What is not said about the Tesla report?

I read another article by non-collaborators about how bad Tesla is doing, some losses and failures. Investors continue to make money, and this is a clear indication that Mask is a cheater and continues to inflate the bubble, etc. etc. Although unlike other companies Mask, Tesla is a public company, which means it falls under the attention of the SEC, which is a Wall Street watchdog and would be extremely interested in this kind of fraud. But of course, such trifles do not have much value in the eyes of media-hungry traffic.

True reality is different from shorts' wet dreams. Therefore, having decided to restore balance in nature, I turned to the original source and invite you to join me. And our primary source is a quarterly report published by the company, usually one month after the end of the quarter, in this case the report for the 2nd quarter (Apr-June 2018) published on the 1st of August.

I quote it in its entirety:

TSLA Update Letter 2018-2Q

For a start, a little-known fact about such reports. See in the middle of the signature of the president and chief financial officer of the company? So they bear criminal responsibility for the veracity of all that is written in the report. That is, if in the report somewhere you lied, embellished, obviously mislead, then not the abstract company will go to the defendants' bench, but Ilon Musk and Deepak Ahuja personally. This, you see, is awesome and energetically motivates not to lie and not to deceive investors.

I recommend reading the entire report, but in order to avoid retelling, I will limit myself to the news:

Car sales margin increased to 20.6% for GAAP and up to 21.0% for non-GAAP

Why two numbers? GAAP (accounting standards) forces companies to take into account, among other things, all revenues and expenses. In the US, automakers have so-called ZEV-loans, or loans for exhaust. Since the Tesla doesn’t produce exhaust while driving, and the government allows these loans to be sold to other manufacturers, Tesla takes this opportunity, so to speak, to cheat, and earn a little money on the side. And so GAAP forces to consider these loans in automobile incomes, and payments to employees in the form of shares, in expenses. These two things slightly distort the real margin from each machine, so Tesla publishes both numbers. But it is, by the way. In fact, the GAAP and non-GAAP margins are not fundamentally different, therefore, we can say that the margin from each machine sold is about 20 percent and this includes all the models produced.

Margin on sales of Model 3 has become a bit positive, there are expectations that it will grow to 15% in the third quarter

Tesla does not indicate a margin specifically on Model 3, but it is known that it is negative. What does it mean? This means that investments in the factory, tools, and labor are not yet discouraged by income. Does this mean that Model 3 is unprofitable? No, it does not mean. Mass economy requires mass production. Tesla claims that profitability will start at a production level of 5,000 cars per week - which is what the report itself says. In late June, Musk said that they had achieved this goal. Even if in a jump, what difference does it make? I think no one should have any doubt that they will go to this level and go further. By the way, in the third quarter, they started selling an even more expensive version of the Model 3 Performance, which should help with the achievement of the promised 15 percent.

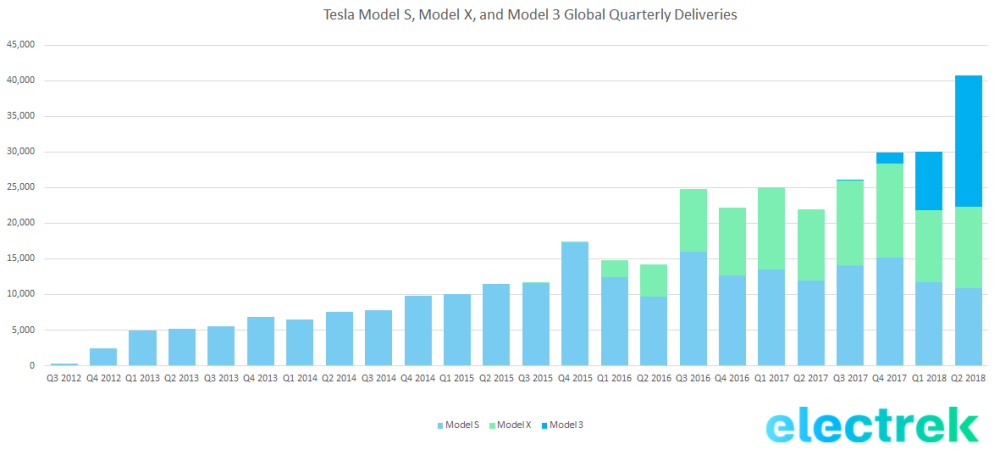

Expected to produce 50-55 thousand. Model 3 in the third quarter, and delivery should be even more

That's huge. For comparison, to make 50 thousand. Model S and X Tesla took 2 years each. And then, just over a year later, they want to make 50 thousand per quarter!

