The merger of telecom operators in 2018

The trend of recent years in Russia is the adoption of laws affecting the regulation of the telecom market. At the same time, telecom is a high-tech and technological industry, which acts as an engine for the development of the country's infrastructure. The year 2018 brought us several reasons to consider the merger of telecom operators closer.

The legislative regulation of the telecom is more and more often on the agenda of the official and unofficial media. This is due to the “Spring Law”, changes in the cost of ownership of frequencies, requirements for collecting and storing personal data of subscribers, changing the cost of roaming within the country, blocking Internet resources, penalties for search engines for showing links to resources that were restricted , and requirements for search engines to connect to the federal information system, where the register of prohibited sites will be posted. Consider some of the reasons in more detail.

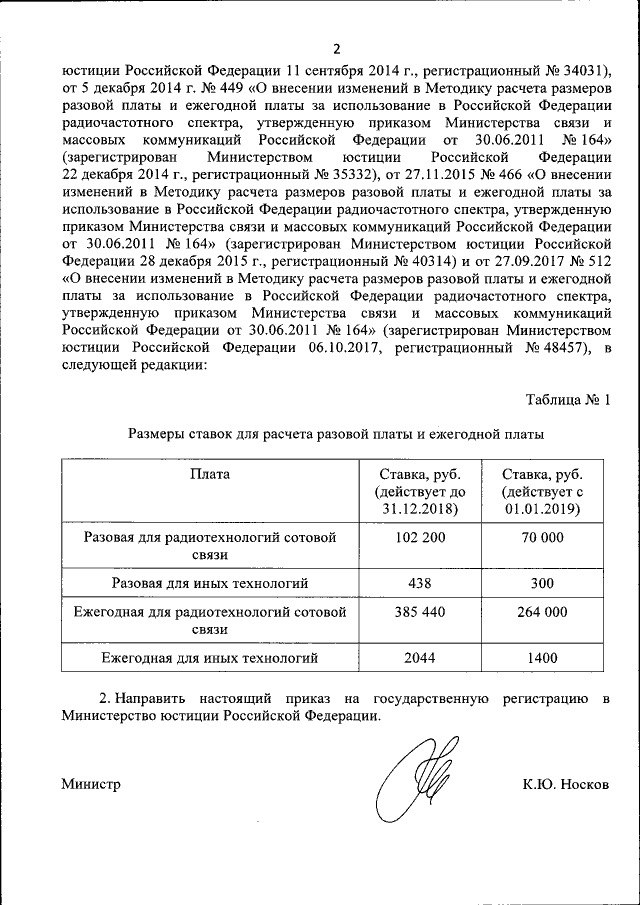

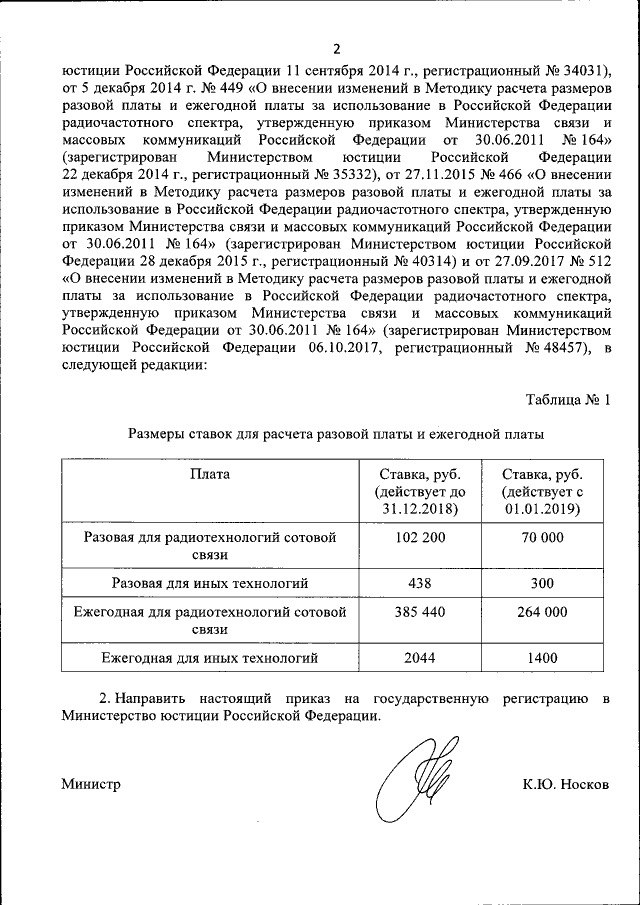

Above is a document image signed by Konstantin Yuryevich Noskov, Minister of Digital Development, Communications and Mass Communications of the Russian Federation since May 18, 2018. The document contains new rates, on the basis of which the one-time and annual payment for the use of radio frequencies in Russia will be calculated.

Current tariff changes from 03/02/2018 minsvyaz.ru/ru/documents/5926

We bring these changes in rates on the scan of the document.

From the related documents with this order we see the following:

1. Initially, in the method of calculation of 06/30/2011, there is no division into rates for cellular and other technologies. One-time 800 and annual 1400 rubles.

minsvyaz.ru/uploaded/files/Metodika_164_1.pdf

2. Then on September 4, 2014 , a change in the methodology. There is a division on cellular radio technologies and others. Sizes of bets for cellular one-time 70,000 rubles. and annual 264 000 rubles. For other technologies, a single 300 and an annual 1400 rubles.

minsvyaz.ru/ru/documents/4299

3. And now we come back to the order from 2018, which suddenly increases prices until the end of 2018, and from the beginning of 2019 introduces tariffs that have been in effect since 2014.

Suppose that in 2018 such a change raises the threshold for new small businesses to enter the market, because the cellular market is already divided among the major players and the future here lies with virtual operators for individuals, virtual corporate operators, IoT, M2M. But high-tech start-ups to provide themselves access to the market will be more expensive.

