How to steal data from an ATM

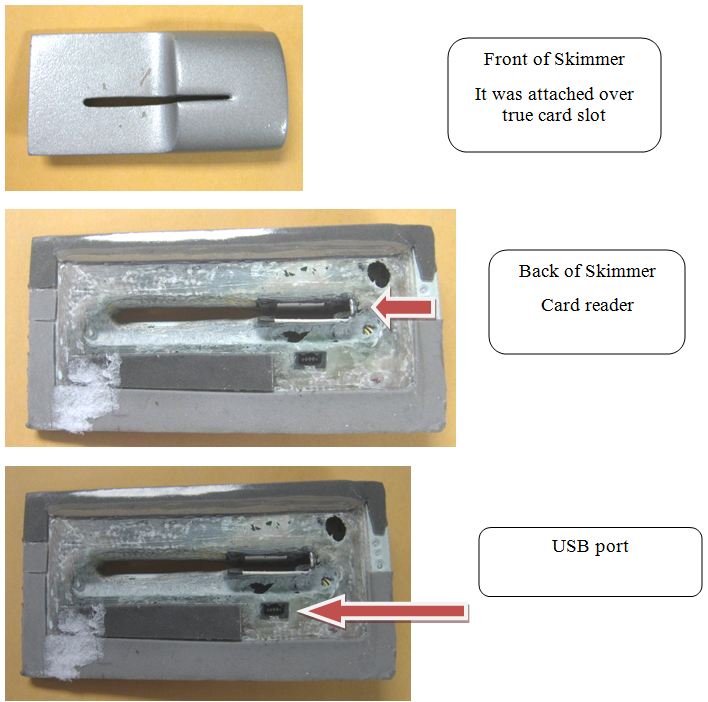

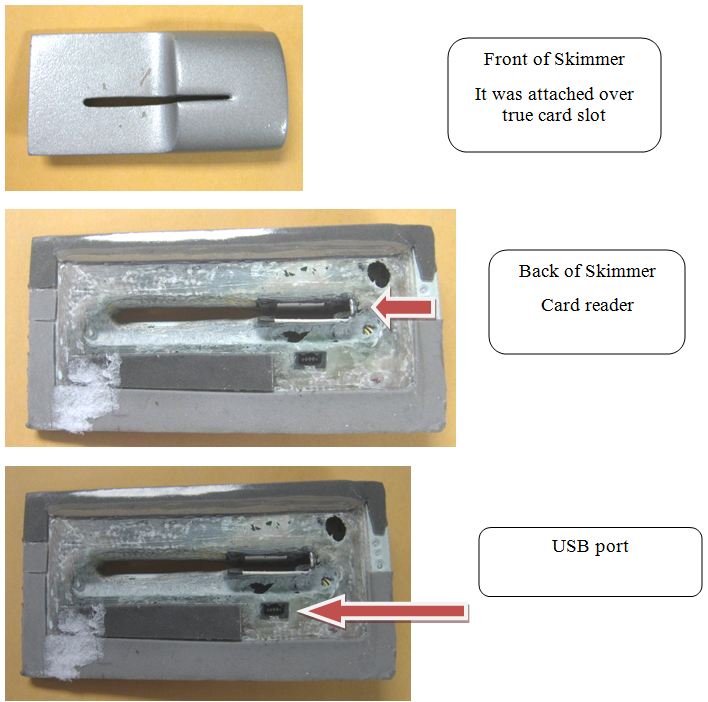

One February afternoon, the user of the glorious ATM of the glorious American Bank of America in California discovered a strange silver plexiglass device attached to a card slot. The device resembled a special stub from card theft.