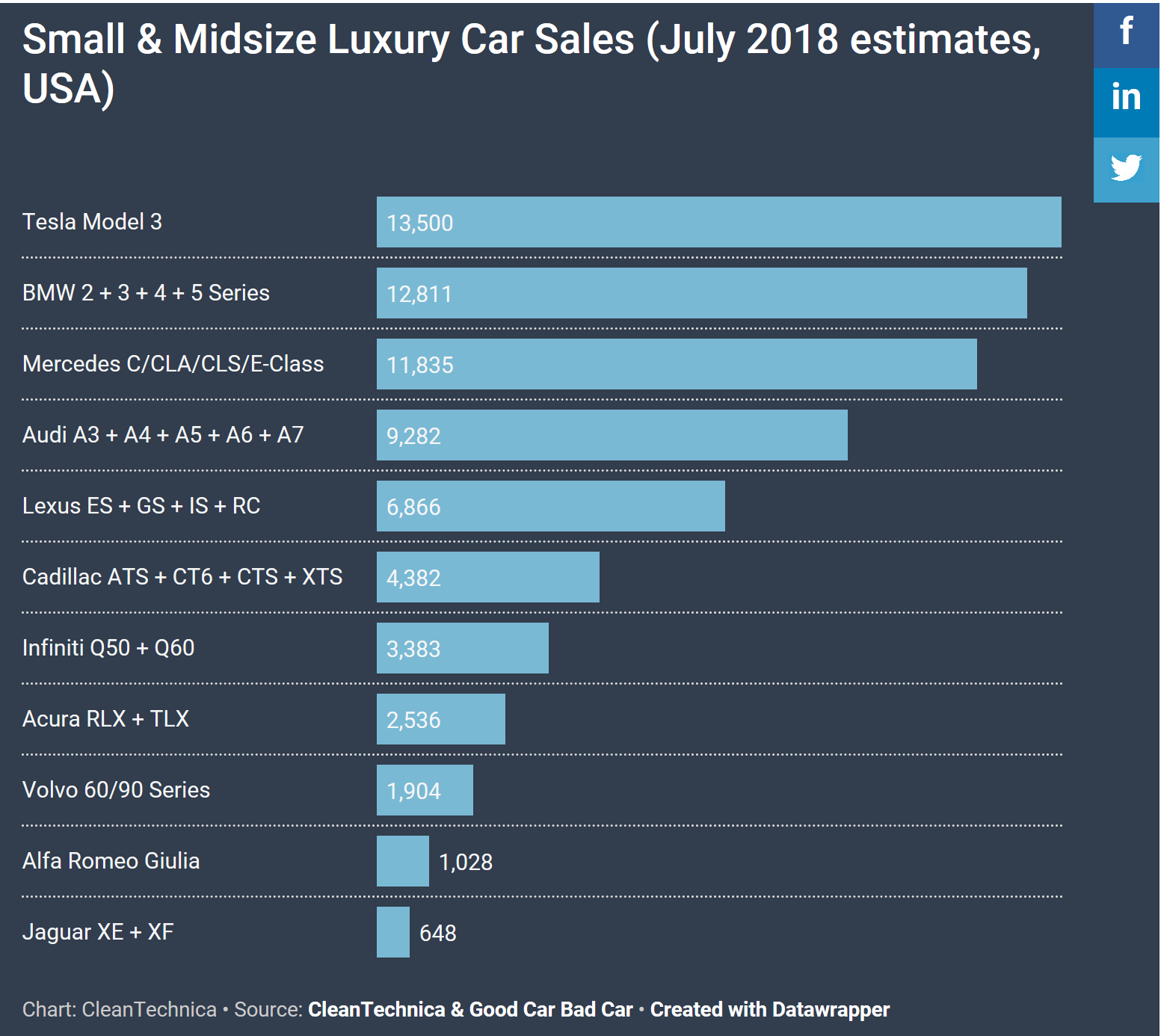

In July, Model 3 bypassed sales of all classmates in the premium segment, and despite the fact that the cars sold are far from basic. Of course, the majority of sales are customers waiting for the car for two years, so it will be interesting to look at the real demand when these people get their cars. But I think there will be no problems with Model 3 with demand.

