How to buy stocks of IT companies before, during and after an IPO

In the comments on our past materials (about IPO and listing on the Alibaba concern), readers asked questions about how to participate in these placements and become the owner of shares in well-known companies. Today we will consider this issue in more detail.

How to find out about IPO

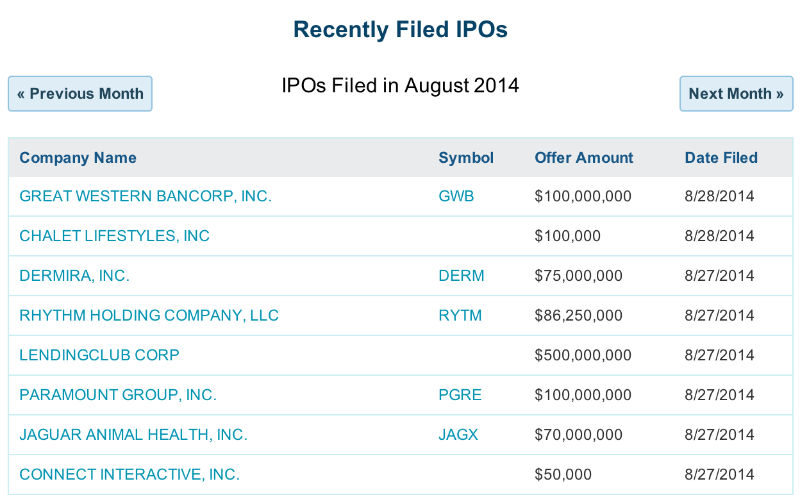

Habr users were interested not only in how to buy shares, for example, of the same Alibaba, but also in how to get information on upcoming placements on exchanges. This process is not covered in great detail in the press - it is rather routine and consists in constant monitoring of special aggregator sites (here is an example of such a resource) or sites of exchange platforms themselves (for example, Nasdaq ). Such resources usually have a calendar of IPO applications filed by companies.

You need to be prepared for the fact that the bulk of these companies are completely unknown to a wide range of Internet users, and many of them are planning not very large-scale placements.

How investors buy stocks before IPO

Everyone knows that the main benefit in the course of entering the stock exchange is gained by the shareholders of the company, which became such in advance. For this, which is logical, it is necessary to invest money in the company. Accordingly, the amount of investment should be significant - otherwise it is difficult to arouse the interest of company owners in the sale of part of the share. In general, in companies that are looking for investments, there is usually an employee who is responsible for relations with investors, which helps them determine the conditions and complete the transaction.

Another opportunity to buy shares is the so-called pre-market. Shares of a company gathered at an IPO can be bought before the underwriter (we considered his role in the general topic about IPO) Like regular investments in a company, the amount of financial injections must be significant in order to arouse the interest of the owners.

Purchase of shares after the start of trading

After the shares officially began to circulate on the stock exchange, they are no different from financial instruments that were previously traded on the site. In the first time after the start of trading, it is usually easier to buy stocks, since on such days liquidity rises due to the general interest in the event.

For example, on the day of the Facebook IPO, more than 80 million shares were sold (and bought) in the first 30 seconds of trading. Such a volume of operations was performed by high-frequency trading robots (HFT).

When you try to buy shares of companies that go public, you should always remember about the possibility of a sharp increase in prices on the first day. For example, in 2011, LinkedIn shares on the first day of trading increased in price by 109% - from $ 45 to $ 94.25 per share. Often, subsequently, the price is adjusted and may even fall below the cost of the initial placement.

How to buy shares on foreign exchanges

In order to trade on foreign exchanges, you must either contact your local broker to open an account (which is not so easy to do) or find a Russian broker that provides access to trading.

The shares of many popular technology companies are traded, for example, on the NASDAQ, respectively, you will need a Russian broker who has access there (a good post for beginners about searching for trading options on the NASDAQ can be read here ). If the company of interest to the investor is traded on the London, New York or Chicago stock exchanges, then a Russian broker will need a partnership with companies operating on these sites (through ITinvest you can work with several foreign exchanges, their list is available here ).

How to buy shares on Russian exchanges

Buying papers on Russian stock exchanges is easier due to the lack of unnecessary links and complex schemes. The main Russian exchange platform is the Moscow Exchange, which was formed after the merger of two competitors - RTS and MICEX. An individual cannot independently trade on the exchange so easily, for this you need to be a professional participant and obtain an appropriate license.

Brokers and some banks have such licenses. The list of operators, for example, on the stock market and statistics on them, can be viewed on the exchange website . In general, it is quite simple to open an account with a broker - for this you need not so many documents (we have an applicationfor opening, you can leave it on the site). Then it will be necessary to deposit money into a brokerage account, install special trading software (we have developed our own terminal) and begin to carry out operations with shares and other financial instruments.

IPOs on the Moscow Exchange are not so frequent. One of the latest news on the topic is the intention to place shares in the holding of Slon.ru, Bolshoy Gorod and the Dozhd TV channel. In addition, Russian companies whose shares are traded abroad sometimes carry out additional placements in Russia - for example, Yandex received it in early summer (we wrote a separate topic on how to buy shares of this company).

I want to buy one share and that's it

Sometimes all the above methods are not suitable for one simple reason - you want to buy one single share not for profit, but “for show” (I am a co-owner of Facebook!) Or, for example, as a gift to a friend. This problem can be solved without opening a brokerage account. Abroad, there are projects specializing in the sale of securities of public companies that offer their shareholders special certificates of ownership (not all companies have such certificates, for example, Apple does not use them).

Sites like GiveAShare.com , OneShare.com, or Uniquestockgift.comthey give the opportunity to buy a share at a market price without opening a brokerage account, but take an additional commission in the amount of several tens of dollars. The buyer needs to select the company of interest and fill out a short form. The certificate of ownership can be “decorated” with a variety of frames, engraved plates, etc.

That's all for today! Thank you for your attention, we will be happy to answer questions in the comments.

Related posts and links: