How do I create a user survey that boosts conversion?

- Transfer

Every day, hundreds, maybe thousands of visitors come to your site. This undoubtedly pleases and speaks of the popularity of your project. But will these people buy? Are they your target audience? Or did they just drop out of curiosity?

Every day, hundreds, maybe thousands of visitors come to your site. This undoubtedly pleases and speaks of the popularity of your project. But will these people buy? Are they your target audience? Or did they just drop out of curiosity? If you cannot separate your target audience from the entire array of Internet users, the chance of success in business is extremely small. That is why it is necessary to constantly study your audience: its interests, behavior, preferences, income level. How to do it? With the help of polls. They will be discussed in our article.

Qualitative polls, quantitative data ... What is the difference?

Before moving on, let's make sure that you and I speak the same language.

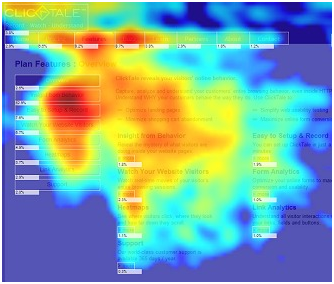

Quantitative data are related to numbers and measurements. As a rule, in the case of conversion optimization, we are dealing with just such information - we are talking about the conversion rate, A / B testing of the results, building heat maps, etc. - All these data suggest specific figures and facts.

As for the qualitative data, they are the characteristics of an object, not specific numbers. This complicates the analysis, because first of all, you need to deal with the data, interpret and analyze them.

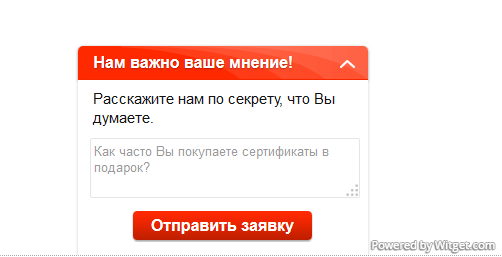

An example of a quality survey implemented using the feedback form of the Witget service .

Both types of data are very important, but the benefits are different.

As a rule, thanks to quantitative data (numbers), we learn that something is going wrong, and working with quality information, we find the answer to the question, what is the cause of this error. Next, we will focus primarily on high-quality data, namely, how to get it through surveys.

Think polls really work?

Let's say you are launching a new product of really good quality - at least that is what users who tried it said. You do a large-scale targeted email distribution for 30,000 people, but, here's the failure, of which only 30 users are registered!

You offer to pass a survey to those users who clicked on the link but did not purchase your product or did not use the service. This is exactly what Noah Kagan did when he launched the project “How to earn $ 1,000 a month from scratch?”.

The questionnaire included only four simple questions :

- Were you interested in buying? - WELL NO.

- Why?

- What keeps you from starting your own business?

- Or did our support have to sing a song about hares for you to buy ?!

Based on the obtained data, an analysis was carried out, as a result of which the landing page was completely redone to meet the preferences of customers and at the same time be useful, giving answers to the most pressing questions of users.

We will talk about how we used the obtained result later.

Where to start conducting quality surveys?

The purpose of any questionnaire is the desire to find out what you did not know before. Unfortunately, entrepreneurs often conduct useless surveys that do not help in further work and do not provide any relevant information.

With high-quality polls, everything is different - you collect both negative and positive reviews, which can lead to real results in the near future.

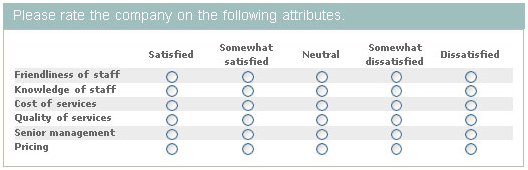

For example, if you want to use high-quality feedback to optimize the hiring process, ask your users to rate the “friendliness of the staff” on a scale of 1 to 5. This will give you really useful information about the personal qualities of your employees - the data you can use to increase customer loyalty.

In addition, questions like “Did you like to work with our employee?” Or “What are the advantages of our staff?” Will help identify the best performers, as well as pay attention to those character traits that your company employee should have.

Another advantage is that you get a clear description by users of your activities - this information can be used to adjust the value proposition or improve your product to make it better and more unique than competitors.

Who to interrogate?

The answer to this question, first of all, depends on the results you want to get, and on the selected client segment.

If you want to improve sales, contact new customers (and users who have not yet made a purchase). If you intend to run a loyalty program to retain customers, ask regular customers. Well, if you plan to create a VIP-program for the most active customers, respectively, conduct a survey among those who buy from you most often.

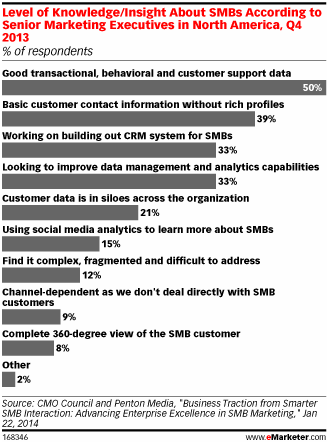

Despite the fact that the above is quite obvious, according to the 2010 TheRelevancyGroup's poll, most marketers most often pay attention to the demographic and geographical data of a client when conducting a survey.

And the point is not that this work is already four years old, but that segmentation is still not set up properly. A CMO Council & Penton Media study in the 4th quarter of 2013 found that only half of the surveyed companies achieved transactional and behavioral data of high quality.

Here are some ideas for grouping users:

- The most active buyers

- regular customers;

- customers who often shop;

- old customers;

- registered but not buying users;

- demographic separation;

- interests;

- grouping according to the history of visits.

