What to invest in the digital economy

- Transfer

I do not know why the author chose this picture, but it is the original cover of the article.

From the article you will learn:

- why IT investment is less risky than any other industry

- when exactly does an investor enter, and when is it too early to do so

- why venture happens only in IT and biotech and nowhere else

- and some more interesting things.

Go.

When people talk about the digital economy, everyone remembers William Janeway's book Capitalism in an Innovative Economy, which has been part of the Financial Times gold library since 2012. The book is based on the research of Dr. W. Janvey, where both the digital economy and the sources and mechanisms of its financing are studied.

William Janway himself.

The main idea of the book is that venture capital went into the digital economy, not because there are more risks, but because in fact there are fewer risks than in other sectors of the economy when it comes to research and development. Venture capitalists are willing to finance innovative companies not because they suddenly got an idea to risk everything, but because of the simple fact:

Internet-based technologies have been tied up by states and many large companies are so firmly and inextricably that they are forced to take on some of the risks of the IT industry.

These are smart guarantees that are not found anywhere else.

New technologies do not bear risks? Is it real?

For startups (especially) of the early stages, technologies are not critical at all - these are the bricks that are lying on the road for free. Just as you can seamlessly connect to the transmission network and the supplier will not notice this, so a startup with a small coverage will simply take advantage of:

- Internet (free technological infrastructure) By the way, with GPS everything is not so simple, because the military is tightly seated inside GPS, but precisely because of their budgets we have free civil geolocation all over the planet.

- Open source software , the use of which reduces to approximately zero the technological barrier to entry into the industry. Open source models have now begun to be used in other industries, such as hardware and biotechnology;

- cloud computing , where, based on typical resource designers, they will quickly test their hypotheses and find (or not) a business. The cost of the cloud starts from zero and grows linearly to the size of the business;

- modern high-level programming languages , which simplifies their use for less experienced programmers. Again: site and application designers allow startups to quickly reach solutions proven in the market.

As a result, the very

the word “technology” (as applied to start-ups at an early stage) has become incorrect .

Too many people still believe that the digital economy, these are lone scientists, who invent something and use very incomprehensible technologies for this. In the laboratories, this is possible, but in the digital economy - by no means.

The fact that technology is commoditized does not mean that this is not a problem. We need talent to build ideas in an innovative way, but on the basis of available technologies. True innovation begins when commoditized technologies no longer meet the needs of a growing company. Jeff Bezos, in a letter in 2010 to Amazon shareholders, wrote:

Although many of our systems are based on the latest computer science research, this is often not enough: our architects and engineers often use inventions that have not yet been approved by science. Many of the problems that we face do not have solutions in textbooks and therefore we are with great pleasure inventing new solutions.

It so happened that the most advanced technologies in the digital domain were invented and implemented by large IT companies that faced their limitations trying to serve hundreds of millions of users: for example, MapReduce, NoSQL or OpenStack technology from Facebook.

Traditional companies

To understand why venture came into the digital economy despite the scientific and technological risks, we first understand how the company grows in a non-digital economy.

