Experts predict that Amazon will become a leader in the field of online advertising

Web advertising now stands on two pillars: Google and Facebook. According to eMarketer research , in 2017 these two companies took over 63% of their market revenue. The United States even coined a special term for their description - “digital duopoly” (“it's like a monopoly, only you don't break any laws”). But from July-2017, industry experts began to turn their heads in the direction of the third company. And this February, it was speculated that in a few years it could get ahead of both Facebook and Google. One of the giants of the marketing industry, WPP plc (with a portfolio of $ 70 billion), called its appearance on the radar “extremely destructive in many respects”, and without much desire allocated $ 200 million for “test” advertising on the site.

It is assumed that neither Google nor Facebook will be able to compete with a competitor if he takes up the matter seriously. The reason is that he has access to a huge amount of information about which the other two web giants do not really know anything ...

The other day, this company became the third most capitalized in the world, after Apple and Alphabet. In 2017, its shares grew by 56%, and its founder became the richest man in the world . On holidays in November-December, it alone accounted for 89% of Americans' purchases on the Internet. This, of course, is about Amazon.

Experts estimate that in the coming months, Amazon will become the third in the world of online advertising, beating Oath (parent company AOL and Yahoo). Top 6 Twitter and Snapchat are far behind. The company, as usual, does not disclose its numbers, remaining as secret as possible. According to the estimates of JP Morgan analyst Doug Enmuts, in 2017 advertising sales brought Amazon $ 2.8 billion. You can’t compare it with the scale of Google: an online search engine on advertising makes $ 73 billion. But Amazon’s advertising sales are expected to grow by 40% in a year, and she will be pulling budgets from Google and Facebook. At a conference in July, announcing the release of the AAP service from open beta status, Amazon said that competitors could not oppose it.

Where such confidence? Still, Google has a huge amount of data about the history of our search and our views. And Facebook has the opportunity to give advertisers accurate information about our age, status, relationships, place of residence, social circle ... But it turns out that Amazon data is much more valuable. She knows about the purchase history of her users, about real sales. The competitors do not have such accurate (and such extensive) information.

Profit from advertising in 2017. Each dice - $ 500 million

Most US online purchases are made on Amazon, and the company does not share its data with anyone. Now she began to recruit advertisers, and promises them that she will become a leader in advertising. Those who have already switched from Google in recent months say that the online store’s ROI is much higher. And the GroupM agency, which is responsible for advertising Unilever, NBC and other large companies, says that in 2017 its customers spent 10-15 times more on promotion through Amazon than in 2016. Growth is amazing.

