Enlarge your pension size or your own financial advisor

Microsoft founder Bill Gates has become a shareholder in Six Flags. According to an analyst at JP Morgan, the purchase of Six Flags shares by the founder of Microsoft is a common investment process. According to information received from a personal representative of Gates, the head of Microsoft regularly invests in various companies selling shares of other companies ... August 2002

We all work and transfer part of our earnings to pension programs. What happens next with pension money in official pension programs and what are the prospects for pension programs for 20-30 years ahead ... we will probably not discuss. Moreover, the problem is not in a specific country, the problems are global in all countries with a pension system:

- The population is aging,getting fat and getting stupid,there are more and more retirees as a percentage, and can compensate for the increase in pension expenses in modern economic conditions ... by increasing deductions and taxes from those who work? And a reduction in real pensions due to inflation?

- The official licensed managers of pension funds all over the world are doing their job so well that in 2008 ... everyone suddenly realized how much. To decide whether it makes sense to depend on the work of these guys in costumes, you can read Michael Lewis on a related topic - “The Big Game for a Slump ” and “ From the First World to the Third . Read easily and quickly.

But not everything is so bad, there is a way out of this situation. At this point, according to the classics of the genre, I have to offer you a miracle product that will immediately solve the problem of pension provisionand excess weight . But I won’t do it. I will simply describe the various available ways to independently solve the problem of pension and long-term investments. Through the efforts of unknown heroes of nameless programmers on the network, you can already find quite a lot of free calculator utilities that allow you to do a lot of things that financial advisors had previously done for a fee.

Those who think about their future find the simplest ways to behave in such a situation - bank deposits (in Russia) and buying real estate (all over the world). A more complicated and interesting point is that in recent years, any private investor with at least 500 dollars has become available with such long-term diversified investment tools (not to be confused with speculation, quick money, makingmoney on the Internet, making money in online casinos, hvoreks, online -betting-petting , etc.), which were previously available only to large investor pools. I mean the emergence of a huge number of so-called ETFs - the Exchange Traded Fund , the diversity of which, in my opinion, made the whole industry of investment intermediaries not particularly needed.