Spent a major cost restructuring in the second quarter.

Tesla has reduced labor by 9%, which should reduce costs. As Musk put it, they cleaned the ship of the shells from numerous contractors, subcontractors and middle managers. I sympathize with these people, being dismissed is very unpleasant.

$ 2.2 billion in cash (and cash equivalents) at the end of the quarter. An increase is expected in the third and fourth quarters.

Whatever the evil tongues would say, but Tesla's cash is all right. And they are not going to take more. This suggests that investment in production, if not ended, has declined dramatically, which indirectly supports a statement on a positive margin in the third quarter.

Capital expenditures for 2018 are estimated at <2.5 billion.

And finally, these investments for the 18th year are more clearly outlined. For comparison, in the first quarter they talked about <3.4 billion investments. Again, this suggests that Tesla no longer anticipates large expenses, which means a further increase in production this year will be achieved through optimizations.

Rest

The rest of the report provides details on both the automotive and energy businesses. I recommend to read.

Well, finally, about the losses. No need to go far, another article . Well what can I say? Well, for example, look at the Snapchata financial report - in Q1 2018 losses of 385 million, and in 2017 by 2.2 billion! TWO billion Carl! And for a moment, this service disappears photos. They have no factories, no production, no goods. And nothing, they live for themselves, floundering.

Once again, yes, Tesla has losses every quarter, but at the same time there is a very good margin of 20-25 percent. For example, BMW has a modest 9% , Daimler 8.4% , VW has a total of 7.4%. And these are premium German brands (VW has both Audi and Bugatti). That is, it turns out that electric cars, if they are seriously engaged in, are actually a profitable business. So where is the profit, why the losses? Here we must understand that the losses are different. Losses from the fact that your product is not needed by anyone and nobody buys it is one thing. Losses from the fact that you invested in a factory for the production of pies and just physically do not have time to meet the demand is quite another. And if in the first case you need to either change the product or close the shop, then in the second case you need time and pumping the skill “reaching the full production capacity”.

How to find out how the case with Tesla? Very simple: we go and look into financial reports - do we see a decline in sales? No, sales every quarter beat records (except when the factory temporarily stopped to reconfigure). This means that the demand for pies is such that it is possible to raise the price. This is by the way about where the basic version of Model 3 is. From a business point of view, why sell something for X dollars, if you can't even meet the demand for 1.5-2X? Yes, it is unpleasant for those who queued for the basic version, I agree. Yes, and Musk talked about much earlier dates. Here he certainly needs to learn to be more realistic in the estimates. But in order for business to survive, it is necessary to go into profit, to which they actually go. We wish them good luck.

Note: in such assessments, it is customary to disclose your financial position for transparency. So I have 10 Tesla shares, which I bought not in order to make a fortune on them, but simply so that when the company inevitably beat Apple it would not be very offensive.

Second note: recently I received my Model 3 LR RWD EAP and absolutely love it. Fully convinced that the decline of cars on fossil fuels is inevitable and is accelerating like an avalanche. Having traveled on this spacecraft, it becomes ridiculous reading any intrigues, scandals, investigations about Tesla.

Technology update

Reading the comments, I met Tesla’s reproaches several times that they had not come up with anything new. Electric cars are 100 years old at lunchtime (or even more), then it didn’t take off and now it doesn’t take off. And Musk, a notable PR man, pushes a stale goods just like your iPhone.

In principle, the claim is valid - what is Tesla's technological advantage?

Unfortunately, only experts who I am not can answer this question. But fortunately, I found a solution that should, if not prove, then at least demonstrate how far Tesla has gone from competitors.