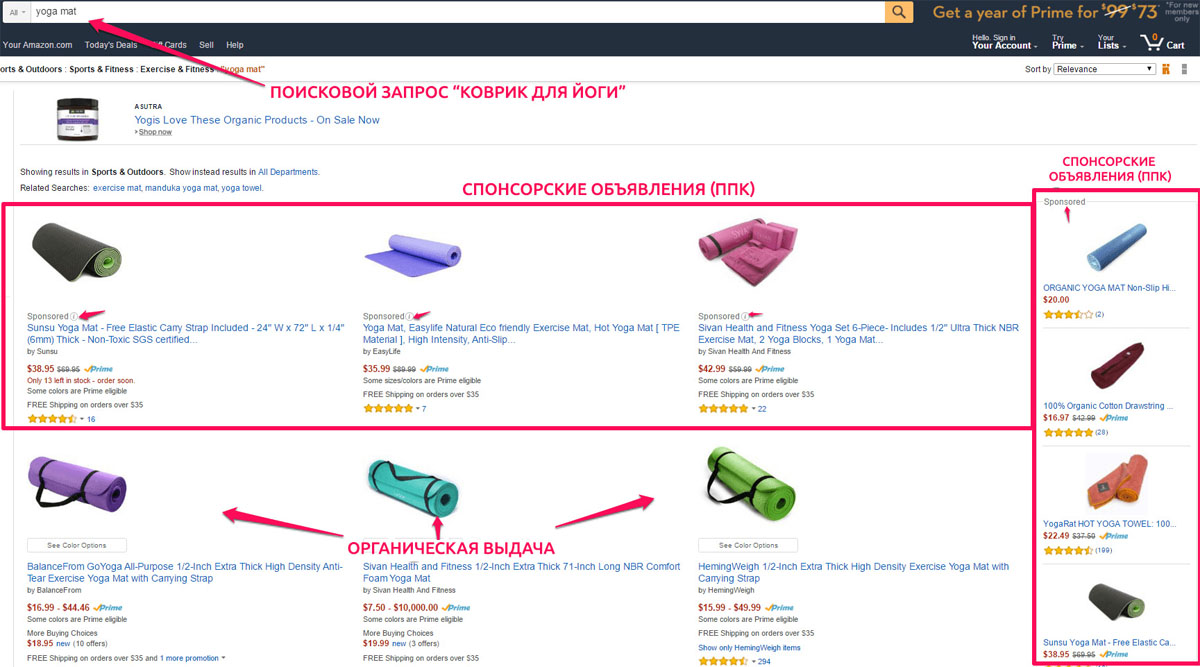

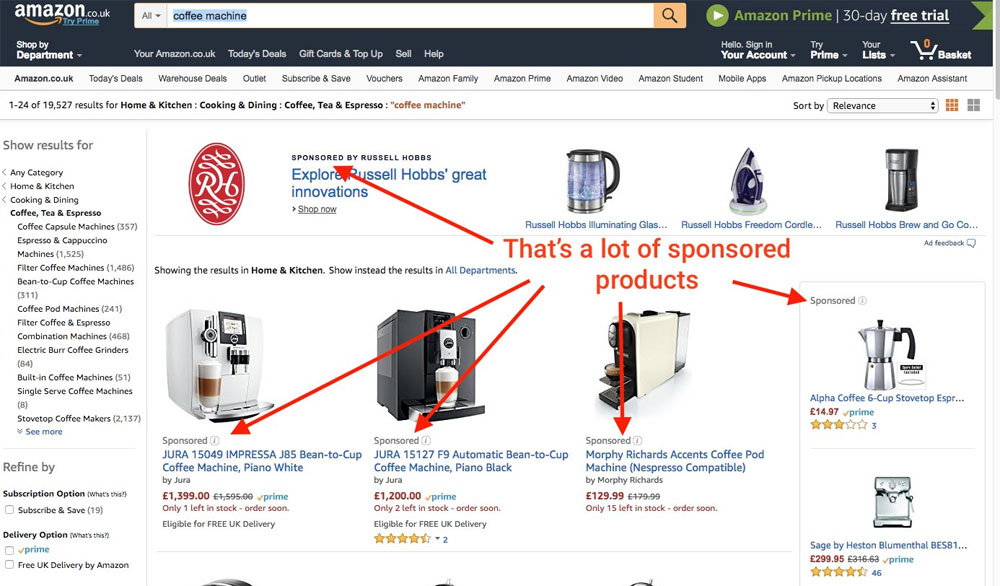

At the same time, users of Facebook and Google are well aware that there is advertising on their sites. And Amazon customers often don’t even suspect this.

How it works

Thousands of companies, large and small, sell their products through Amazon Marketplace. Now about 40% of the store’s sales are accounted for by such companies that place their products with her. For this they pay $ 39.99 per month +% of the price of the goods (if they sell a lot), or $ 0.99 for each item (if they sell less than 40 goods per month). Plus - various additional fees for storage and delivery. This is beneficial for companies due to the huge Amazon customer base and the frenzied popularity of the site. Over 95 million unique visitors per month! In addition, Amazon takes over the packaging and distribution of goods, the company has the largest warehouses and the fastest delivery in the States. Showdown with the return of goods - also on it. The seller feels like behind a big brother. If you have a “tasty” price, and the reviews are positive, that's all, the future is guaranteed to you.