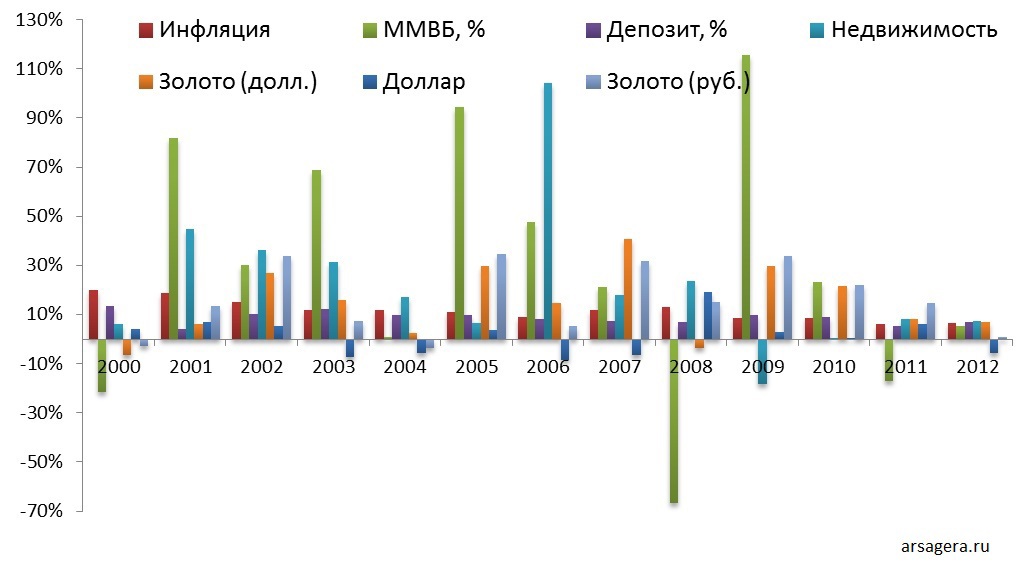

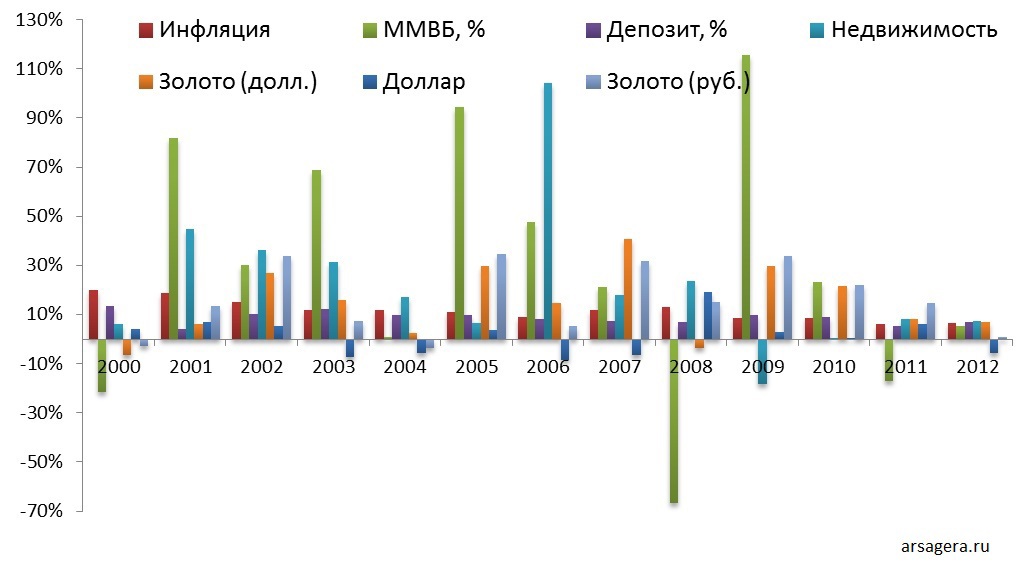

We start the discussion with Deposits. This is the easiest and most affordable tool. A small nuance is that on average over the long term, deposit rates lose inflation . Below is the very first chart in Google that clearly shows inflation and average interest on deposits year after year for the Russian Federation:

Not always, not so much, but on average deposit rates lose inflation. Over the past 10 years, inflation (Russia, Ukraine, Kazakhstan) has been on average about 7-10%, which means a fall in purchasing power over 10 years every two and a half. Do we often have higher deposit rates? Usually (worldwide) the rate loses inflation at least one and a half to two percent. But even these 1-2 percent a year, before retirement, can eat a lot from our savings, and not at all provide us with a good pension. You also need to consider that the highest rates are observed in not the most reliable banks, and reliability is important for our savings. Yes, I speak for you - It is important for us - I know your opinion.

