Are high frequency traders too slow?

- Transfer

High Frequency Trading (HFT) is an excellent object to study, because until now there is no consensus in the world about its pros and cons. Therefore, scientists and practical traders can continue to write articles about why it is bad or, conversely, good, and some statements will not contradict others, since article authors often use different rating systems. Moreover, even if you have decided on the object of assessment, it is usually very difficult to measure, not to mention giving a comment on the measurement results.

Not so long ago I got a working reportEuropean Central Bank on High Frequency Trading by Jonathan Brogaard, Terrence Hendershott, and Ryan Riordan *. They gave high-frequency trading mostly positive assessments, which attracted the attention of the public. In their opinion, the criteria for evaluating HFT lie in the answers to the questions: "Does high-frequency trading simplify the search for [current] market prices?" and “Does high-frequency trading provide liquidity?” - It seems to me that if they thought that the HFT is evil, they would ask about something else. But they answer “Yes” to their questions: according to the results of their research, high-frequency trading simplifies the search for current market prices and does not cause instability by reducing liquidity during high market volatility.

If you like to make jokes about scientific articles, it's time to do this - I honestly don’t know what else can be done after reading this work. The term “simplifies the search for prices” is followed by a serious explanation “by accelerating the search by three or four seconds” after the price information appears on the market. This means that high-frequency trading makes markets three seconds more efficient. Is it good? This is a question from the field of metaphysics, so we will lower it to the level of note **.

You can joke about instability, but also a little lower ***.

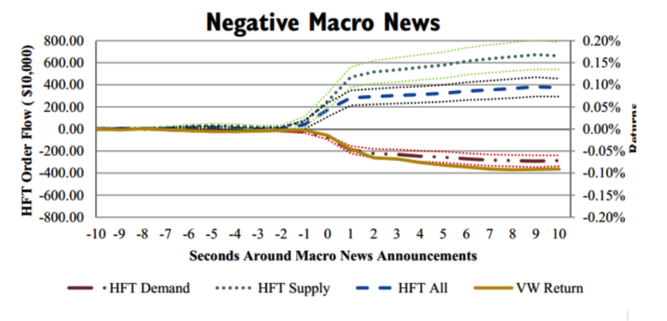

But there is one oddity. The authors analyzed the state of the market after the appearance of negative macroeconomic news and built the following chart:

What happens: about a second before the bad news, high-frequency trading companies actively sell (that is, form a demand for liquidity for the sale of shares - this is indicated by a red dotted line). At about the same time, stock prices begin to fall (gold line, see axis Ox). At the same time, about two seconds before the news, HFT companies passively buy. Thus, they form a liquidity offer: companies give orders to sell and buy, after which the offer price increases. This is indicated by gray, green, blue and God knows what points. The blue dotted line is the “pure” result of the activities of HFT firms. It turns out that companies involved in high-frequency trading, during the period of the appearance of bad news, buy more than they sell, and, most likely, lose money on this.

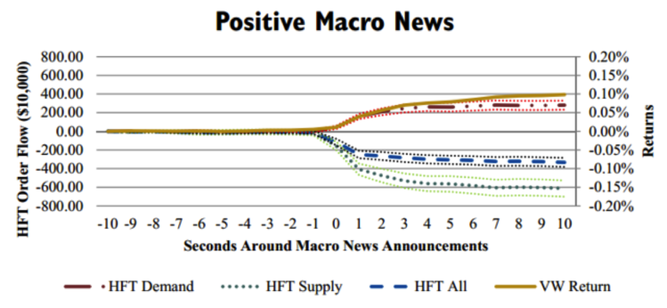

The exact opposite happens when there is positive news: HFT companies in this situation sell more than they buy, and again lose money. As with the bad news, the price is changing, and the demand for liquidity of HFT firms is about a second behind their liquidity supply:

This generally corresponds to the view of the authors of the report on high-frequency traders, as market players providing high liquidity - in fact, HFT companies in these cases act as market makers, taking the side opposite to the actions of the majority - but here are the temporary calculations presented on the charts seem very strange. According to this interpretation, the reaction of HFT companies to this or that news lags behind market actions by a full second, which is why these companies are forced to suffer losses. Their teams for buying and selling shares do not change for some time after the news, while someone receives this news a little earlier **** - and begins to enrich themselves at the expense of high-frequency traders.