They repeatedly wrote about blocking Internet resources in the media, and even during a teleconference with the President of Russia they asked questions. The peak of publications fell on the period of active struggle with access to the Telegram messenger. To block access to the messenger in Russia, entire subnets of the largest Internet giants were blocked - Google, Amazon, Microsoft, Digital Ocean. Blocked and many addresses of smaller, but well-known Internet companies. The number of blocked addresses in some of the spring-summer 2018 periods reached 17-18 million, almost a third of Amazon cloud service addresses were blocked, which made the server with sites and services, including Russian companies, inaccessible. It got even Yandex and VKontakte, which, it would seem, do not belong to the Telegram.

All of this for the Russian user resulted in the inaccessibility of services from popular entertainment resources like YouTube to Google services for business — email, cloud storage of corporate information, etc. The network featured a number of Russian companies who sued for failures and suspension of their work due to blockages - 400. For telecom and Russian business in general, this increased the risks of operating convenient foreign infrastructure services, and therefore increased the cost of maintaining the infrastructure by purchasing VPN , creating their own fronts for insurance and reliable access to critical services.

“Spring Law” has been discussed for a long time. Previously, all operators understood that the implementation of the requirements of the law would require substantial capital expenditures. The media was filled with semi-official warnings about the fact that once the costs of operators are rising, this will inflate prices for service consumers. Here is an example of the cost of installing equipment for an operator with a band of 7 gigabits with peaks of up to 10 gigabits:

The volume of data transferred grows year by year, therefore, most likely, the cost of storing data for compliance with legislation will increase. With such volumes of costs, small and medium-sized operators will be in critical condition. Large operators of the federal level will be able to afford it, but for them it will be a hard blow to revenues.

We now turn to mergers.

Exaggerating, we can distinguish the following options for mergers in terms of company management and automation:

In the context of the above trends, I expect activity on the market for scenario 3 and 4. Increasing the cost of maintaining compliance with the law will accelerate the process of monopolizing the market - mergers, acquisitions, leaving small players out of business. For those who remain, the optimization of processes, the control of operating profits to prevent cash shortages and the search for new items of income will be a dire need.

