Paperwork and Currency control Upwork + USN6% / Patent + VAT

- Tutorial

This note contains a brief description of the process of filling out paperwork in Elba (relevant for other similar services, but adjusted for their UI) when working with Upwork in the event that you decide to pay VAT and take everything that comes to your upwork account into income e (I will immediately note that there are several opinions on this point, the final choice is always yours), as well as passing currency control.

Initially, all this was written as a memo for personal use , but it turned out that it was interesting to other users. Publish at their request. The choice of services is due solely to my personal experience (what I use and write about), if you have experience with other / best / cheap services I will be glad to hear in the comments :)

Important:

- Actual on 08/27/2018

- Examples are given for Elba ( for other services, everything, in principle, will be the same, but adjusted for their UI )

- The bank is not particularly important, he used Alfa Bank, and the Module, in principle, all the same, but there are / may be nuances that are best to check with your accountant, your bank’s currency control and even the tax itself.

- Again, there are different opinions at which point income arises (see the links) and whether it is necessary to pay VAT at all. In any case, it is highly advisable to consult with your accountant, currency control of your bank, tax (by the way, it is strange that no one has yet asked them ). The possible consequences of a choice are also in the articles on the links.

- I am not even close to an accountant - you do everything at your own peril and risk.

useful links

- How to pay VAT on Uber services

- Upwork, IP and currency control - how to properly execute documents?

- Certificate of earnings

- User Agreement and Confirmation of Service ( ask upwork for current versions )

- Working with Upwork: currency issues ( good discussion )

- Legal withdrawal of funds with upwork ( there are a lot of comments there + a lot of links to previous topics )

- VAT and freelancers working with Upwork (the most valuable there is a list of links to the laws explaining why everything is so, it can be useful when dealing with tax )

- Google Tax has been changed

General

- With the cost of upwork services, it is necessary to pay 18% VAT once a quarter ( up to 01/01/2019 [8], further, as far as I understand, we do not have to pay this VAT, but what will happen in reality is unknown to me yet )

- USN 6% must be paid from the total amount received on the account, date of income = date of availability of funds on the account upwork ( from gray became white ).

- On the Patent, it is still necessary to enter an accounting book, date of income = date of availability of funds ( and here you should be more careful with the names of the receipts - it came across somewhere that the tax might doubt the legality of including some formulations in the Patent instead of the USN ).

- You do not need to pay VAT for the withdraw fee (bank transaction)

- If the sale of currency exchange rate turns out more than the rate of the Central Bank ( at the date of sale ), then you need to pay a tax on the income generated ( elba can do it yourself, but for the fact that the currency is on the account and it does not grow, you do not need to pay for several years ).

Registration of income in the Elbe

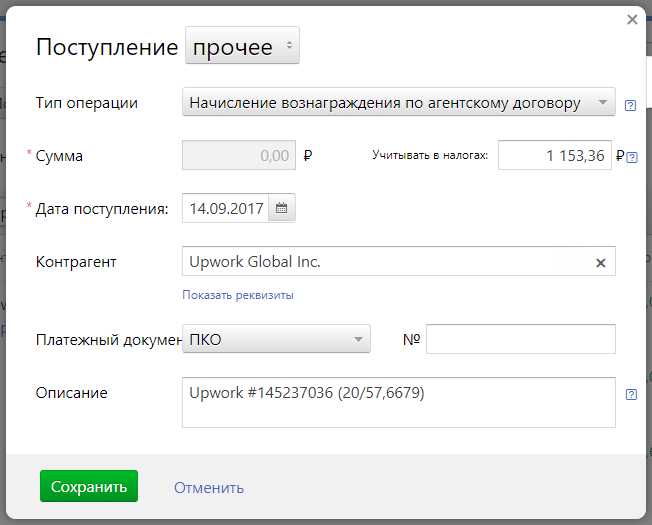

- In the "Money" section, create a receipt with the "Other" type on the availability date of funds in the upwork account and take into account in income the full amount at the Central Bank rate on the availability date. The description for the simplified tax system is usually indicated simply in the form of Upwork # 190703319 (123.45 * 70.07) (# figures are the transaction number), but for the Patent I copy directly from Transaction History as "PHP Backend and API Development / Upwork # 190703319 ( 123.45 * 70.07) "(along with the transaction number, the numbers in brackets make it easier to check for yourself)

- Next, you need to create an invoice for the same date, type of operation "Payment for electronic services by Uber, Apvork and other foreign firms that are not registered in Russia", to drive in the amount of commission (in rubles at the Central Bank exchange rate on the availability date), then Elba will add VAT and then form a billing for the quarter ( why so, see [1] ). Description again in the form of "Upwork # 191740947: Provision of service - Ref # 191740944 (12.34 * 70.07)"

- Money that will come from upwork to the p / s is not necessary to take into account either in the simplified tax system or in the Patent, for this it is necessary to reset the amount in the column "to take into account in the income", and the type of operation "other" (the comment there is true after This will be something like “payment for services”, I don’t know if it has any value (?), but I usually change it to “transfer between accounts” ).

