tma - total management accounting

In the near future, new big changes await us. Technology opens up and promises us unprecedented changes, unheard of opportunities. But it is necessary that we are ready for all these changes and opportunities.

In the near future, new big changes await us. Technology opens up and promises us unprecedented changes, unheard of opportunities. But it is necessary that we are ready for all these changes and opportunities. Ya. V. Sokolov (Doctor of Economics, professor, member of the Methodological Council for Accounting at the Ministry of Finance of Russia)

With these words of the great historian of accounting, I want to start a series of articles where I will tell you how to break the reinforced concrete stereotypes of financiers and accountants with using zeros and ones. Accountants and financiers are not yet ready for these changes and opportunities, but IT professionals who are able to fully realize these opportunities should help them. To do this, they need to look at the grounds on which these stereotypes are built.

The first article is devoted to tma (general management accounting) - a concept designed to lead all these changes in the future.

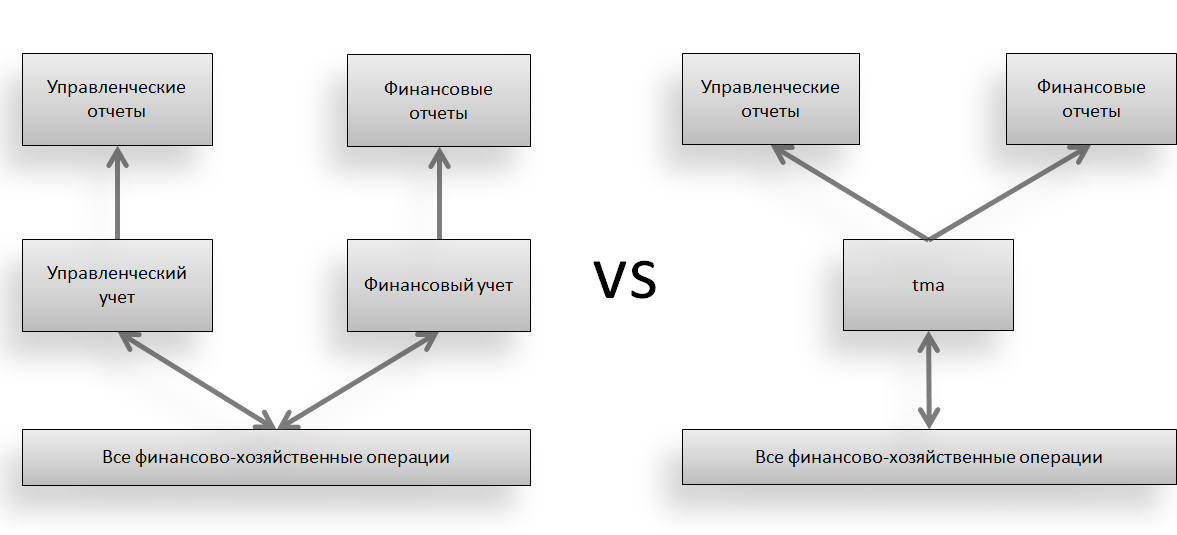

IT-technologies allowed us to combine two different functional areas in accounting into a single system:

- Financial Accounting.

- Management Accounting.

The result is a general management accounting system or tma-system.

What is financial accounting

The result of financial accounting are financial statements ( triad of financial statements ). Consumers of financial accounting are usually external parties, including business owners. The objective of financial accounting is to provide a general picture of the state of the business and the results of its activities so that external financially interested parties can make their decisions:

- To sell or not to sell a business.

- Whether to invest extra money in a business.

- To give or not a cash or commodity loan.

- Is it worth it to work for this company.

- ....

Typically, an enterprise operates for a period (year, half year, quarter, month), and then reports in the form of a triad of financial reports to its stakeholders .

Using financial reporting data, you can control a business in the overall picture of its success, but detailed information cannot be obtained.

Note that throughout the civilized world, financial statements are the same for various direct and indirect stakeholders. In our country, financial statements submitted to the state are not suitable, for example, for business, and this is a fact. Therefore, accounting in order to create financial (accounting) reports for the state, we will call, as we used to, namely, accounting.

In our country, the culture of financial accounting is only in its infancy. Many are involved in data transformation and financial reporting in accordance with IFRS or US GAAP. In any case, financial accounting is a complex and expensive pleasure that quite large companies with good income can afford.

In the generally accepted basis of the procedure of financial accounting is book keeping (maintaining accounting records) on the principle of double entry. Therefore, financial accounting is conducted in terms of a single accounting (reference) currency. That is, all accounting units are converted into accounting currency before writing them to accounting accounts. Therefore, financial statements are only considered in terms of accounting currency. To transfer them to another currency, you must rewrite all accounts in the expression of another currency.

The accounting procedure almost without changes migrated from paper to a computer, but without a system data record this will no longer be financial accounting.

What is management accounting

By definition, it is accounting for management purposes. Well, or more officially, to support managerial decision making.

Since financial accounting gives us the resulting data only once during the reporting period, it is not suitable for business management purposes.

Thus, the main property of management accounting is daily life, which financial accounting cannot boast of.

The result of management accounting are various management reports. Their form is not regulated anywhere outside the business. Management accounting is an internal kitchen of an enterprise, for internal parties (management of various levels).

The management report cannot show the general picture of business success, but the details are as much as needed.

Unlike financial accounting, management does not have a strict procedure for recording data and a rigid binding to the accounting currency. We can have management reports of various forms and in physical units of accounting (in the number of accounting units).

