rates : when paying through WebMoney, a fee is charged when accepting funds and when withdrawing.

| Visa / MasterCard / Maestro | Other payment methods | |

| Up to 750 thousand turnover | 3.5% | 3.5% |

| 750,000 - 60 million | 3.1 - 2.4% | 3.4 - 2.7% |

Chips :

- IntelectMoney customers receive a 10% discount on Ritm-Z services (outsourcing service for receiving calls, maintaining an online store and other services).

- Manual billing from your account.

- Restricting IP access to your account.

- Holding cash.

- Affiliate program to connect other online stores.

Cons : technical experts advise only by mail.

Website : Eshop.intellectmoney.ru

Nextpay

Who can connect : legal entities (LLC) .o

Tariffs : on the site there are 6 tables with information about tariffs. Tariffs are divided by turnover, type of company activity and type of cooperation.

Chips : special tariffs for utilities, Internet providers, online games, budget institutions.

Support : at the time of writing, the company was experiencing technical problems with the phone.

Customization : no.

VIP clients : do not provide information.

Website : Nextpay.ru

Uniteller

Who can connect : legal entities and individual entrepreneurs.

Tariffs : calculated individually depending on the business sphere and turnover.

Support : 24/7 technical support.

Services : accepting non-cash payments in all areas where payment by bank cards is applicable (Internet acquiring, payment terminals and kiosks, mPOS and POS terminals). Services in Internet acquiring: IFrame, recurring payments, payment by registered card, payment link generator, pre-authorization, automatic control of order status.

Customization : the client has the ability to independently change the design of payment pages, adapting them to their corporate style.

VIP customers: portal of the Electronic Government Government Services, Electronic Government of the Republic of Tatarstan, the portal of state and municipal services of the city of Moscow, the metro of St. Petersburg, Mosgortrans, Pulkovo airports, Domodedovo and others, Avia Center, RU-Center, Level Travel, Yakitoria, Rosa Khutor, Sportmaster , Give life, 1001 Tour, Sochi Park

Chips :

- Free connection.

- A full range of acquiring services: e-commerce, self-service systems, mobile and commercial acquiring.

- Support for popular platforms for creating sites.

- Connection of reception to payment of electronic currencies.

- Payment in a mobile application on any operating system.

- Servers in data centers in the Russian Federation.

- Compliance with international security standards: PCI DSS, PCI PA-DSS, PCI PIN Security.

Cons : do not cooperate with individuals.

Website : Uniteller.ru

ONpay

Who can connect : legal entities (LLC).

Support service : online chat. By phone from 11 to 19.

Services : recurring payments.

Customization : great opportunities to customize the payment page from your personal account.

VIP clients : information is not provided.

Rates : The site provides a very detailed tariff schedule. The commission is charged from the owner of the online store when withdrawing funds.

| Signed an agreement | Contract not signed | |

| Where is the conclusion | To current account | On e-wallets and mobile phone balance |

| Withdrawal period | Next business day | Up to 15 days |

- Supported payment method Liqpay.

- SMS informing the store owner and the buyer about the successful payment.

- Manual billing.

- Ability to disable payment methods from your account.

- Changing the design of the payment page from your personal account (colors, fields, order of fields, order of payment methods displayed to the buyer).

- The customer’s personal account and a quick form for checking the status of payments, which is available without authorization.

- Withdrawal of funds to the balance sheet.

- After payment, the buyer receives a link, clicking on which he will be able to leave a review about the store, which will be visible to other customers.

- Creating a discount coupon from your personal account.

Cons : There is no WS integration and support for embedding a payment page in an iframe.

Comment : recurrent payments are not connected to everyone. You need to score a special rating.

Website : Onpay.ru

PAY2PAY

Who can connect : individuals and legal entities of any country in the world.

Tariffs : individual offer already at a turnover of 300 thousand rubles / month. Special rates for utilities, tourism and air. No withdrawal fee is charged. Withdrawal of accumulated funds is possible to Russian and foreign accounts.

Support service : online chat, skype, by phone on weekdays from 10 to 19 hours.

Services : WS-integration. Mass payments.

Customization : setting the logo on the payment page.

VIP clients : information is not provided.

Chips :

- The ability to distribute the commission between the buyer and the owner of the online store.

- Affiliate program to attract online store owners.

- The ability to disable unnecessary payment methods.

- Email notifications of the store owner about successful payments.

Cons : no recurring payments.

Comment : SLA agreement may be concluded for VIP-clients.

