How to receive income from Google Play on the account of LLC

- Tutorial

This article will be of interest to Russian companies that sell applications through Google Play. I have such a company, and in my experience I will tell you how we set up cash flows with GP so that they are legal. If you are not white and not fluffy, i.e. If you think that taxes can not be paid, feel free to close this article.

Problem:

Revenues from Google Play - the same income, they have to pay taxes. Not all developers know how to set up revenue generation to meet the requirements of the Tax Code.

Solution:

To receive income on an IP or on an LLC and formally pay income.

If interested in IP read here and here .

This article is about generating income to the account of LLC.

Initial data

You have a developer account on Google Play - how to create it, read here

. You have an application that generates income - how to create it, you won’t get off with one link.

You have an LLC.

Setting up

Google Play conducts settlements in USD, so you will need a currency account. You can open a foreign currency account in any normal bank. Call there, they will explain the procedure. Open an account will cost 2-3 tr.

When you open a foreign currency account, you will receive the account details. You will need:

1. Name of the bank in English

2. BIC

3. Number of an open account

4. BIC of the bank (or it is also called SWIFT)

In order for the bank to have a reason to accept payment from Google, you must provide it with several documents:

1. Public offer with Google Wallet in 2 languages. Read more about it here .

2. If the amount of receipts for the period of validity of the public offer exceeds $ 50K, then it will be necessary either

a) to issue a transaction passport;

b) re-signing a public offer with your bank (this is easier because it is done unilaterally, without the participation of Google Corp).

Some banks request a letter in any form, where you notify the bank that the amount for this public offer will not exceed $ 50K.

3. Developer Distribution Agreement. This document , the glory of Google, is in Russian.

It remains to tell Google the details of your account.

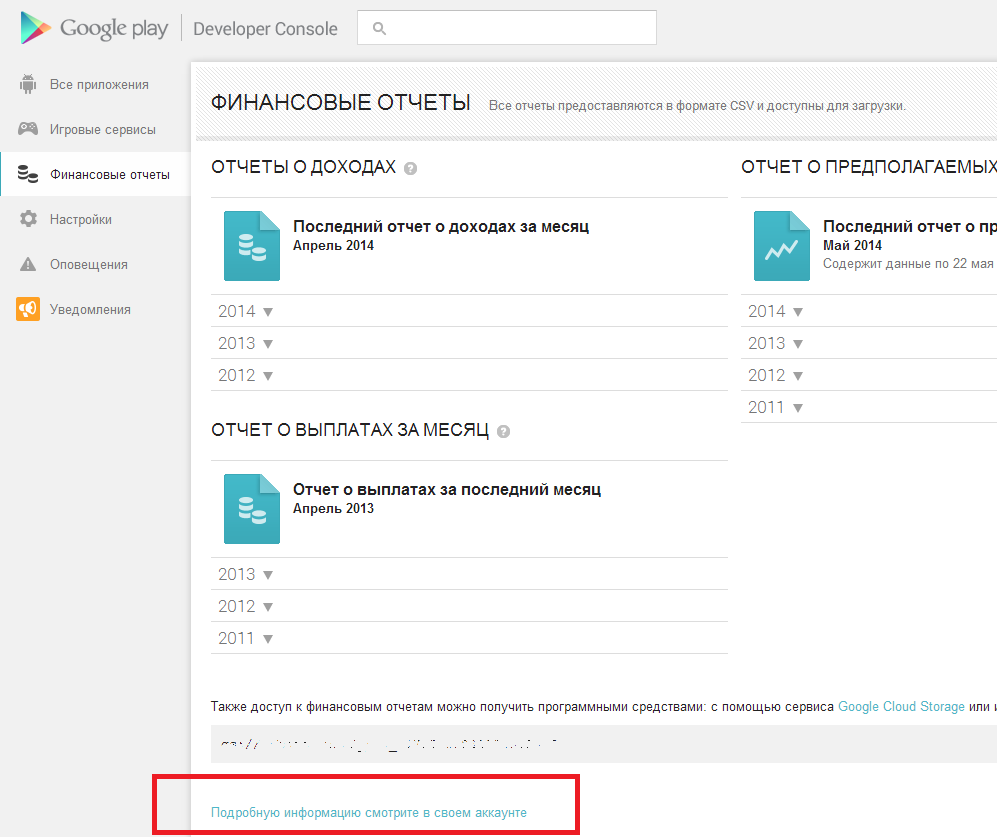

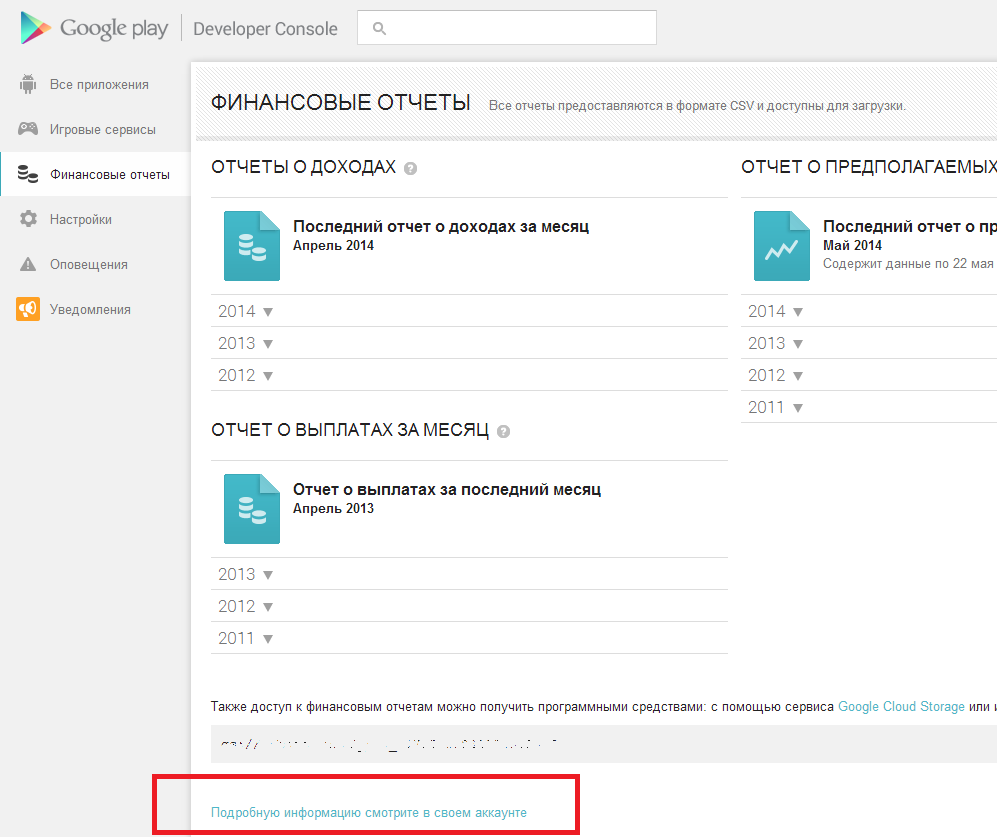

Go to the Google Play Dev Console:

Go to the Payment settings and fill in the fields:

Name of the account holder : name of your company in English, for example, Roga and Kopyta

Bank name : for example, NEOVASYUKIBANK

BIK : BIC of your bank, for example, 123456789

SWIFT / BIC : SWIFT Your bank, for example, NVSKRU5T

Account number: number of your foreign currency account (not to be confused with transit)

Congratulations! Now Google will send your hard earned money to this account.

But to accept this money, you need to accompany each transaction with documents.

Money Acceptance

Scenario:

1. Google sends money to a transit account at your bank.

2. A bank employee notifies you of the receipt of money in a transit account. From this moment you have 15 days to accept this money, i.e. transfer them from a transit account to a settlement account, otherwise a fine.

3. You provide documents to the currency department of the bank confirming that the money came to you. What to do for this:

3.1. Form Invoice by template , save to PDF

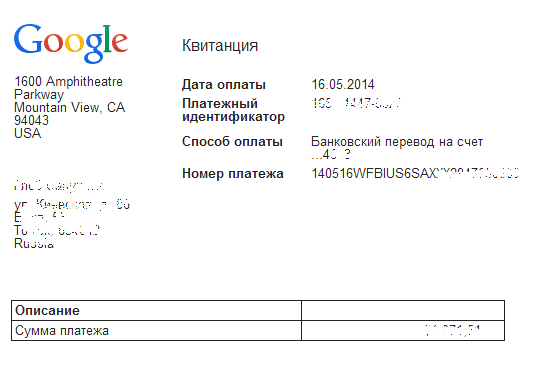

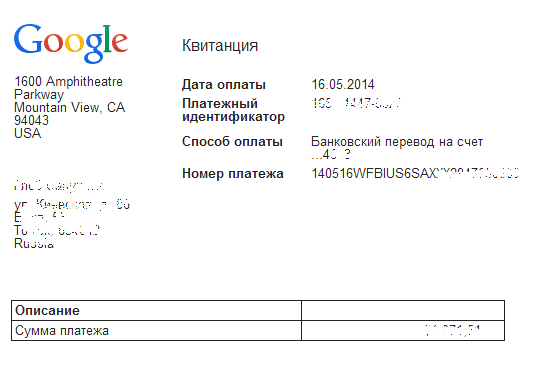

3.2. Create a receipt: Google Wallet -> Payments -> Transactions -> Automatic payment => A receipt will appear, take a screenshot

3.3. Send Invoice and receipt to the currency department of the bank.

4. You transfer money from transit to a current foreign currency account. To do this, create an acceptance order. I do this through the Internet bank, I create the currency document “Order for compulsory sale”.

At the disposal you will need to indicate the amount of foreign exchange earnings. It will be less than the amount sent by Google due to transit bank fees. The total amount will be reported to you by a bank employee.

Total amount = Amount sent by Google - $ 15 (approximately).

How to fill in other fields of the order, tells the employee of the foreign exchange department.

5. You draw up a certificate of currency operation - a bank request. They need this for accounting: how much money, and on what grounds it comes to Russia.

I also do this through the Internet Banking, I create the currency document “Certificate of Currency Transactions”.

Ask the bank employee for the rules for this document.

6. You sell currency for rubles.

Most likely, you are calculating in rubles, therefore, the accepted currency needs to be sold, i.e. transfer from a foreign currency account to a ruble one.

This is also done through online banking: an order is created to sell foreign currency.

Important:

Currency control does not tolerate errors - all financial documents must be drawn up correctly (check all dates, amounts and numbers of contracts), otherwise fines on legal entities in the amount of 50 - 80 tr

You must accept the currency no later than 15 days, otherwise, too, a fine up to the entire amount received.

When Google sends money

1. When the accumulated amount exceeds $ 100.

2. From 15 to 18 of the month following the month of sales.

Conclusion

By earning revenue from the sale of mobile apps on Google Play, you are required to pay income tax. If you are building not a one-day company, but a stable company for many years, then you need to work in accordance with our laws.

Problem:

Revenues from Google Play - the same income, they have to pay taxes. Not all developers know how to set up revenue generation to meet the requirements of the Tax Code.

Solution:

To receive income on an IP or on an LLC and formally pay income.

If interested in IP read here and here .

This article is about generating income to the account of LLC.

Initial data

You have a developer account on Google Play - how to create it, read here

. You have an application that generates income - how to create it, you won’t get off with one link.

You have an LLC.

Setting up

Google Play conducts settlements in USD, so you will need a currency account. You can open a foreign currency account in any normal bank. Call there, they will explain the procedure. Open an account will cost 2-3 tr.

When you open a foreign currency account, you will receive the account details. You will need:

1. Name of the bank in English

2. BIC

3. Number of an open account

4. BIC of the bank (or it is also called SWIFT)

In order for the bank to have a reason to accept payment from Google, you must provide it with several documents:

1. Public offer with Google Wallet in 2 languages. Read more about it here .

2. If the amount of receipts for the period of validity of the public offer exceeds $ 50K, then it will be necessary either

a) to issue a transaction passport;

b) re-signing a public offer with your bank (this is easier because it is done unilaterally, without the participation of Google Corp).

Some banks request a letter in any form, where you notify the bank that the amount for this public offer will not exceed $ 50K.

3. Developer Distribution Agreement. This document , the glory of Google, is in Russian.

It remains to tell Google the details of your account.

Go to the Google Play Dev Console:

Go to the Payment settings and fill in the fields:

Name of the account holder : name of your company in English, for example, Roga and Kopyta

Bank name : for example, NEOVASYUKIBANK

BIK : BIC of your bank, for example, 123456789

SWIFT / BIC : SWIFT Your bank, for example, NVSKRU5T

Account number: number of your foreign currency account (not to be confused with transit)

Congratulations! Now Google will send your hard earned money to this account.

But to accept this money, you need to accompany each transaction with documents.

Money Acceptance

Scenario:

1. Google sends money to a transit account at your bank.

2. A bank employee notifies you of the receipt of money in a transit account. From this moment you have 15 days to accept this money, i.e. transfer them from a transit account to a settlement account, otherwise a fine.

3. You provide documents to the currency department of the bank confirming that the money came to you. What to do for this:

3.1. Form Invoice by template , save to PDF

3.2. Create a receipt: Google Wallet -> Payments -> Transactions -> Automatic payment => A receipt will appear, take a screenshot

3.3. Send Invoice and receipt to the currency department of the bank.

4. You transfer money from transit to a current foreign currency account. To do this, create an acceptance order. I do this through the Internet bank, I create the currency document “Order for compulsory sale”.

At the disposal you will need to indicate the amount of foreign exchange earnings. It will be less than the amount sent by Google due to transit bank fees. The total amount will be reported to you by a bank employee.

Total amount = Amount sent by Google - $ 15 (approximately).

How to fill in other fields of the order, tells the employee of the foreign exchange department.

5. You draw up a certificate of currency operation - a bank request. They need this for accounting: how much money, and on what grounds it comes to Russia.

I also do this through the Internet Banking, I create the currency document “Certificate of Currency Transactions”.

Ask the bank employee for the rules for this document.

6. You sell currency for rubles.

Most likely, you are calculating in rubles, therefore, the accepted currency needs to be sold, i.e. transfer from a foreign currency account to a ruble one.

This is also done through online banking: an order is created to sell foreign currency.

Important:

Currency control does not tolerate errors - all financial documents must be drawn up correctly (check all dates, amounts and numbers of contracts), otherwise fines on legal entities in the amount of 50 - 80 tr

You must accept the currency no later than 15 days, otherwise, too, a fine up to the entire amount received.

When Google sends money

1. When the accumulated amount exceeds $ 100.

2. From 15 to 18 of the month following the month of sales.

Conclusion

By earning revenue from the sale of mobile apps on Google Play, you are required to pay income tax. If you are building not a one-day company, but a stable company for many years, then you need to work in accordance with our laws.