In 2016, 12 thousand companies worked on the site, totaling more than $ 1 billion a year. Now all this has grown by 5-10 times. But this means that there is more competition. And the place on the page of the search results of the site - oh how limited.

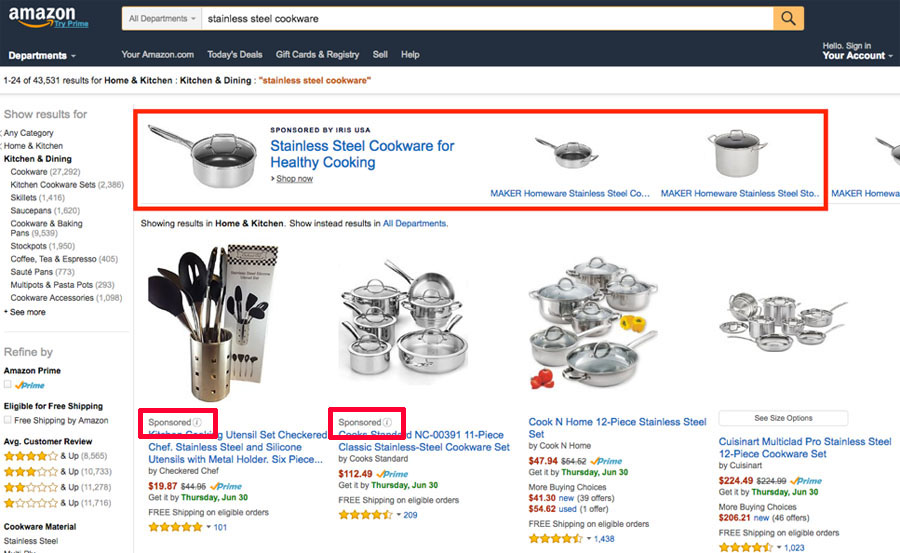

A good example - " dzhidzhamy " (jijamas). Pajamas for women in cotton, super soft and expensive. The company was founded in 2013, it has its fans, and the reviews are positive, but there are two problems. The first is the price: Amazon doesn't really like giving out $ 80 stuff at the top of the page if you can find $ 20 items from the same category. The second is the name. Nobody is looking for "Jijamas." Except, perhaps, old customers who already know what it is. In order not to lose profit, the head of the company is forced to resort to advertising through Amazon. To pay money so that his “djjams” stand on a par with “pajamas” in extradition. Moreover, if the ratings of his goods are worse - he must pay more and more for his chance to catch the eye of the client.

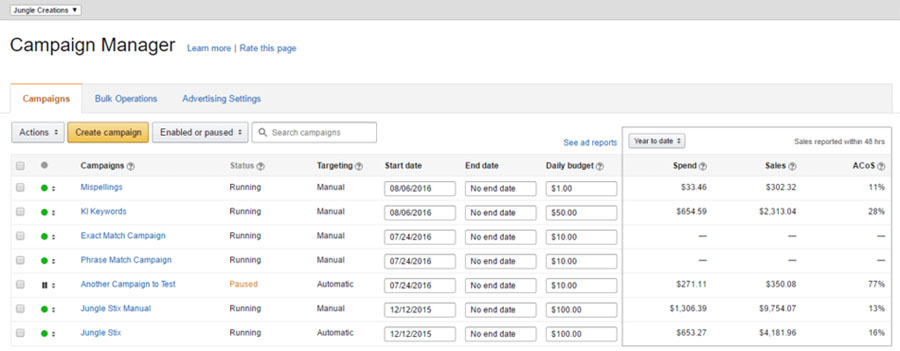

Amazon Campaign Settings

The owner of a small company has no way out. Advertising with Google is pointless. You will either promote the site of Amazon itself, which is simply stupid, or try to promote your site, from which all the same in the USA there will never be such sales as from the country's main online platform. From the point of view of the user - why take things from some obscure site if you are already used to a free two-day delivery directly to your home.

Amazon now accounts for 70% of jig sales (the remaining 30% comes from its own website). In order not to lose the position in extradition on a key request, the business is forced to pay Amazon more and more, because the number of competitors on the site who pay for the same places in the extradition increases every year. At the same time, the Amazon algorithm loves low-priced products, so raising margins for the sake of such advertising is usually not an option: you will lose more positions than you gain. A vicious circle comes out.

Daniel Knizhnik, founder of Quartile, a small Amazon-only ad agency, compares the local platform with Google AdWords. Basically, ads appear on top of search results for different keywords, and are marked with a Sponsored plate (which, however, few people pay attention to). But, like Google, search results also go only to those who liked the company's algorithms. You can “like” in many ways: by spending money, getting good reviews and ratings, selling a lot of goods, confirming that your product works with Alexa ...

Amazon's algorithms are constantly changing, trying to find something that will interest buyers and will be beneficial to the company. And just as many CEOs here try to guess the Yandex and Google algorithms, so in the USA, many sellers instead of buying ads try to organically "adapt" to the Amazon algorithms. According to the Wall Street Journal , there are whole price optimization services, "reporters." They automatically change the value of your products so that they like the store. The systems there are so complex that WSJ reporters compare them with stock market trading. But the profit is also very tangible. Sometimes a price raised or lowered by ten cents can promote your product two or three places in search results. And this is many thousands of additional orders.

As a result, even the “most profitable store in the world” increases the price decently, sellers complain. Especially for those products that are advertised in ads. The creator of the "jijam" says that 15% of the starting price he goes to ensure that the goods were simply registered on the Amazon Marketplace. Another 5-6% is the fee for the warehouse and for delivery. An additional 12% of the site is awarded for each item sold through an ad with a Sponsored die. And in April, Amazon will begin to take an extra 2% for clothes (the company did not explain the reason). As a result, 35% of each advertising "jijama" goes into the pocket of a giant retailer. For $ 28 with a successful transition! Google and Facebook only dream of such numbers. And the result is $ 2.8 billion for Amazon for advertising those products that already generate revenue for it.

What's in the future

Amazon is constantly introducing or buying new sources of information about the tastes of its potential customers and their behavior. To do this, she bought a Whole Foods food chain for $ 13.7 billion last year, and set up a store without Amazon Go cash registers . And, of course, she developed an intelligent assistant, Alex , whose devices are specially relatively cheap, so that Amazon can then quietly and for many years pay for them by unobtrusively selling its products and services to users. According to the model of a Kindle reader or printers with cartridges.

It is expected that by 2020 alone, Alexa will bring the company at least $ 10 billion - mainly through advertising. So, when you request a purchase, she always first of all checks whether the product is on the site of Amazon itself. And if you ask, “Alexa, what is the best tablet now?”, The assistant will recommend taking the same Kindle Fire. Potentially, Amazon plans to sell contextual advertising on such requests as well, when smart devices become fairly commonplace.

Every time an Amazon store bites off another percentage of a delicious “pie” of American retail at $ 5 trillion, this is another $ 50 billion of data that Google and Facebook will never get. Competitors receive less information for analysis and for sale. In addition, the main online store is the only one who knows about real products that interest users. The Wall Street Journal is told about this by Diana Gordon, director of Shop +, one of the WPP subsidiaries:

Amazon doesn't just know where you are going. He knows what you are buying and how you are doing it. He knows the history of your purchases, how you choose a product, how you look for it, how much money you are willing to spend. He knows what days you should offer certain products for you to buy.

Amazon accounted for over 53% of online sales in the U.S. in 2017. More importantly for online advertisers, the site has collected the most information about all products. Reviews, videos, photos, ratings, details about the specifications. Therefore, even if customers are not going to buy on Amazon, they often start their searches for suitable things in this store. The company said that in 2017, 60% of online buyers in the United States searched for something through its website. Yes, people launch Google and Facebook every day, and they visit Amazon once or twice a week. But audience coverage is already comparable, and the percentage of conversion of clicks into sales at the store is higher by an order of magnitude.