Professor Savchuk V.P. Compares the unified beginning of financial and managerial accounting with an iceberg, where the visible small part is financial accounting, and the large invisible part under water is management accounting. So all our companies are icebergs that float in various oceans of industries :).

Professor Savchuk V.P. Compares the unified beginning of financial and managerial accounting with an iceberg, where the visible small part is financial accounting, and the large invisible part under water is management accounting. So all our companies are icebergs that float in various oceans of industries :). For clarity, we summarize all of the above in a simple tablet (drawbacks are highlighted in red):

| Management Accounting | Financial Accounting | Tma general management accounting |

| Data is presented at any point in time. | Data is presented only at the end of the reporting period. | Data may be presented at any time. |

| Cannot summarize holistic state and results | Summarizes holistic state and results | Summarizes holistic state and results |

| Gives detailed data | Cannot give detailed data | Gives detailed data |

| Haphazard data recording | System data record | System data record |

| It is carried out in any expression of units of account | Only in terms of accounting currency | It is carried out in any expression of units of account |

| Reports can be presented in any expression of currency or unit of account | Reports can only be presented in terms of a single accounting currency | Reports can be presented in any expression of currency or unit of account |

| For internal use | For external financial stakeholders | For external and internal use |

The table clearly shows that in order to achieve certain tasks, one had to sacrifice something else. So there were two functional accounting systems: financial and management accounting. At the same time, the shortcomings of financial accounting are critical and unacceptable for management purposes and vice versa, the shortcomings of management accounting do not allow the use of its results for general control and analysis of the business from above.

According to the table, one can easily characterize tma - general management accounting.

Accounting, the results of which can be suitable for both external and internal consumers, since you can both monitor and analyze the overall picture of the success of the enterprise, and analyze the data in detail. In both cases - at any given time. Data is systematically and balancedly recorded in physical units of accounting. Both management and financial statements may be presented in any expression of currency or units of account.

The root of the solution to the problem of combining management and financial accounting functions lies in the system of writing data to the database of accounting accounts. Unfortunately, I cannot yet disclose the essence of the method of recording data in which such a union became possible, since this is a trade secret. But in the near future, this information will be in the public domain.

Thanks to the new electronic form of bookkeeping and a new way of writing data to it, general management accounting is kept in kind of accounting units, and financial statements can be presented in any currency. The concept of accounting currency is simply absent.

For now, you can simply accept that such a method exists and is implemented in applied solutions that can be used in practice, and talk about what opportunities are opening up for us thanks to this.

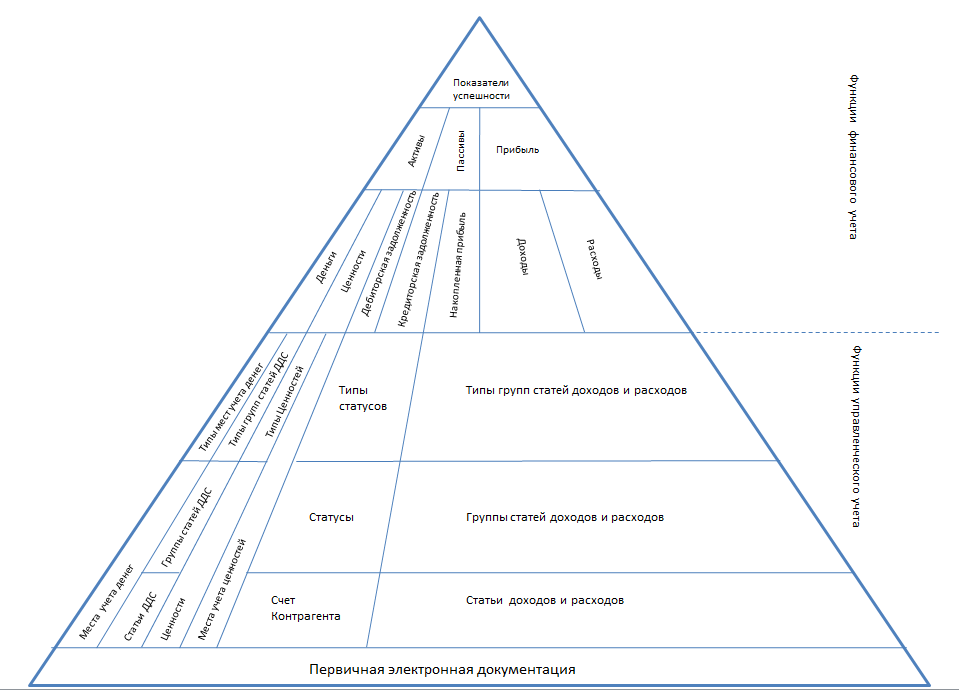

Data on financial and economic operations from primary electronic documents form at a single level of management and financial accounting a single integrated system.

Such a system can be represented in the form of a pyramid, where at the base are all electronic primary documents, and to the top, all these data are summarized in the success indicators of the enterprise. At various horizontal slices, the data forms information at the level of management or financial accounting.

As an example of such a pyramid:

The integrity and interconnection of all information, general and detailed, is well visualized. Due to this interconnection, any data of financial statements can be decomposed (detailed) to any levels of management accounting and compared with each other. Moreover, the overall picture of the success of the enterprise can be formed at any time.

In the next article I will tell you how you can generate daily financial reports, how to analyze them and automate the control of key indicators of business success.