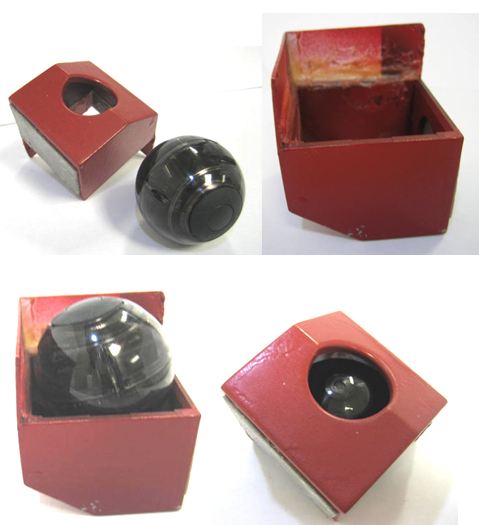

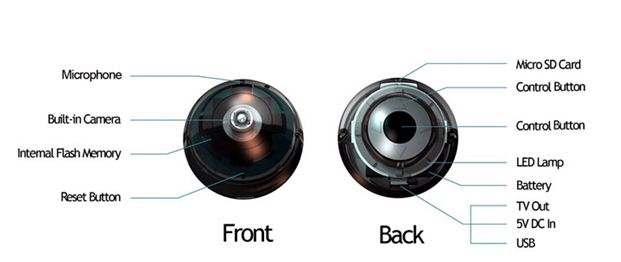

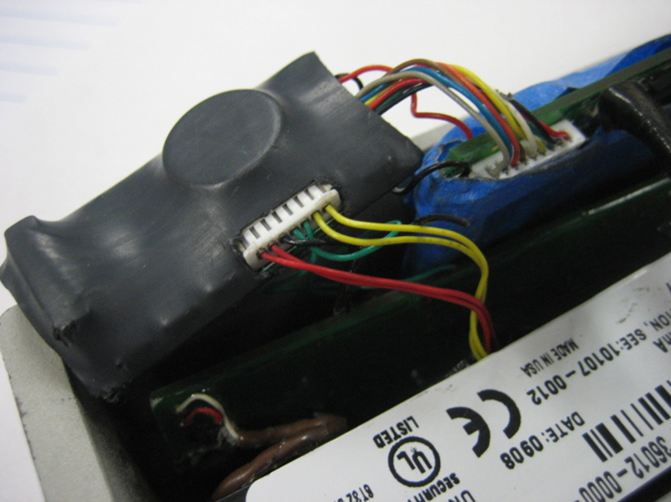

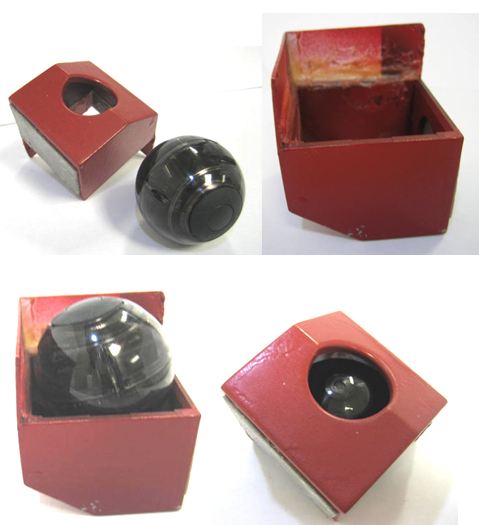

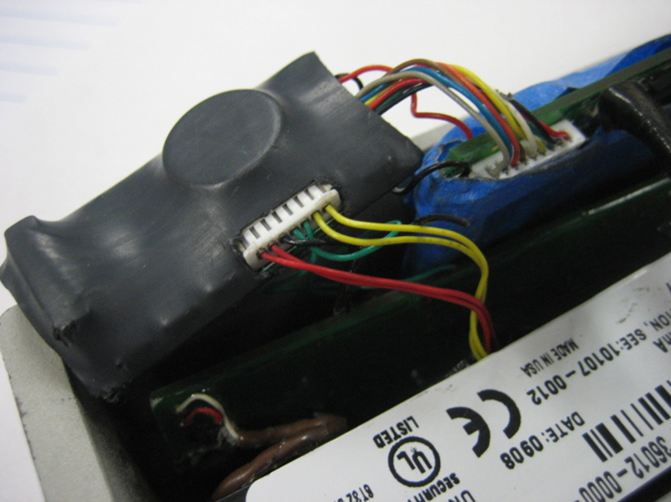

However, our hero was not at a loss and turned to the bank, as a result of which another device was discovered: a battery-powered camera that was turned on by a motion sensor. This camera was hidden in a special box and attached to the corner of the ATM in a place where you can conveniently observe the entered PIN code.

In total, the ATM began to look like this:

As it turned out, the attacker received an image with the entered PIN code on the camera with reference to the time when this happened:

At the same time, a skimmer installed on top of the original card insertion slot read data and also tied it to time.