It turns out that other players who are a little faster than HFT companies manage to take advantage of high-frequency traders .

Strange, isn't it?

However, in essence, everything is so. By the term “high-frequency traders”, the authors of the report understand 26 large independent HFT-companies from the Nasdaq list, which do not include large brokers / dealers, such as Goldman, which uses the high-frequency trading strategy, as well as private companies working in the field of algorithmic trading: they trade fast, but do not have a constant income from trading operations. These firms are more likely to react to the emergence of important news than large HFT companies, whose trading strategies are usually based on statistics on the purchase and sale of securities (information on prices and order portfolios), and not on current news reports *****.

Which conclusion follows from this? Well, firstly, if in your understanding “high-frequency traders” is “everyone who sells and buys using computer programs very quickly”, then you are unlikely to like the conclusions regarding HFT companies contained in the above report. They relate to one single category of high-frequency traders - because other high-frequency traders trade against them. If, according to this report, traders from the first category are good, then the rest (high-frequency traders playing against them), therefore, are bad. Averaged estimates for the entire group are rather difficult to give here.

By the way, we [Bloomberg] already wroteabout attempts to limit the capabilities of various kinds of "high-speed" traders who receive economic information milliseconds earlier than other market players. At that moment, these attempts led me into confusion, because in fact they should not protect individual investors, but another, slightly less rapid category of “high-speed” traders. If the news becomes known at 14:00, and you [your computer] receive it at 13: 59: 59.999, and you are trying to buy shares based on your informational advantage, then the only market player who can sell you shares at 14:00: 00.006, there will be another computer. At that moment, the trader or the manager of the Fidelity securities portfolio, or any other person, will still run their eyes over the news lines, lagging behind computers for many seconds and therefore remainingin complete safety .

So here. People who are beaten by “high-frequency traders” in the broad sense of the word when news appears are themselves “high-frequency traders” - in the narrow sense. Algorithmic market makers are left with a nose through the fault of algorithmic speculators. And all this financial and market drama unfolds in the blink of an eye - so all you need to avoid it is just blink.

* Like many other ideas in the near-financial scientific community, for some time this “surfaced on the Internet” (taking various forms), but was ultimately expressed in the “quasi-declaration” of the European Central Bank. The Central Bank is an important and significant organization, so today we are talking about this document.

** Quote from the document itself:

From the fact that HFT companies predict price movements in the coming seconds, it does not follow that this information inevitably becomes public. Perhaps high-frequency traders are competing with each other for the possibility of obtaining optional public information and using it to predict price behavior. If high-frequency traders did not exist, it would not be known how such information (in the absence of a player with a similar role) is transformed into prices. The main difficulty is how to determine which information is public and how it translates into prices, that is, what are the incentives for investing in the acquisition of information (Grossman and Stieglitz, 1980).

You are probably interested in what kind of basic research high-frequency traders conduct in order to find out new information and make it public.

It is possible, within the framework of a thought experiment [and the answer to the question - approx. Transl.], To think that what would happen if high-frequency traders were blocked from access to economic news for three seconds - would their three-second advantage be preserved over “non-high-speed” market players? And if it were not three seconds, but five minutes?

*** The authors monitored the behavior of high-frequency traders during the top 10% of the most volatile days, compared it with the remaining 90% of the most volatile days and found that high-frequency traders maintain approximately the same level of liquidity of securities. A likely model for creating a strategy for high-frequency traders can be expressed with the words “volatility is profitable, but blind panic is not”, which means that you actively provide liquidity supply within 90–99.5% of the day, and significantly reduce activity in the remaining 0.5% of days . Such a model can lead to sudden drops in the market with a frequency of about once a year (and not once every two weeks) - this, in essence, happens, but the Central Bank’s document examines the behavior of high-frequency traders within the top 10% of moderately volatile days.

**** And what happens before the news becomes known? The authors use timestamps from Bloomberg to determine the “zero” second (the moment when the news becomes known to everyone) - it can be argued that the true moment of the news release is the 1st second, and then it takes some time for the news to reach Bloomberg, however, the start of trading 2 seconds before the publication of the news would have looked frankly strange.

***** For this thought, I owe a talk to Terrence Hendershott, one of the authors of the document. By the way, if we assume that high-frequency traders react only to market prices and commands, and not to fundamental news, then the statement of Grossman-Stieglitz in the footnote ** departs to an absolutely metaphysical plan.