Fundamental Economics Problems at Bitcoin

Is Bitcoin suitable as the main currency for a full-fledged economy?

In this article, I will emphasize several not for all the obvious problems that are inherent in the nature of Bitcoin. I will also suggest that you and I think and reflect on possible alternatives.

Bitcoin has a deflationary nature. The creator of the currency laid it in it algorithmically, when creating. Judge for yourself: the currency has a clearly defined and strictly falling over time emission volume. At the same time, the market is growing, which means that the volume of trade is growing and the need for currency is growing. That is, in fact, the limited issue obviously does not satisfy the market demand for currency. As a result, the value of the currency is growing all the time, that is, deflation is observed.

What is the main problem of a deflationary-based economy? Stagnation. Roughly speaking, the ever-growing exchange rate encourages people not to spend money, but to accumulate it. In addition, the ability to profit from simple hoarding saves people from the need to produce goods and services. The result is a tough crisis throughout the economy, because society cannot live in prosperity when no one does anything.

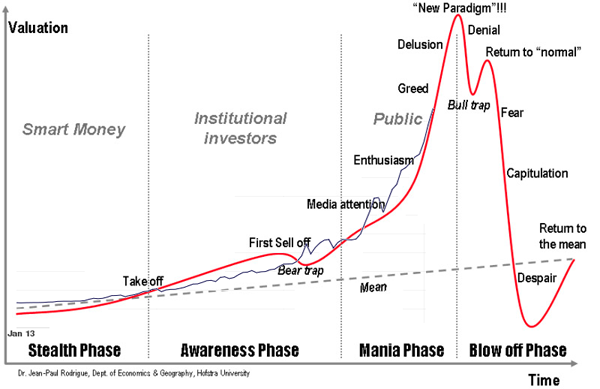

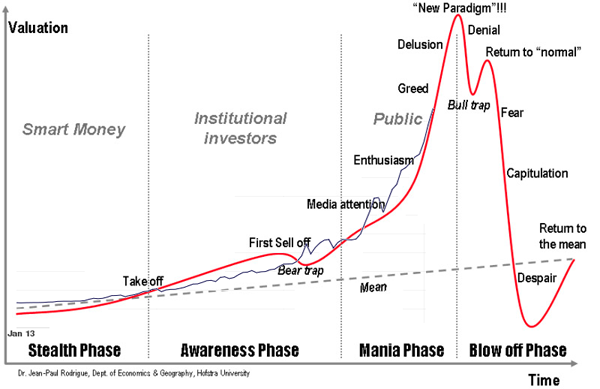

The second important issue is market speculation. When the exchange rate is forced to constantly grow by nature, bubbles are inevitable. Classic scenario:

Bitcoin, by its deflationary nature, is doomed to constantly repeat such bubbles over and over again. For example, over the past two years, two very similar bubbles can be observed: summer 2011 and spring 2013. The levels at the same time differed 10 times, and the proportions are similar. Such bubbles are almost impossible to contain: when the currency is constantly growing, even slowly, it is of interest to speculators. Bought cheaply, waited half a year, sold expensive. And the more such enthusiasts, the more growth is spurred. This inevitably causes an exponential growth of the currency, a bubble. With such a bubble, we observe an approximately 20-fold increase in the rate, followed by collapse. And after all, the market does not die after the collapse: bitcoins are actually used, for example, on the same ever-growing Silk Road, and for other sales, whose participants wish anonymity and non-control. It turns out that such a picture of the bubble will inevitably be repeated time after time, with a certain periodicity. That is, we will never wait for a stable rate, it will always jump at times and even dozens of times. What kind of economy can be built?

Bitcoin has a lot of forks offering alternative schemes. But they are all alike in one thing - in their deflationary nature. Because they are all created for speculation above all.

I invite everyone to think about how to build a real economy based on anonymous decentralized currency. Such an economy, which will not be "fever", throwing it in the heat, then in the cold, because of the bubbles in the main currency. Perhaps a certain replacement of Bitcoin is needed, with other emission algorithms? Or not a replacement, but an addition?

What is the important role of the state in the country's economy? Regulation of the economy, stimulation of its growth, smoothing crises. For this, in particular, the state has a monopoly on the issue of the main currency. This tool can be used so that the country flourishes. But at the same time, everyone is forced to trust the right of issue to a certain narrow circle of people whom no one knows personally. With all the ensuing problems and a constant desire to redo everything in a new way (and in fact, in the old one, but with new people).

But it is possible to lay the mechanism of automatic regulation of emissions algorithmically in the currency itself. At the same time, the scheme can be very simple, for example: if market volumes grow, we reduce emissions; volumes fall - increase emissions. By analogy with the automatic regulation of mining complexity, which allows you to more or less accurately adhere to a clearly defined volume of emission. Such regulation can achieve a more or less stable value of the currency, which will allow the economy to develop much more fully.