- As a result, all of our receipts and invoices, and therefore the declarations and the accounting book, almost literally repeat the Transaction History, which can be very useful when dealing with tax.

Currency control

Each bank has its own characteristics, so it’s best to specify all this in the bank itself, but on the whole it’s all quite simple, and it’s even easier than filling out a payment for paying a patent ... I’d like to say that large amounts (from about $ 1000) it makes sense to withdraw exclusively in foreign currency, for in that year, rubles came from Kivi Bank with a commission of 5%, which is very much.

He personally used the following banks:

On their website there is a fairly detailed article describing the process and all the necessary documents, there is really nothing to add. Unless , it does not say that their correspondent bank bites off its 12 euros (~ $ 14) from each incoming payment - i.e. when withdrawing the final commission will be ~ 30 + $ 14 . Somewhat unpleasant.

Повторюсь — желательно уточнить в банке, всё-таки с момента как я добавлял контракт прошел год. Так же замечу что используется старая версия (поэтому когда в новой появится этот же функционал информация ниже скорее всего устареет)

Первый раз

- Просим открыть счет в валюте

- Добавляем его в апворк: SWIFT Code ALFARUMM, ваше фио транслитом (должно совпадать с тем что банке), адрес и номер счета (у меня указан валютный р/c, возможно нужно было указывать транзитный, но и так всё работает...)

- Далее нужно получить подписанный User Agreement [4] и подписать его последнюю страницу (нужно поставить подпись и сфоткать/отсканировать обратно), скачать Certificate Of Earnings (находится в меню Reports, нужен он чтобы банк мог установить сумму контракта и знал когда пора ставить его на учет, что делать если вы создали аккаунт более 12 месяцев я не знаю).

- После этого идем в "Уведомления / Досье" и создаём "Контракт / договор,

не требующий постановки на учет в Банке", без номера, без суммы, дата "начала" = дате регистрации на upwork, "окончание" — любой срок в разумных пределах, у меня вроде 15 лет, прикладываем документы из предыдущего пункта (User Agreement, последняя подписанная страница и Certificate Of Earnings), добавляем контрагента (вот тут самая большая засада — нужны реквизиты, я указал реквизиты upwork escrow, от которого пришел платеж, что конечно немного неправильно, лучше всего уточнить этот момент в банке) - После того как договор зарегистрируют можно выводить деньги

Вывод денег

- Забавно, но несколько рублевых выводов пришли без всякого валютного контроля

- Выводим деньги, подписываем Сonfirmation of Service [4] на сумму без учета 30$ (заполняем, печатаем, подписываем, сканируем/фотографируем, отправляем на подпись в upwork)

- Ждем пока придет уведомление о входящем платеже

- Идем в "Уведомления / Документы валютного контроля" и создаём "Распоряжение о списании средств с транзитного валютного счета" и "Сведения о Валютной Операции" (к ним добавляем подписанный Сonfirmation of Service [4], можно создать из прямо Распоряжения), крайне внимательно заполняем все нужные поля — уведомление, контракт, сумма, валюта, что с ней сделать (перевести на р/с или продать), код валютной операции указываем 21500 (Платеж в связи с оказанием нерезидентом услуг по реализации иным лицам товаров, работ, услуг, информации и результатов интеллектуальной деятельности, в том числе исключительных прав на них, резидента в соответствии с договором комиссии (агентским договором, договором поручения)).

- Подписываем, отправляем в банк, всё.

I did not use it myself, but I would add it to be in one place:

Personal experience

Since last year I have been taking into account everything as it is written (2017 USN6%, from spring 2018 Patent), it takes about an hour and a half a month for youtube in time - unpleasant, but not very critical. Further, in articles on Habré, many were afraid that in this case, what comes in at p / c does not coincide with the income book and tax questions arise. And so - really will arise :) After delivery of the declaration somewhere in the spring the inspector called, asked, "what for a garbage ?!", and then sent the requirement for providing explanations. As a result, everything was limited to the provision of a screenshot of transactions over the past year and an explanation that I work under an agency contract, taking into account the income on the date of availability of funds in the upwork account (as was initially assumed almost complete document identity and Transaction History was very good). And that's all. But no, not all - then they called about VAT, but after explaining that I am obliged to pay it due to the fact that a foreign organization is not registered in the Russian Federation, they also fell behind. Those. In general, there are no special problems yet and in theory there should not be (ttt).