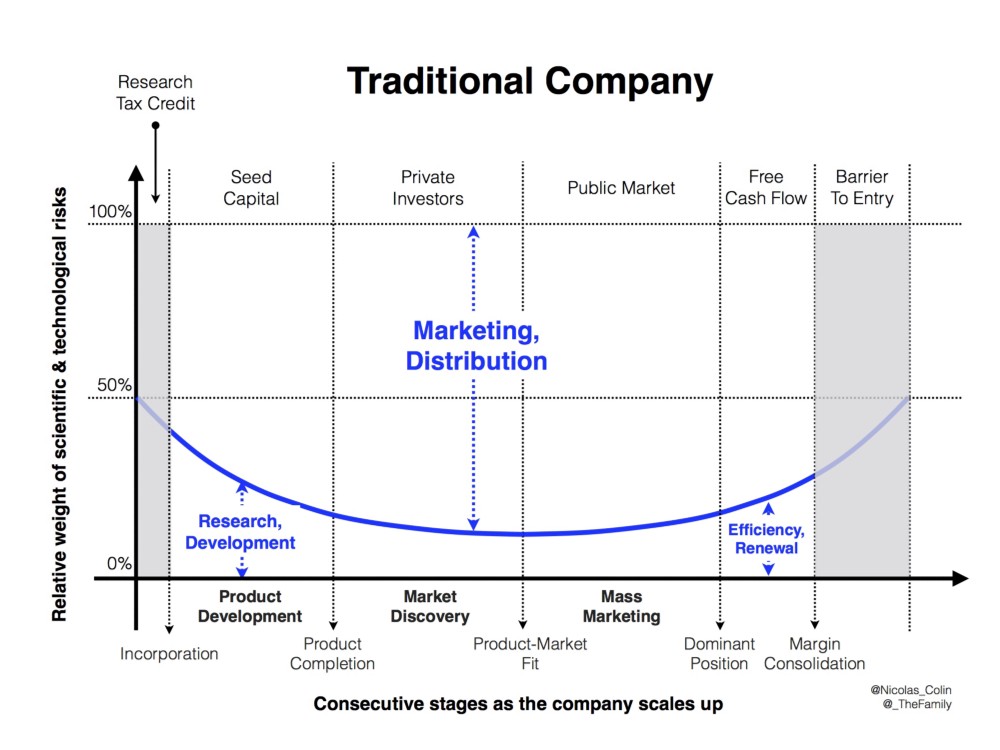

Risks in a normal company. Vertically indicates the relative weight of risks in terms of R & D at different stages of a startup's maturity, and horizontally - stages of a company’s maturity.

Initially, technological and marketing risks have the same weight: it is necessary both to create a product and to tell about it to potential investors, employees and customers. This is in theory.

In practice, government budgets (in the Vizhe state programs, grants and subsidies) cover the costs of some product research and allow the company to move faster to the development stage, which compensates for a significant part of the technological risk at an early stage. This reduces the need for initial capital, which often comes from an individual investor or from an existing company's free cash flow. See how Joe Macmillan, in the Halt & Catch Fire series, hacks Cardiff Electric to get cash flow and create a portable computer.

Shot from the series "Halt & Catch Fire" (season 1)

At the next stage, the weight of scientific and technical risk is reduced to zero, and all risk is now on a different front: marketing and distribution. This is due to the fact that the product is fully developed and packaged before being introduced to the mass market (in the series, this can be seen when Joe Macmillan makes a deal with a network of retail stores only after the product is ready). That is, the risk of not finding a solvent market for the product is the most important. Again, R & D goes by.

In traditional economics, it is enough for private investors to show a working prototype that can be touched (for example, at the computer exhibition COMDEX, see Halt & Catch Fire) and add any market research from a venerable company where it is clear that the market is there and it is growing. Everything: the investor is ready to give money for marketing and sales. Where is the risk of wrong technology? He is not.

If the marketing and distribution efforts were successful and the startup finally found its solvent niche (reached the "market fit"), it moves to a new stage of development - dominance. Usually, at this time, it is taken out for IPO (recall: in the traditional economy, IPOs are usually carried out at an early stage).

It is important to clarify that domination is the only way to protect against the risk of the emergence of new technologies. Only when a company is a leader in its niche, is its scale large enough to keep competitors at a distance. The leader always has a lot of advertising money to brainwash customers whose iPhone is the best. Moreover, a leading company can specifically deal with raising barriers to entry for competitors in a niche (patenting, buying start-ups, deliberately ignoring innovative solutions in their products, or worse). So it keeps scientific and technical risk at a low level: no one simply hears more innovative and useful newcomers in the shadow of a huge leader.

Technological risk may increase here, but it still remains below 50%: this is the risk that a company undertakes to introduce efficiency innovations (thus freeing capital and earning more money for its shareholders) or innovating new product versions (shipping new products). that help keep competitors at a distance).

During this period, the only danger is a competitor who is willing to bear a higher level of technological risk and thereby break the barrier to entry with its radically innovative product.

For example, Japanese automakers destroyed the American auto industry in the 1970s.

As a result, technological risk is almost never financed by investors:

1) the first stage is partially funded by the state;

2) intermediate stages are associated with more noticeable risks in marketing and sales;

3) at the last stage, operational efficiency and updating are funded by the free cash flow of a new startup.

Digital Companies

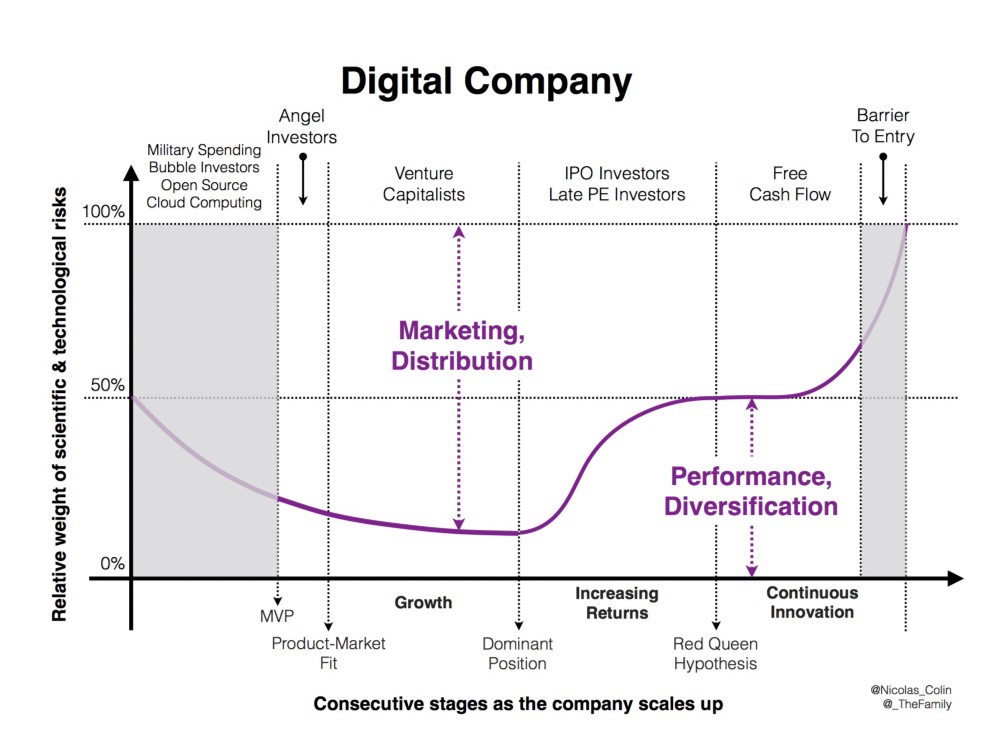

Now let's look at digital (technology) companies. Here is the appropriate scheme:

In comparison with traditional "digital" startups, there are 3 main differences:

1) The gray zone on the left is the MVP design. Here, startups select the right combination of commoditized technologies and all this time you can not open the legal entity at all. As a result, the business starts much later than the development of the product in the traditional economy, and the creation of the company falls on a period where the level of technological risk is already very low. And the potential loss of investors - too.

2) The start-up of a solvent niche ("market fit") occurs much earlier than in traditional companies. This is due to the fact that technology entrepreneurs have turned customer development into science: hacking audience growth and even crowdfunding are powerful tools that are not found in a non-digital economy in principle.

Instead of conquering the market with mass marketing (= deferred market fit), it’s enough to find early followers (= early market fit) and grow on the feedback from this community (= crossing the “valley of death”).

3) The digital startup has a dominant position earlier than the traditional one for one simple reason: the winner gets everything.

In the digital economy, the leader is the one who runs faster. Therefore, in IT startups such a large return on investment.

There are at least four reasons why digital companies tend to grow exponentially.

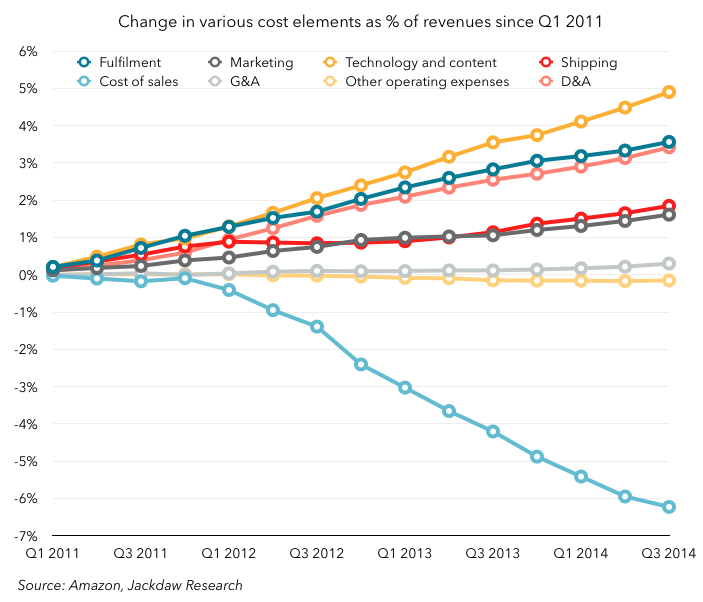

The effect of scale, which led to a fall in the cost of sales in Amazon.