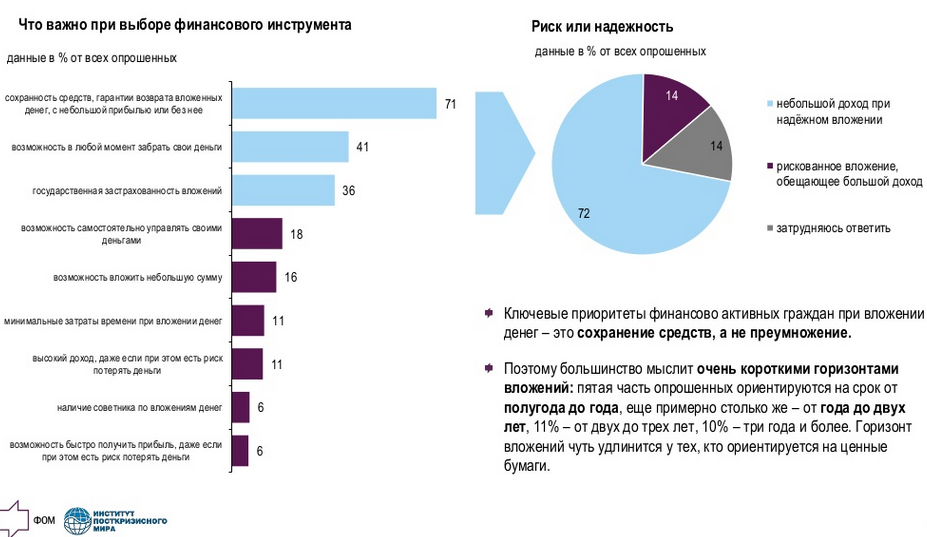

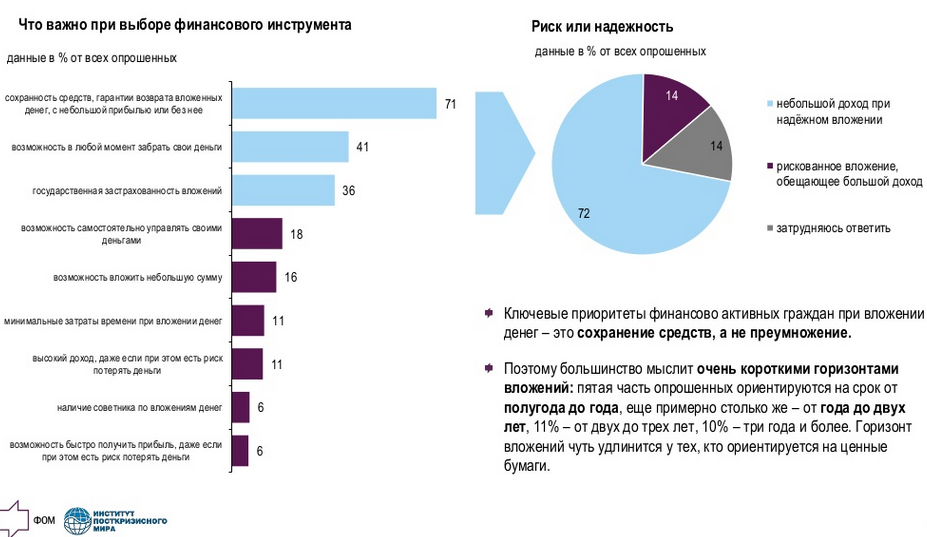

According to a survey by the Public Opinion Foundation in March 2013

71% of respondents said that when choosing an investment in the first place is the safety of funds, money back guarantees with little or no profit. The key priority is not multiplication, but safety. According to the authors of the study, this leads to very short horizons of investment. And naturally, inattention to, for example, what real profitability real estate shows in the long term for 20-30 years (and not just during boom periods), inattention to the long-term effect of inflation.

57% of respondents use bank deposits to achieve long-term goals. At the same time, people do not notice that deposit rates only allow you to protect yourself from most of the inflation, nothing more.

The logical low-risk payment is low income, so there is nothing surprising here. Risk and profitability are inextricably linked. Also, in the long run, inflation cannot be defeated by other low-risk instruments - accumulative life insurance, bonds, savings certificates and ... pension funds.

Further, the gurus of financial markets will inevitably make the transition to high-yield instruments - to stocks. And immediately they advise you to buy shares of mutual funds, open a brokerage account, get training in trading,sell your soul to the devil, go with an ax to an old woman .

Over the long term, the stock indices of different countries (especially those that do not lose the war on their territory) are actually significantly ahead of inflation and generate income sufficient for the pension portfolio:

However, the payment for a few percent higher than inflation is monstrous volatility (volatility) in the short term, which is measured already tens of percent. And these fluctuations are very downward directed. Those. profitability is balanced by risk. Moreover, the closer to retirement, the more inappropriate such fluctuations will be in the pension portfolio, and the weaker the heart. I would not really like to receive a 50% drawdown one year before retirement along with the stock index.

There are 2 ways to avoid a heart attack in this situation.

The first - like Buffett to devote 7 days a week to the study of investment opportunities, or like Soros - to devote 7 days a week to the study of speculative opportunities. A small nuance is that the labor costs here will be huge, but success is not very guaranteed. For various reasons, described, for example, by Taleb and Kahneman in their books, very few try to repeat the successes of Buffett and Soros. Let's say we all have evolutionary-driven bug-features in our heads that make us prone to:

- fall into euphoria, panic, tilt, gambling on the stock market;

- incorrectly assess the risks.

These bugs can be circumvented, you can generally learn a lot. This is not much harder than quitting. Everyone can easily. We will agree that we can, too, but we simply do not have time to do this professionally now.

Therefore, we will be interested in the second method - the so-called Asset Allocation. In Russian, it is commonly called the Asset Allocation, Passive Investments.

Even a investor who does not know anything about investments will be able to surpass the achievements of most investment professionals if he periodically invests in index funds. This is paradoxical, but when “stupid money” acknowledges its limitations, it ceases to be stupid - Warren Buffett.

On the website of the US Federal Securities Commission (SEC) posted thisintroduction to the essence of the method, such as translation , I will quote:

Even if you are new to investing, you probably already understand some of the most important principles of effective investing. Just from my life experience unrelated to the stock market. For example, you often saw that street vendors sell things that seem to be incompatible with each other - like rain umbrellas and sunglasses. This may seem counterintuitive to many. When do customers take both at the same time? Obviously, never - and this is the whole point of the actions of sellers. Traders understand that when it rains, it’s easy to sell umbrellas, but it’s hard to sell sunglasses. Clearly, the opposite is true in sunny weather. “By diversifying the product line”, i.e. offering both products - a street vendor can reduce the risk of losing profits any day ...

And then the Federal Commission proposes that the investor take care of the portfolio of stocks, bonds and money market instruments (I know that sounds strange, but you can start with Schiller’s translated course of lectures ). Until you forget, on the Vanguard website you can interactively play around with the simplest portfolio of these 3 parts with annual rebalancing (annual restoration of the given distribution of assets):

- in the upper right part of the diagram there is a display mode switch, and below there are sliders for changing the shares. Practical utility is not enough, but for clarity it is very useful. I mean the visibility of the change in the smoothness and stability of portfolio growth depending on the distribution of asset classes.

Another online calculator for the distribution of savings (it also takes into account the age of the future pensioner) from Iowa is available here .

The simplest portfolio of stocks / bonds / money indicated by the Federal Securities Commission of the United States is actually not suitable for everyone and not always. It is good for illustration. We ourselves can make the portfolio more reliable. If we have at least a few hundred dollars, thanks to a large selection of ETFs (units of index funds), we can compile a portfolio of asset classes that will allow us to smooth out fluctuations in financial markets, reduce risk and the size of losses, but at the same time maintain profitability above inflation. And spend quite a bit of time on all this.

In fact, the ETF is a new type of securities that acts as a certificate for a share of a portfolio of shares. This allows each investor to own a piece of any index, i.e. diversify very much. Previously, the size of such a piece was relatively large and expensive, and therefore inaccessible to most investors.

If you do not chase superprofits, you can significantly reduce the risks and the complexity of our investment activities. You won’t get rich at a frantic pace, but for the pension portfolio, that’s it.

Continued here .

PS If I gave a link to somewhere, this does not mean that you need to trust there and enter into commercial relations. Quite the contrary, the meaning of my posts is that "not the gods burn the pots." You can easily avoid unnecessary intermediaries and costs. Much can be understood and easily done independently. And tell friends who have not had time to attend to the work of the pension system, long-term statistics, and are confident that "real estate can only go up in price."

We all work and transfer part of our earnings to pension programs. What happens next with pension money in official pension programs and what are the prospects for pension programs for 20-30 years ahead ... we will probably not discuss. Moreover, the problem is not in a specific country, the problems are global in all countries with a pension system:

- The population is aging,

- The official licensed managers of pension funds all over the world are doing their job so well that in 2008 ... everyone suddenly realized how much. To decide whether it makes sense to depend on the work of these guys in costumes, you can read Michael Lewis on a related topic - “The Big Game for a Slump ” and “ From the First World to the Third . Read easily and quickly.

But not everything is so bad, there is a way out of this situation. At this point, according to the classics of the genre, I have to offer you a miracle product that will immediately solve the problem of pension provision

Those who think about their future find the simplest ways to behave in such a situation - bank deposits (in Russia) and buying real estate (all over the world). A more complicated and interesting point is that in recent years, any private investor with at least 500 dollars has become available with such long-term diversified investment tools (not to be confused with speculation, quick money, making

We start the discussion with Deposits. This is the easiest and most affordable tool. A small nuance is that on average over the long term, deposit rates lose inflation . Below is the very first chart in Google that clearly shows inflation and average interest on deposits year after year for the Russian Federation:

Not always, not so much, but on average deposit rates lose inflation. Over the past 10 years, inflation (Russia, Ukraine, Kazakhstan) has been on average about 7-10%, which means a fall in purchasing power over 10 years every two and a half. Do we often have higher deposit rates? Usually (worldwide) the rate loses inflation at least one and a half to two percent. But even these 1-2 percent a year, before retirement, can eat a lot from our savings, and not at all provide us with a good pension. You also need to consider that the highest rates are observed in not the most reliable banks, and reliability is important for our savings. Yes, I speak for you - It is important for us - I know your opinion.

According to a survey by the Public Opinion Foundation in March 2013

71% of respondents said that when choosing an investment in the first place is the safety of funds, money back guarantees with little or no profit. The key priority is not multiplication, but safety. According to the authors of the study, this leads to very short horizons of investment. And naturally, inattention to, for example, what real profitability real estate shows in the long term for 20-30 years (and not just during boom periods), inattention to the long-term effect of inflation.

57% of respondents use bank deposits to achieve long-term goals. At the same time, people do not notice that deposit rates only allow you to protect yourself from most of the inflation, nothing more.

The logical low-risk payment is low income, so there is nothing surprising here. Risk and profitability are inextricably linked. Also, in the long run, inflation cannot be defeated by other low-risk instruments - accumulative life insurance, bonds, savings certificates and ... pension funds.

Further, the gurus of financial markets will inevitably make the transition to high-yield instruments - to stocks. And immediately they advise you to buy shares of mutual funds, open a brokerage account, get training in trading,

Over the long term, the stock indices of different countries (especially those that do not lose the war on their territory) are actually significantly ahead of inflation and generate income sufficient for the pension portfolio:

However, the payment for a few percent higher than inflation is monstrous volatility (volatility) in the short term, which is measured already tens of percent. And these fluctuations are very downward directed. Those. profitability is balanced by risk. Moreover, the closer to retirement, the more inappropriate such fluctuations will be in the pension portfolio, and the weaker the heart. I would not really like to receive a 50% drawdown one year before retirement along with the stock index.

There are 2 ways to avoid a heart attack in this situation.

The first - like Buffett to devote 7 days a week to the study of investment opportunities, or like Soros - to devote 7 days a week to the study of speculative opportunities. A small nuance is that the labor costs here will be huge, but success is not very guaranteed. For various reasons, described, for example, by Taleb and Kahneman in their books, very few try to repeat the successes of Buffett and Soros. Let's say we all have evolutionary-driven bug-features in our heads that make us prone to:

- fall into euphoria, panic, tilt, gambling on the stock market;

- incorrectly assess the risks.

These bugs can be circumvented, you can generally learn a lot. This is not much harder than quitting. Everyone can easily. We will agree that we can, too, but we simply do not have time to do this professionally now.

Therefore, we will be interested in the second method - the so-called Asset Allocation. In Russian, it is commonly called the Asset Allocation, Passive Investments.

Even a investor who does not know anything about investments will be able to surpass the achievements of most investment professionals if he periodically invests in index funds. This is paradoxical, but when “stupid money” acknowledges its limitations, it ceases to be stupid - Warren Buffett.

On the website of the US Federal Securities Commission (SEC) posted thisintroduction to the essence of the method, such as translation , I will quote:

Even if you are new to investing, you probably already understand some of the most important principles of effective investing. Just from my life experience unrelated to the stock market. For example, you often saw that street vendors sell things that seem to be incompatible with each other - like rain umbrellas and sunglasses. This may seem counterintuitive to many. When do customers take both at the same time? Obviously, never - and this is the whole point of the actions of sellers. Traders understand that when it rains, it’s easy to sell umbrellas, but it’s hard to sell sunglasses. Clearly, the opposite is true in sunny weather. “By diversifying the product line”, i.e. offering both products - a street vendor can reduce the risk of losing profits any day ...

And then the Federal Commission proposes that the investor take care of the portfolio of stocks, bonds and money market instruments (I know that sounds strange, but you can start with Schiller’s translated course of lectures ). Until you forget, on the Vanguard website you can interactively play around with the simplest portfolio of these 3 parts with annual rebalancing (annual restoration of the given distribution of assets):

- in the upper right part of the diagram there is a display mode switch, and below there are sliders for changing the shares. Practical utility is not enough, but for clarity it is very useful. I mean the visibility of the change in the smoothness and stability of portfolio growth depending on the distribution of asset classes.

Another online calculator for the distribution of savings (it also takes into account the age of the future pensioner) from Iowa is available here .

The simplest portfolio of stocks / bonds / money indicated by the Federal Securities Commission of the United States is actually not suitable for everyone and not always. It is good for illustration. We ourselves can make the portfolio more reliable. If we have at least a few hundred dollars, thanks to a large selection of ETFs (units of index funds), we can compile a portfolio of asset classes that will allow us to smooth out fluctuations in financial markets, reduce risk and the size of losses, but at the same time maintain profitability above inflation. And spend quite a bit of time on all this.

In fact, the ETF is a new type of securities that acts as a certificate for a share of a portfolio of shares. This allows each investor to own a piece of any index, i.e. diversify very much. Previously, the size of such a piece was relatively large and expensive, and therefore inaccessible to most investors.

If you do not chase superprofits, you can significantly reduce the risks and the complexity of our investment activities. You won’t get rich at a frantic pace, but for the pension portfolio, that’s it.

Continued here .

PS If I gave a link to somewhere, this does not mean that you need to trust there and enter into commercial relations. Quite the contrary, the meaning of my posts is that "not the gods burn the pots." You can easily avoid unnecessary intermediaries and costs. Much can be understood and easily done independently. And tell friends who have not had time to attend to the work of the pension system, long-term statistics, and are confident that "real estate can only go up in price."