For small and medium telecom operators, the optimization of merging can be migration to the cloud - SaaS billing, management of online billing, business processes, human resources, equipment, CRM. Of course, cloud solutions have their advantages and disadvantages. It is important that the use of SaaS solutions will eliminate the need to immediately spend a large amount on the purchase of these products and licenses to them. Plus, you can reduce the costs of maintaining and developing your own information systems: the cloud service provider will himself strive to develop its service in order to keep up with competitors and not lose customers.

Increasing profitability from servicing legal entities or ARPU individuals is now largely tied to creating unique content and personalizing services. In general, telecom intersects with different types of businesses. For example, the “big four” strongly develop mobile retail, but for small and medium-sized operators, such a business is unlikely to be profitable. Therefore, it makes sense to pay attention to the global trend to merge operators and content producers.

In June of this year in the United States, a $ 85.4 billion merger deal was approved between the telecommunications company and the media conglomerate that manages several television channels and studios. Cable television networks provide Internet access services. Social networks launch virtual operators with unique offers for their users. Everything that is connected with IoT, the Internet of things, is actively developing. And this is a reason to pay attention to technology startups that develop products that require constant access to the network.

2018 for the telecom industry in Russia brought several unpleasant moments. Forward Telecom, like many others, works in this market and cannot but pay attention to these trends, plus our customers often share their concerns and concerns with us.

Summing up, I would like to say: the state sets difficult tasks for the industry, but all of them can be solved both technically and organizationally.

Sergey Saprykin, General Director of Forward-Telecom

The data used are from open messenger channels @ unkn0wnerror, @zatelecom, @ usher2

Trends in legislation

The legislative regulation of the telecom is more and more often on the agenda of the official and unofficial media. This is due to the “Spring Law”, changes in the cost of ownership of frequencies, requirements for collecting and storing personal data of subscribers, changing the cost of roaming within the country, blocking Internet resources, penalties for search engines for showing links to resources that were restricted , and requirements for search engines to connect to the federal information system, where the register of prohibited sites will be posted. Consider some of the reasons in more detail.

Above is a document image signed by Konstantin Yuryevich Noskov, Minister of Digital Development, Communications and Mass Communications of the Russian Federation since May 18, 2018. The document contains new rates, on the basis of which the one-time and annual payment for the use of radio frequencies in Russia will be calculated.

Current tariff changes from 03/02/2018 minsvyaz.ru/ru/documents/5926

We bring these changes in rates on the scan of the document.

From the related documents with this order we see the following:

1. Initially, in the method of calculation of 06/30/2011, there is no division into rates for cellular and other technologies. One-time 800 and annual 1400 rubles.

minsvyaz.ru/uploaded/files/Metodika_164_1.pdf

2. Then on September 4, 2014 , a change in the methodology. There is a division on cellular radio technologies and others. Sizes of bets for cellular one-time 70,000 rubles. and annual 264 000 rubles. For other technologies, a single 300 and an annual 1400 rubles.

minsvyaz.ru/ru/documents/4299

3. And now we come back to the order from 2018, which suddenly increases prices until the end of 2018, and from the beginning of 2019 introduces tariffs that have been in effect since 2014.

Suppose that in 2018 such a change raises the threshold for new small businesses to enter the market, because the cellular market is already divided among the major players and the future here lies with virtual operators for individuals, virtual corporate operators, IoT, M2M. But high-tech start-ups to provide themselves access to the market will be more expensive.

They repeatedly wrote about blocking Internet resources in the media, and even during a teleconference with the President of Russia they asked questions. The peak of publications fell on the period of active struggle with access to the Telegram messenger. To block access to the messenger in Russia, entire subnets of the largest Internet giants were blocked - Google, Amazon, Microsoft, Digital Ocean. Blocked and many addresses of smaller, but well-known Internet companies. The number of blocked addresses in some of the spring-summer 2018 periods reached 17-18 million, almost a third of Amazon cloud service addresses were blocked, which made the server with sites and services, including Russian companies, inaccessible. It got even Yandex and VKontakte, which, it would seem, do not belong to the Telegram.