Website : Pay2pay.com

CHRONOPAY

Who can connect : IP and legal entities, including non-residents.

Tariffs : are formed individually, depending on the turnover and industry of the client. Connection is free.

Support Service : around the clock.

Services : recurring payments, mass payments, WS-integration.

Customization : the design of payment pages can be customized in accordance with the corporate style of the client.

VIP clients : MTS, Transaero, Begun, Sony, SoftLine, re: Store, WWF, GreenPeace, KupiVip, Stoloto

Chips :

- Acceptance of American Express, Diners Club, JCB, iDeal (Netherlands), GiroPay and ELV (Germany) cards.

- PayPal payment method.

- ChronoPay-MobileApp — специальное решение для приема денежных средств из мобильных приложений.

- Ускоренная схема подключения (за 2 дня) для малых и средних интернет-площадок.

- Привязка карты к интернет-площадке. Позволяет совершать оплату в один клик.

- Фирменная система противодействия мошенничеству ChronoMethod Anti-Fraud на основе нейронных сетей.

- Реклама на платёжных страницах (только для клиентов).

- Е-POS-терминалы для курьерской службы и других.

- Предавторизация.

- Специальное решение для Е-Travel. Интегрированы со всеми крупными системами GDS.

- Партнерская программа по подключению владельцев интернет-магазинов.

- IVR — приём платежей с помощью телефона.

- Электронный документооборот. Благодаря этому сокращаются расходы на персонал, доставку корреспонденции и расходные материалы

Cons : do not cooperate with individuals.

Comment : mass payments and WS-integration as agreed.

Website : Chronopay.com

ASSIST

Who can connect : legal entities and individual entrepreneurs.

Support Service : 24 hours.

Services : recurring payments.

Customization : change of the payment page template paid - 5270 rubles.

VIP clients : Google, Ozon, OZON.Travel, Oktogo, Puma, NokianTyres, Mariinsky and the Bolshoi theaters.

Rates : to connect the acceptance of payments by bank cards, you need to pay 2950 rubles. The tariff is calculated individually. Average data: bank cards - 4%, WebMoney - 4.5%, Qiwi - 5-8%.

Chips :

- OneClick - at the next purchase, the buyer does not need to enter his card information, except for CVC.

- Flexible system for setting access rights for employees in your account.

- Solutions for receiving payments through Call centers - wPOS, InteractiveVoiceResponse (IVR).

- Payment solutions for mobile devices.

Cons : long connection time 2-6 weeks. Paid connection for accepting payment by credit cards. Individuals cannot connect to Assist. There is no number 8-800.

Comment : Assist was the first in the Russian Federation to develop an intelligent anti-fraud system, and began to actively work to increase payment conversion.

Website : Assist.ru

SPRYPAY

Who can connect : individuals and legal entities.

Tariffs : the average commission for withdrawing funds is 3%.

Support service : icq support, by phone from 9 to 18.

Customization : logo installation on the payment page, the ability to set a light or dark color scheme for the payment page.

VIP clients : information is not provided.

Chips :

- Quick check of payment status without authorization.

- Affiliate program to connect the owners of online stores.

- SpryPay works with the SuperLend service, which allows you to get a loan for WebMoney wallet.

- The withdrawal of accumulated funds in the Contact system.

- Email invoicing.

Website : Sprypay.ru

FREE-KASSA

Who can connect : individuals.

Support service : online chat.

Services : mass payments, WS-integration.

Customization : logo placement on the payment page.

VIP clients : information is not provided.

Rates : during registration, you can choose who will be charged the commission. Average tariffs 4-6%. The site has very detailed information in the Tariffs section.

Chips :

- Credit purchase for WebMoney.

- Acceptance of payment PerfectMoney.

- Referral program.

- Quick payment search form.

Website : Free-kassa.ru

NET PAY

Who can connect : legal entities.

Support Service : 24/7 Live Chat.

Services : recurring payments, WS-integration.

Customization : it is possible to change the background of the payment page.

VIP clients : information is not provided.

Rates : individual.

Chips :

- Free help from technical specialists for integration.

- Billing the buyer by e-mail.

Cons : do not cooperate with individuals.

Website : Net2pay.ru

Finally

In conclusion, I would like to give a few important points that should never be forgotten:

- The buyer wants to make payment quickly and without difficulty.

- A payment aggregator is an important link on the way of the buyer to a successful purchase.

- It is necessary to minimize the user’s excitement due to the difference in the design of the payment page and your site using customization.

- If the buyer has difficulty paying, he can simply go to another site.