In 2017, the company not only began to actively develop its advertising business, but also recruited a team of “sales people” to attract large brands to the site and demonstrate the benefits of posting ads on Amazon search. Nike, Victoria's Secret, New Balance and other well-known brands would prefer to sell on their site and advertise it somewhere on Google. But they can’t do it anymore either. If you don’t sell on Amazon yourself, fakes or resellers inevitably appear on it. Almost all large companies in the end decided not to give them such a tidbit in the market.

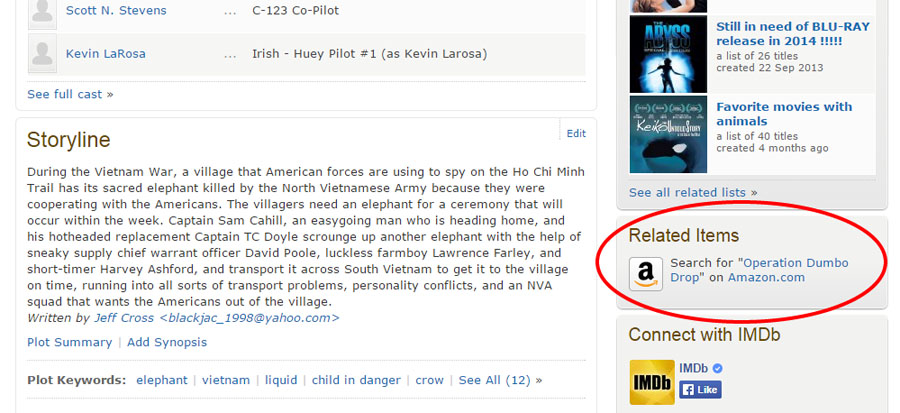

In July-2017, the AAP (Amazon Advertising Platform) system was opened to the public and began to rapidly develop . It allows customers to buy ads on the exchange, and run it on numerous sites, mainly controlled by Amazon (for example, IMDb). The platform is a lot like Google’s DoubleClick. Some kind of vacuum cleaner that the user once thought about buying, then pursues it on third-party resources until he surrenders and goes to Amazon to buy it.