What to do with users who open the site, follow the link, but do not buy?

screenshot Monthly1k.com

Remember how Noah polled users who followed the link but did not purchase the product?

Using a quality survey, he realized that people do not buy, because:

They are afraid.

- Not sure if this model will work in their country.

- Not sure about the effectiveness of the program in their particular case.

- The user remembers previous failures and is not sure that this time will be different.

Fear:

We determine whether the model will be effective for your country:

Personalization: will it suit me?

Past failures: will it be different now?

And while Noah preferred to keep silent about the jump in conversion and the increase in income that occurred due to the above transformations, he boasted that "my whole product changed literally in one night."

The moral of this story is that you should not neglect users who did not immediately make a purchase. By accessing the site and following the link, they showed their interest, and you just have to find out why they decided to refrain from buying so far.

... and how many users need to be polled?

Our goal is to get from 100 to 200 answers to the proposed questions, but if there are more than 200 respondents, we randomly select 200 results and analyze them.

It should be noted that if we take more than 200 answers, many of them will be repeated, and if less than 100, then some random negative comments can significantly affect the overall result, which is undesirable.

Again, if you have made a purchase of only 100 people, you should interview them. Even 20 users is more than nothing, but in this case you should be careful with the analysis results - they are not always accurate.

How can I get your polls answered?

Based on our experience, the best way to encourage your customers to fill out a questionnaire is to offer them some kind of bonus - a gift card, a discount coupon, free delivery, etc.

Of course, the value of the gift should depend on the size of your company or the number of people you are going to interrogate - the bonus for providing information should somehow reflect the total profit from cooperation with the client segment from which you want to get a response.

In the example above, ThinkGeek suggested that Tommy participate in a $ 500 certificate draw in exchange for feedback.

Even if you discard the fact that $ 500 is a fairly large amount, Tommy still bought goods on this site worth 4-5 times more than last year. If ThinkGeek used this quality data to recruit at least four such buyers as Tommy, they would have earned $ 10,000 more a year.

But what if users pass the survey, only to receive a gift, and answer a lie?

Of course, there is always a risk, but in our experience, the information received is a hundredfold outweighs the potential risks. In addition, it’s easy enough to notice when “especially gifted” users deliberately distort the results.

Yes, there are always such clever people, but in reality there are not so many of them - out of 100 respondents, on average, only 5 people answer the survey just for the sake of a gift. And they do not even so much distort the results as they answer monosyllabic and short. We simply exclude such users from the analysis.

Tips & Tricks

Before sending an invitation letter to take a survey, make sure the message is as simple and short as possible. Do not forget to indicate how long it takes to fill out the questionnaire (as an alternative, use the number of questions - “only five short questions!”).

Define a deadline (up to a week) and do not forget to send a reminder several times. Based on our experience, most (about 80%) of replies come within 24 hours after sending the first letter.

The letter template we use

We use a universal template to send an invitation letter to take a survey, which we customize for each client based on his needs.

Here's what it looks like:

*** STARTING A LETTER ***

Hello friends!

We are doing everything in our power to provide you with high quality service, and we need your help. Help understand your expectations.

Please take only 5 minutes to fill out this short form: link . Your answers will really help us a lot.

Please take the survey in the next 2-3 days. Here is the link to go to: link .

We really value your time, so each respondent will receive a useful gift: you can choose a $ 25 gift card from Amazon or Starbucks, a $ 25 donation from UnitedWay, or free delivery of your next order.

We will contact you after you send us the completed form.

Many thanks!

*** END OF LETTER ***

You can use this template or trust your imagination. Read more about how to create the perfect email for the newsletter in the article “Increasing sales of the online store: 5 steps to create a perfect email newsletter” .

What questions can you ask?

Depending on what you want to know about your customers, types of questions are being developed.

To get all the necessary information and better know your target audience, pay attention to the following examples:

- Tell us about yourself! -> identifying trends that your customers are targeting. Representatives of B2B business will be able to obtain information about the industry in which the user works.

- Which product are you using? -> What kind of problem does it solve for the user?

- Are you simplifying your life by using our product? -> the client himself speaks about the advantages of your product, and this is invaluable information for the formation of a value proposition.

- What made you register / buy our product? -> those features that you use + benefits.

- Do you know alternatives to our product / purchase from us? If yes, please name them -> what is the competition? Ways to help you beat your competition.

- Have you doubted before making a purchase? In what? -> identification of sources of disagreement and their resolution (or correction, if they are related to usability).

- Was there something that almost stopped you from buying? -> again identifying difficulties.

- Do you have any questions that you could not find the answer to? -> 50% of purchases on the site do not occur due to lack of information. Such questions help you find out what information your customers lack.

- What was the biggest difficulty in choosing the right product? -> this will help you find out the conversion path of the client.

- Would you like to ask us something? -> the user will leave data for feedback so that you can answer questions.

Of course, do not blindly copy these questions - if for the successful development of your business some specific information is needed, do not be afraid to ask customers about it. And do not forget to make sure that each of your questions pursues a purpose, and is not asked simply out of interest.

Only registered users can participate in the survey. Please come in.

What questions should I ask in the survey?

- 23.8% Why do you use our product / service? 16

- 26.8% Which product (which service) do you like most? 18

- 46.2% What would you like to change? 31

- 17.9% Tell us about yourself. 12

- 47.7% Do you have any questions for which you could not find an answer on the site? 32

- 46.2% Does our product solve your problem? Which one? 31