All of this for the Russian user resulted in the inaccessibility of services from popular entertainment resources like YouTube to Google services for business — email, cloud storage of corporate information, etc. The network featured a number of Russian companies who sued for failures and suspension of their work due to blockages - 400. For telecom and Russian business in general, this increased the risks of operating convenient foreign infrastructure services, and therefore increased the cost of maintaining the infrastructure by purchasing VPN , creating their own fronts for insurance and reliable access to critical services.

“Spring Law” has been discussed for a long time. Previously, all operators understood that the implementation of the requirements of the law would require substantial capital expenditures. The media was filled with semi-official warnings about the fact that once the costs of operators are rising, this will inflate prices for service consumers. Here is an example of the cost of installing equipment for an operator with a band of 7 gigabits with peaks of up to 10 gigabits:

The volume of data transferred grows year by year, therefore, most likely, the cost of storing data for compliance with legislation will increase. With such volumes of costs, small and medium-sized operators will be in critical condition. Large operators of the federal level will be able to afford it, but for them it will be a hard blow to revenues.

We now turn to mergers.

Merger options

Exaggerating, we can distinguish the following options for mergers in terms of company management and automation:

- Bought, we work completely independently. In fact, two different companies, only owners are common.

- Bought, total MC and consolidated management reporting. Everything else — operational processes, automation systems, and so on — is historical, in no way intersecting with each other.

- Bought, then absorbed with bringing all the processes and automation to the status of the dominant organization. In fact, the purchased office adapts to the new owner.

- Bought, all organizations are transferred to new processes and automation tools, immediately optimizing and improving for everyone. That is, both the dominant organization and the purchased one simultaneously switch to new automation tools for mergers.

In the context of the above trends, I expect activity on the market for scenario 3 and 4. Increasing the cost of maintaining compliance with the law will accelerate the process of monopolizing the market - mergers, acquisitions, leaving small players out of business. For those who remain, the optimization of processes, the control of operating profits to prevent cash shortages and the search for new items of income will be a dire need.

For small and medium telecom operators, the optimization of merging can be migration to the cloud - SaaS billing, management of online billing, business processes, human resources, equipment, CRM. Of course, cloud solutions have their advantages and disadvantages. It is important that the use of SaaS solutions will eliminate the need to immediately spend a large amount on the purchase of these products and licenses to them. Plus, you can reduce the costs of maintaining and developing your own information systems: the cloud service provider will himself strive to develop its service in order to keep up with competitors and not lose customers.

Increasing profitability from servicing legal entities or ARPU individuals is now largely tied to creating unique content and personalizing services. In general, telecom intersects with different types of businesses. For example, the “big four” strongly develop mobile retail, but for small and medium-sized operators, such a business is unlikely to be profitable. Therefore, it makes sense to pay attention to the global trend to merge operators and content producers.

In June of this year in the United States, a $ 85.4 billion merger deal was approved between the telecommunications company and the media conglomerate that manages several television channels and studios. Cable television networks provide Internet access services. Social networks launch virtual operators with unique offers for their users. Everything that is connected with IoT, the Internet of things, is actively developing. And this is a reason to pay attention to technology startups that develop products that require constant access to the network.

Current reality

2018 for the telecom industry in Russia brought several unpleasant moments. Forward Telecom, like many others, works in this market and cannot but pay attention to these trends, plus our customers often share their concerns and concerns with us.

Summing up, I would like to say: the state sets difficult tasks for the industry, but all of them can be solved both technically and organizationally.

Sergey Saprykin, General Director of Forward-Telecom

The data used are from open messenger channels @ unkn0wnerror, @zatelecom, @ usher2