But there is a problem with this approach. How to introduce a currency in society whose price does not rise by leaps and bounds? Pay attention to the peaks in the growth of Bitcoin popularity: they happen quite clearly due to the frenzied growth of the rate. Let's be honest: the bulk of the people who fill the market and give it an ever-growing popularity are driven by a thirst for profit. A very narrow layer of people using Bitcoin for its intended purpose - for anonymous uncontrolled money transfers. And will these people want to switch to a new unfamiliar instrument with a complex incomprehensible emission mechanism only for the sake of the theoretical stability of its course? The big question.

I want to hear your thoughts and suggestions on this subject. Let's talk together. It is possible to build an economy, if not ideal, but much better than the current one. You just need to figure out how.

In this article, I will emphasize several not for all the obvious problems that are inherent in the nature of Bitcoin. I will also suggest that you and I think and reflect on possible alternatives.

Problems

Bitcoin has a deflationary nature. The creator of the currency laid it in it algorithmically, when creating. Judge for yourself: the currency has a clearly defined and strictly falling over time emission volume. At the same time, the market is growing, which means that the volume of trade is growing and the need for currency is growing. That is, in fact, the limited issue obviously does not satisfy the market demand for currency. As a result, the value of the currency is growing all the time, that is, deflation is observed.

What is the main problem of a deflationary-based economy? Stagnation. Roughly speaking, the ever-growing exchange rate encourages people not to spend money, but to accumulate it. In addition, the ability to profit from simple hoarding saves people from the need to produce goods and services. The result is a tough crisis throughout the economy, because society cannot live in prosperity when no one does anything.

The second important issue is market speculation. When the exchange rate is forced to constantly grow by nature, bubbles are inevitable. Classic scenario:

Bitcoin, by its deflationary nature, is doomed to constantly repeat such bubbles over and over again. For example, over the past two years, two very similar bubbles can be observed: summer 2011 and spring 2013. The levels at the same time differed 10 times, and the proportions are similar. Such bubbles are almost impossible to contain: when the currency is constantly growing, even slowly, it is of interest to speculators. Bought cheaply, waited half a year, sold expensive. And the more such enthusiasts, the more growth is spurred. This inevitably causes an exponential growth of the currency, a bubble. With such a bubble, we observe an approximately 20-fold increase in the rate, followed by collapse. And after all, the market does not die after the collapse: bitcoins are actually used, for example, on the same ever-growing Silk Road, and for other sales, whose participants wish anonymity and non-control. It turns out that such a picture of the bubble will inevitably be repeated time after time, with a certain periodicity. That is, we will never wait for a stable rate, it will always jump at times and even dozens of times. What kind of economy can be built?

Bitcoin has a lot of forks offering alternative schemes. But they are all alike in one thing - in their deflationary nature. Because they are all created for speculation above all.

What to do?

I invite everyone to think about how to build a real economy based on anonymous decentralized currency. Such an economy, which will not be "fever", throwing it in the heat, then in the cold, because of the bubbles in the main currency. Perhaps a certain replacement of Bitcoin is needed, with other emission algorithms? Or not a replacement, but an addition?

My thoughts on the alternative currency account

What is the important role of the state in the country's economy? Regulation of the economy, stimulation of its growth, smoothing crises. For this, in particular, the state has a monopoly on the issue of the main currency. This tool can be used so that the country flourishes. But at the same time, everyone is forced to trust the right of issue to a certain narrow circle of people whom no one knows personally. With all the ensuing problems and a constant desire to redo everything in a new way (and in fact, in the old one, but with new people).

But it is possible to lay the mechanism of automatic regulation of emissions algorithmically in the currency itself. At the same time, the scheme can be very simple, for example: if market volumes grow, we reduce emissions; volumes fall - increase emissions. By analogy with the automatic regulation of mining complexity, which allows you to more or less accurately adhere to a clearly defined volume of emission. Such regulation can achieve a more or less stable value of the currency, which will allow the economy to develop much more fully.

But there is a problem with this approach. How to introduce a currency in society whose price does not rise by leaps and bounds? Pay attention to the peaks in the growth of Bitcoin popularity: they happen quite clearly due to the frenzied growth of the rate. Let's be honest: the bulk of the people who fill the market and give it an ever-growing popularity are driven by a thirst for profit. A very narrow layer of people using Bitcoin for its intended purpose - for anonymous uncontrolled money transfers. And will these people want to switch to a new unfamiliar instrument with a complex incomprehensible emission mechanism only for the sake of the theoretical stability of its course? The big question.

I want to hear your thoughts and suggestions on this subject. Let's talk together. It is possible to build an economy, if not ideal, but much better than the current one. You just need to figure out how.