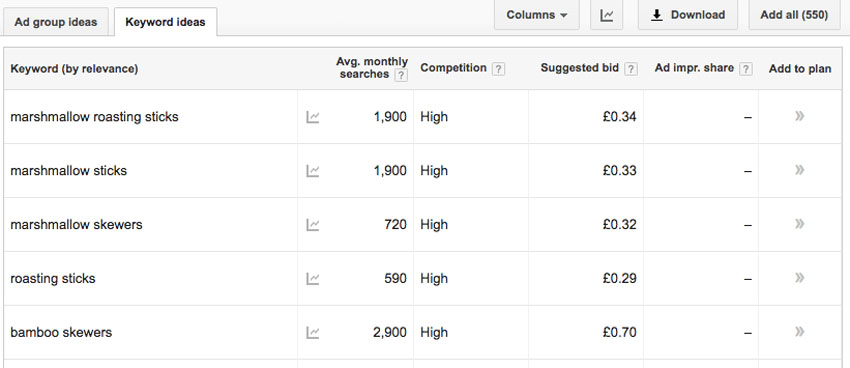

Keywords

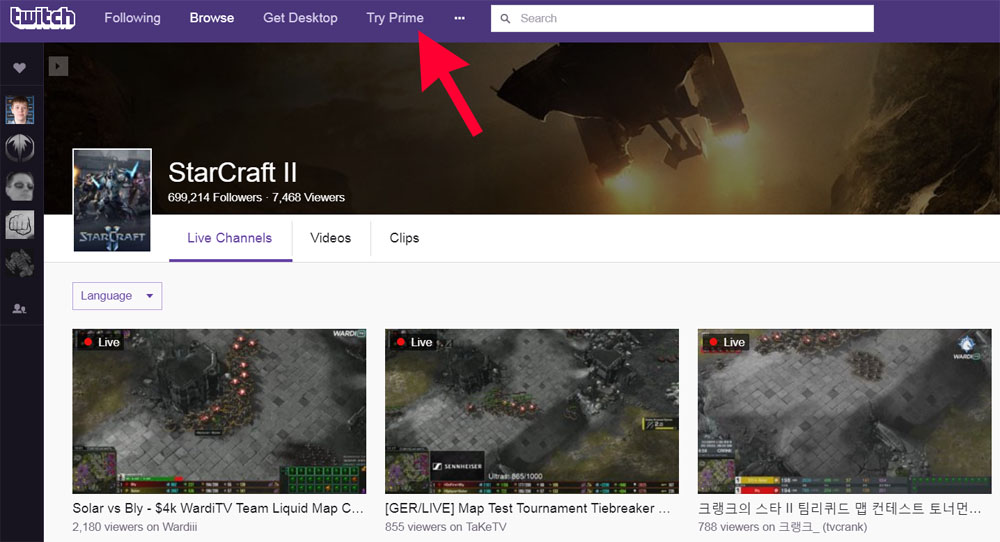

To expand the number of platforms on which it is possible to sell advertising, the company bought the service for streaming video games Twitch.tv for $ 970 million, and continues to invest in Amazon Video, which in the United States on projections in the coming years should bypass its only competitor, Netflix. Amazon makes its own TV shows and television series, in between which viewers will be able to show ads (not to mention the fact that both Amazon Video and Twitch themselves work to attract users to the Amazon Prime program). In November 2017, Amazon Video announced the start of production of the most expensive television series in the world - based on The Lord of the Rings. They will spend $ 1 billion on it, of which $ 250 million have already gone for the rights. For comparison, the Game of Thrones season now costs about $ 100 million.

On twitch

All this works like a giant machine, “sucking” users into the Amazon world. If you watch games on Twitch, it’s silly not to try Prime so you can support your favorite streamer for free. If you buy something in a store, why not access movies and TV shows? The website interface has been redesigned so that the cross-promotion of Amazon products on them seems natural and organic. But the more time a user spends in the Amazon’s cycle, the more advertising he consumes, from goods advertisements to videos. Even on the boxes in which the company packs things, movie posters or photos of products that could still be bought begin to appear. There are also ideas about the stock exchange of sound ads for Alexa - the type of ones that can sound on the radio.

Amazon is still focused on growth, but investors and experts understand that it has almost nowhere to grow in the e-commerce market. It’s time to start reaping the benefits of your labor: increase commissions from sellers, open your platforms to the public, and get the profit that the company has been putting aside for so long tomorrow.

On IMDb

Hence the unprecedented growth in the company's shares in 2017 and the beginning of 2018. Amazon has already bypassed Microsoft and almost caught up with Google in terms of capitalization, although the net profit of all its competitors is several times higher. It's all about the expectation that Jeff Bezos, having finished his preparations, will pull the lever in the near future and start earning as much as the company with its assets is supposed to. Starting selling ads on Amazon.com and launching the AAP platform are steps in that direction. In retail, an estimatedfinancial analyst Stephen Mallas, the company is able to “take off” 5% of the profit from the sale of the product. On advertising, profitability can be increased up to 20-30%. Placing ads under search results and pushing sellers to fight for a “place in the sun” can be the most profitable part of the business of the main online store.

It is interesting that the idea of marketplaces once was that for the seller this is an advantage over ordinary supermarkets, because there is no need to pay “per shelf”. For the buyer to see your product, for it to be favorably presented, etc. Now Amazon is actually starting to bring us back to that old classic shelf pay model. Only in the new electronic age, and on a much larger scale.

PS

You can buy in the USA with Pochtoy.com. We deliver goods from America to Russia at a price of $ 8.99 per 0.5 kg. And registration with the Geektimes code brings to your account $ 7.