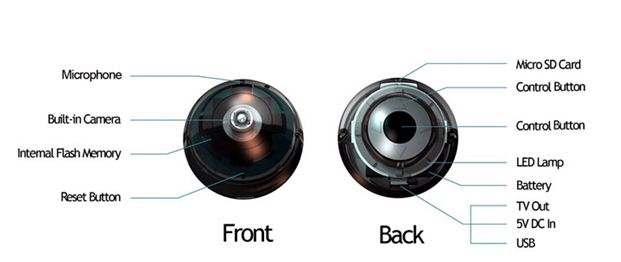

The received data can either be stored on a card, which an attacker secretly picks up over time, or transmitted using simple WiFi or GPRS. The card, by the way, can be stored in the camera itself. By the way, the described camera is called Camball-2, it costs about $ 200 in the USA and can work in the specified mode for 48 hours.

According to representatives of the bank, such a scheme is one of the most popular theft schemes for credit card data from ATMs. Typically, such devices are installed on the night before the weekend, on which banks are closed and the influx to ATMs is especially large.

Here are some tips to protect you from possible theft.

1. Always cover the terminal with your hand when entering the PIN code, even if no one is standing next to you.

2. If there is any suspicious device on the card input slot of the ATM, it is better to use another ATM.

3. If you suspect that your card has been compromised, immediately inform the bank with a written statement, etc. In the event of theft of funds using hacking an ATM or various additional devices (as in this article), all expenses should be compensated by the bank itself. Well, in any case - in the USA :)

UPD: Since they accuse that everything is too simple, I’ll add more complicated versions :)

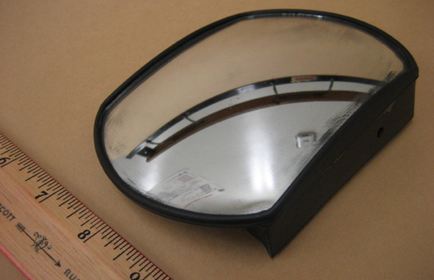

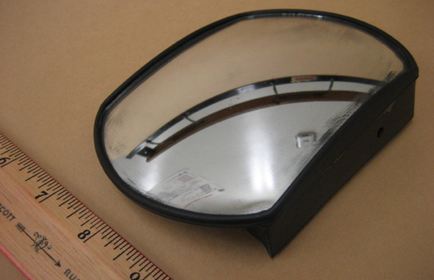

Here is a camera mounted in the mirror. usually a mirror is hung on some ATMs so that you can make sure that no one is peeking your PIN code:

Only at the bottom of the mount of this mirror is a hole made where the camera is installed:

Often, skimmers put on the door in a small foyer where the ATM is located. Well, so that no one would come in, but only cardholders and only this bank. You can also slip a reader into these skimmers:

There really are a lot of options - here the imagination works well for someone who does not need it.

However, our hero was not at a loss and turned to the bank, as a result of which another device was discovered: a battery-powered camera that was turned on by a motion sensor. This camera was hidden in a special box and attached to the corner of the ATM in a place where you can conveniently observe the entered PIN code.

In total, the ATM began to look like this:

As it turned out, the attacker received an image with the entered PIN code on the camera with reference to the time when this happened:

At the same time, a skimmer installed on top of the original card insertion slot read data and also tied it to time.

The received data can either be stored on a card, which an attacker secretly picks up over time, or transmitted using simple WiFi or GPRS. The card, by the way, can be stored in the camera itself. By the way, the described camera is called Camball-2, it costs about $ 200 in the USA and can work in the specified mode for 48 hours.

According to representatives of the bank, such a scheme is one of the most popular theft schemes for credit card data from ATMs. Typically, such devices are installed on the night before the weekend, on which banks are closed and the influx to ATMs is especially large.

Here are some tips to protect you from possible theft.

1. Always cover the terminal with your hand when entering the PIN code, even if no one is standing next to you.

2. If there is any suspicious device on the card input slot of the ATM, it is better to use another ATM.

3. If you suspect that your card has been compromised, immediately inform the bank with a written statement, etc. In the event of theft of funds using hacking an ATM or various additional devices (as in this article), all expenses should be compensated by the bank itself. Well, in any case - in the USA :)

UPD: Since they accuse that everything is too simple, I’ll add more complicated versions :)

Here is a camera mounted in the mirror. usually a mirror is hung on some ATMs so that you can make sure that no one is peeking your PIN code:

Only at the bottom of the mount of this mirror is a hole made where the camera is installed:

Often, skimmers put on the door in a small foyer where the ATM is located. Well, so that no one would come in, but only cardholders and only this bank. You can also slip a reader into these skimmers:

There really are a lot of options - here the imagination works well for someone who does not need it.