Jumpstart: how the new economy began on January 1 for the IT sector

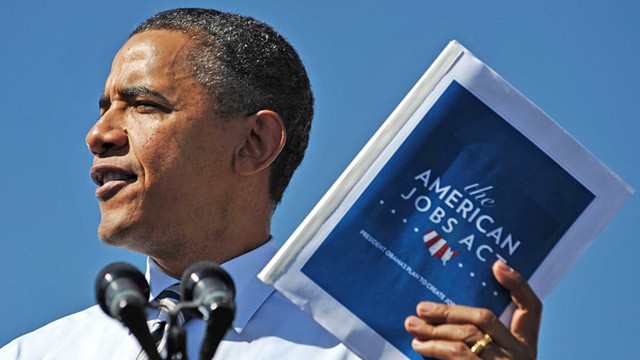

On April 5, 2012, Barack Obama (current US President) signed the JOBS Act (the Jumpstart Our Business Startups Act). It entered into force on January 1, 2013.

Now I’ll tell you a couple of common things about what this means and why a lot of things will change for startups. It is necessary to look in the complex together with the documents of the SEC (Securities Commission). SEC is important here because the law itself (like many others) is rather a framework, and it is this organization that determines the specific details of its implementation.

In one simple sentence: what does all this mean? - The explosion of the growth of IT projects in the United States. And perhaps the beginning of a new economy.

What changes the law?

The JOBS Act allows small-cap companies, that is, the so-called developing companies (startups) to raise funds from a wide range of investors. At the current stage, in order to accommodate a non-public company, they would need to place a maximum of 50 people, some of which would not include certain categories of investors. Previously, it was necessary to be an investor accredited with the SEC - this is either income of 200 thousand dollars, or millions of assets.

Once again: now anyone can invest in a startup .

Why did major brokers oppose the adoption of the act?

Because large brokers entered into an agreement with a judge of the State of New York five years ago that they have no right in their analytics to promote companies that place on IPO. There was a very big story that both JP Morgan and Merrill Lynch actively promoted their clients to IPOs. And small companies are no longer limited in this opportunity.

What are the requirements for a startup?

To receive investment from ordinary people, you need to attract no more than a million dollars during the calendar year. If the amount is greater - this is an IPO “by the rules”. The source is just crowdfunding and crowdinvesting (in fact, the law uses the term, which is an abbreviation that includes both of these concepts).

What does “only from this source” mean?

You can take a million on credit, get a million from a major investor, and get another million through crowdinvesting. It will turn out three million in a year, but only one of them will be received through the crowd source. This means, among other things, the opportunity for very large companies to get a couple of “goodies” in the form of a hundred or two “evangelists” of the project, social connections and an IPO rating at a cost of 1-2 percent.

What is important to know about accommodation?

The general principle before the JOBS Act was this: the larger the company, the more stringent the requirements for it. Starting from a certain amount, it was required to show generally all accounting entries and all assets to each of the investors. This, among other things, was done so that any client who purchases some paper would be fully informed of literally every risk. That is, about the risk of liquidity, or rather, the lack of liquidity, about the risk that he might lose all his funds. The whole system of American investment is based on the fact that if the client is fully notified and signed the documents, then he can no longer automatically claim that, relatively speaking, he was deceived. In Europe now they are also moving towards this.

What is going on now?

Now you can give back either 2 thousand dollars, or 5% of income (with annual income less than 100 thousand dollars), or 10% with higher income. If the amount was larger, the broker simply did not have the right to accept it (this is already a professional investor). If the total amount exceeded a possible million, some investors had to withdraw applications in order to "crawl" into the requirements. There are no restrictions on the number of people. It turns out such a quasi-IPO, with fast paperwork and the absence of a whole bunch of restrictions and formalities.

Can I do everything without pieces of paper?

Yes, everything is done over the Internet. Electronic document management in the US has already been established. True, with Russian citizens everything is complicated - all the charms of the law concern only Americans. Well, plus Russian citizens it is very difficult to pass compliance in American brokers, it is almost impossible. There is no direct prohibition, but in practice they very quickly filter out.

What does this mean for our projects?

If it turns out to pass the quest with the registration of a company in the USA, then you can start collecting applications. It is clear that a piece of Kaspersky or Yandex will be torn off with their hands, but some candle factory in Novgorod will not work - people simply will not subscribe, because they will not understand what it is and where. Accordingly, this is good news for tech startups, but not very good for projects such as cafes or bakeries (by the way, our future crowdfunding system will be an outlet for them, for which the legal basis is almost ready, but this is a separate issue).

And another nice feature - if you think about it, we are now in a winning position relative to US citizens. They have a law that limits their investment opportunities; we do not. In the Russian Federation there is no regulation of such relations, those law enforcement practices on them, which means they are regulated to a much lesser extent than now in the USA. That is, the only question is the correct “legal binding” of the investment project for a startup, even for a not very large one.

Who of the big companies is interested?

- Those who need an assessment. The sale of a couple of percent of the shares is a direct estimate right away. For example, Tinkoff did so recently with us, which has become very expensive.

- Those who need money here and now. To accept cash from individuals is more than a serious impetus for many.

- Those who need the simplest procedure for selling shares. That is - working with crowdinvesting, where it is not about dozens of people, but about hundreds and thousands.

Brokers and financial portals are interested in the fact that you can track work with applications online, that is, see the demand rating for each project. This is the most fun: after all, while there is no demand for the project, everyone is sitting on their money. As soon as someone starts investing, the others see that there is movement, and a wave begins. This is a very important factor for this kind of placements. And this opens up another possibility - you can sell not the shares themselves, but applications for them. Roughly speaking, the promise is “if Yandex sold, I would buy a stock.” And then, when Yandex sees a ready-made pool of promises, this may turn out to be an incentive to sell 1% (because the rating, cache, people).

How much do we have before the same wonderful moment?

We have almost laid the legal base for crowdinvesting. In principle, something can be done now (we are already doing it - from the official start of the project in a couple of months it will be clear how it went). Of the important parts of the mosaic, there is not enough opportunity to work with contracts for individuals directly without paper. Ideally, you also need an electronic passport - and they’re already doing it on a card that you can use to log in to complete transactions. So I think, from 2 to 4 years - and we will begin the same explosion of growth of small projects.