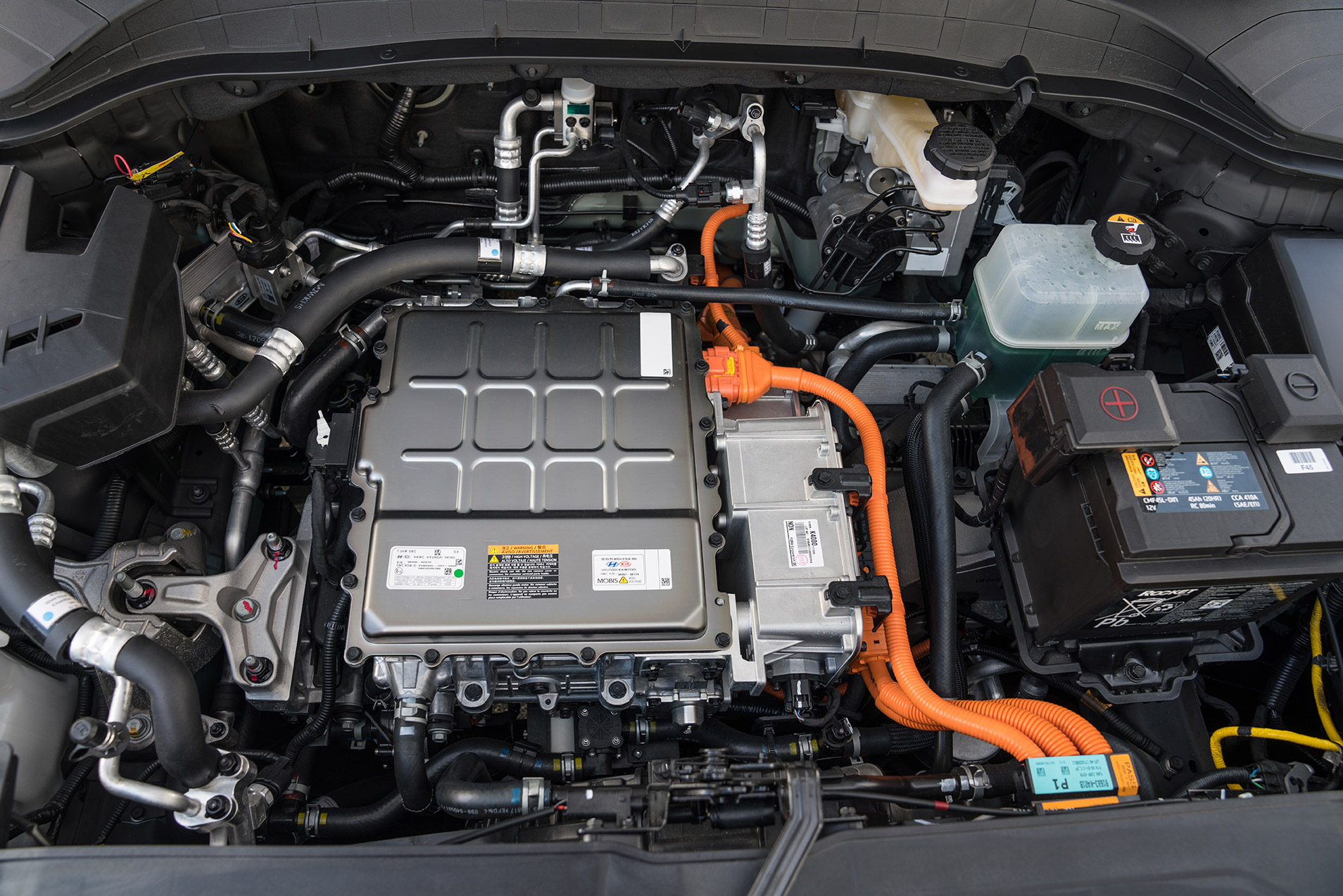

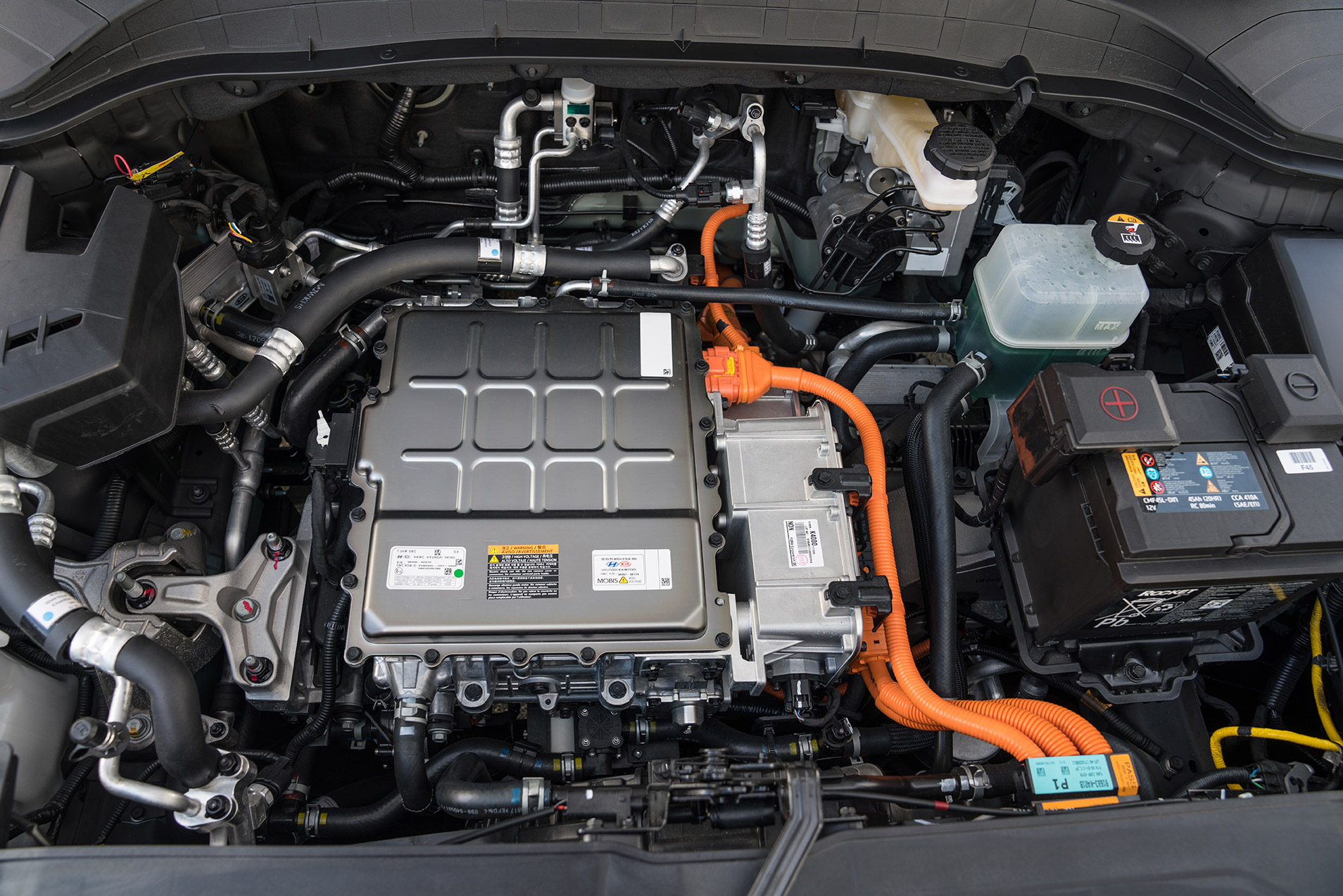

So first check out the underhood space of some of Tesla's competitors:

Hyundai Kona Electric

Chevy bolt

VW eGolf

And now…

Tesla Model 3

I think these pictures clearly show how cool technology Tesla has. All of these motors, inverters, control electronics, cooling, Conder, and autopilot are compact and even leave space for the front trunk. The gap from the rest is the same as that of the modern Motorola DynaTAC 8000X smartphone .