The effect of scale. Several centuries of history have shown that the larger the sales scale, the cheaper the cost of production.

True, there are limits: demand ceases to grow exponentially, factories reach their maximum capacity, logistics gets complicated, new customers become more difficult to convert, scale ceases to be an advantage and turns into a commitment - therefore most companies cannot go beyond a certain market share. Well it is, by the way.

The drop in Amazon's sales value (see picture above) illustrates the economies of scale in a traditional industry, such as retail.

Network effects. Most tech companies connect their users to each other, providing a link between them either directly (sharing content with our friends from Facebook) or indirectly (reading another user on the Amazon product page). Such connections turn users into nodes and trigger powerful network effects. When they work, the value created for each particular user increases exponentially as the number of these users increases. The more a business has grown that has a network effect in the development model, the easier and cheaper it is for it to acquire new users. In addition, the more users the application has, the easier it is to save current users. The result is a growing barrier for the user to leave the company's ecosystem and, therefore,

The data . The more a business grows, the more data it can collect from different sites, especially from its customers. This data can be returned to the company's supply chain for learning algorithms that are constantly being improved in terms of accuracy and processing speed. In other words, the bigger your business, the more data you collect, and the cheaper and more accurate your internal operations are through machine learning. That is why machine learning has become the main scale technology underlying the business models of technology companies.

Virality . This is not the same as network effects. Network effects are about when the more users of a product are, the more valuable it is, and even more users come from this value. Virality is about when users themselves distribute the product for free. For example, the dropbox business model has network effects, but their main growth stunt is based on virality: a new user is given free cloud storage if he has invited friends.

When a company starts to make a profit (a lot of profit), its marketing and sales risks cease to be critical, but the risk of losing flexibility with the urgent need to move to a new technological platform or infrastructure comes to the fore. Well, or the high cost of internal transactions - to the same, machine learning has to be introduced, and competitors from Asia will overtake it :)

In the end, it turns out that technological risk rises along with the dominant company’s market share.

The increase in profits, as a rule, protects it, but:

- technological risks peak when the company occupies the entire market (see McKinsey’s article), and

- since the customers of a leading company in the IT industry almost instantly change a product or service if desired, it has to endlessly improve performance, create new functions, launch new products and constantly improve the usability of all of these (Red Queen hypothesis).

Obviously, there is a correlation between the very high competitiveness in the digital economy and the small amount of technological risk that is present in the early stages of a start-up development.

Marketing risks are very high, because customers of the digital economy are orders of magnitude more difficult to attract and retain than in the traditional economy.

Therefore, the more actively startups minimize technological risks and use ready-made technologies such as the Internet or open source (low barrier to entry into the digital economy), the greater are the risks of marketing and distribution, and competitive pressure in any niche of the digital economy will increase. These are the reasons why software eats the world.

Software eats the world because it is commoditized.

A traditional company will cope with this pressure by creating a barrier to entry. Companies from the digital economy to build a barrier is much more difficult - you need to have a truly huge profit compared with competitors. Amazon is protected by retailers and builds its stores around the house, but it also has higher profits than its digital competitors, such as Google or Facebook.

Netflix also creates a barrier to entry, because it creates original content, but again it works in a market where it is difficult to maintain an increase in profits, mainly due to the current restrictions on rights holders and established rules.

Technically, the method of building barriers to entry is based on two pillars:

1) closed ecosystems such as Google (Search, Gmail, Maps, Chrome, YouTube) or Apple (iPhone, App Store, iTunes);

2) a two-way platform business model developed by companies such as Google (users / advertisers), Amazon (sellers / buyers) and Uber (drivers / passengers).

How are technology companies coping with unprecedented levels of technology risk on a large scale? This is another difference from traditional businesses.

Since barriers to entry are not as high as in traditional economies, companies cannot only rely on efficiency and frequent product updates. They need to be serious about dominating innovation on long planning horizons in principle. This means that they must attract and retain talents. A war for talents begins, pointed out by John Doerr:

“Google, Facebook, Amazon, Apple - I think these are the four great race leaders on the Internet. They really set the pace. They are not limited to the market. They are limited by the number of hired clever and clever. "

John Doerr: talent is the only growth limit for digital companies

Since it is so difficult to introduce radical innovations within the company, the dominant technology companies have to constantly buy innovative start-ups: this is why acquisitions in the digital world are more frequent than traditional ones.

Well, there is another branch of the digital economy where there is a venture, but it is not about IT. And she is special.

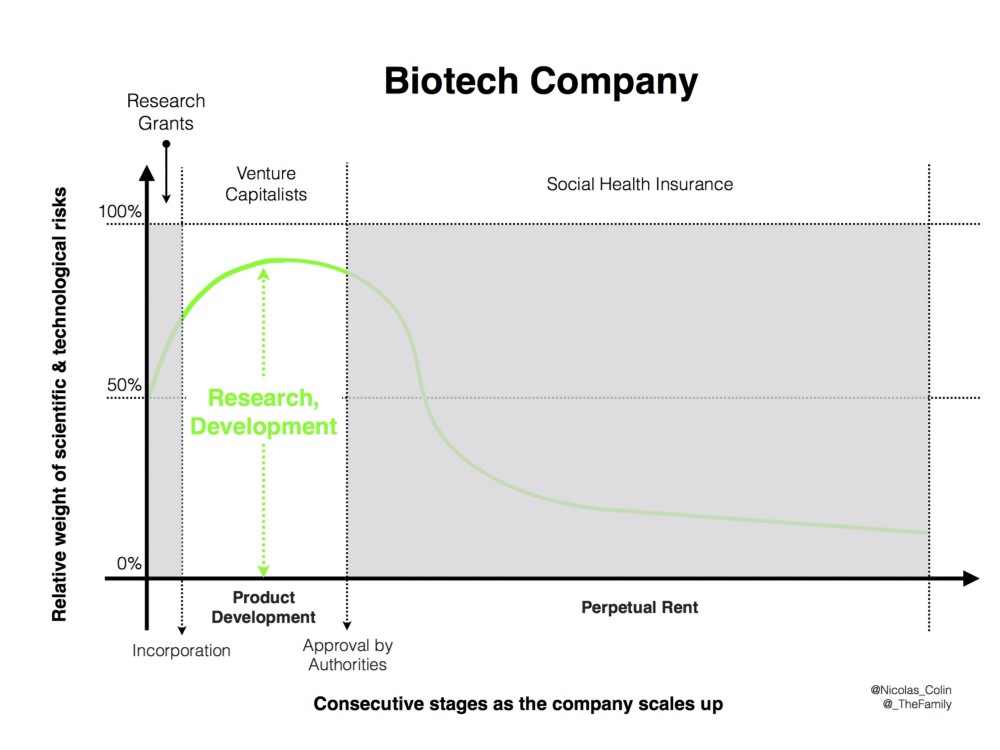

Biotech Companies

In general, the process is similar: suppose a scientist discovered a drug formula using a state grant (such as the NIH program in the US), and then he (or another entrepreneur) founded a biotechnology startup to try to create an effective drug based on this work and to launch business attracted venture money, then ... no matter how promising the market is, the drug must be approved by the authorities + get on the list of allowed for reimbursement in health insurance programs - only then the company can be opened. And invest in it.

The picture with the risk is disclosed in more detail.

As Dr. Janeway puts it, the situation of biotech companies is very different from IT companies, although both are based on venture capital:

Since the entire market for biotech innovations is heavily regulated by the state, the demand for a product becomes inelastic. That is, a startup faces uncontrollable risks of sales and marketing in a situation of huge risks of unsuccessful R & D.

Thus, the very fact of launching a business in biotech is already an event: from this point on, it is possible to estimate the fundamental value, the present value of net cash flows from investments - and only in this case - the scientific and regulatory obstacles to market entry are overcome.

The fact that investors repeatedly made bets in biotech only confirms the rule: either low technology risks and high marketing (digital startups), or vice versa (for example, biotech) and then the free market will not work, you need a state.

Biotech is the only sector outside the digital economy where venture capital exists. In the early stages, investors are ready to abandon the quick expectations of profits because the companies in which they invest do not risk the sales and distribution market (after all, an approved drug is very easily brought to the market and paid for by social insurance, and sick and dying people buy medicines despite no matter what.

You do not have a business, as long as there is no medicine, and vice versa; if you have a medicine, you can make a fortune. Consequently, it is important, as Index Ventures wrote in its blog, to focus only on one thing (and on one risk): the development of one (right) molecule.

Key findings

Venture capitalists work with the market under two conditions, when:

- there is a need for financing for only one risk category (marketing in a digital economy or technology in biotechnology) and

- The potential success is so huge that it will cover both the possible losses from the realization of the risk and all the losses of the investor’s portfolio.